Ethereum is down 3% in the last 24 hours, but up 30.50% in the last seven days according to coinmarketcap. In this Market Moment I will go over some of the fundamentals behind this latest crypto surge, and what I am looking on the charts! Yesterday’s crypto splash adds more drama to a week which already has major earnings, US-China high level meetings, and the Federal Reserve on Wednesday.

First off some repeat. I still stand by my bullish case for cryptocurrency. I believe they will move higher due to the currency war. Central banks will continue cheap money policy, and one day, the markets will question their confidence in central banks and fiat. The trade will be out of fiat currency. This is what billionaire hedge fund managers, some current and some past, such as Ray Dalio, Stanley Druckenmiller, and Paul Tudor Jones have been saying. Commodities will do well, but money will rush into crypto, especially as it gets more mainstream adoption.

Ironically, crypto bulls back in the day said Bitcoin and other crypto’s were going to be money. Provide a means for faster and cheaper transaction. But now, we hear talks of Bitcoin being its own asset class, and some are now held for a store of value. This is debatable as crypto’s slide downwards when stocks are too. Mind you Gold has as well, but Gold has years of history and we know how it will react when a confidence crisis or financial crisis occurs. What I am suggesting is that certain crypto’s will be seen as safety/a store of value rather than money. I mean if the price is moving up so fast and will continue higher, you would be a fool to spend it as money.

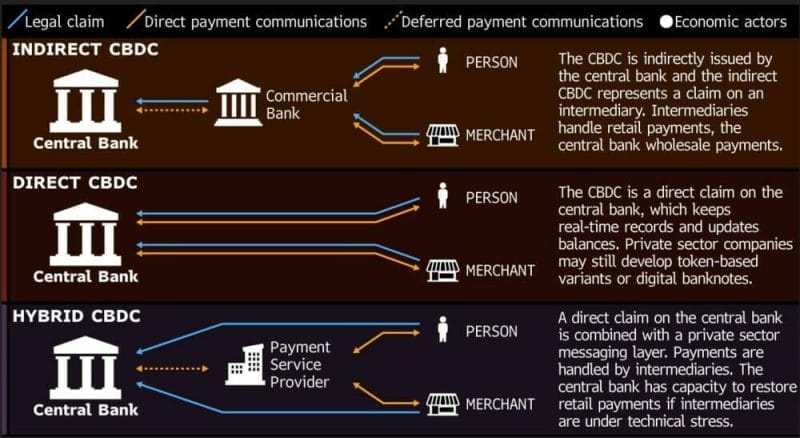

The big thing which can hurt crypto’s is some major government regulation. Something akin to banning crypto’s and only using the central bank digital currency (CBDC). CBDC’s are coming, and I can see money flowing into crypto’s and De-Fi tokens to hide money, as in a CBDC world, all your money will be tracked and taxed.

Now that I refreshed your memory, let’s get to the good stuff. Many of the crypto bulls look at Bitcoin as the safe haven/store of value while Ethereum as the money of the internet. Ethereum 2.0 is slated to come out later this year, and will play a big role in cementing Ethereum as the money of the internet. It has been delayed a few times, and if it does get delayed again, there might be some worry. Some others look at ADA/Cardano as the Ethereum killer. But right now, Ethereum has a great ecosystem. ETH is used to purchase NFTs, and was used to stake De-Fi tokens (albeit with a VERY expensive gas light fee). Some would argue this is its real value. A crypto ecosystem to crate projects on.

