Years ago on my personal blog, I wrote a piece titled “Future Investment Opportunities“. I had the usual: commodities, water, farmland, Green/Clean Energy, and AI. But then I had one which got some people asking questions. I used the term, “geek culture” referring to video games, cosplay, anime, and board games. In Japan, they refer to someone obsessed with Anime and Manga as an “Otaku”. Otaku levels of obsessiveness are making its way to the West. Some would argue it’s already here…and I might just qualify as one.

Board games remain hot, especially during the pandemic lockdowns. Kickstarters see tons of money backing a variety of tabletop games. We are talking over $500 million dollars worth. Big money. In fact, there is an opportunity to even flip Kickstarter board games once they come out for higher prices to people who missed out on funding, but want the game. It is a very common thing for millennials like me to have board game nights.

The cosplay trend is getting hotter. A big part of it has to do with Netflix, and other streaming platforms bringing in anime’s. Another part of it has to do with incredibly beautiful women dressing up as our favorite anime characters on Instagram and Twitch.

But today, I want to discuss video games. In a way, video games encapsulates the entire geek culture movement as it includes elements of cosplay and anime. Gaming is a huge market. I was one fortunate enough to get my hands on a PS5 when it initially came out, and from what I am hearing, it still is difficult to get your hands on one.

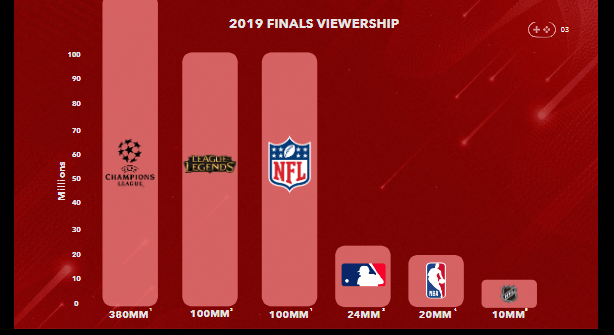

I am more of a casual gamer myself, but competitive e-sports is definitely taking off. Twitch streamers who stream themselves playing video games are already racking in the moolah. Over in South Korea, competitive gamers are celebrities. This is happening here too. I have seen famous athletes such as Neymar Jr joining famous gamers on Twitch.

E-sports and gaming leagues are set to be the next big investment opportunity here in North America. We have seen celebrities such as Drake and Snoop Dogg invest or sponsor esports teams. The owners of the Vancouver Canucks own the Vancouver Titans, which is an esports team that competes in the Overwatch League.

Not only will competitive esports get bigger, but so will gaming events and conventions. This brings me to today’s chart: TGS Esports, or the Gaming Stadium.

This is Canada’s first esports gaming stadium located in Richmond, BC, built to be the best place to play and watch esports. With the pandemic, live events have been put on hold, however, events are still being played online. With BC allowing indoor events to take place soon (the Vancouver Whitecaps will be having their first game in front of a live crowd starting next weekend), we will hear about The Gaming Stadium’s next plans.

In fact, they have already announced Canada’s first Live Esports event post pandemic on October 8-10th/2021 at the Vancouver Convention Centre. Recently, TGS Esports also reported revenues of $282,220 in the first month of a new fiscal year.

With both of these news pieces, I truly believe there is an opportunity to invest in TGS Esports just before more catalysts hit the news, and before the esports mania takes off!

