The Bank of Canada (BoC) took the markets and investors by surprise yesterday. Expectations were an announcement of gradually slowing down Canada’s Quantitative Easing (QE) Program. While the Fed in the US is buying up $120 Billion worth of bonds and mortgage backed securities per month, Canada was doing as much as $5 Billion per week, or about $20 Billion a month. A few months back, the BoC announced a taper. They cut down their weekly purchases of bonds by $1 Billion. Our Central Bank governor, Tiff Macklem, announced the ending of QE… well sort of. No more increase of stimulus. And it appears that all these measures by Central Banks to support the economy during the pandemic, and keeping interest rates low by buying bonds, are coming largely to an end. Those who follow markets regularly know the saga about tapering in the US. Markets are waiting for some sort of tapering announcement from the Federal Reserve.

The end of QE marks the beginning of what the bank calls a “reinvestment phase,” where it will keep the size of its balance sheet steady by purchasing only enough assets to replace existing holdings as they mature. It currently owns around $425-billion worth of federal government bonds, most of which it acquired over the past year and a half. Going forward, the bank expects to buy between $4-billion and $5-billion worth of government bonds each month, down from a peak of $5-billion every week earlier in the pandemic.

“The significant stimulus remains in place … we’re just not adding to it,” Macklem said.

With Canada ending QE (sort of), the markets are now considering interest rate hikes sooner rather than later. The BoC was aiming for a first rate hike somewhere in the second half of 2022. But now, some analysts are expecting the first hike in April of 2022. Analysts expect three rate hikes next year, taking us to 1%.

It is important to know that the BoC did not mention anything about interest rate hikes yesterday. The markets and analysts are just seeing it as the logical next step after ending QE. What is weighing in on the minds is the current inflation narrative. If inflation increases and lasts longer, then Central Banks will be forced to raise rates. But it seems the BoC sees inflation just like the Fed, it is transitory and temporary.

“The main forces pushing up prices — higher energy prices and pandemic-related supply bottlenecks — now appear to be stronger and more persistent than expected,” the bank said, adding that it now thinks Canada’s multi-year high inflation rate will go higher still — topping out at about five per cent, the bank said — before coming back down to the range of about two per cent next year.

“In other words, we continue to expect that inflation will ease back but relative to our July forecast, it’s higher for longer,” bank governor Tiff Macklem said at a press conference after the release of the rate decision.

“We will be considering raising interest rates sooner than we previously thought,” Bank Governor Tiff Macklem said in a Wednesday morning news conference. “Interest rates don’t need to be as low for as long to get that full recovery and get inflation back.”

A hawkish tilt seems appropriate due to Canada’s employment back at pre-pandemic levels, higher inflation, and crazy real estate and equity markets. But the big question in many contrarians’ mind is can the BoC, and other Central Banks for that matter, even raise rates up to 1%? With governments and consumers in more debt than before, a rate hike has the possibility to slow down the economy and cause a recession. The thinking being people would consume less because money would be used to pay off debt or the interest on the debt. You wouldn’t necessarily borrow more to pay off the debt due to higher interest rates. Have we now become Japan, Switzerland and the European Union? Where any rate hike would put pressure on the financial system as a whole?

We heard the term ‘token taper’ with the Fed recently. Perhaps we can say the same for rate hikes. A 25 basis point hike would be a token hike. Perhaps we get that next year and Central Banks see the effects from there. Mind you anything can happen from now until Spring next year. If we get higher Covid cases in the winter, and say another lockdown like parts of China, and now the US is even contemplating, expect QE to return and any talk of rate hikes being kicked further down the road. And I mean a big boot down the road.

