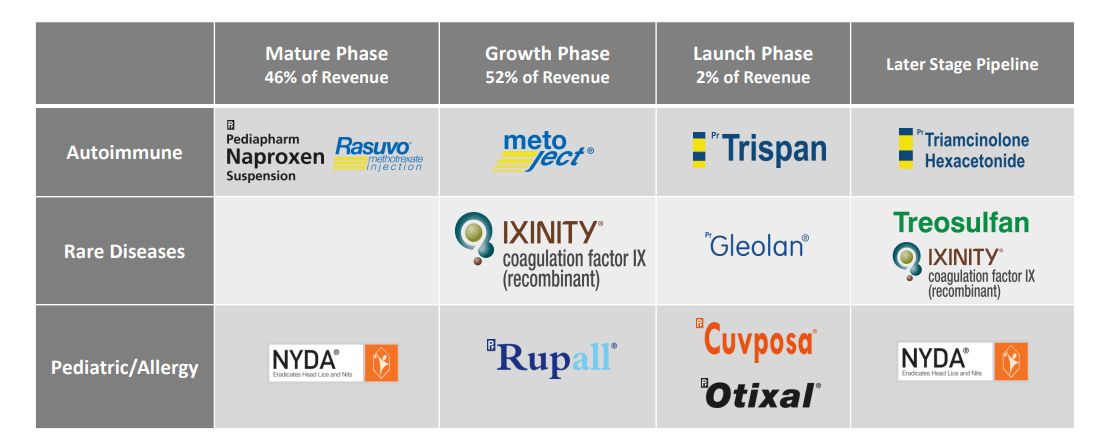

Medexus Pharmaceuticals (MDP.TO) is a rare disease pharmaceutical company with a portfolio of innovative and high value rare disease products positioning the company for growth in the next decade and beyond.

Here is the Medexus product portfolio:

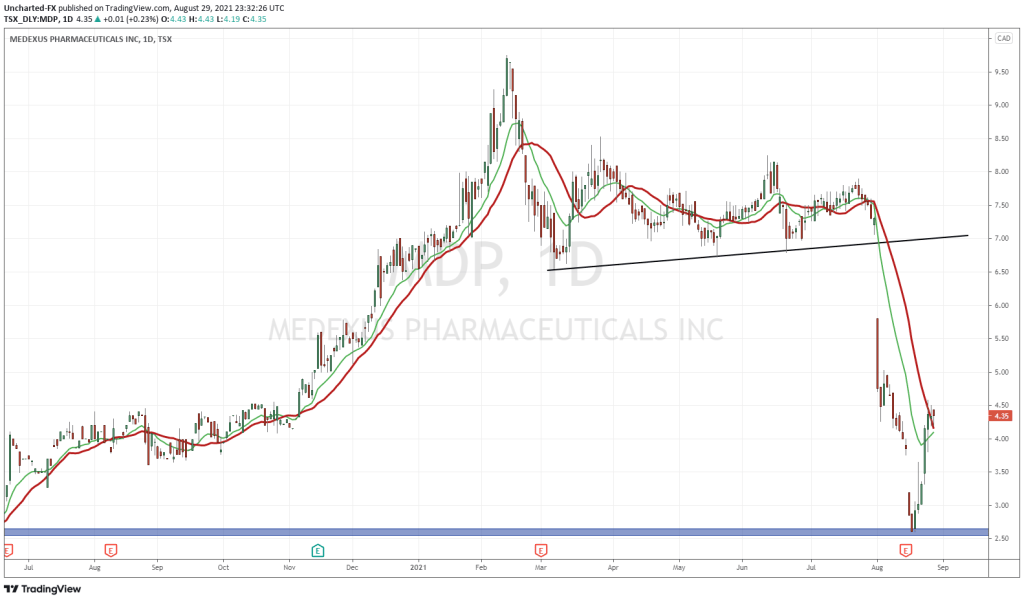

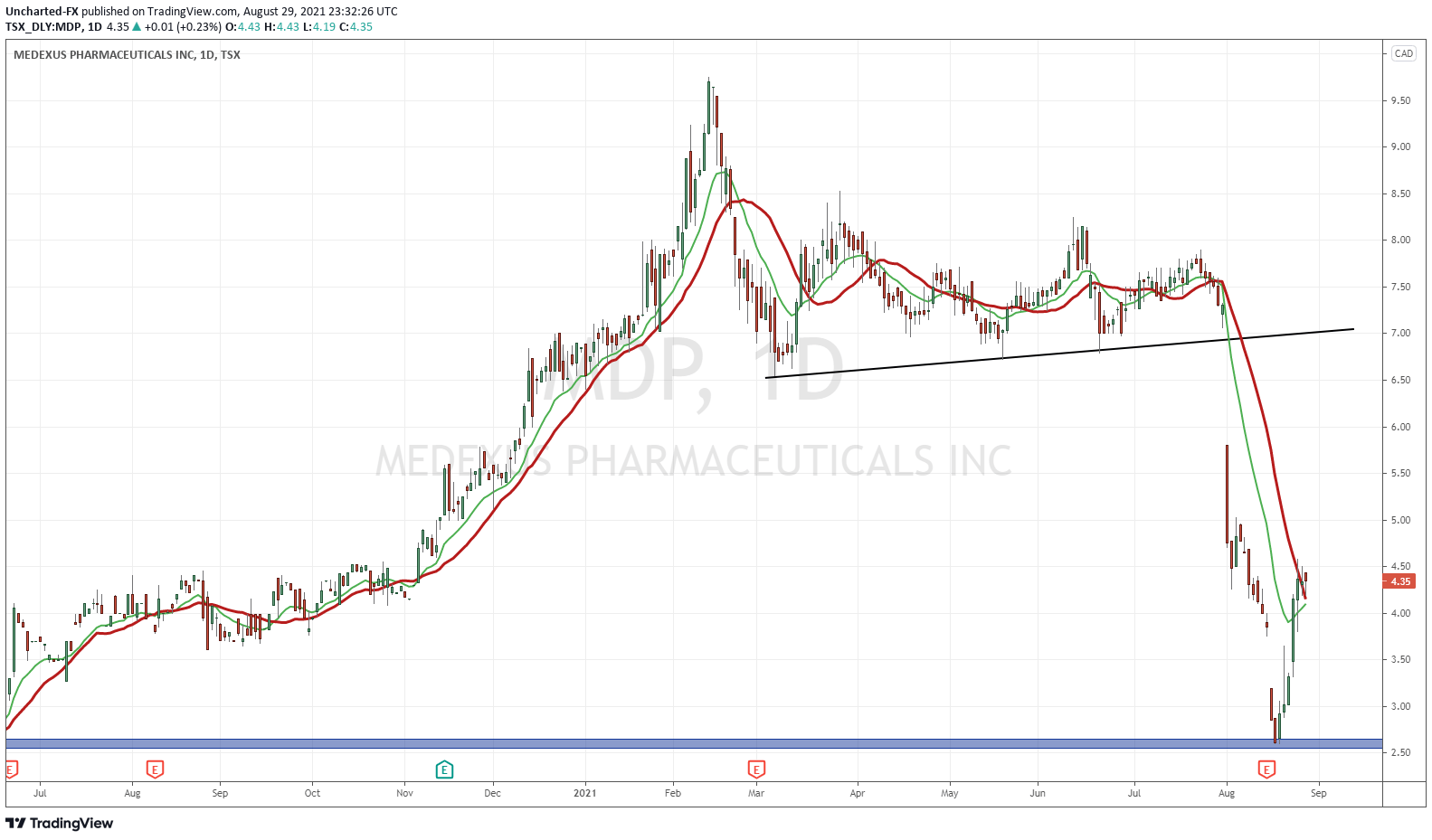

In terms of recent news headlines, there has been quite a few. More importantly, one of them impacted the chart, which may have been the market overreacting, but provides long term investors with a gift of an entry opportunity.