Technical Tactics

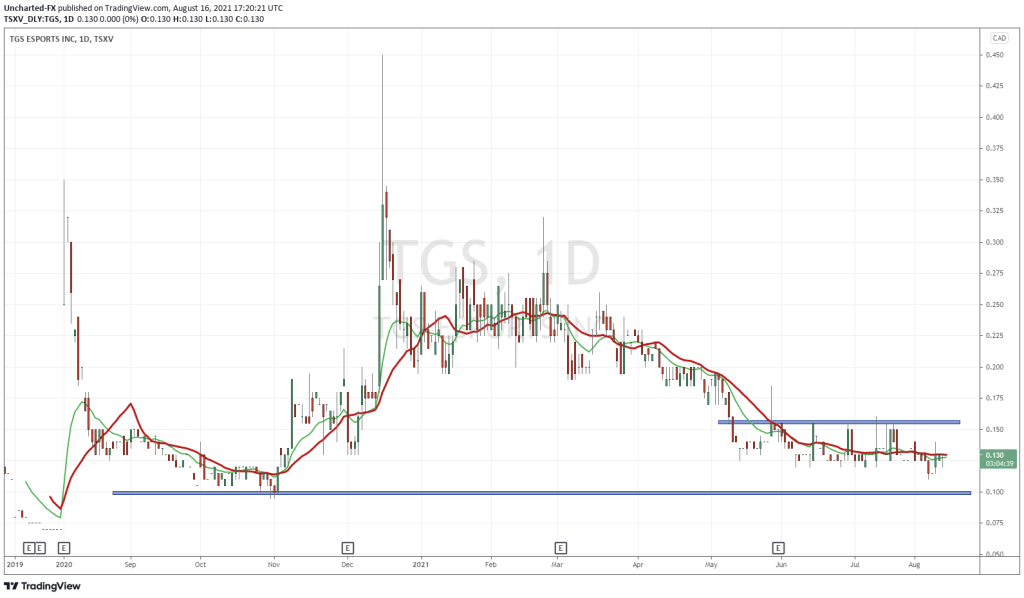

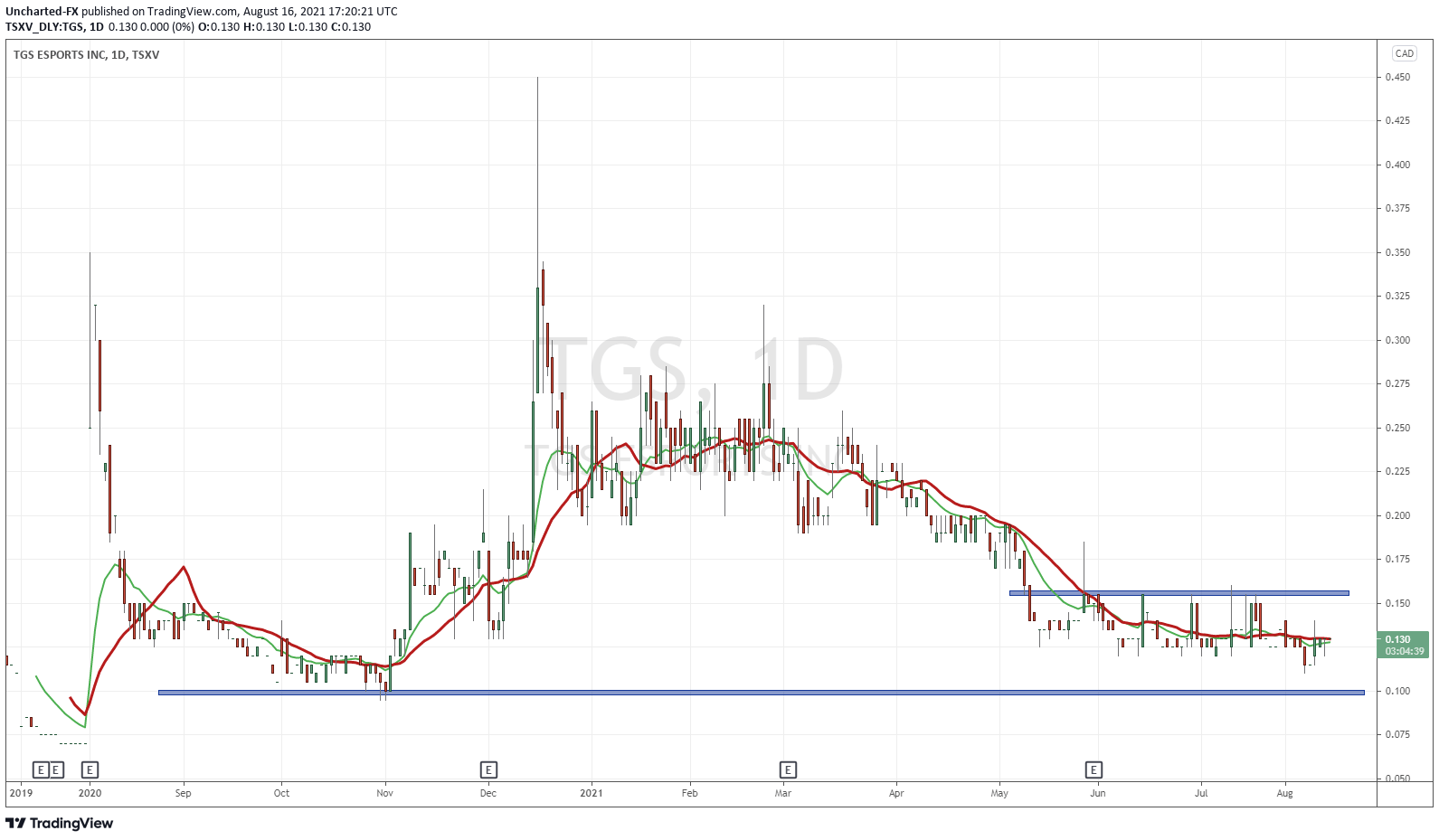

Now that we have the future trends out of the way, we will take a look at the chart to determine when one should put some cash into TGS Esports stock.

Remember: approach this with a long term stance.

TGS Esports is basing. We are ranging between $0.11-$0.155. The $0.155 resistance zone is what’s important for us technical traders. If price closes above this level, we have a technical breakout. Some sort of catalyst will be required for the break and momentum move higher.

To the downside, we have a larger price floor at $0.10, pretty much close to all time lows.

As I said, the price levels here provide an attractive opportunity to buy the stock at these levels for a company in a sector that will see upside in the future. We can get in early here, but the opportunity cost is missing out on other moves if the stock continues to range. Alternatively, just await the breakout above $0.155 for a better chance of the stock continuing higher and beginning its next bull run.

If one were to accumulate at these levels, I would do so strategically. The stock is traded thinly. Somedays we see 80,000 shares plus traded. On other days, we see 5,000 shares traded. placing larger orders on those thin trading days can move the market, or not see your orders get filled.

In summary, the chart is providing a basing pattern here, for a company that is in an upcoming hot sector and trend. I see the share prices moving higher, but the opportunity cost is seeing the stock just range. We have all been in those trades. They can be incredibly frustrating, as your money sits while you miss out on other moves. Hence why approach this opportunity with a long term focus. You will be rewarded for doing so. For more info on TGS Esports, be sure to check out all the other fundamental pieces here on Equity Guru!