Back in January of this year, we told you about a psychedelics company that was going to come at that sector like many had talked about, but few had achieved. Their angle? Be a biotech company. Don’t dick about with fakey business plans or black velvet paintings of Elvis. No Jamaican B&Bs dressed up as clinics, no clinics dressed up as celebrity compounds, no lobbies designed to look like Apple Stores, and no beanbags – like – anywhere.

The thinking was simple – compounds in psychedelics can radically upgrade treatments in a number of mental health areas, and they will, but instead of treadmilling their business model waiting for someone else to prove it, Cybin just went out and started proving it.

That’s a radical approach., but one being rewarded with market interest.

In the early days of the cannabis boom, every licensed producer in Canada (and many yet-to-be licensed producers) broke their backs trying to sell the idea they’d do clinical trials right away to prove cannabis’ efficacy. They’d have conferences with doctors and medical associations, they’d have special discounts for medical patients, they’d interact with insurance companies… and in the end it was all horse shit. What they really wanted was to be able to sell edibles with cool logos.

The psychedelic sector, such that it is, is even less effective at pulling off this routine than the cannabis companies were. Buy a mushroom farm that sells button mushrooms to Loblaws and suddenly you’re ‘well positioned for the psychedelics space.’ Convince a ketamine-happy psychiatrist to sell you their patient list and suddenly you’re a ‘leader in the clinical space.’

But all of that is rubbish, let’s be honest. It’s good for a market play when a sector is new and hot and nobody really looks too deep, but it’s not going to lead the way.

Cybin is leading the way. How?

By being straight forward as to what they are:

“Cybin is a leading biotechnology company focused on progressing psychedelic therapeutics by utilizing proprietary drug discovery platforms, innovative drug delivery systems, novel formulation approaches and treatment regimens for psychiatric disorders.”

And by doing the work:

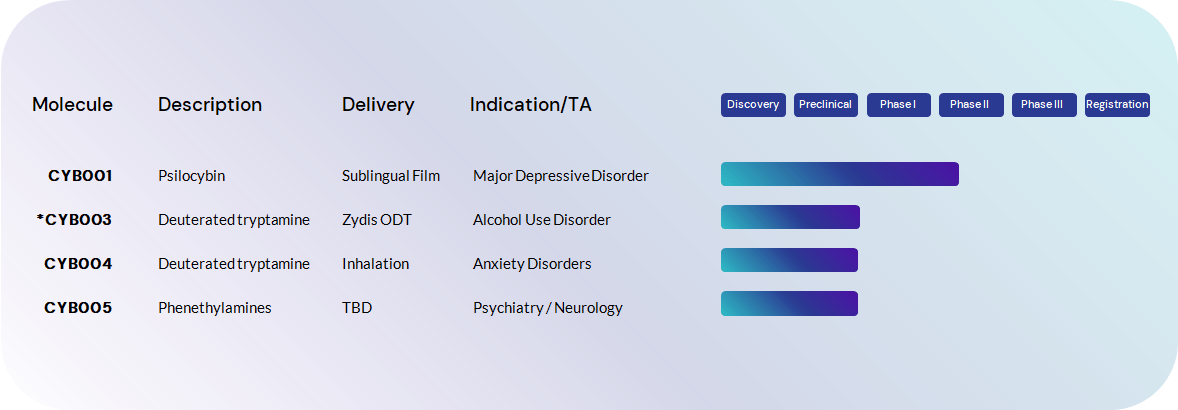

Yes, you read that right.. phase II trials.

For those who don’t know how clinical trials roll, phase I trials are tested on around 50 healthy people to evaluate general safety of the drug, side effects, and how it might linger in the bloodstream at various dosages. Phase II moves on to 300 or so patients who show signs of the disease to be treated. Phase III involves thousands of people and gives data on a wider population, allowing researchers to build a safety profile. There can be several Phase III trials based on what is revealed in the research and, once through that process, the drug maker can apply for a New Drug Application (NDA) where they’re pretty much good to go.

Getting to Phase II trials, as Cybin has for #CYB001, a sublingual film delivery option for psilocybin in the treatment of major depression, is a big deal. If approved, the potential medical market for folks who might want to take a thin film microdose to treat their depression would be staggering, and the reason Cybin is currently a half billion dollar company and being uplisted to the NYSE is because Phase II success would launch the company into the stratosphere. It would hold valuable IP that could be licensed or protected, it would make the company an instant takeout target, and frankly Cybin may not even need to get to the NDA stage to find itself in a hefty ten-digit-plus acquisition auction.

