Magnifying the problem

When lockdowns first hit back in March 2020 I was pretty sure the capital markets and the psychedelic sector would suffer. It was a burgeoning new industry that was reliant on raising heaps of capital to complete costly clinical trials. I remember reading a MindMed (MNMD.Q) pitch deck from 2018 and was stunned at how much it was going to cost to execute their business plan. They would need to raise upwards of $400 million CAD for 5-6 years of runway.

In times of economic insecurity, most people want to de-risk their investments, and a new industry like psychedelics seemed like the perfect candidate for a long-term contraction that could take out nearly all of the momentum it had been gathering the last 12-18 months. I was unsure not only how the sector would fair, but how society, in general, would cope with the situation. I wrote yesterday about how in my first 6 months of the pandemic I flourished, but then as time started to compound my mental health took a turn for the worst. This has been a common story with many people I have talked to. Since the pandemic started anxiety, depression, addiction and suicide have all been on the rise. What I didn’t see coming was a perfectly timed mental health crisis on top of a pandemic that has psychedelics companies sitting on fertile ground.

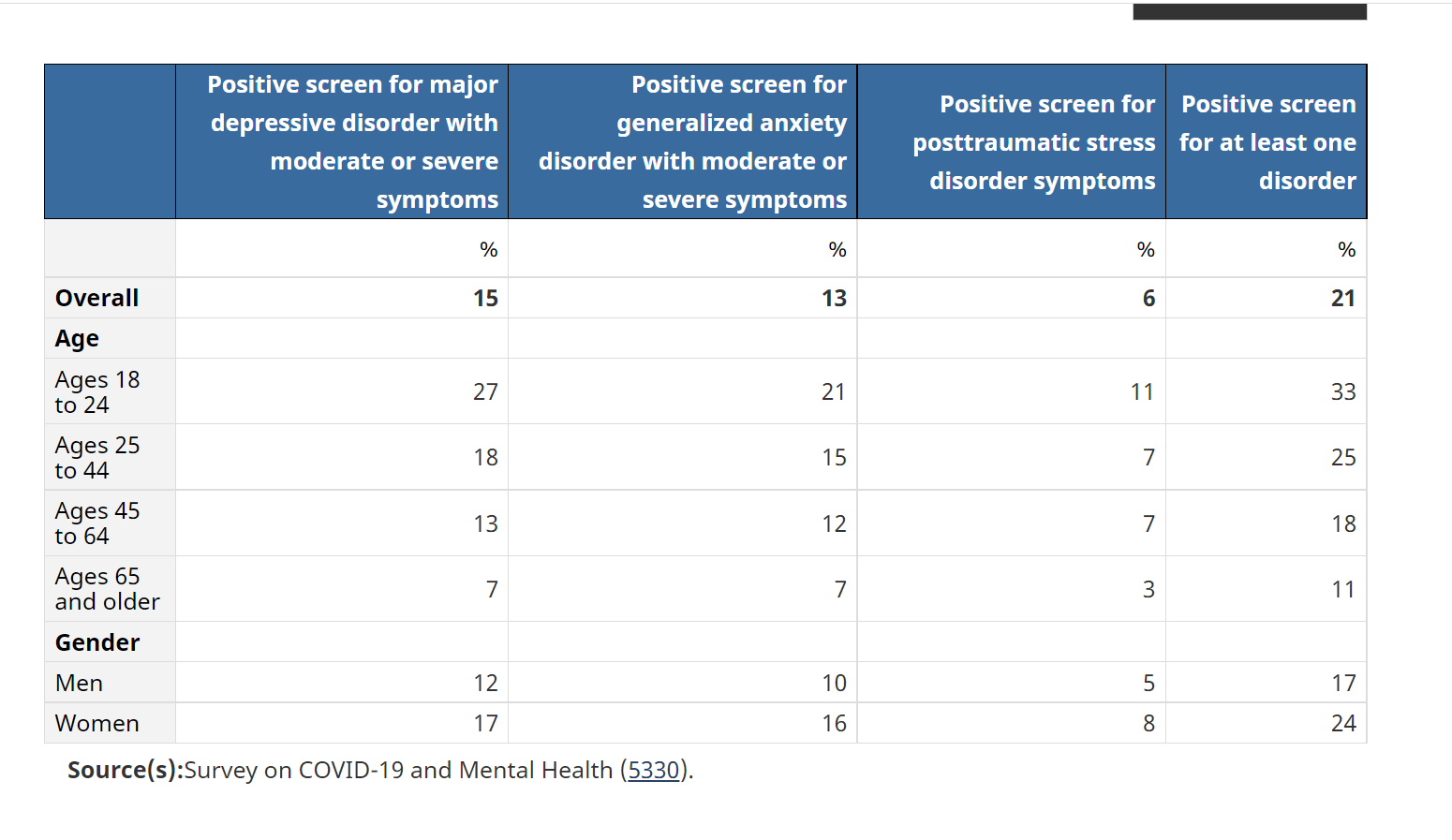

According to Stats Canada, the prevalence of positive screens for major depressive disorder, generalized anxiety disorder, and PTSD was over three times higher among young adults than among older adults. For example, 27% of young adults aged 18 to 24 screened positive for major depressive disorder compared with 7% of adults aged 65 and older. A similar pattern was observed for the proportions of positive screens for generalized anxiety disorder (21% versus 7%) and PTSD (11% versus 3%).

