This week is going to be big! Or as the cool people say, it is going to be lit. Stock Markets are poised for a huge week with tons of catalysts and high risk/volatility events. The big one of course is on Wednesday, when we hear from the Federal Reserve. Fed week is already enough to move markets, but oh just wait, there is so much more!

Earnings season is upon us. The last two weeks has seen some mixed earnings from the Banks and Netflix. But this week going to be jam packed.

We are going to kick off this week with numbers from Tesla and Logitech. Apple, AMD, Microsoft, Google, Visa, Starbucks, JetBlue, Boeing, Facebook, Ford, Pfizer, McDonalds, PayPal, Amazon, Caterpillar, Chevron, Exxon Mobil just to name a few, make up the rest of the week. This is going to be big with some of America’s largest and most popular companies.

I mentioned circling Wednesday on your calendar. It is Fed day! We will hear from the Federal Reserve, and it really is going to be about whether the Fed is “talking about thinking about tapering”. Not much is expected to change. Markets expect Powell to be less dovish, and the real changes in rhetoric to happen next month in August. Why? Because that is when all the central bankers will meet up for Jackson Hole.

Personally, I will be listening to Powell attentively for the word “transitory”. We have talked about this on Market Moment. The “transitory” part of transitory (therefore temporary) inflation has been dropped recently. Now inflation is here to stay and will be around for a long time. The Fed cannot really admit that they were wrong, so they will either point fingers at something else to save face, or not even mention the word anymore. However, to their defense, they HAVE mentioned in previous FOMC statements that inflation will be transitory BUT uncertain how long it will last and how much higher prices can go. Even the Bank of Canada ended their rate statement a few weeks back with the similar statement.

On the data front we have US Durable goods out on Tuesday, and US preliminary GDP out on Thursday. Jobless Claims on Thursday are worth noting since we saw jobless claims climb higher and miss expectations last week (came in higher than expected).

