Robinhood (HOOD). Another one of those highly anticipated IPOs. Robinhood had an opening price of $38 bucks. Things looked good as orders came in taking the stock up to $40.25. But then things changed. I was watching the IPO live on CNBC. They had the Robinhood team on screen cheering the rip higher. A lot of “wooo’s”, “let’s go!”, fist bumps and high fives. And then they became quiet. The stock fell, and became one of the worst debut IPO’s in US history.

In this Market Moment, I answer the question whether I would buy shares of Robinhood (HOOD).

But before we begin, I highly suggest you all read Chris Parry’s take on why it is better to be burning your money rather than buying shares of Robinhood. You can probably tell whether he is bullish or bearish by the title. Great stuff.

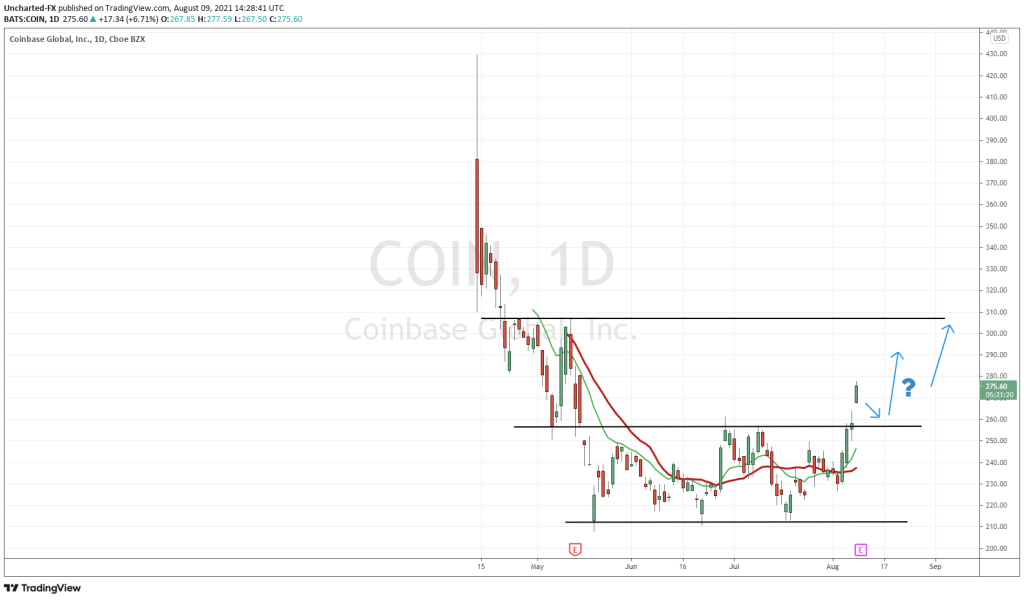

IPOs have been getting trashed lately. We have seen Coinbase and Dunkin Donuts see big drops on their first day. It could mean two things: the retail trader and institutions are short selling right away, OR those who got involved (ie: the venture capital and major banks) pre IPO are selling their stakes.

On the Venture Capital (VC) side it is the same thing. VC investing is hot. I recently read up on VC, and realize why it is more appealing to those with larger bank accounts. Many cities have thriving VC environments, but California is where you want to be. In all the VC books I have read, they mention how you will likely be travelling to Silicon Valley many times a year if you focus on this type of investing. You might as well live there. For those interested on VC, the book recommendation I have is “Angel: How to Invest in Technology Startups–Timeless Advice from an Angel Who Turned $100,000 into $100,000,000” by Jason Calacanis. A fun and easy read.

In terms of Robinhood, one of the biggest stories going around Social Media is Snoop Dogg making BANK with HOOD. Reportedly, he got in at around 20 cents. Now think about other VC funds, celebrities, or angel investors who got in early. I’m not sure about you, but I would be taking at least some of my profits, if not all. The return is already in the thousands of percent.

So would I be investing in Robinhood for the long term? I have no problem trading or swing trading the stock, but in terms of holding for the long term, I would pass. Now I realize the current environment we are in. It seems that fundamentals don’t matter. It is all about the Fed and cheap money keeping stock markets propped up in this world chasing yield. This has led to insane valuations, and companies with poor to crap fundamentals, being traded at ridiculous prices because they look cheap compared to everything else.

Robinhood likely moves higher…the fact that Robinhood is ‘encouraging’ users to not flip IPO shares within 30 days otherwise they will not be able to play IPO’s for two months, will help keeping the share price higher. But one day, fundamentals will begin to matter. When this occurs and markets rebalance to reflect this, some of these recent IPO companies will take a massive hit.

In terms of fundamentals there are a few things I need to note on Robinhood.

