Sky Harbour (“SYH.V”) is a junior exploration company with an extensive uranium and thorium portfolio of projects around Canadas Athabasca Basin.

Their flagship high-grade Moore Uranium Project produces mostly Triuranium octoxide (U3O8). Triuranium octoxide, a yellow powdery substance, is the most stable form of uranium oxide and is the form most found in nature.

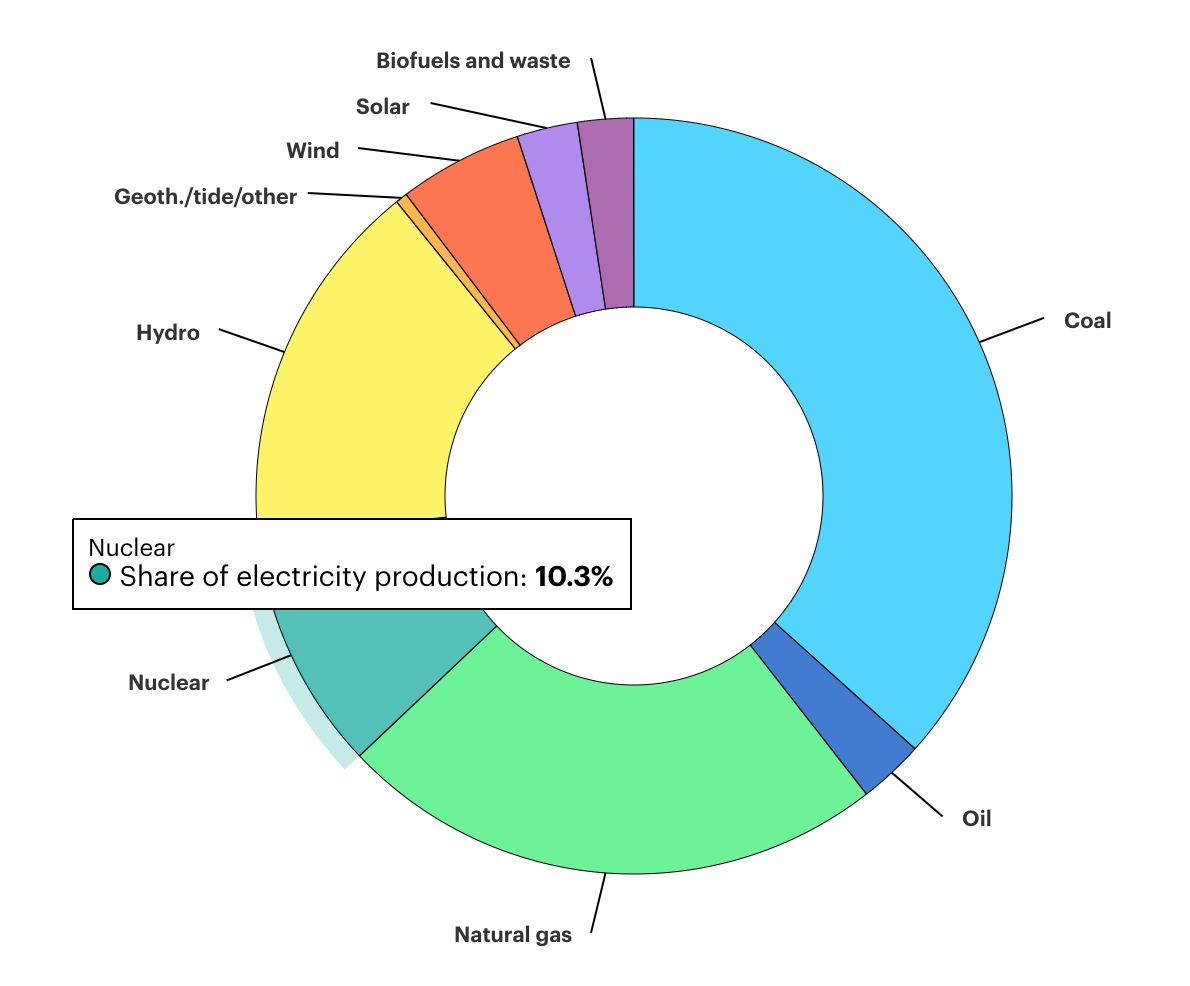

Uranium at its simplest is a metal and is one of the most found elements on Earth, naturally occurring in all rocks, soils, rivers, and oceans. Uranium’s physical properties give it the potential to generate very large amounts of energy from a small amount of material without releasing a large number of greenhouse gases. Currently the precious energy metal fuels about 10% of the world’s electricity production according to a study done by Statista on the distribution of electricity generation worldwide in 2018.

According to the International Energy Agency (“IEA”), the share was in the 10.3% range in 2019 according to their studies and reproduced in the donut chart above. I could pull up many more credible sources and studies that show empirical evidence that the world is moving to cleaner nuclear energy with greater fundamentals for the metal.

So, the big question is, why is everyone not digging up uranium deposits like the gold mania in the 1860s?

Uranium is present in low concentrations in many rocks and bodies of water.

The extraction of which is only economically viable from wealthier deposits. The decision to mine is determined by many factors including withdrawal method, auction market prices, and societal and ecological considerations. These pitfalls add to the economic cost of extraction outside of the accounting costs.

The economic cost of extraction = Accounting costs + Financing costs +Social and Environmental Costs – any tax credits or subsidies.

- Accounting Costs (i.e., Capital Expenditures, Exploration costs, Selling, and General Admin expenses)

- Financing Costs (i.e., Cost of debt and cost of equity)

- Social Costs (i.e., the image of the brand or business goodwill and economic goodwill)

- Tax credits or subsidies (i.e., energy subsidies of investment in sustainable clean energy)