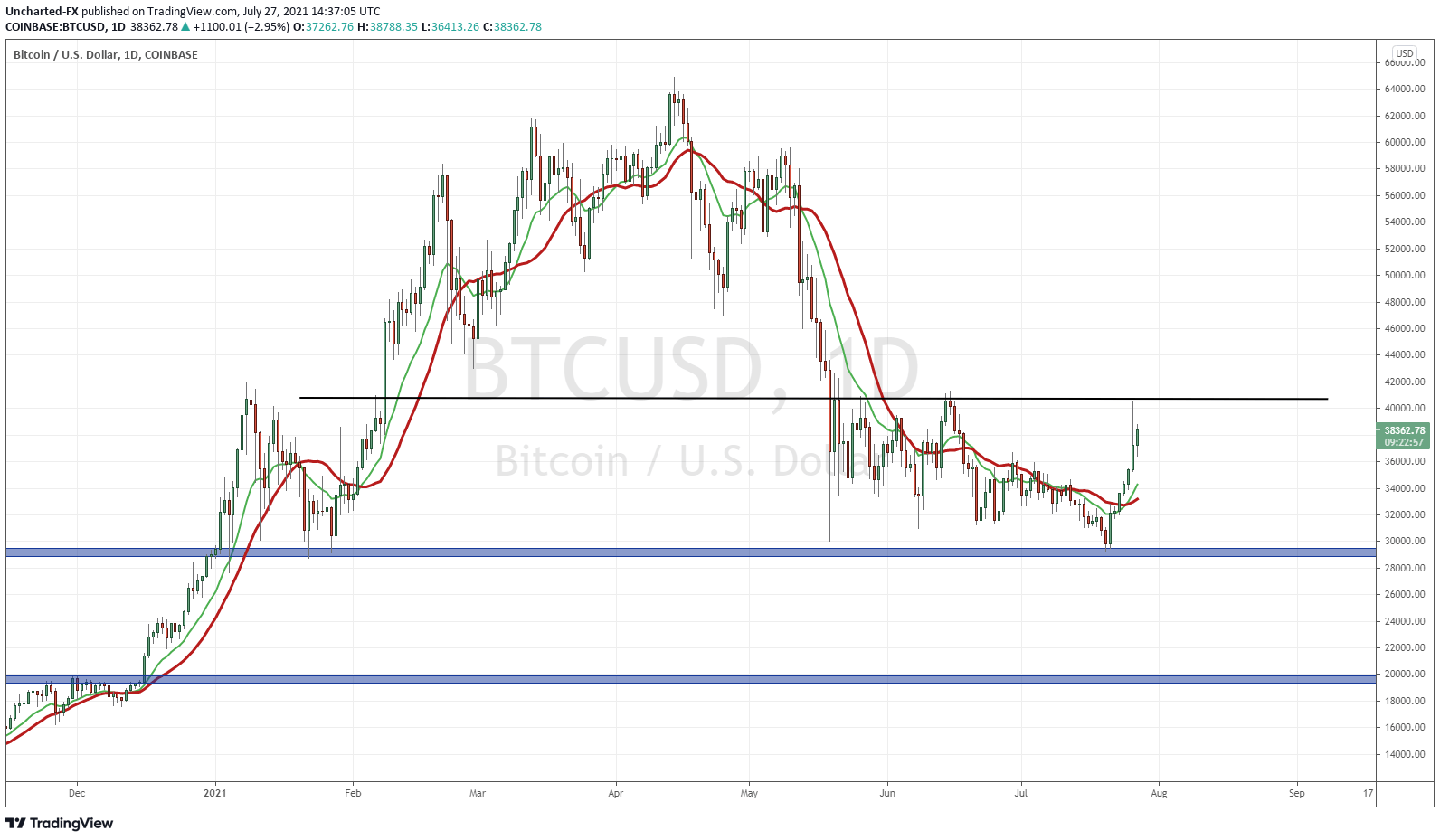

Yesterday was WILD for crypto’s. Tracking back, we had the B word conference where Elon Musk, Jack Dorsey, and Cathie Wood spoke about Bitcoin and cryptocurrency in an effort to motivate institutions to accept them. Or some say…pump them. I wrote about how this event was occurring when Bitcoin was breaking the MAJOR 30,000 zone. In that Market Moment piece, I detailed what to look for to confirm a breakdown or a fakeout/bear trap. The latter happened.

That conference also provided us with important information: Elon Musk not only owns Bitcoin and Dogecoin, but also confirmed he holds Ethereum. Price of Ethereum jumped 10% on this news, and took us back over $2000 per ETH.

Crypto’s held over the weekend drifting higher post B word event, and then we come to Monday.

Technical Tactics

I turned on my monitors yesterday to see Bitcoin tagging $40,000 and Ethereum tagging $2400. I was thinking, “okay, the support zones held and buyers jumped in”. But something else was brewing. Reports came out that a source said Amazon will be accepting Bitcoin (and then Ethereum, Bitcoin Cash, and Cardano) for purchases, and will also be working on their own crypto. This would be big news.

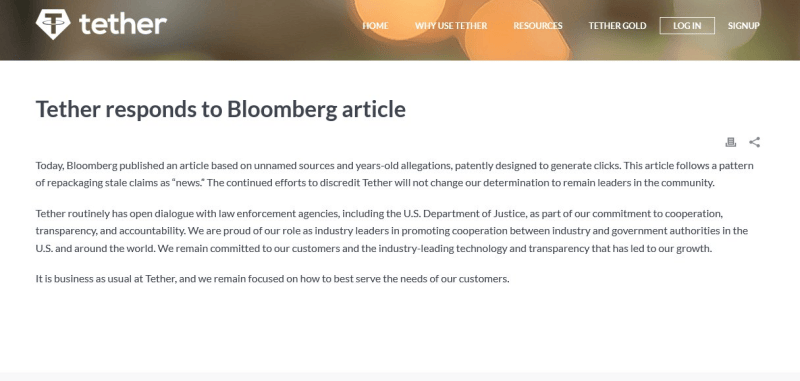

Minutes later, another article came out stating that Tether executives might be facing a criminal probe into bank fraud. It seemed as one side tried to pump crypto’s, while another tried to limit the move higher. In the end it turned out to be a buy the rumor, sell the news event.