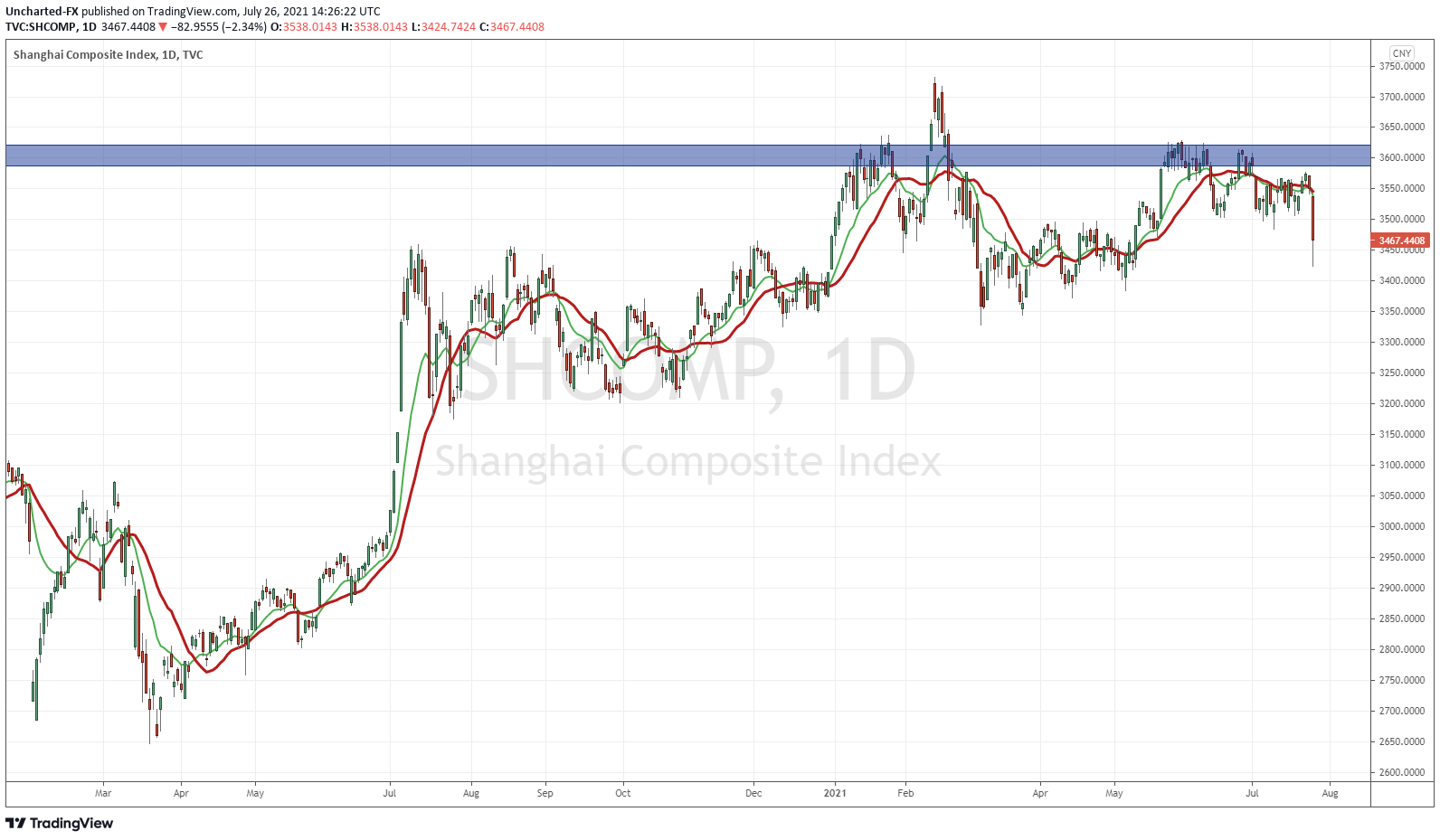

Let’s add some geopolitical risk shall we? The US and China are set to have high level talks after a long time. This is garnering more attention due to actions out of China recently. China has cracked down on companies listing overseas, and last week, cracked down on education stocks. Media headlines of ‘new trade war’ are coming out, but let’s be honest, the first trade war never ended. Both nations held talks today and the meeting was described as ‘tense’, with Beijing saying the relationship is “now in a stalemate and faces serious difficulties”. Harkens back to the President Trump day’s when US-China headlines would move markets. Is the same in store for 2021?

To add some more drama, Chinese stock markets are making headlines. The Shanghai Composite Index was down 4% yesterday. The Hang Seng is also taking a beating. US stocks and other worldwide markets are not following along. I add this part because there is a school of thought that likes to think Chinese markets are leading indicators since they open first for the week. Basically if Chinese stock markets are red on their first day of trading, US markets will also be red on Monday.

Technical Tactics

Okay so a big week. All this data will hit the stock markets, and what should we expect stock markets to do? The key here is the retail trader.