Overall, almost one in four women (24%) screened positive for at least one disorder, compared with 17% of men.

38% of Canadians reported that, due to the COVID-19 pandemic, they experienced feelings of loneliness or isolation. Those reporting this impact had more than four times higher prevalence of major depressive disorder (29% versus 6%), generalized anxiety disorder (25% versus 6%), and PTSD (13% versus 2%), compared with those who did not report experiencing this impact.

These ailments are what several psychedelics companies are seeking to try and solve. The pandemic put a magnifying glass onto the issues that were somewhat mainstream before, but are becoming more and more talked about as this mental health crisis worsens.

Stocks and loans

Psychedelics stocks in general have responded pretty well to the pandemic with all things considered. The cash contraction that I thought could deal a heavy blow to the sector never really happened, at least not for long. Companies like Cybin (CYBN.NE), MindMed (MNMD.Q), Compass Pathways (CMPS.Q), Field Trip (FTRP.T), and Atai (ATAI.Q) have raised almost $800 million CAD combined in the last year or so. But it has hampered logistics and timelines for several companies who are all racing to get clinical trials done and patent their compounds in order to be first to market. It’s also hurt ketamine clinics that rely on walk-in traffic and can’t necessarily leverage online and remote business methods. That being said, the clinics were able to still operate, although I would imagine there was a decrease in foot traffic as people weren’t leaving the house as much, especially earlier on in the pandemic. Field Trip stated:

Because our clinics have been deemed “essential service”, we have been able to continue operating our clinics, however, the health, safety and well-being of our employees has been our first priority and has informed the rate at which we have been on-boarding new patients to ensure compliance with health and safety measures and social distancing protocols, consistent with government recommendations and requirements.

The Canadian government helped out businesses in these trying times, but it wasn’t a huge bailout or anything that would really even show on the balance sheet of a company like Field Trip for example, who in their most recent MD&A stated:

We also applied for, and received, governmental assistance related to the COVID-19 pandemic: (i) The Canada Emergency Business Account (CEBA) program provides an interest-free loan of $40,000, of which and if required conditions are met, only 75% or $ 30,000 of the loan amount is repayable by December 31, 2022. Government assistance is comprised of the fair value of the loan amount forgiven using an 15% effective interest rate (see Note 15 Loan Payable of our audited consolidated financial statements). (ii) The 10%Temporary Wage Subsidy for Employers (TWS) program provides a subsidy of 10% of wages from March 18, to June 19, 2020 up to $1,375 for each eligible employee. The maximum total is $25,000 for each eligible employer. For the three and fiscal year ended March 31, 2021 the Company received wage subsidies of $0 and $17,381 respectively. (iii) The Innovation Assistance Program (IAP) provides assistance to early stage, small to mediumsized enterprises unable to access COVID-19 support. The Company received $20,328 to cover salary expenses for the period from April 1 to June 24, 2020.

PsyBio (PSYB.C) stated in their most recent MD&A,

The COVID-19 pandemic may negatively impact the Company’s business, which would influence the amount and timing of planned expenditure. For example, prolonged disruptions in the supply of goods and services relied on by the Company to research, test, and develop its products or restrictions resulting from government regulations that impact the Company ability to conduct its studies and clinical trials, may adversely impact the Company’s business.

https://equity.guru/2021/03/17/are-ketamine-clinics-a-fast-path-to-profitability-for-psychedelics-companies/

Another fast track

We saw the FDA fast track psilocybin and ketamine in 2018/2019 because a new approach to mental health was clearly needed. I believe the pandemic has provided a second fast track.

Money that used to go to companies making antidepressants and opiates are seeing their investment dollars drop as public perception around those types of drugs is becoming more negative by the year. I previously wrote about how trauma healing is taking over the self-help industry from breathing coaches to life coaches to pickup artists to alt-right freaks, it’s everywhere. ‘How to win friends and influence people’ isn’t as hot as ‘Healing From Trauma’, and rightly so.

Ultimately, as was the case with me, the pandemic has pushed some people over the edge to finally seek out help. What was maybe a 4/10 problem turned into a 7/10 problem after several months of isolation. This huge shift could have probably only happened from a pandemic or far-reaching natural disaster.

Obviously, the pandemic has been a net negative, but if there is a silver lining it’s that it sped up the healing process for many people who may have kept going on decades stuffing down their suffering. Now that jurisdictions, where psychedelics companies are primarily located, are back up and running at almost full speed, these companies are in an ideal situation as the cash contraction never really happened, clinical trials have been wildely successful, and most of all their mission is on everyone’s mind more than it ever has been before.