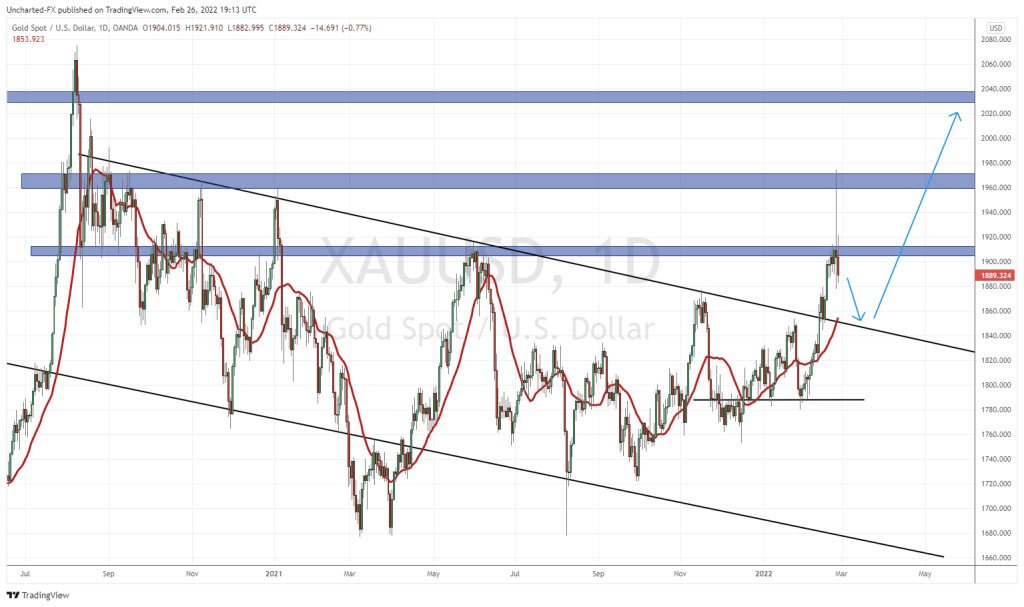

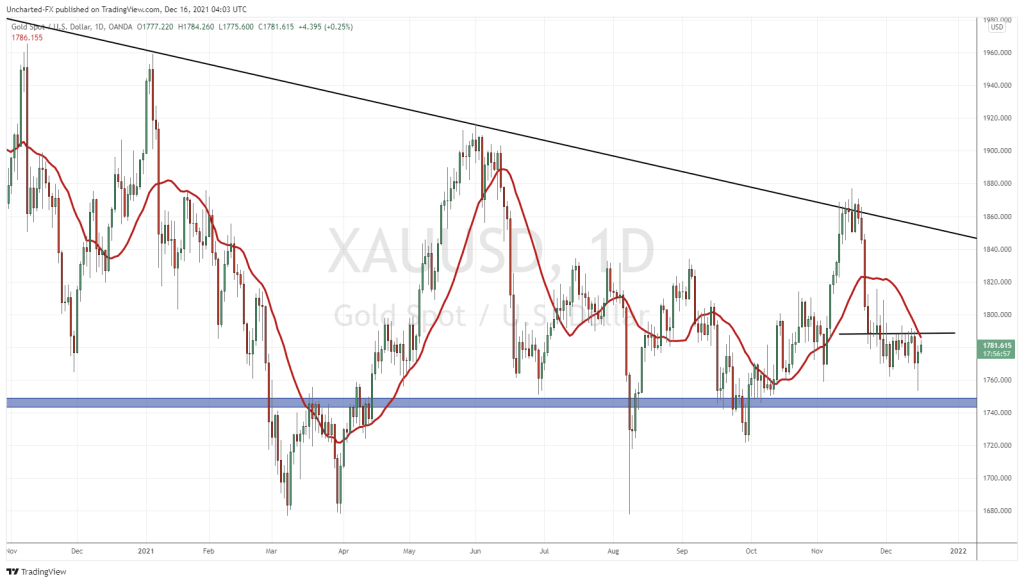

A year ago, the spot price of gold was USD $2,050 an ounce. In the last 12 months, gold has sold off to the $1,780 an ounce level, which is a solid resistance point.

