Online Casinos Stocks

International Game Technology (IGT.NYSE)

2021-11-16 06:40 ET – News Release: International Game Technology PLC Hosting 2021 Investor Day Today

The company breakdown their strategic initiatives for growth, innovation, and optimization for their Long-term objectives as follows:

Grow: They aim to leverage their innovative content and solutions as well as their market-leading position to expand market share, support customer sales growth and capture new market opportunities.

Innovate: The operators are laser-focused on utilizing the large and highly differentiated intellectual property portfolio and prominent investment in research and development to create high-quality games, structures, and solutions that help further enhance the player experiences and their growth objectives customer growth.

Optimize: The outlook now calls operational excellence and structural cost reductions as companies use higher quality technology and operational leverage. This enables continued profitability and margin improvement.

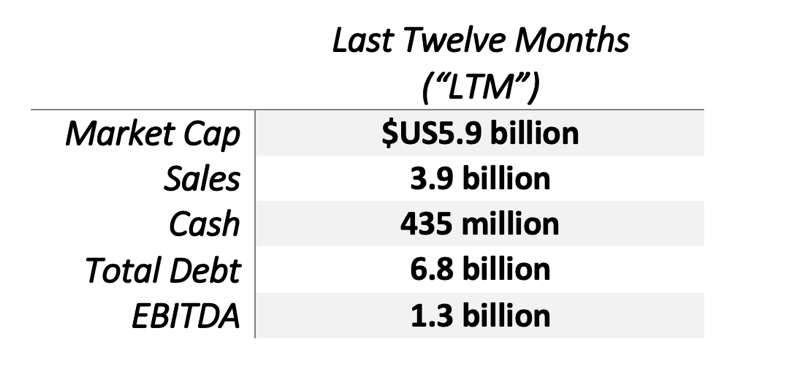

IGT 2022 Outlook

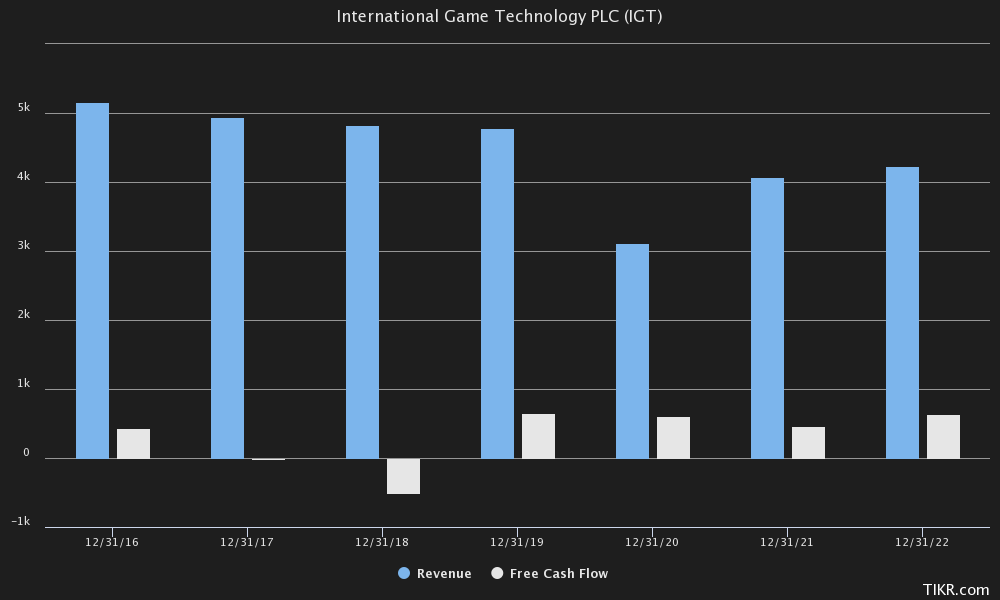

- Revenue of $4.1 – $4.3 billion

- Operating margin of 20% – 22%

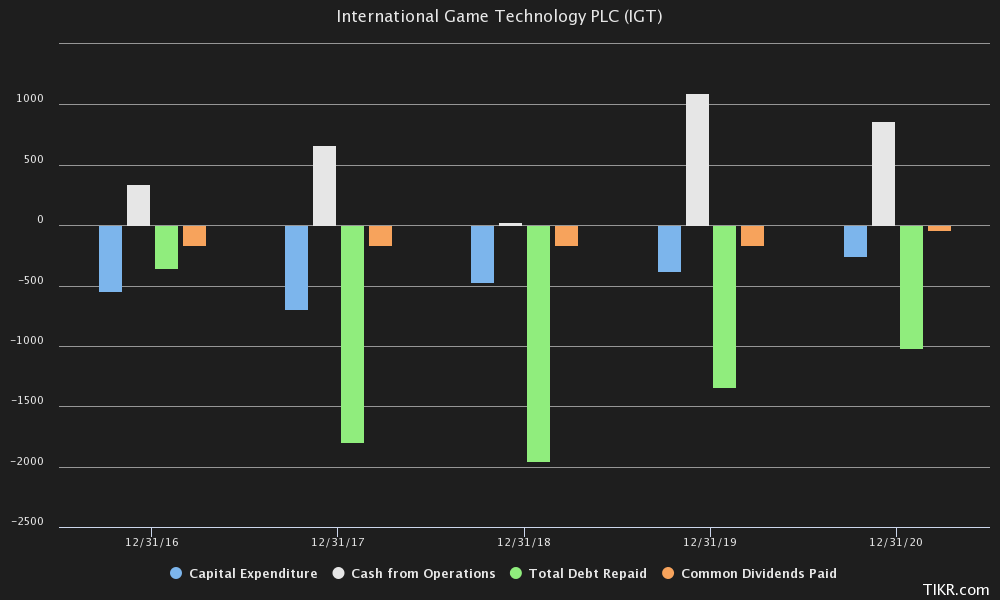

- Cash from operations ranging from $850 million – $1.0 billion

- Capital expenditures totaling $400 million – $450 million

- Net debt leverage of 3.5x – 4.0x

They have also set what they believe are ‘Compelling and Achievable Financial Goals for 2022 – 2025’,

- Revenue of $4.6 – $5.0 billion in 2025, reflecting a mid-single-digit compound annual growth rate

- Mid-teens operating income CAGR; operating margin expansion of over 500 basis points to 26% – 29% in 2025

- Cumulative cash from operations of approximately $4.0 billion; free cash flow of approximately $2.4 billion

- Disciplined Capital Allocation Plans Balance Reinvestment in the Business with Increased Shareholder Returns

- A comprehensive capital investment plan of approximately $2.8 billion in aggregate capital expenditures and research and development from 2022 – 2025, supporting the existing portfolio with a focus on fast-growing iLottery and Digital & Betting activities