I watched the panel of fund managers on CNBC on the day of the IPO. Not many of them were fans of the stock, except Jim Cramer. Fundamentally there were some reasons they did not like the stock.

Most of this can be summarized by Chris’ statement in his article:

There are multiple lawsuits and investigations going on of Robin Hood right now, including one looking into the CEO not being licensed with FINRA, the reputation of the company is shot after it stopped customers selling stock during the WallStreetBets run, and the financials aren’t all that impressive, considering it’s coming out of the gate at a $30 billion valuation.

Firstly, the IPO right off the bat was setting up to fail due to the hatred of the retail crowd. The whole Citadel drama. If you all remember, when meme traders were trying to short squeeze stocks such as Gamestop and AMC, brokerages clamped down on orders. Robinhood was one of them. Lot of these meme traders were using Robinhood, and this whole thing left a sour taste in their mouths. From following these meme traders on reddit, I can tell you a LOT of them want to punish Robinhood by shorting it. With this animosity still fresh in the retail crowd, many analysts have said Robinhood should have laid low and then released its IPO further down the line. The counter argument on my side though would be that Robinhood and other companies know the current market environment. This is the best time to raise money on markets…when things correct, it won’t look too pretty.

Secondly, Robinhood may have trouble making profits. In fact, it may actually lose money as more people sign up. The CNBC panel mentioned this, but then commented on other companies such as Uber, Peloton, Coinbase etc being in the same boat. Once again, the fundamentals don’t seem to matter, but some investors see these as growth stocks. That one day, these companies will churn in a profit.

Unlike many recent IPOs, Robinhood was profitable last year, generating net income of $7.45 million on net revenue of $959 million in 2020, versus a loss of $107 million on revenue of $278 million in 2019.

However, the brokerage had a loss of $1.4 billion in the first quarter of 2021 tied to emergency fundraising-related losses during January’s GameStop trading mania. The company generated $522 million in revenue in the quarter, up 309% from the $128 million earned a year earlier.

Thirdly, most of their profits are made on options trading. This is all fine and good, but it is sort of against the best interest of their clients. In our recent Vishal and Co show, our very own Taku Ndachena went through the Robinhood IPO documents. He mentioned how they talk about investing for the long term….but then the way they make cash is by having their clients trade as much as possible per day. Bit of a conflict of interest.

Finally, and this ties in with the above, the average account size on Robinhood is apparently around $4500. Compare this with another traded brokerage, Charles Schwab (SCHW), is $331,664. Yet Robinhood is worth 1/4th of Charles Schwab in terms of market cap. The truth is that retail traders who want to day trade and take riskier trades are on Robinhood. You are not seeing much 401ks and longer term investments there.

Technical Tactics

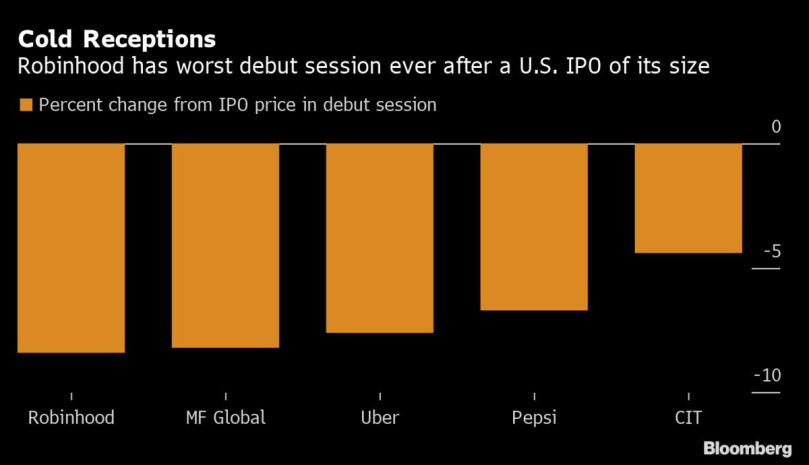

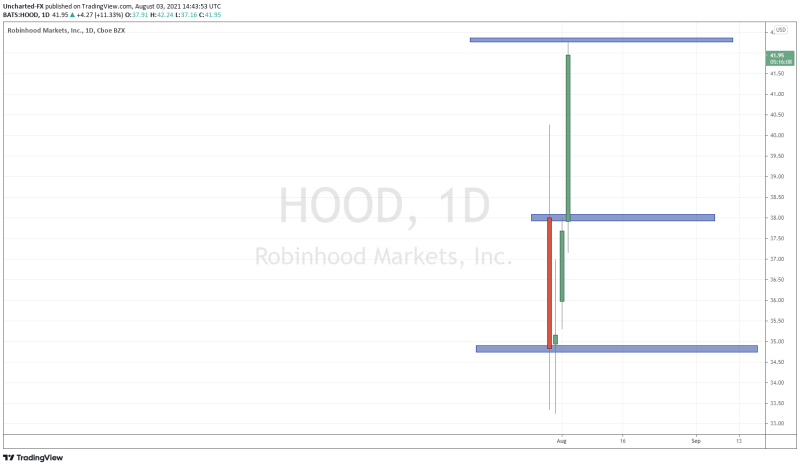

As mentioned earlier, Robinhood had the worst debut ever after a US IPO of its size.

