They say timing is everything in comedy, but the same goes for resource stocks.

Mining explorers spend years raising money and kicking rocks, eventually sending drills out into the wilderness, and then they wait months for the results to come back. Over time they hope two things will happen next: That they get great numbers in the drill results, and that the market doesn’t happen to die on the day they announce them.

Arizona Silver Exploration (AZS.V) nailed the first part Tuesday, but got nailed on the second.

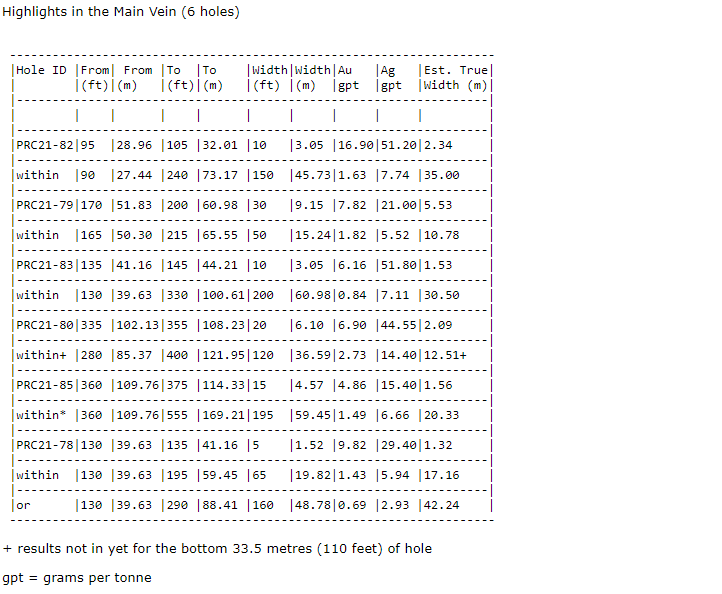

Despite announcing what some commentators called “huge news for a cheap and heavily owned by insider junior mining silver deal in tier 1 Arizona”, the news that “all 15 holes hit wide intervals [with] fantastic bulk tonnage and grade” and “open at depth,” didn’t rock the party on the markets as the AZS team might have been expected.

The company did notch up on the day, one of the few to hit green over the course of the trading period, and the news their 7.9% price rise put the stock over $0.20 was not to be scoffed at.

As you can see, the news initially sparked a big jump, from $0.18 to $0.23, before selling and the general downward trend of the greater markets took the spring out of AZS’s step.

Arizona Silver has found itself rocked by the tides outside their control in the past, most infamously back in 2017 when a Keith Schaeffer buy call of some 100x their then price caused a tsunami of interest in a single day, followed by a tsunami of disappointment when subsequent results were ‘only’ pretty great – and not astronomical.

By 2021, the company has found what could be called its base, shaken off a lot of that past, and focused on what they have under the ground which, if we’re being honest, is worth focusing on.

I’m going to try to keep this in layman’s terms for those not in the mining game, but here’s the guts of it:

All 15 holes also intersected thick zones of gold-silver mineralization along the plane of the vein.

Not 8 holes, not 12.. Every single drill hole pulled out metal, and it got better as it went.

Mike stark, the President and CEO, laid out that, though this is a historic mining area, where AZS hit wasn’t a patch that had been worked previously:

“We are delighted that drilling has discovered high grades in a vein that was overlooked historically. Significantly, the high-grade zone is open at depth.”

What this means is, as far as the drills went, they kept finding gold and silver, which indicates there’s more below.

Geologist Greg Hahn has some detail:

“Reverse circulation drilling has confirmed my interpretation that high grades would begin 50 to 100 metres below the low-grade, partially outcropping Perry vein. That interpretation was based on the vein textures at surface compared to textures within ore zones elsewhere. Fortunately for us the productive part of the vein appears to be entirely intact and is open to depth.”

You don’t have to be a geo to understand that language.