Earnings is always important, and Medexus delivered Q1 2022 financial and operational results on August 16th 2021. Here are some highlights:

- Revenue of $17.3 million compared to $20 million for Q1 of fiscal 2021. The decrease in net sales was due to a temporary decline in ex-factory sales of IXINITY®, as pharmacy and wholesale customers continued to work through inventory on hand. Despite the decreased sales, patient unit demand for IXINITY® increased 25.3% compared to the corresponding period in the prior year, to 7.6 million IUs, which reflects the Company’s successful commercial efforts. These efforts are expected to be realized in strong ex-factory sales and improved gross margin, once the inventory on hand is reduced to normal levels, in the coming quarters.

- Adjusted EBITDA* decreased to $(4.9) million compared to $3.6 million for the same period last year, due primarily to the decrease in Net Sales, the impact of a manufacturing expense related to IXINITY®, an increase in Research & Development Costs over the comparative period due to the ramp up of the IXINITY® pediatric trial, and the investments the Company made related to plans for the commercialization of treosulfan.

- Cash used by operating activities was $6.8 million, compared to cash provided by operating activities of $3.0 million for the same period last year. $5 million of the cash used was a milestone payment to medac for the treosulfan license. There are no additional milestone payments for that license until approval.

- Net loss was $6.6 million compared to $3.4 million for the same period last year.

- Adjusted Net Loss* (which adjusts for such unrealized losses (or gains) on the fair value of derivatives) was $9.8 million compared to $0.8 million for the same period last year.

Definitely take a look at TK’s piece here on Equity Guru for a breakdown of the numbers. And also take a look at our Investors Roundtable for further breakdown.

I think the big news has to do with the Food and Drug Administration (FDA) and Medexus’ New Drug Application (NDA) for the use of Tresosulfan in combination with Fludarabine. This is important because the chart was definitely impacted on the news. This is what I mean by impact:

A gap down dump. Hate to see them, but it happens. The big drop happened on August 3rd 2021, which coincides with the letter received from the FDA. This is where the market may have overreacted. What the FDA said in the NDA rejection is that Medexus should go back and provide additional clinical/statistical data and analysis. Medexus will take the appropriate course of action, which to me, is now a future catalyst for the stock price. They’ll fix what they need to, and then go back with a newly submitted NDA.

According to MarketWatch, Medexus is a company pulling in revenues of $105.31 million with a market cap of $83.19 million. Wow. Some bargain hunters will be looking around here.

Also I want to point out that the stock crashed on earnings. A gap down. And then finally found support at the $2.50 level, before seeing a five day green candle bounce.

In terms of technicals, as an investment, this is a great pick up. I still remember receiving a call from Equity Guru’s Biotech expert Ehsan. He was telling me to watch these guys and pick up shares around $2 bucks. The stock price nearly hit $10 bucks, and is allowing me to pick up shares at the cheap because of one hiccup that will be remedied.

As a trader, I might prefer to see some sort of base form. One thing that may deter traders is the large gap between $5.85-$6.50. Gaps are major support and or resistance levels. In this case, it is a resistance area, meaning sellers will want to short at that area. It is very similar to breakdown market structure: price breaks below support, now what was once support becomes resistance.

On the positive side, if we fill this gap, meaning we close above the $6.50 zone, this will lift up. A gap fill is a very bullish signal. It should be. The stock plugged the gap indicating how strong the buying pressure is. It would mean the FDA news was an overreaction.

This happens. Biotech stocks are quite volatile. But then, there are some days where positive news sends the stock soaring. We have seen many instances of this on US markets recently.

So in summary, this is a bargain pick up. The business of the company did not change, and the FDA news can be remedied. Earnings pop confirms this. I think this is one where the market and traders got wrong and overreacted. As they say over on WallStreetBets: I like the stock.