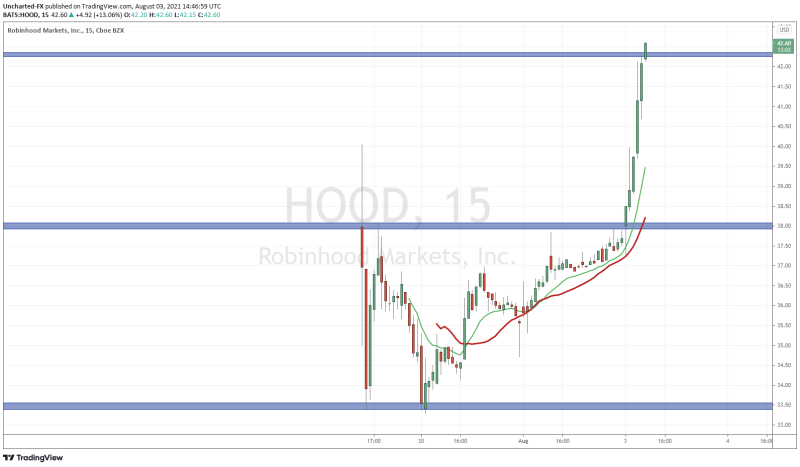

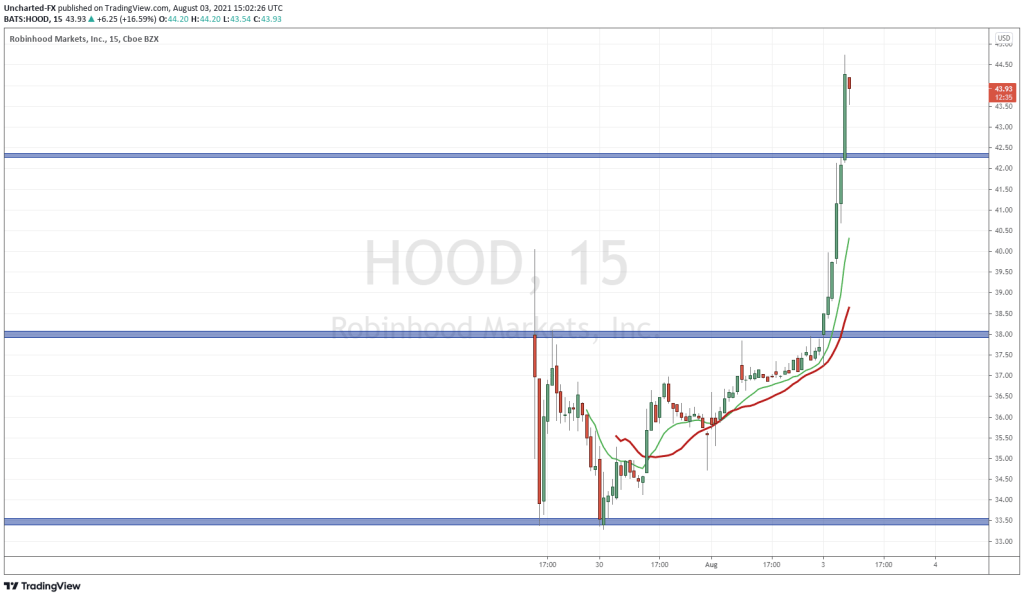

The opening price was $38, hit lows of $33.35, and closed at $34.82. The following day, we made new lows at $33.25 and then bounced. But the dips have been bought. As of today, Robinhood has broken above the $38 IPO price AND is making new record highs!

I am not one to trade IPOs right away. I like to wait for a few days or weeks so I have some technical price levels to work with. We want to develop some support and resistance levels. Currently, we have all time record highs which can continue to be made during the trading day. But the MAJOR zone to work with is $38.

Right now, I would be looking at Robinhood at the 15 minute level. We have our support at $33.50 zone. The resistance currently is whatever record high gets printed today. The break above $38 was immense for Robinhood. This is the major flip zone (an area that has been both support and resistance) that we are working with. However, keep in mind that perhaps some traders who got in right at $38 may want to start taking profits.

Right now the momentum is hot! A 15% mover at time of writing! $50 is the next major psychological resistance zone we are approaching. Perhaps we find some resistance there.