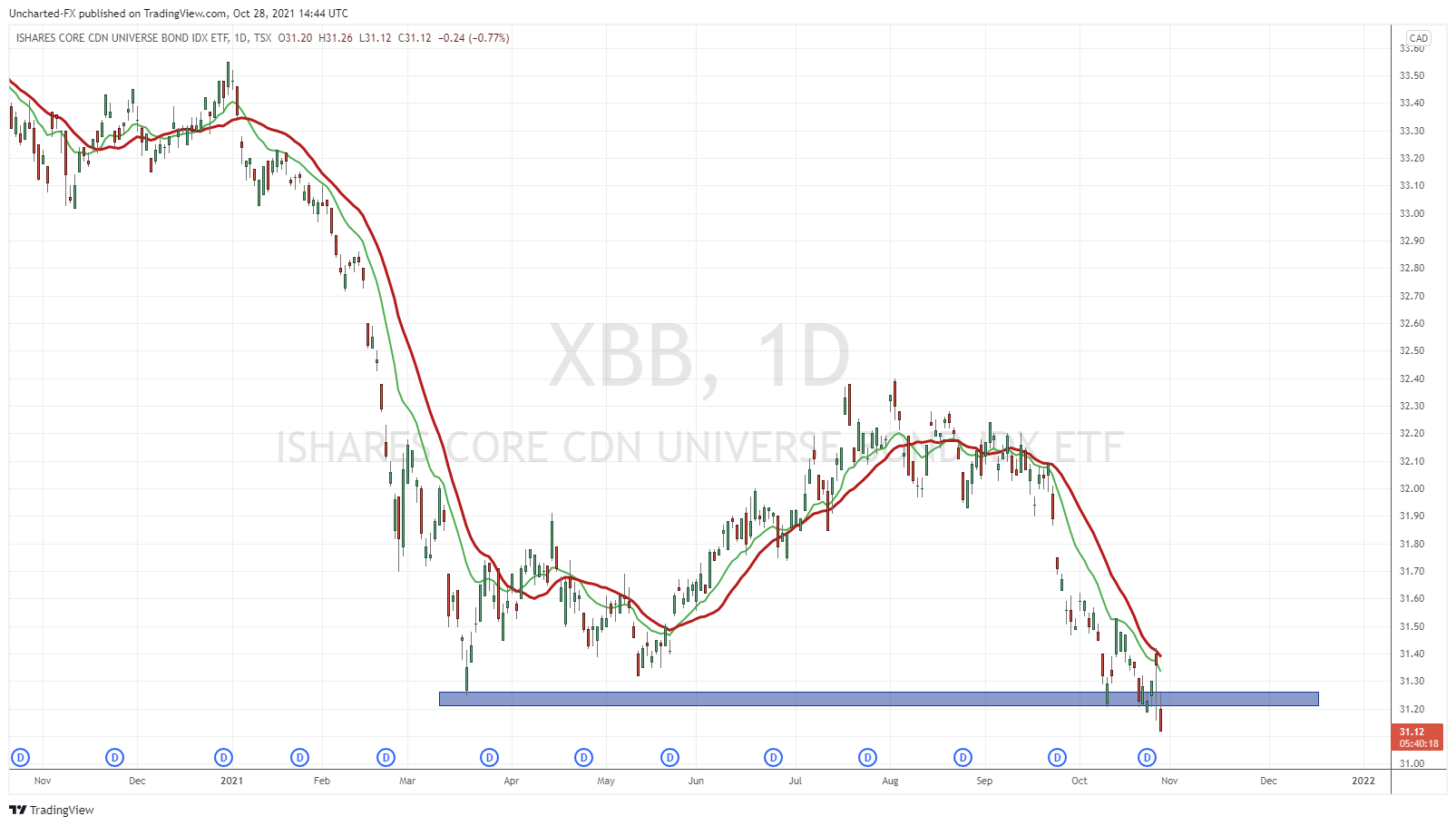

On the day of the rate decision, Canadian Bonds (I use XBB) fell but then rose during the rest of the trading days. The market took some time to digest the news, and now we are reacting how one would expect bonds to react to the market pricing in higher rates. XBB is selling off, which means yields are rising. A big support here being tested. A close below just like the candle being printed right now, would be a breakdown trigger.