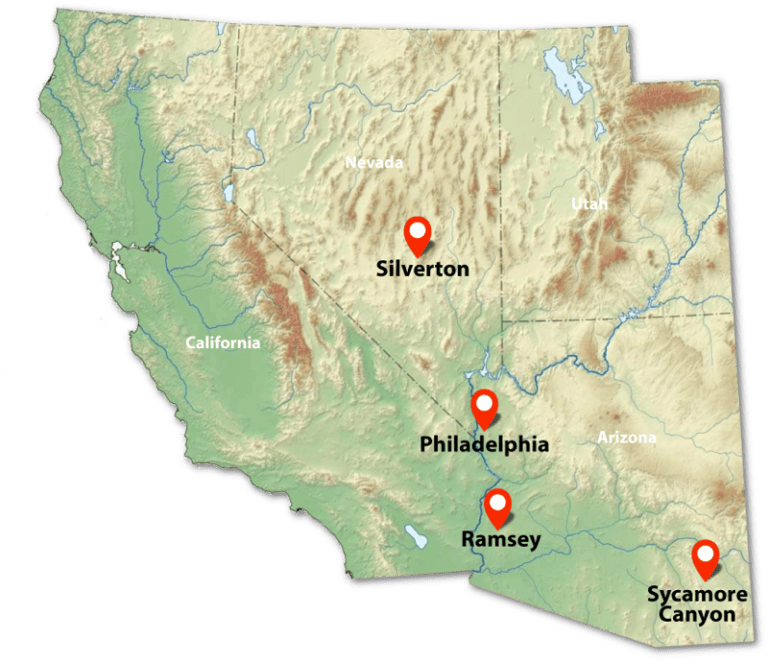

At a mere $10.9 million market cap, there’s a lot to like here. But it gets even better when you realize this is one project of four the company holds.

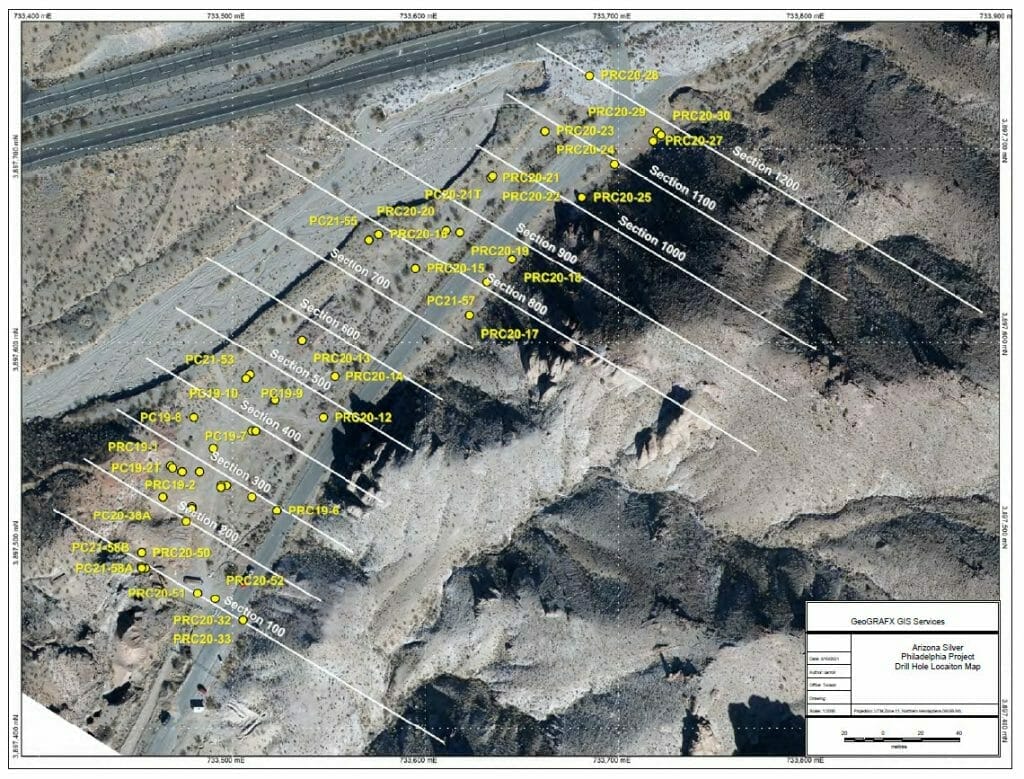

The Philadelphia project is where the drills are grinding down, but the others have promise and are in mining friendly jurisdictions.

The 100% owned Sycamore Canyon Project recently reported eight handheld drill cores in mineralized breccia contained silver and gold values from 19.8 gpt to 553 gpt Ag and 0.05 to 31.0 gpt Au. Surface mineralization is 800 meters long and 110 meters wide to date. – Link

The Ramsey Silver Project has drills banging at it on the regular.

For ten million bucks, this is a cheap bet on gold and silver in a place that, frankly, loves a good mine. The results today were top rate and I imagine if the entire market wasn’t tumbling arse over breakfast Tuesday, we might have seen the stock really take a foothold.

The old thinking goes that you look for the dips before you buy in.. well, with drill results like this, I imagine this could be the closest to a dip you’re going to get for a while.

Not a client, just a company with a very hard working CEO who called me up and made me a believer. Fair play.

— Chris Parry