Despite the current gloomy bullion sentiment, the long-term macro arguments for gold investment have never been stronger.

“The COVID pandemic has added $24 trillion to the global debt mountain over the last year a new study has shown, leaving it at a record $281 trillion and the worldwide debt-to-GDP ratio at over 355%,” reported Reuters.

Most of that global debt is based on fiat currency (paper money), and many experts believe is very easy to manipulate supply.

No act of Congress can magically make a tonne of gold appear on the lawn of the White House.

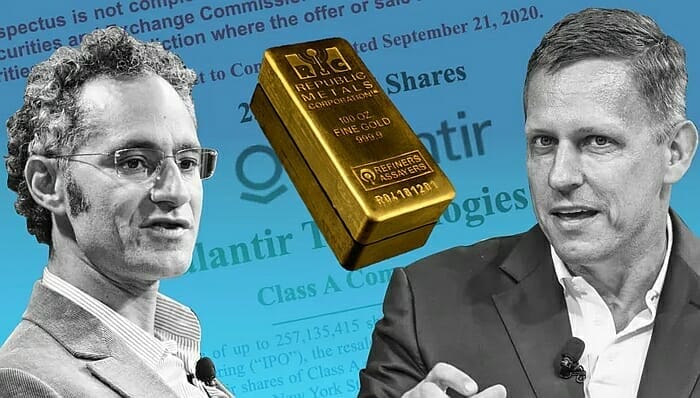

As it turns out, not everyone has gone bearish on gold.

“While some companies such as Tesla are diversifying into bitcoin, the data analytics software company Palantir is betting on gold,” CNBC reported on August 17, 2021, “Palantir bought $50 million in gold bars in August, 2021.”

If Palantir’s contrarian bet plays out (the price of gold goes up) owning gold-in-the-ground or a stake in a producing gold miner could also be a significant wealth-generator.

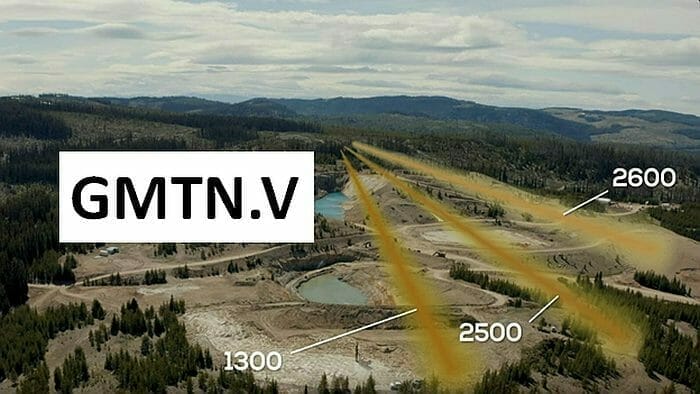

High on our list of gold small-caps is Gold Mountain Mining (GMTN.V) – a $100 million gold developer located near Merritt, BC. GMTN is trading at $1.45 – 50% lower than it was a month ago.

“If you are looking for exposure to the precious metal and can appreciate the risk/reward dynamics of the junior exploration arena, Gold Mountain is a compelling speculation—a near-term production scenario boasting a (growing) high-grade resource and significant exploration upside,” wrote Equity Guru’s Greg Nolan on May 14, 2021.

Waiting for small gold companies to start mining, processing and pouring gold can take decades – the buzz around GMTN is that it moves fast.