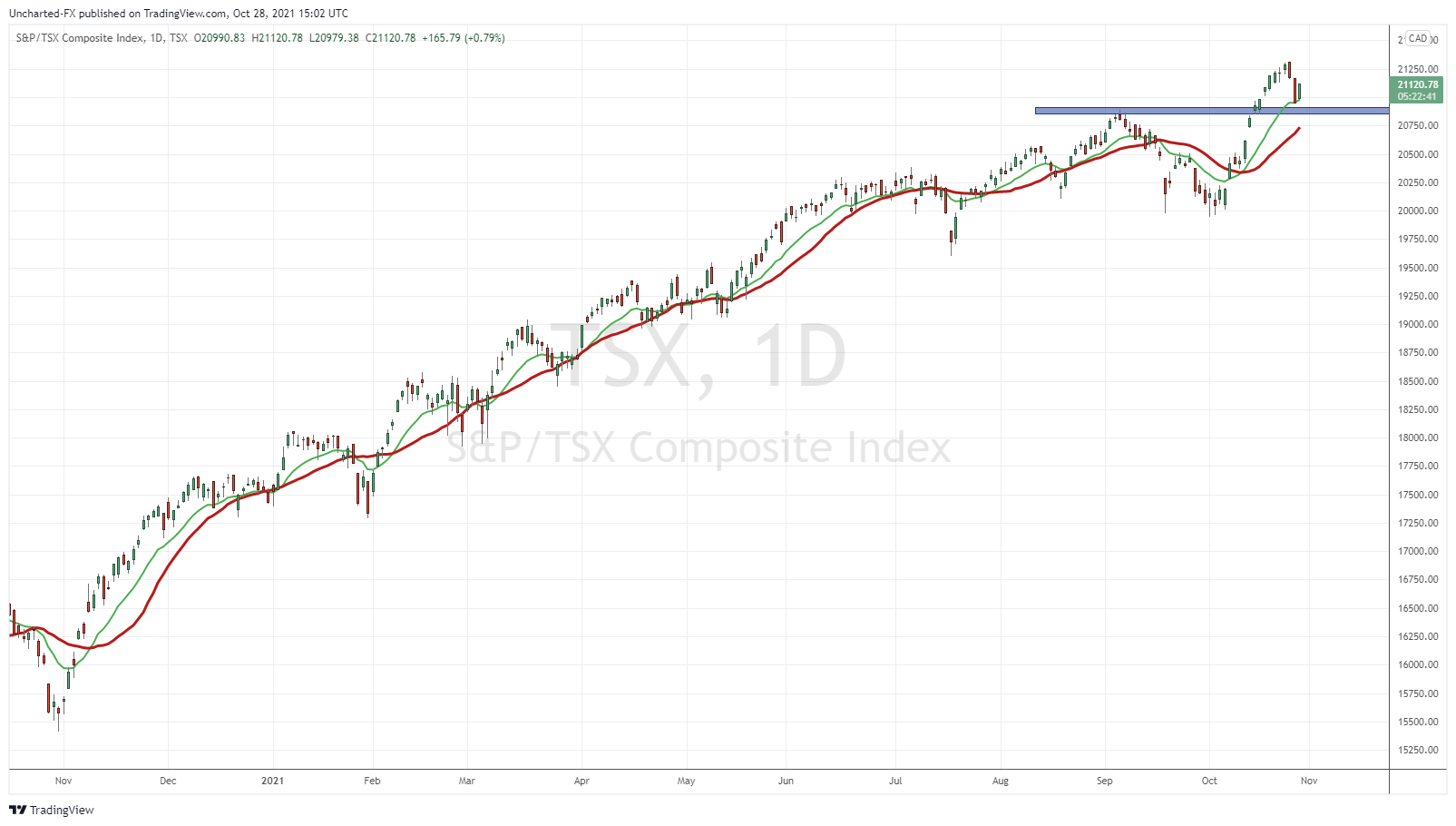

The TSX itself fell on the day of the rate decision. Was it a taper tantrum? Or was it just because other equity markets were weak? To me its the latter. Just technical pullbacks to retest the previous breakout zone. Which we are today. And what do you know, a nice green candle so far indicating buyers stepping in on the retest.

