Virgin Galactic stock (SPCE) is one to keep on our radar for this week. The company is building some momentum on its test flight in space back in July. Sir Richard Branson became the first billionaire in space…beating out Jeff Bezos. Virgin Galactic moved their test flight before Blue Origin’s July 20th test flight, to beat the previous CEO of Amazon. The momentum continues with the reopening of ticket sales. But they don’t come cheap. Nevertheless, Virgin Galactic stock has cleared an important technical zone, and currently is seeing the ‘retest’ part of the breakout.

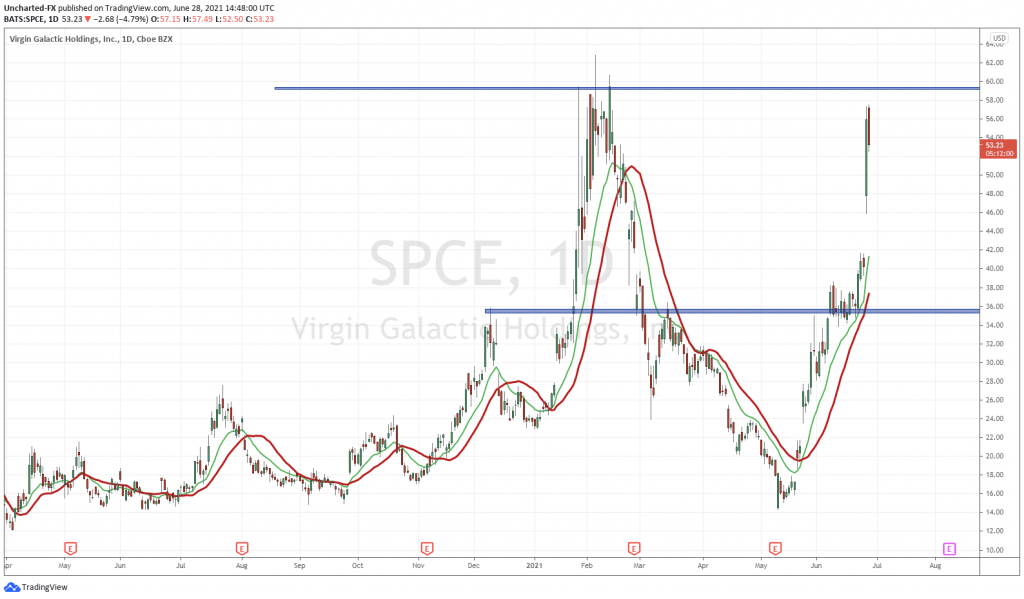

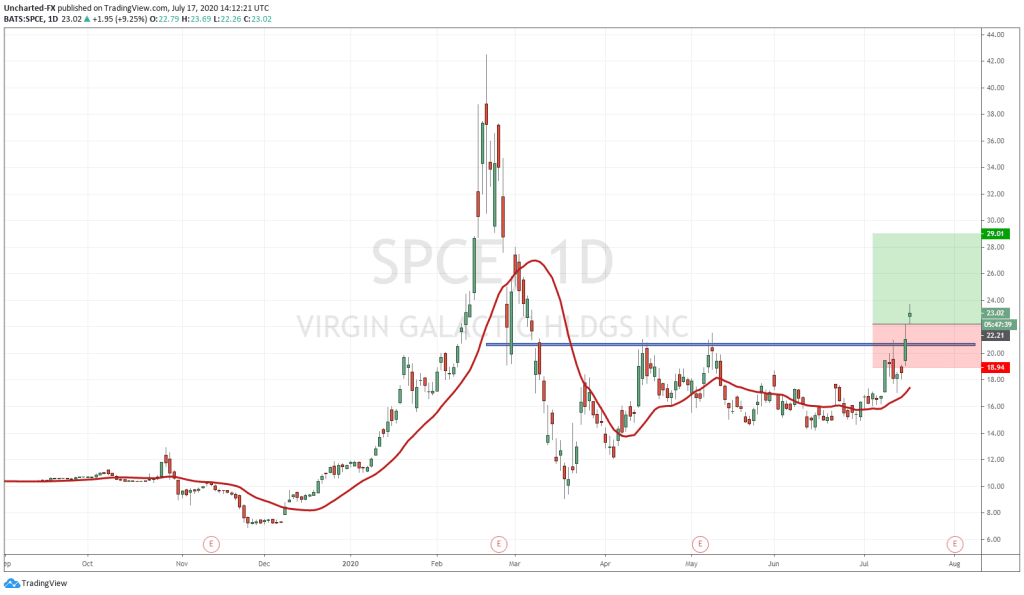

I looked at Virgin Galactic back in July 2020. We ripped it then, and a similar looking pattern is happening 1 year later. But back then we did not have the FAA approval to fly people into space. This is big news, and in my latest Virgin Galactic piece, I discussed that the market may be getting a wake up call. I for one thought space travel was still years away. It looks like it may be happening sooner rather than later, and the market is now pricing this reality in.