The risk profile is limited. We know, after all, that psilocybin works as a treatment for depression, and that the side effects in small doses are limited.

Some of us know this first hand..

What Cybin is looking into is whether a sublingual film makes for a better delivery system than what’s out there and the answer is YERP.

Hey man, I’ve got anecdotal evidence for days, having tried every shroom delivery system from capsules to edibles to handfuls of scrawny dried Malabar from the guy behind the Dennys, and the single unifying factor is dosage is messy.

A thin film, the same kind used by breath fresheners for years, would allow for controlled dosage – even user-controlled dosage if you want to grab a pair of scissors and get snipping. It would mean a quicker delivery system into the blood stream, pre-gastric delivery (which means better bioavailability), it would be mondo cheap to produce, and have a substantial shelf life.

The only other decent option on delivery of psilocybin is hard pressed pills, and as far as I know the boys at Canntab (PILL.C) have that locked down.

And if you think all their eggs are in the one CYB001 basket, guess again.

13 patent filings covering: Novel psychedelic compounds, delivery mechanisms, supportive treatment platforms and a drug discovery pipeline of modified and novel tryptamines and phenethylamines.

Cybin is leveraging parent molecules that have shown positive early efficacy and optimizing their pharmacokinetics, bioavailability, and delivery through our proprietary deuterated process thus creating patent-protected, commercially scalable drug candidates.

-

Novel Second-Generation Psychedelics based on well-known scaffolds including Psilocybin, DMT, and MDMA with improved bioavailability.

-

4 active drug programs targeting Major Depressive Disorder (CYB001), Alcohol Use Disorder (CYB003), Anxiety Disorders (CYB004) and Therapy Resistant Psychiatric Disorders (CYB005).

-

50+ pre-clinical studies completed and progressing lead programs toward FDA IND filings

-

Leveraging cutting-edge Neuroimaging technology to generate quantitative data to better understand psychedelic therapies.

This isn’t a shroom company though, lordy, there’s an opportunity there one day. This is a biotech company putting biotech IP through the clinical trial process so they will OWN THE INDUSTRY down the line.

When we started talking about this deal late last year it was still private, and some scoffed when it debuted on the markets at $0.80, bringing in a market cap of around $120m.

If you bought in on that day, you’re already up 4x on your money, and there’s no reason to think the present half billion dollar valuation is inflated.

If results on the board are your guide, this newsflow is the stuff of legend.

Combined with the company’s recently announced collaboration with Kernel (quantitative neuroimaging technology), Greenbrook TMS (operator of 129 outpatient mental health service centres in the United States), and the progression of other proprietary tools such as the EMBARK psychotherapy model, Cybin is building an advanced eco-system that can drive innovation from the psychedelic molecule, delivery of the molecule, quantitative testing of the molecule in patients to late-stage trials and one day potential patient treatments.

Cybin’s subsidiary Adelia helped move things forward, hitting their milestones and receiving their earnout.

Positive preclinical results achieved as part of various earnout milestones determined that proprietary deuteration modifications in multiple lead new chemical entity candidates did not alter pharmacodynamic properties and did not alter safety as assessed in in vitro toxicity tests as compared with non-deuterated analogs.

Management of Cybin believes that these initial results add value to Cybin’s pipeline of proprietary novel psychedelic compounds by demonstrating these molecules perform similarly to the naturally occurring molecules in certain important metrics. The development of these compounds differentiates Cybin from companies focused on naturally occurring psychedelic compounds.

TRIAL. TRIAL. TRIAL.

MILESTONE. MILESTONE. MILESTONE.

ACQUIRE. ACHIEVE. ADVANCE.

I’m not blowing any smoke here by saying this company is delivering on all fronts, with an advanced and well-formulated business model that avoids the ‘shroom boom’ stigma that many pretenders are weighed down by. The question for most investors will be, with a chart going up so hard it looks like the Matterhorn, have I already missed the boat?

Folks asked that at $1.80. If you think CYbin’s success so far has been accidental, then yeah, you’re too late.

But if, like me, you feel like their success is by design and execution, there’s no reason to assume that won’t carry on.

If you want psychedelics exposure but don’t want to play with pretenders, this is a strong option.

We’re proud to have brought this idea to you, and hope y’all did well.

— Chris Parry

FULL DISCLOSURE: Cybin is an Equity.Guru marketing client, and the author has stock in the company.