- Continue to reduce leverage to a range of 2.5x – 3.5x across the investment cycle, targeting the lower part of the guidance range by 2025

- Reinstated quarterly cash dividend of $0.20 per common share

- Implementing a $300 million multi-year share repurchase program, the first in IGT PLC’s history

- Strategic Positioning to Increase Optionality for Digital & Betting Segment

- Realigning Digital & Betting into a new legal entity; expected to be completed within 12 months, supporting evaluation of a potential separate public listing of the business

2021-11-17 16:31 ET – News Release: IGT Adds Cliff Castle Casino to Growing List of Retail Sports Betting Customers

IGT also announced this week that they will be expanding their sports betting footprint in Arizona through a multi-year agreement with Cliff Castle Casino. IGT PlaySports technology and trading advisory services will power Cliff Castle Casino’s retail sportsbook, enabling casino guests to place pre-match and in-game wagers over the counter or at the venue’s self-service PlaySports Kiosks.

“We believe adding sports betting to Cliff Castle Casino’s existing entertainment offering will enable us to attract new patrons, extend and enhance our guests’ visits and help us stay competitive in Arizona’s rapidly growing sports betting market,” said Aaron Moss, Cliff Castle Casino General Manager. “Cliff Castle Casino looks forward to introducing our guests and local sports fans to the excitement and quality of an IGT-powered sportsbook.”

“Cliff Castle Casino can be confident in the reliability and scalability of IGT PlaySports technology, and in the abilities of our skilled trading advisory services team to help them maximize the opportunity,” said Joe Asher, IGT President of Sports Betting. “Arizona is an exciting sports betting market and we’re pleased to see IGT’s long-time customer, Cliff Castle Casino, be a part of this growth opportunity.”

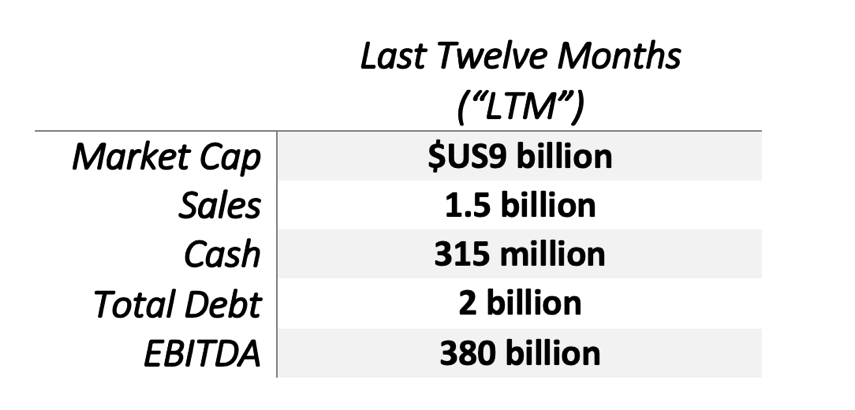

Churchill Downs Incorporated (CHDN.NASDAQ)