January 19, 2021 – Mining Contract with Nhwelmen-Lake LP

January 26, 2021 – Ore Purchase Agreement with New Gold

May 14, 2021 – Increased Mineral Resource Estimate

May 27, 2021 – Updated PEA

June 17, 2021 – Increase Tonnage Limit in Ore Purchase Agreement

June 30, 2021 – Phase 2 drill program starts off with a bang

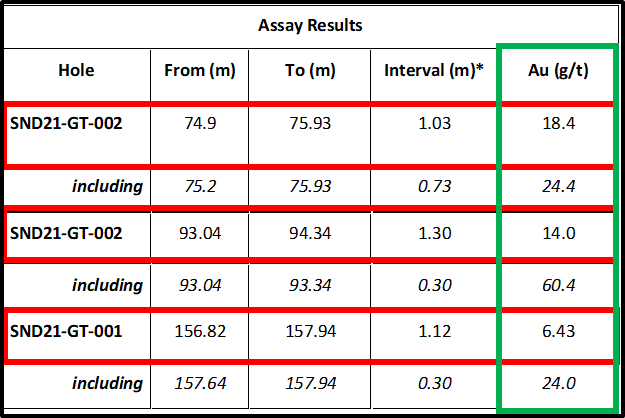

The June 30, 2021 assay results from the initial holes of its Phase 2 drill program at the Elk Gold Project located near Merritt, BC were good.

“These high-grade assay results continue to extend the deposit’s established mineralized zones down dip and indicate clear vein continuity at depth,” stated GMTN.

Highlights:

- Drilling Highlights Include:

- 1.0m grading 17.3g/t Au including 0.73m of 24.4g/t Au

- 1.3m grading 13.9g/t Au including 0.30m of 60.4g/t Au

- 1.12m grading 6.4g/t Au including 0.30m of 24.0g/t Au

Gold Mountain’s Phase 2 drill program continues to methodically extend the Elk’s shallow, open pit amenable vein systems as well as its deep, high-grade mineralization at the Siwash North Zone.

Gold Mountain continues to re-log historical core samples after the success of the Phase 1 relogging program.

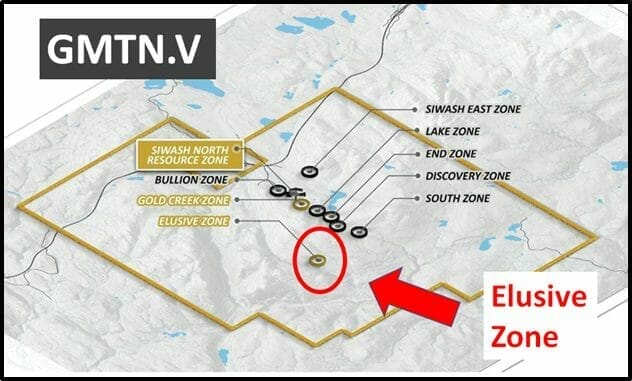

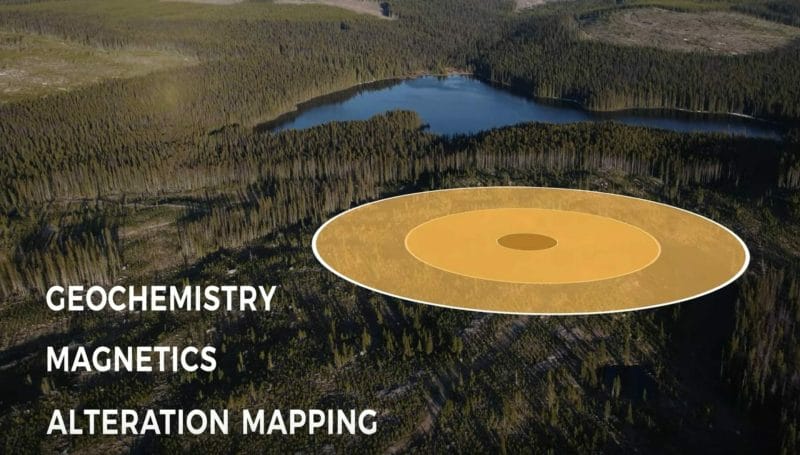

HEG and Associates (“HEG”) has completed a soil geochemical survey over highly prospective exploration targets on the property including the Elusive Zone.