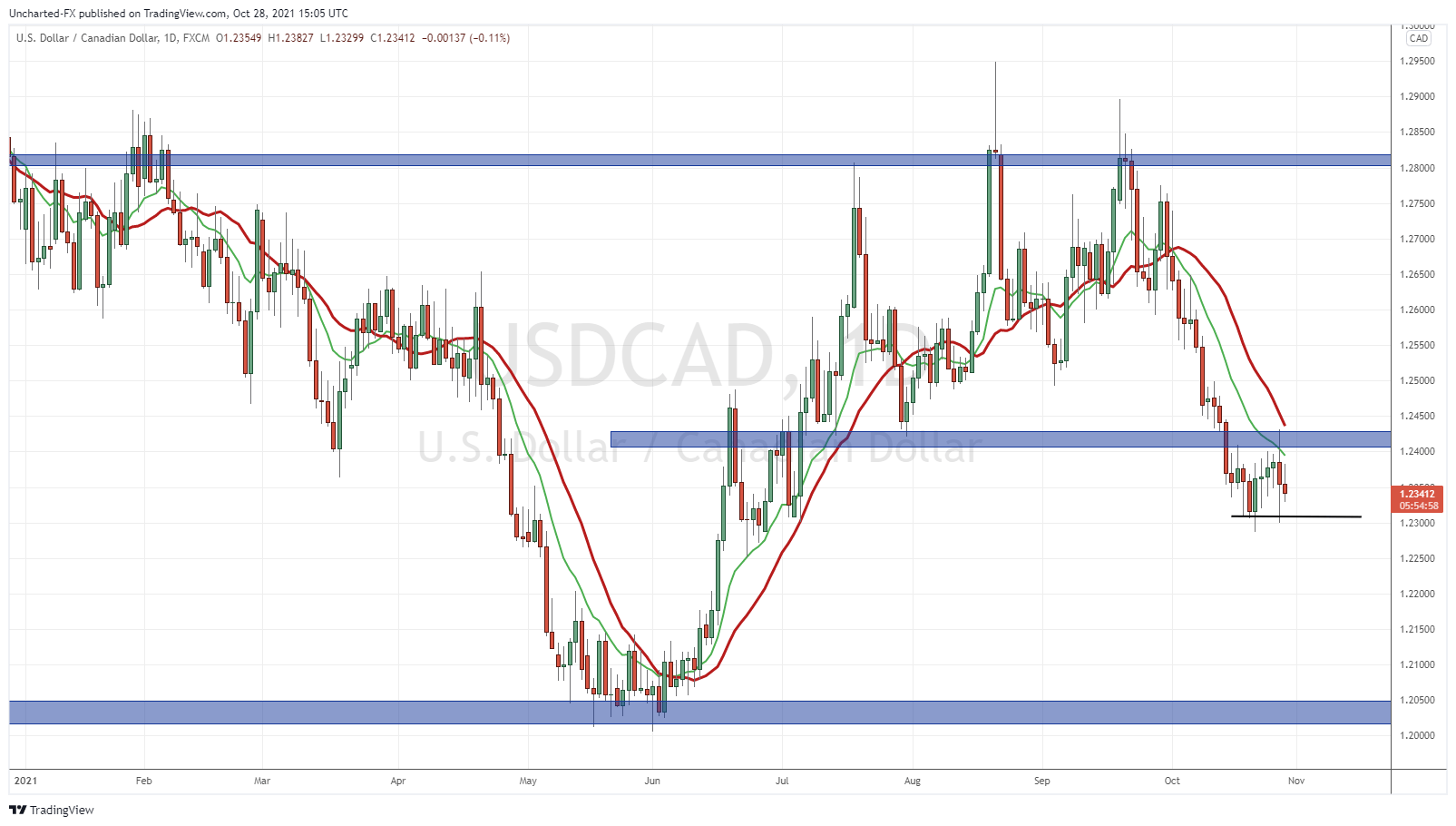

When it comes to Central Bank decisions, one must look at the currency reaction. So let’s take a look at the Canadian Loonie.

Above is the chart of the USDCAD. Just a quick reminder: when the chart moves up, it means the US Dollar is appreciating (strengthening) and the Canadian Loonie is depreciating (weakening). When the USDCAD moves down, or is red, it means the Loonie is appreciating and the US Dollar is depreciating.

I have been watching the USDCAD ever since we broke down below $1.24. My big blue rectangle marks it as a resistance zone. If we closed above, I would be bullish the US Dollar. But the $1.24 breakdown made me bullish the CAD. Yesterday’s BoC rate decision gives me a fundamental reason for the trade. As of right now, the BoC is tapering while the Fed is not. Markets are pricing in Canadian rate hikes, and not the Fed just yet. Although this can change in the upcoming Fed meetings if the Fed also takes on a hawkish tone.

As you can see from yesterday’s price action, we were all over the place. A chop fest. This is why I don’t hold a currency overnight when their central bank is up. If you are a part of our Discord channel, then you know I have been long AUDCAD for two weeks. Closed my position on the day before the CAD rate decision because I did not want the volatility to take away some of my pips. Give the markets time to digest the big fundamental news, and then see if the trend is still intact. For the case of USDCAD, I await the breakdown and close below $1.23 to confirm a lower high and the rejection of $1.24.

