It’s no secret that I am a fan of precious metals and base metals. I like commodities in general. In this Market Moment, I spotted opportunities in charts of metals that are not talked about too often. The two metals in question are Platinum and Palladium (XPT and XPD for you traders).

Gold and Silver look great. Last week I discussed the set up which I am still riding. Nice pattern and breakout and the structure is intact. What impresses me is how Gold and Silver held even with a strong US Dollar. Of course, anything I write is not trade recommendations, but I am looking to pick up some Palladium contracts. You will see why in a bit. The fundamental reason? Like always, I think commodities are going to take off as an inflation hedge.

You may have noticed that today’s featured idea on Equity Guru is Mineworx Technologies (MWX.V). They have a huge Platinum and Palladium element, and I spoke about both commodities in my chart attack.

So let’s talk a bit about Platinum and Palladium.

Platinum is sometimes known as the ‘rich man’s gold’. Yes, you can buy 1 oz Platinum coins from mints around the world. Just recently, the Chinese began minting Platinum Panda’s. It is the rarest metal in the world, and if all the Platinum that has ever been mined could be placed into an Olympic sized pool, it would not even cover your ankles! Some properties on why it is considered precious: resistant to corrosion, doesn’t oxidize in the air, and has stable chemical properties.

Where is Platinum found? Primarily in South Africa, Russia and North America. This is where it is time to get on your geopolitical thinking caps. South Africa has the largest deposit of Platinum in the world. According to my handy dandy commodity book beside me, South Africa may contain up to 90% of the world’s total reserve estimates! After South Africa, Russia is a large producer of Platinum, accounting for around 20% of total global production.

Usage for Platinum? Catalytic converters to reduce carbon emissions from vehicles. As environmental standards become more stringent, demand for Platinum will increase…or you know…we go down the Electric Vehicle route. Platinum has many industrial applications. Used in personal computers, hard drives and fiber optic cables. Finally jewelry, although nowadays, it seems people prefer white Gold.

Mining companies to watch are Anglo-American, who even have a Platinum stock traded on the OTC under the ticker ANGPY. There are plenty of juniors out there too for a more speculative play. I prefer trading the commodity itself through futures of CFDs.

Platinum currently is hovering around $1068. Note the structure. Very similar to Gold and Silver in that the downtrend has broken. A new uptrend is beginning. A close back above $1000 was huge. That is the higher low we are working with going further. As long as price remains above $1000, the uptrend is intact. We just ride it for more waves to the upside. Once again, I include this in my inflation trade.

Palladium is sometimes referred to as the metal for the new millennium. And maybe that is correct. When we take a look at the chart, Palladium’s price might surprise some of you.

Just like Platinum, Palladium’s largest consumption comes from the auto industry in the creation of pollution reducing catalytic converters. Whichever metal is less expensive becomes the metal of choice for the converters. Other uses come from jewelry, electronics and dentistry.

I mentioned South Africa and Russia with Platinum. Well the same two nations are the top two Palladium producing countries by far. Since they dominate production, any supply disruption could cause an impact on both Platinum and Palladium prices. However, some say there are no two countries that dominate a commodity as much as Russia and South Africa dominate Palladium. Keep this in mind for the future.

How to play Palladium? Once again, I prefer futures and CFDs, but you can take a look at Palladium One, Nornickel in Russia, and Anglo-American. There are juniors too on the TSX at the early stages of potential discovery.

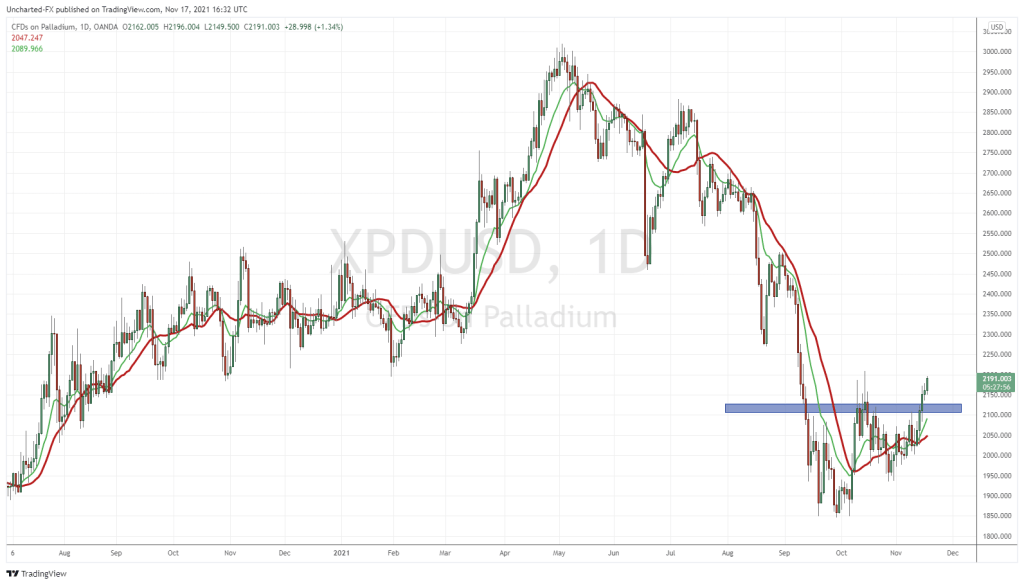

This is what I am excited about:

Beautiful chart. Note the price: $2191. Yes, Palladium has a higher price than Gold. We hit record highs around $3000 this year when all metals were rising. The pullback led to a downtrend, and now I think we are ready for a new uptrend. Bit of a cup and handle pattern here, and we got a confirmed close above $2125. We could be making a move back to $2500 in this run.

Honestly, Palladium is one of the better looking precious metal charts alongside Silver. Really liking what I am seeing here in the precious metal space, and I say again: this could just be the beginning of the inflation trade. Commodities as a whole will do well, but metals, which are considered an inflation hedge, will attract money flows.