One of the big arguments against Virgin Galactic is the fact it makes no money. Many of these growth stocks do not (think Uber, Air BnB etc). But investors price in future expectations for profit. Back in the day, I remember joking about how one day, analysts would be putting up schematics of the SpaceX, Virgin Galactic, and Blue Origin vehicles and then determining how many seats there are and which company will make more revenue per flight. Well, this is likely to happen in the next few months.

Ticket sales are a thing. Virgin Galactic has reopened ticket sales, but you probably wish you booked them in advance in 2014. Tickets were priced at around $250,000 with a $1000 refundable deposit. Now the prices have gone up by 200k to $450,000 for a four minute ride in space. 600 people already have tickets from the earlier round of sales, with 1,000 more tickets to be available for those who reserved a spot on the waiting list.

Technical Tactics

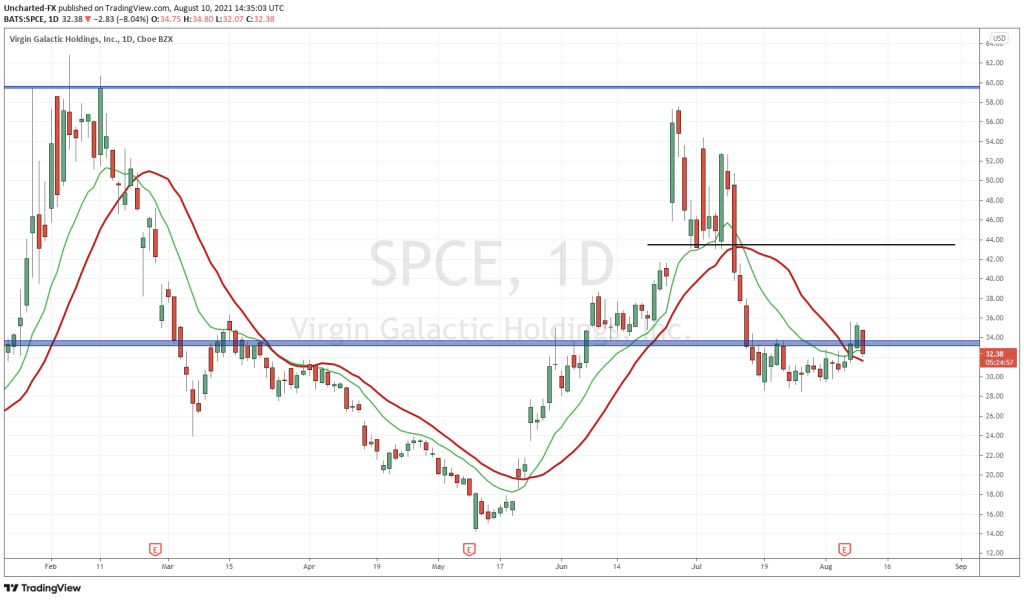

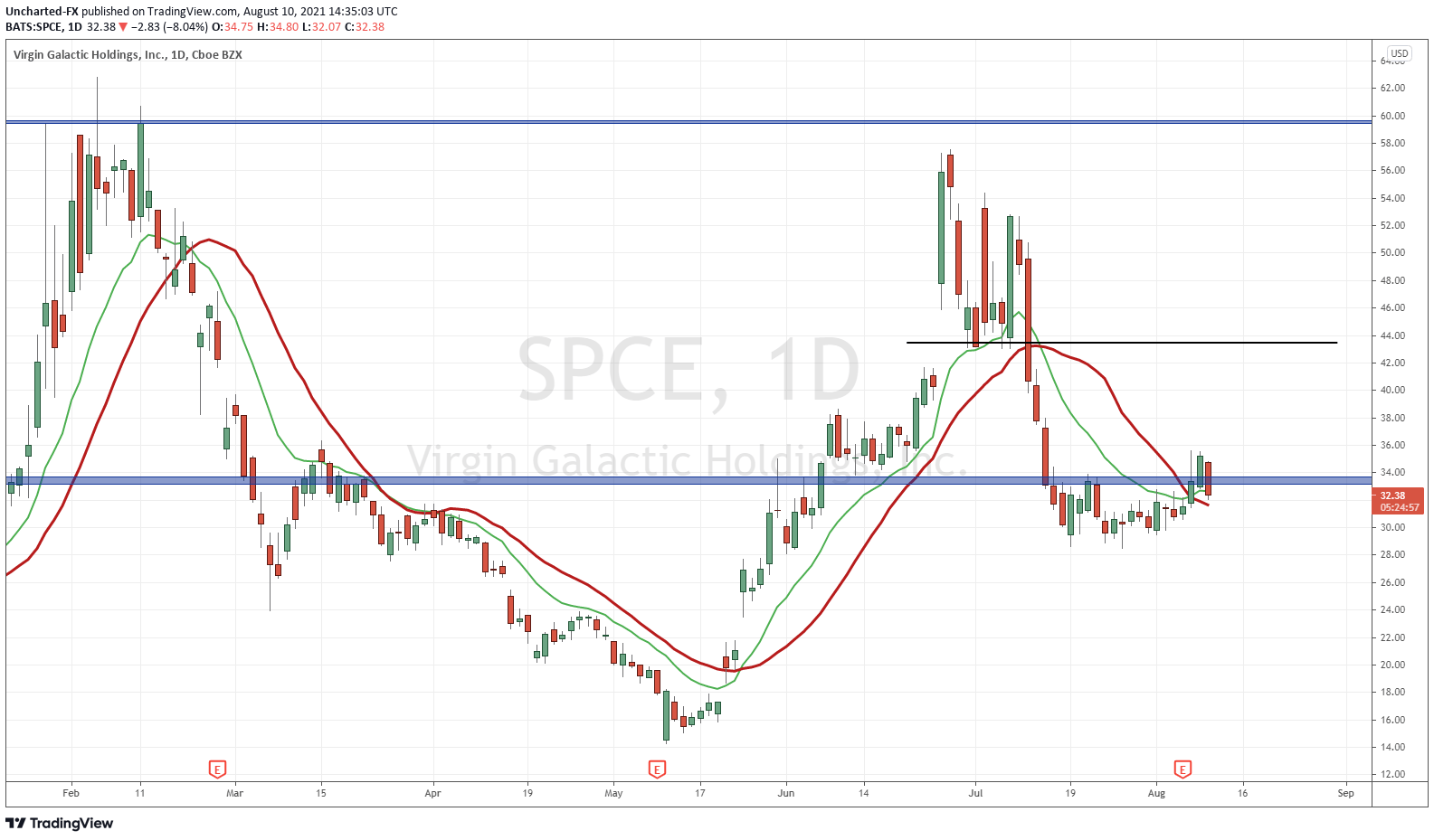

Alluded to earlier, but Virgin Galactic stock confirmed a major breakout yesterday, and today is the all important retest portion of the breakout.

For those who are apart of Equity Guru’s Discord Channel, you were given the heads up in advance! We also released the Technical Tactics portion in video format on our Youtube channel, where I discussed the breakout trigger for Virgin Galactic stock.

Before I discuss the charts, one major thing to keep in mind is how the Nasdaq acts today. While the S&P 500 and the Dow print new record highs, the Nasdaq is red on the day. News out earlier today regarding a unit of Softbank selling off US tech shares including that of Facebook, Microsoft, Alphabet and Google. This seems to be putting pressure on tech. Not really going to help Virgin Galactic stock on the retest, but at time of writing, we still have over 5 hours of trading left in the day.