2021-11-18 09:00 ET – News Release: Indiana Gaming Commission Selects Churchill Downs Incorporated’s Application for a Casino Owner’s License in Vigo County, Indiana

CHDN announced on Thursday that the Indiana Gaming Commission selected the company’s application for a casino owner’s license, submitted by its wholly-owned subsidiary CDITH, LLC, to develop the Queen of Terre Haute Casino Resort (the “Queen of Terre Haute”) in Vigo County, Indiana. The IGC unanimously voted to grant CDITH the sole Certificate of Suitability following an economical proposal process that included applications from three other bidders.

“We are thrilled for this opportunity and honored for the trust that the Indiana Gaming Commission has placed in CDI and our plan to bring a true destination casino resort to West Central Indiana,” said Bill Carstanjen, Chief Executive Officer of CHDN.

CDI’s plan includes,

- a $240 million investment that will feature 1,000 slot machines,

- 50 table games,

- a 125-room luxury hotel,

- and a state-of-the-art TwinSpires Sportsbook, and several food & beverage offerings.

The IGC will officially award CDITH the casino owner’s license to operate an inland casino in Vigo County upon the final affirmation of the pending nonrenewal of the prior license holder.

eSports Stocks

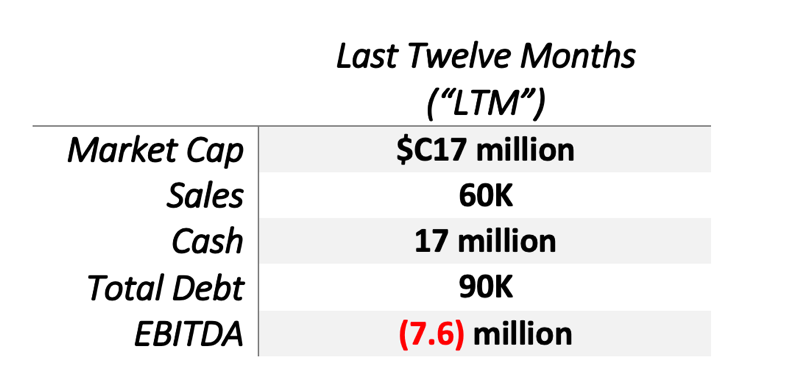

Real Luck Group (LUCK.V)

Last news was in October on the 20th of 2021: Real Luck Group Limited announces partnership with Nuvei to Enhance Pay-in and Payout Capabilities

LUCK announced a partnership with global payment technology company Nuvei (NVEI.T)

“We are thrilled to announce Nuvei as our payment technology partner,” commented Luckbox head of payments Boris Kostadinov. “Nuvei is a leading payment technology company with extensive experience in the digital and iGaming sectors, and its extensive range of payment methods will allow new and existing customers a comprehensive choice of payment options when betting on the Luckbox platform. Nuvei is fully integrated and live on our site now and this represents another step in realizing our vision to deliver the best iGaming experience in the market.”

Luckbox will take advantage of Nuvei’s large range of payment methods and innovative payout products with the hope of improving its own offering to new and existing players. Nuvei offers direct connections to all major payment card schemes in over 204 markets worldwide, and also supports 480 local and alternative payment methods, nearly 150 currencies, and 40 cryptocurrencies.

“We are delighted to support Luckbox with our innovative payment solutions, technology and longstanding market knowledge in the regulated gaming space,” said Philip Fayer, Nuvei’s Chair and CEO. “As we continue to expand our payment capabilities to help our clients succeed and expand into new markets, we look forward to working closely with Luckbox on enhancing its checkout experience by delivering the most relevant payment solutions for its customer base.”

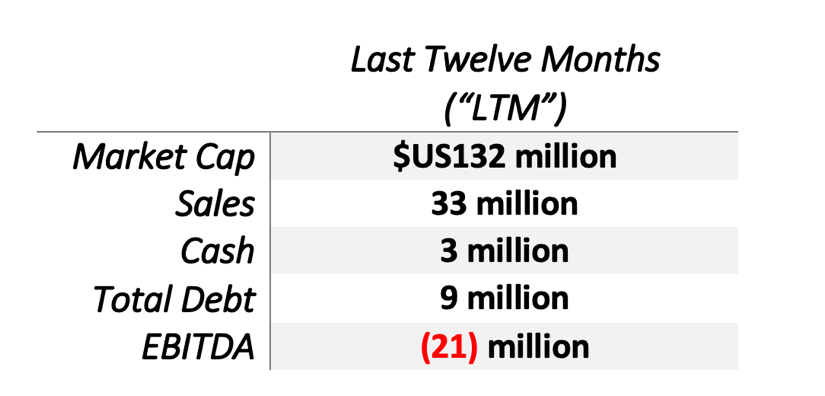

Esports Entertainment Group, Inc. (GMBL.NASDAQ)