For years, Equity Guru boss-man Chris Parry has been screaming from the tree-tops that mining companies need to modernize the way they speak to investors.

Mining companies “still think of millennials as idiots and rubes,” wrote Parry on January 23, 2019 , “a lost cause that will never pay attention to a mining explorer or an oil and gas play, even though they were front and center on lithium and cobalt.”

“Step one of any good marketing program in the real world, where actually selling products is how you live or die, is to NOT market to the same old crowd in the same old way, every time,” added Parry, “That’s just a pathway to the middle of the pack, at best”.

Geologically and operationally GMTN has already separated itself from the pack.

Here Gold Mountain CEO and Director Kevin Smith explains the June 30, 2021 drill results.

“Our Spring Summer exploration program is in full swing as we continue to drill out the property and march this resource past a million ounces by fall,” stated Smith.

“Phase two drilling is picking up where we left off in phase one continuing to chase high grade in the Siwash North Zone,” confirmed GMTN COO Grant Carlson, “Right now the drill is located south of pit one and it’s drilling through the 1300 2500 and 2600 veins. This is very efficient and cost effective because we’re able to intercept three mineralized zones with each hole.”

“We’ve hit three highlight intercepts in his latest batch,” added Smith, “two 24 grams per tonne and one 60 grams per tonne, and the thickness of these veins is consistent with previous intercepts.”

“We learned in phase one that as we chase the veins further west, they’re starting to converge,” stated Carlson, “and the results from this drilling in phase two is confirming that model.”

“As a part of phase two, we have a team of eight geologists from HEG exploration, completing a geochemical survey over the Elusive Zone,” added Carlson, “By pairing our geochemical data with our magnetic survey and alteration mapping it will allow us to paint a bullseye of where we need to drill.”

“So far, we received assays for the first 500 meters of drilling. This represents 12% of our drilling in this Siwash North Zone and only 5% of our total phase two program. It’s critical that we continue to nail these early intercepts so we can meet our commitment of delivering a million-ounce resource,” concluded Smith.

“This area has the second highest gold in soil anomaly, numerous copper showings, and is yet to be drill tested,” added Smith, “If we are able to connect, Gold Mountain could be looking at a bulk tonnage style deposit, to pair with our known high-grade sulphides, at the Elk Gold property.”

GMTN’s geo-team continues to relog its historical core after uncovering significant mineralization that was overlooked by previous operators during its Phase 1 relog program.

Current relogging efforts are focused on historical drill holes adjacent to the current Phase 2 drilling to better understand the deposit geometry, which will ensure that subsequent drilling has the best chance of hitting further mineralization.

June 17, 2021 GMT News: Increase Tonnage Limit in Ore Purchase Agreement

“This move to feed the New Afton mill substantially greater volumes of ore adheres to the year 4 production profile outlined in the Company’s recently updated PEA,” wrote Equity Guru’s Greg Nolan on June 18, 2021.

“Aside from enhancing the project’s overall economics—the reduction in the AISC from $735 per oz to $554 per oz is HUGE—this move to aggressively scale production via accelerating the toll milling option greatly reduces risk,” added Nolan.

“During August 2021, Plantir purchased $50.7 million in 100-ounce gold bars,” Palantir admitted in its earnings statement.

The data analytics software company also announced that customers could pay for its software in gold.

“You have to be prepared for a future with more black swan events,” Palantir COO Shyam Sankar told Bloomberg.

Palantir’s newly purchased gold will be stored at a secure third-party facility.

If Palantir decides to purchase more gold in the future, GMTN could be the source.

– Lukas Kane

Full Disclosure: Gold Mountain is an Equity Guru marketing client.