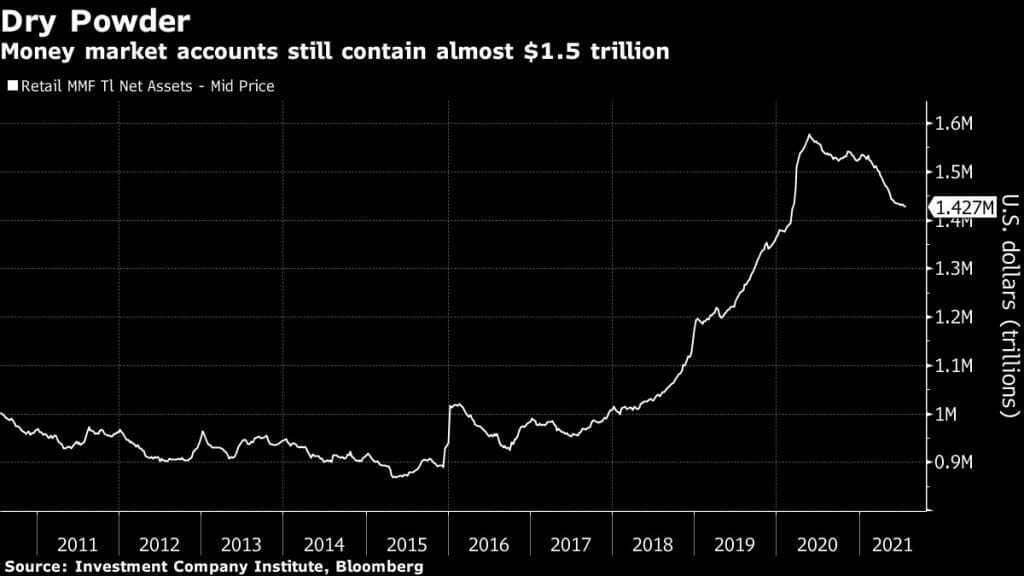

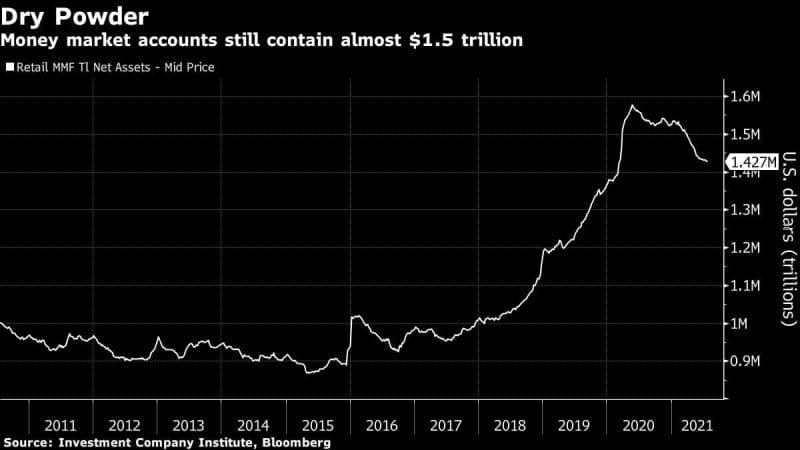

The most popular article over this weekend on Bloomberg had to do with a large amount of money sitting on the sidelines. Dry powder waiting to buy the dip. Depending on how earnings come out, and what the Fed says, this money is ready to be deployed, but is currently sitting on the sidelines.

Money Market accounts show the retail crowd sitting on $1.5 Trillion in cash. Another way to put this is there is a lot of cash sitting in retail trader brokerage accounts. Earnings and the Fed this week will do a lot to determine where this money goes. Does this money enter and take us into new stock market record highs just like that, or does this money come in to buy the dip after a market drop after the Fed meeting and possible poor earnings? It seems that higher stock markets seem to be the case which way we look at it, unless something unexpected comes from the Fed, a black swan, and if America’s largest companies deliver really poor earnings.

Long time readers shouldn’t be surprised. Since the Stock Market drop of 2020, I have always said that there is nowhere to go for yield. Stock Markets will recover. They will continue to do so in this Frankenstein environment the Fed has created. In a way, the markets need to go up due to Pension funds entering stocks for yield (cannot make 8% return a year on bonds), and maybe even more leveraged funds out there. A large drop in markets could trigger a financial crisis.

The trading strategy so far this year has been to buy the dip until you get clapped, and then buy the dip once again! Stock Markets are at important zones, and we should expect some volatility given the events this week. Just remember, there is dry powder waiting to buy the dip.

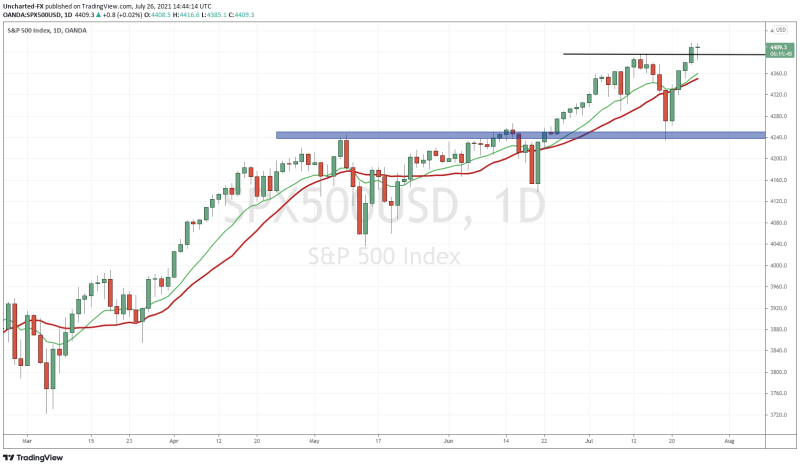

The S&P 500 closed the week at new record highs. Would not be surprised to see more records being made this week. Currently, price has pulled back to retest the breakout zone at around 4390. This can be seen clearly on lower timeframes. Buyers are stepping in there. This is normal price action. We tend to see a retest of the breakout before price continues higher.

