Northstar Clean Technologies Inc. (ROOF.V) today announced positive results of the independent carbon dioxide (CO2) footprint Life-Cycle Assessment (LCA), completed by Burgess Environmental Ltd., of selected performance indicators for Northstar’s Empower Facility in Delta, British Columbia.

“The LCA not only confirms the merits of our proprietary Bitumen Extraction & Separation Technology (“BEST”) and the positive impact on the environment that we believe it will have, but it also measures the benefits of our production process when compared to sending asphalt shingles to landfills and using asphalt from virgin production.

This analysis quantifies how our operations can support our customers and industry partners in delivering circular and “green” renewable asphalt produced with significantly lower carbon intensity. The global context for reducing industry carbon footprints is forcing companies to identify alternative renewable avenues. With the reduced carbon footprint solution for repurposing asphalt shingles, we believe we can support our customers and industry partners on their sustainability journey,” commented Aidan Mills, CEO of Northstar.

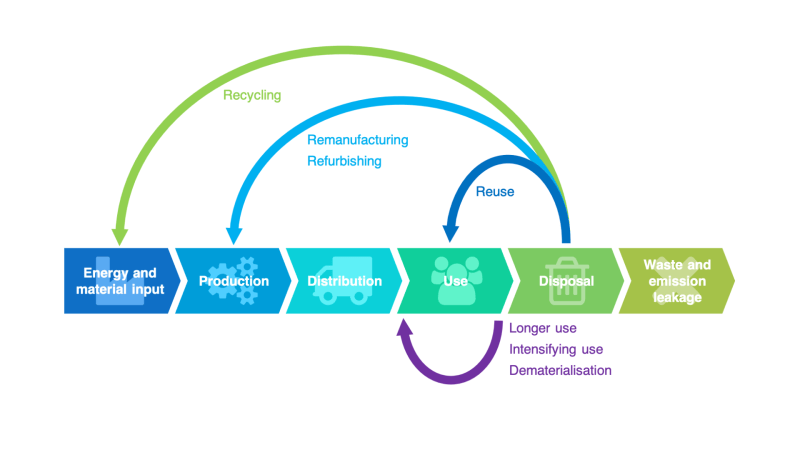

I am a circular economy novice. That being said, the circular economy has become a topic of interest for those who are concerned with the environment. A circular economy refers to a model of production and consumption, which involves sharing, leasing, reusing, repairing, refurbishing, and recycling existing material and products for as long as possible. Why? To tackle global challenges like climate change, biodiversity loss, waste, and pollution.

As these issues continue to loom over us, there has been a significant increase in environmental awareness. In particular, awareness has grown substantially since the onset of the COVID-19 pandemic. A survey conducted by the Boston Consulting Group found that roughly 70% of survey participants were more aware of environmental challenges now than they were before the pandemic. Additionally, a 2020 global survey conducted by Accenture revealed that 60% of consumers were making more environmentally friendly, sustainable, or ethical purchases since the start of the pandemic.

The circular economy plays a pivotal role in the preservation of our environment. With this in mind, Northstar is a clean technology company doing its part by recovering and repurposing single-use asphalt shingles. The Company has developed a proprietary design process for taking discarded asphalt shingles, which would typically end up in landfills, and extracting the liquid asphalt, aggregate, and fiber. These extracted materials are then used in new hot mix asphalt, construction products, and other industrial applications.

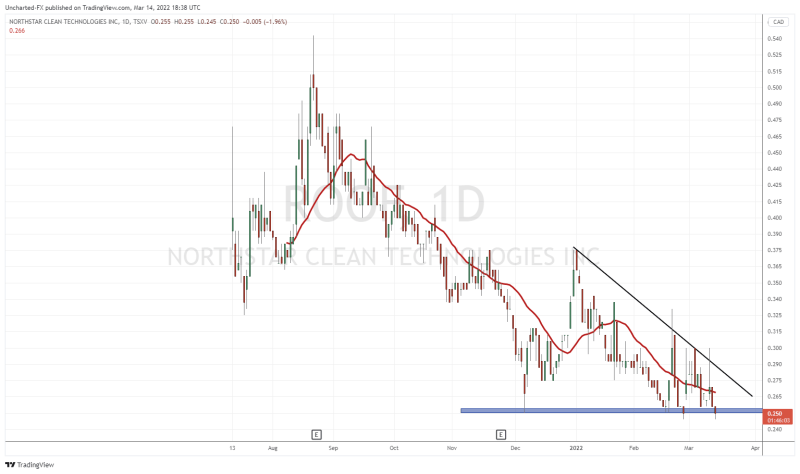

Life-Cycle Assessment

A Life-Cycle Assessment (LCA) refers to a methodology for assessing environmental impacts associated with the life cycle of a commercial product, process, or service. In the case of manufactured products like shingles, environmental impacts are assessed from raw material extraction and processing, through the product’s manufacture, distribution, and use, to the recycling or final disposal of the materials composing it. Before we move on, let’s talk about the Global Reporting Initiative (GRI). The GRI is an international independent standards organization that helps businesses, governments, and other organizations understand and communicate their impacts on issues including climate change, human rights, and corruption.

With this in mind, the GRI Standards were used as the framework for reporting on sustainability performance metrics for Northstar’s Empower Facility LCA. For context, the Company’s Empower Facility is a 20,000 square foot asphalt shingle repurposing facility. I touched on it briefly earlier, but let me go into more detail. The Empower facility utilizes a design process called the “Bitumen Extraction and Separation Technology,” which breaks down asphalt shingles into its three primary components, which are asphalt, aggregate, and fiber. Finally, these recovered components are expected to be re-sold back into the market for “next use”.