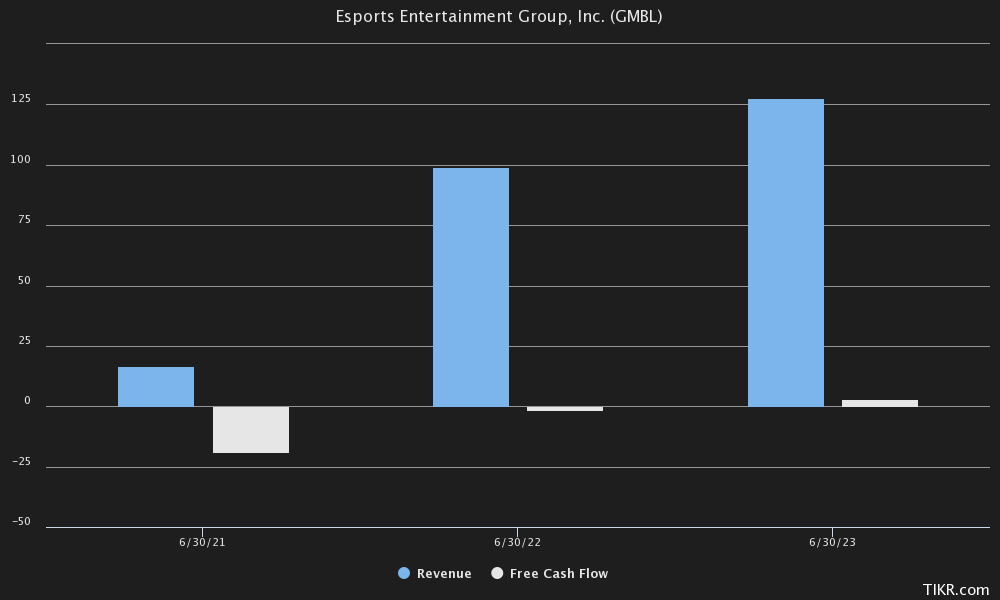

2021-11-15 09:00 ET – News Release: Esports Entertainment Group First Quarter Revenue Rises 86% Q/Q to $16.4 Million

GMBL announced its financial results for its fiscal 2022 first quarter ended September 30, 2021.

Fiscal First Quarter 2022 Financial Results

- Net revenue of $16.4 million, up to $16.2 million compared to 1Q21 and an 86% increase compared to net revenue of $8.8 million in 4Q21

- Gross profit of $10.0 million, up to $10.2 million compared to 1Q21 and a 92% increase compared to $5.2 million in 4Q21

- Gross margin of 61%, compared to 59% in 4Q21

- GAAP Net Loss of $0.5 million, or $0.03 per share, compared to a net loss of $1.8 million, or $0.15 per share in 1Q21, and a net loss of $4.8 million, or $0.28 per share, in 4Q21

- Non-GAAP adjusted EBITDA of ($2.7 million), compared to adjusted EBITDA of ($2.6 million) in 1Q21 and adjusted EBITDA of ($5.5 million) in 4Q21

- As of September 30, 2021, the Company had total cash and cash equivalents of $0.9 million

- After the end of the quarter, the Company raised $8.0 million in gross proceeds via a preferred stock offering

First Quarter 2022 and Recent Operational Highlights

- Completed acquisition of BetHard, the B2C business of Gameday Group, which brought the Company gaming licenses in Sweden and Spain

- Submitted transactional waiver to the New Jersey Division of Gaming enforcement, which, pending final approval, would allow the Company to begin in-state betting operations

- Completed $8.0 million private placement of convertible notes with $17.50 conversion price

- Expanded roster of professional sports team partnerships with new agreements with the Indianapolis Colts, Tampa Bay Buccaneers, and Los Angeles Chargers

- Launched fan-centered EGL ClubClash program with professional sports teams

- Partnered with Hall of Fame Resort and Entertainment Company to become the official esports provider for the Hall of Fame Village powered by Johnson Controls

- Entered into an agreement to launch a state-of-the-art Helix eSports gaming facility at UCLA

- Established content partnership with ESTV EsportsTV, the world’s first 24-7 live linear video channel dedicated to esports

- Partnered with NetEase to become official North American tournament and broadcast provider of Naraka: Bladepoint

Fiscal 2022 Financial Outlook

The Company expects net revenue growth of at least 490% to $100 million in FY22, driven primarily by the platform-building and strategic diversification acquisitions completed in calendar 2021.