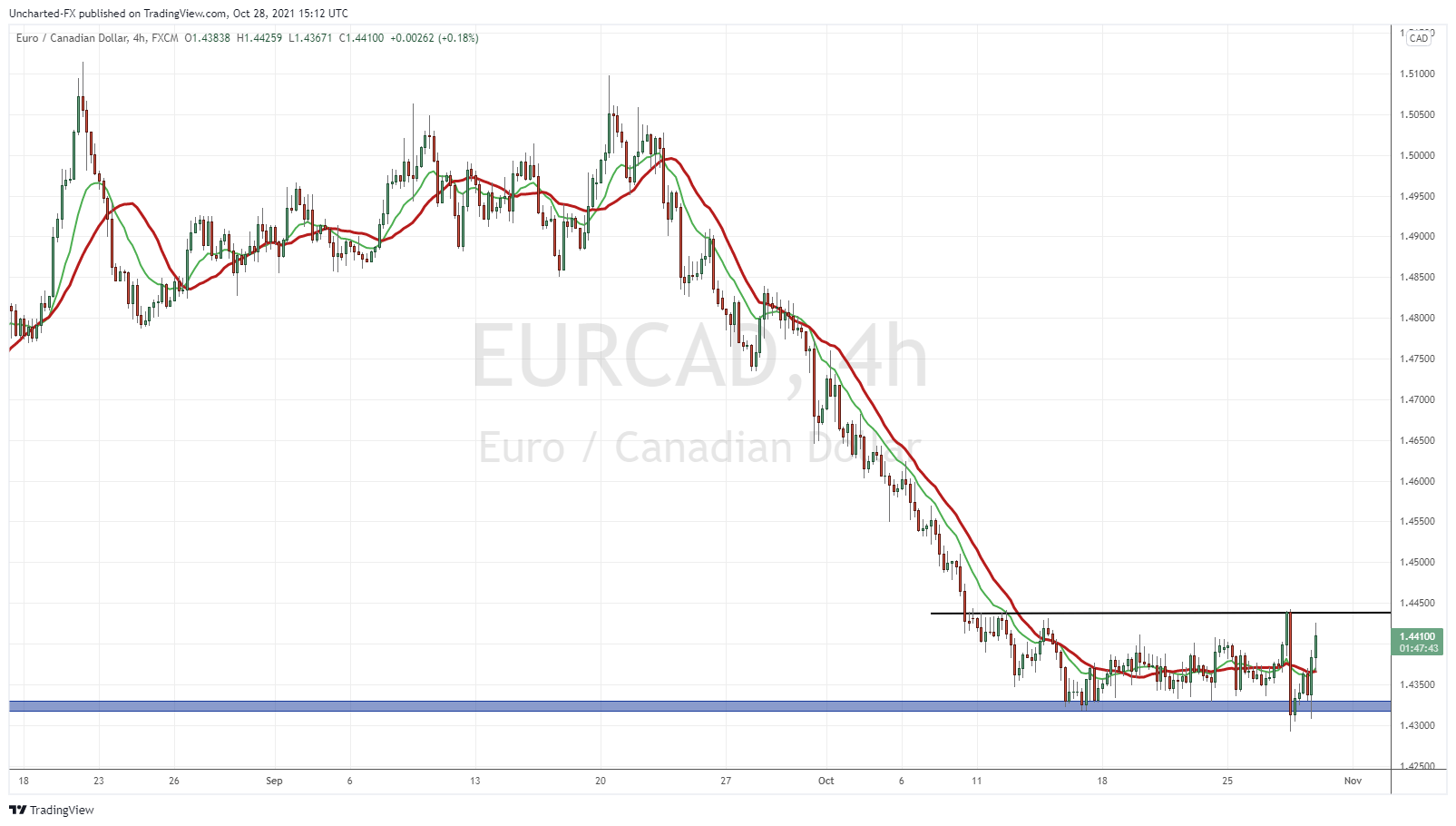

As a bonus, I will give you my favorite CAD set up. EURCAD. The European Central Bank just had their rate decision today. No changes. So now both currencies don’t really have a major market moving event for some time. At least on the central bank side of things.

The structure is beautiful. We have 2/3 market phases depicted in front of us. The downtrend, and now the range, and we are just missing the uptrend. Waiting for the confirmed breakout for an entry and the beginning of a EURCAD bull run. If the CAD continues to strengthen though, the trade is off. This same type of analysis just by looking at structures can be applied to any market. In fact, if you utilized it to buy Shiba Inu you would be one happy camper. Same structure was on Shiba as you can see here on EURCAD.