All the Shingle Ladies

Referring back to the GRI Standards, these performance metrics assessed the impacts and benefits of repurposing liquid asphalt shingles and compared them to the impacts and benefits of simply disposing of discarded or defective asphalt shingles. In particular, the LCA compared GHG emissions, land disturbance, and water consumption.

That being said, GHG emissions from the Empower Facility are expected to be 60% lower than emissions related to virgin products and landfill disposal of asphalt shingles. More specifically, the Empower Facility is expected to emit 77.21 kg of CO2 equivalent per tonne of feedstock compared to 199.15 kg of CO2 equivalent per tonne of feedstock for virgin products and landfill disposal. Of the 199.5 kg of CO2 equivalent per tonne of feedstock, the breakdown is as follows:

- 151.81 kg of carbon dioxide equivalent per 1 tonne of feedstock is from virgin production

- 3.25 kg of carbon dioxide equivalent per 1 tonne of feedstock is from the transportation of replacement facility products to market

- 44.09 kg per 1 tonne of feedstock is from the degradation of asphalt shingles in a landfill

Let me clarify some terms here. GHG emissions refer to carbon dioxide (CO2) emissions. Virgin materials are materials sourced directly from nature in their raw form. With this in mind, virgin production refers to manufacturing products, in this case, asphalt shingles, using virgin materials. This process uses much more energy and depletes more natural resources, as opposed to producing goods using recycled materials. Lastly, feedstock refers to the materials used for the processing or manufacturing of a product.

Overall, the Empower Facility’s results imply a net carbon emission saving of 121.94 kg of CO2 equivalent per tonne of feedstock. Assuming that the Empower Facility operates five days a week and 52 weeks per year, and has a production range of between 50 and 100 tonnes per day, net estimated CO2 emissions savings are expected to be in the range of 1,500,000 kg to 3,000,000 kg of CO2 equivalent per year. GHG emission reductions increase to over 220 kg of CO2 equivalent of wood-based shingle feed and to over 240 kg CO2 equivalent per tonne when the asphalt is sourced exclusively from oil sands.

Additionally, finding related to the other performance indicators, including water consumption and land disturbance, pointed to quantifiable benefits from the operation of the Empower Facility. Performance indicators revealed a reduction of water consumption by more than 650 liters per tonne of asphalt processed. Moreover, the LCA found that land disturbance was reduced by more than 0.44m2 per tonne of asphalt processed.

“Our long-term mission is to be an environmentally responsible, sustainable clean technology company delivering renewable products with a significantly lower carbon intensity. In addition to the full diversion of asphalt shingles from landfills, we now know our production process can deliver a meaningful difference to our climate by reducing carbon dioxide emissions in both degradations of asphalt shingle tiles in landfills and virgin asphalt production. We are committed to the long-term sustainability of our operations. The first step on the journey towards carbon neutrality is to quantify corporate emissions accurately and the LCA quantifies exactly that,” continued Mr. Mills

Depending on the regulatory and legislative framework, carbon dioxide emissions benefits may allow Northstar to potentially generate future revenue and margins from carbon credit sales. This is in addition to the Company’s expected revenue streams from incoming tipping fees and the sale of its end-use products. It is worth noting that the Asphalt Shingles Market was valued at more than USD$7 billion in 2018 and is projected to expand at a compound annual growth rate (CAGR) greater than 3.8% through 2025. Rising demand for advanced roofing systems owning to changing consumer inclinations towards ecological and sustainable construction methods is likely to stimulate the industry’s growth.

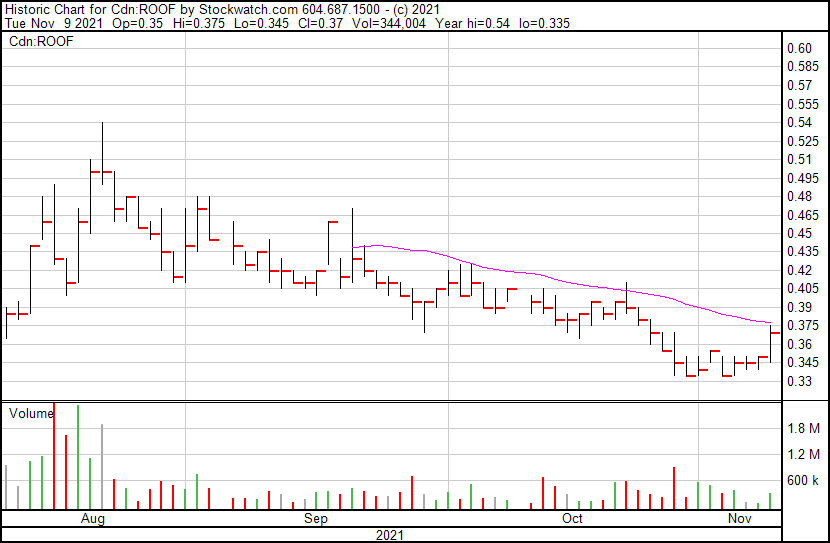

Northstar’s share price opened at $0.35, up from a previous close of $0.345. The Company’s shares are up 7.25% and were trading at $0.37 as of 11:42 AM ET.