Lexaria Bioscience (LEXX.Q) today announced results from its antiviral drug molecular characterization study VIRAL-MC21-1 recently completed by Canada’s premier federally funded research organization, the National Research Council (NRC).

Its been over a month since I last wrote about Lexaria, however, in a sea full of pharmaceutical-related press releases, the Company’s latest news managed to catch my eye. According to the NRC, Lexaria’s DehydraTECH™ processing and formulation technology does not create a covalently bonded new molecular entity (NME). In fact, each drug tested in the study remained stable and did not undergo change in chemical structure. These drugs were remdesivir, ebastine, bepridil, rupintrivir, and colchicine, which have antiviral effects through a variety of different modes of action.

Lets rewind to August 8, 2019. On this date, Lexaria announced the successful completion of its Master Collaborative Research Agreement with the NRC to investigate new opportunities associated with the Company’s DehydraTECH technology. A primary goal of this R&D program was to determine whether Lexaria’s DehydraTECH technology caused the formation of NMEs through its processing. This program involved the preparation of over 50 formulations utilizing DehydraTECH methodology, 33 of which were selected for in-depth analytical examination. The contents of these formulations ranged from THC and CBD, pure nicotine, nicotine polacrilex, and pure ibuprofen.

According to the R&D program, all evidence suggested that no covalent-bonded NMEs were created utilizing Lexaria’s DehydraTECH technology. With this in mind, the playing field was a little different for Company’s latest study with the NRC. In this study, DehydraTECH was tested in combination with an array of drugs associated with the treatment of SARS-CoV-2. Regardless, DehydraTECH came out on top, demonstrating that it did not create new NMEs and did not cause instability in chemical structure.

So what does this mean? NMEs are generally subjected to more involved regulatory examination and approval processes than non-NMEs, however, in this study DehydraTECH demonstrated that it did not create NMEs. As a result, findings in this study strongly support the acceleration of DehydraTECH-enabled, repurposed antiviral drugs to market. In light of Lexaria’s excellent news, the Company intends to pursue strategic collaboration opportunities with established pharmaceutical industry partners to incorporate DehydraTECH technology with additional antiviral drugs.

Although Lexaria’s total liabilities increased to $469,545 on February 28, 2021 up from $346,230 on August 31, 2021, this difference pales in comparison to the Company’s total assets of $12,172,408 in Q1 2021. During this period, Lexaria’s total assets increased by almost 125%, up from $2,828,488 on August 31, 2020. Regarding Lexaria’s cash, the Company saw another massive increase, growing to $9,346,933 from $1,293,749. With this in mind, Lexaria looks like a promising bioscience company with a solid portfolio of products, including its versatile DehydraTECH technology.

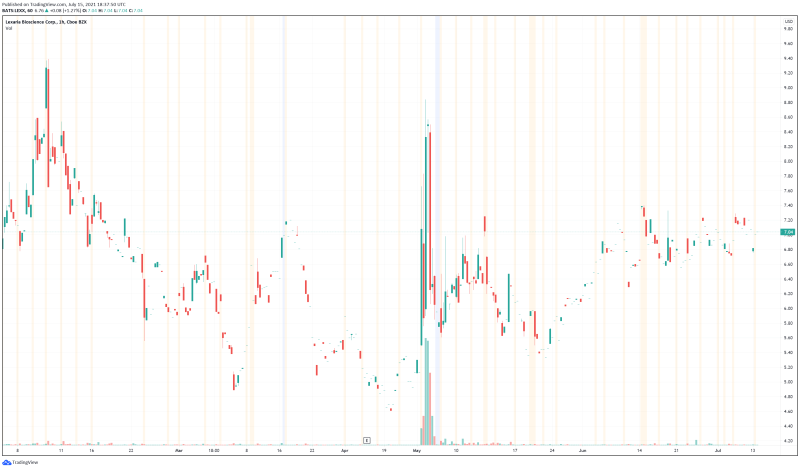

Lexaria’s share price opened at $7.03, up from a previous close of $6.67. The Company’s shares are up 1.27% and are currently trading at $6.76 as of 2:25PM ET.