Companies like SYH have tried to mitigate some of this economic cost/risk by implementing a prospect generator model. Over the few decades, the prospect generator model has become the resource industry’s most unappreciated strategy for minimizing risks while maximizing rewards. Prospect generators acquire likely land packages with a high potential for a significant discovery (or high-quality assets) and then carry out the initial pre-drilling exploration work (i.e., geologic mapping, geophysics, geochemistry).

SYH finds strategic partners using options and joint ventures to acquire secondary projects minimizing risk and maximizing reward (growth by buying up high-quality assets). This reduces the accounting costs and social costs to the prospector and allows them to leverage their know-how and network to get higher-yielding assets.

This operational leverage goes hand in hand with a conservative balance sheet. SYH has $C9 million in cash and cash equivalents. Of that $C9 million, $C6.8 million was in cash and $C2.1 million was invested in 233,333,333 shares in a publicly-traded company with an initial value of $C1,605,629 pursuant to an option agreement for the Hook Lake, South Falcon Point in the Athabasca Region, Saskatchewan.

The company has a current liability account of just shy of $C500 thousand and $C10,75 million in capitalized property plant and equipment. Essentially what you’re getting if you’re buying into the common stock is $C9 million in cash and cash equivalents plus $C10.75 million in property plant and equipment subtracting about $C500,000 in payables.

I should also mention the fact they are yet to generate revenues from mineral-producing operations, but the uranium market is showing signs of recovery, and analysts that cover the segment have itemized that there could be a sustained improvement as they are currently seeing some of the best fundamentals since pre-Fukushima. (An Analyst has given a 1.14 price target. The current auction price is around a bid of 70 cents.)

The operators at SYH believe this should be supportive of higher uranium prices as a major supply-side response is playing out while the sticky demand-side continues to improve. This hodgepodge of catalysts is what investors seek when they make acquisitions of companies that are pre-sales. It should be noted that buying securities on this basis is speculatory in nature and should not be confused with investing operations. Although both are just ways of profiting from the auction market, speculatory bets have higher probability distributions meaning the eventual outcome is more uncertain.