Above is the daily chart of Virgin Galactic. For those a bit more eager to enter, you can drop down to the 4 hour chart. The next 4 hour close clocks in at 10am PST. Depending on how that candle closes, one can enter a position ahead of the daily close.

So what do we have here? Virgin Galactic stock dropped after retesting highs near the $60.00 zone. We pulled back hard and began ranging around the $30.00 zone. A range is important. It tends to let us know that the previous trend is ending, and a new trend is about to begin. In this case, the downtrend is ending, and an uptrend is beginning.

When a range breaks, we call this a breakout. Virgin Galactic could have seen the break to the downside (below $30), but instead it is breaking out higher. The $33.50 zone was the top portion of the range (marked in blue on my chart), and yesterday saw a nice daily breakout candle. Notice how we attempted a breakout on Friday, but instead got a close below. This is why candle closes are very important. Another technical confluence? Price is now breaking above the moving averages in red and green.

You have heard me use the word ‘retest’ many times in this Market Moment. It is because that is what is happening. After a breakout, stocks either tend to rip higher if there is a lot of volume and interest before eventually pulling back to retest the breakout zone. Or we first retest before taking off.

Right now, the daily candle is not looking too good for Virgin Galactic. A lot of this has to do with the Nasdaq drop. If Virgin Galactic fails to remain above my blue zone, we then have what is referred to as a fake out. If buyers step in by the end of the day, and we remain above, I will be targeting the $44 zone for taking profits.

As of now, we watch the Nasdaq for hints of bottoming and buying.