If these markets drop below 4390, we can drift lower heading into the Fed, or maybe this occurs after the Fed meeting. But I expect the dip to be bought.

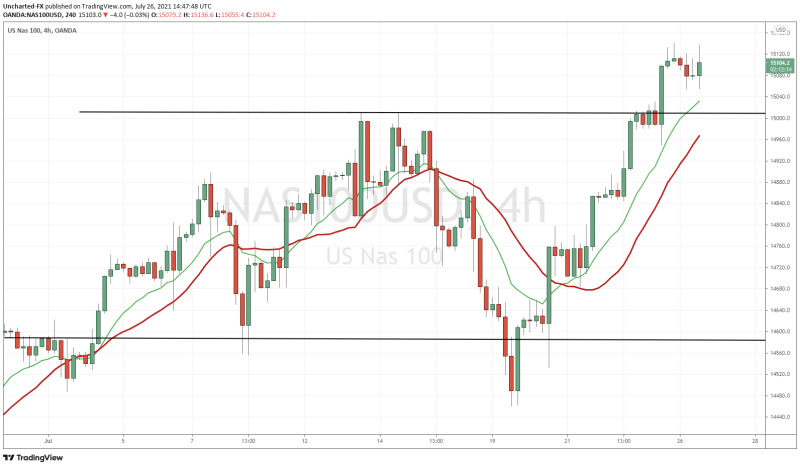

Nasdaq 4 hour chart, shows another US Stock Market that printed record highs on Friday. Same boat as the S&P 500. But in the Nasdaq’s case, we haven’t pulled back to retest the breakout zone at 15,000. With companies such as Tesla, Facebook, Google, Apple, and Microsoft set to release earnings this week…the Nasdaq is the one to watch. This is the market that could drift on its own making record highs.

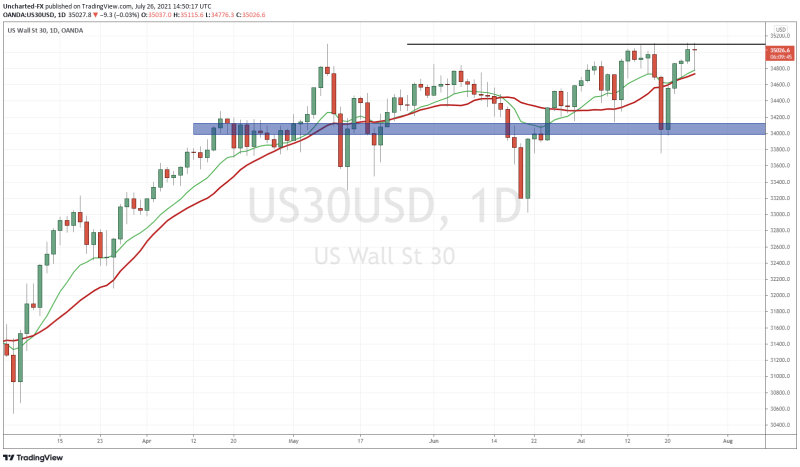

The Dow Jones might be the one to play for the dip buying. Unlike the S&P 500 and the Nasdaq, the Dow did not make a candle close into record highs. I want to see a record candle body close like the other indices. This week might be that week. Technically, the Dow is testing a resistance level. We should expect to see sellers around here.

I say this is my preferred market to trade because we tend to see prices drift lower or range during a Fed week until the Fed speaks. I can see the Dow slowly drift lower or range here until we hear from Powell. But the big difference is we have earnings and Powell on the same week.

I would like to see the drift lower, but if we do get a break out higher before the Fed, perhaps the Fed meeting is when we see prices pullback to retest the breakout zone.