The Tether executives denied these claims. Amazon also came out denying the rumor that they are planning to accept crypto’s and create their own in 2022.

This was some really shady stuff. Both rumors turned out to be false, yet someone put these out to impact crypto prices. Things you need to be careful of in this space. Because crypto’s are not regulated, a lot of shady things like this can happen.

Bitcoin and other crypto’s fell hard when Amazon came out denying the rumor. Today they have recovered, and this is where things get more exciting.

Hands down Ethereum is one of my favorite crypto charts. Dogecoin has something going too. Read my article here if that coin interests you.

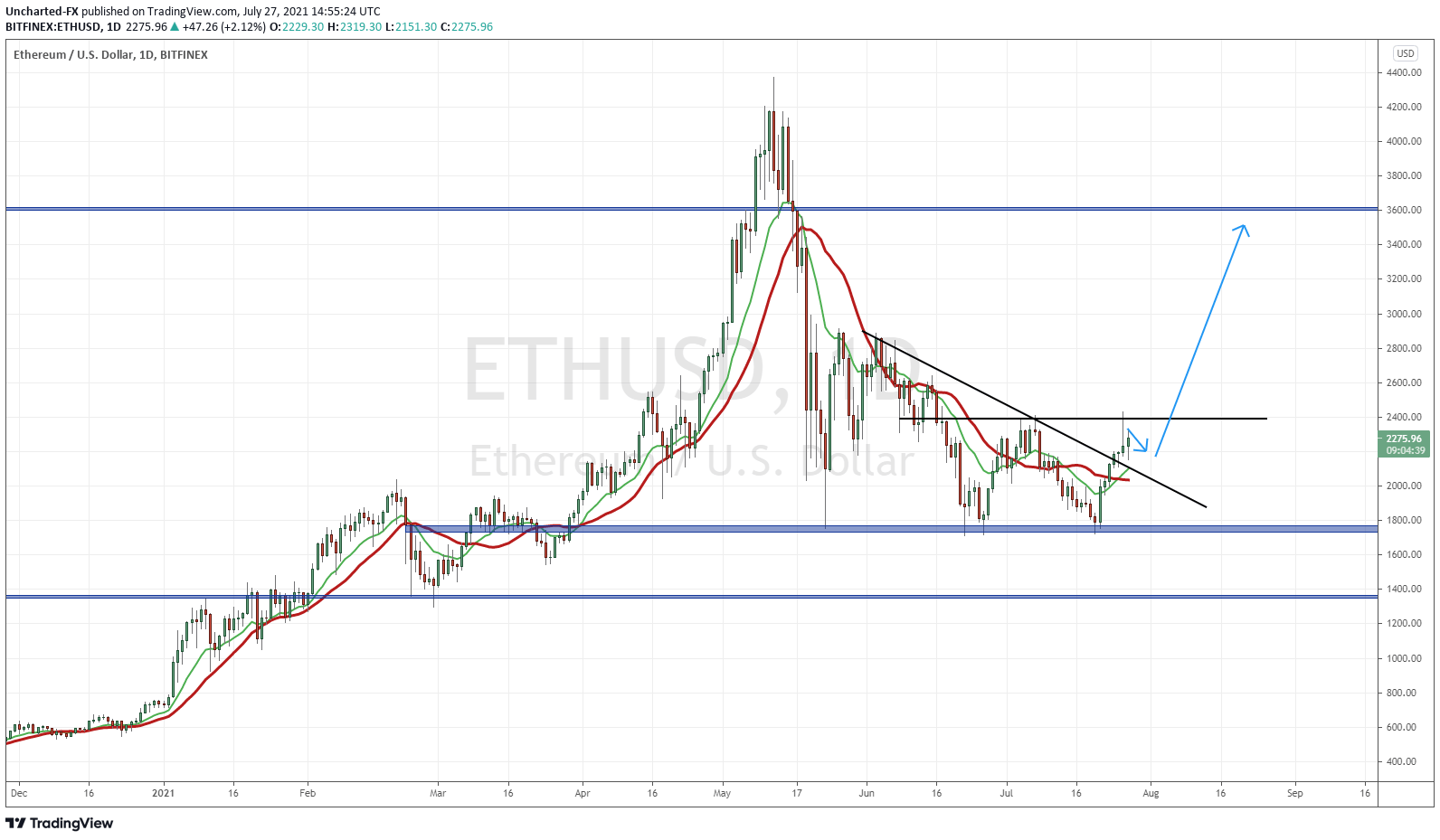

Many people are focused on the news, but my readers and our Discord members know that we focus on market structure. Cycles really. Prices never move up or down forever. Instead, they move in cycles. In the case of Ethereum and many other crypto’s, we have had a downtrend, and now a base, which leaves an uptrend next.

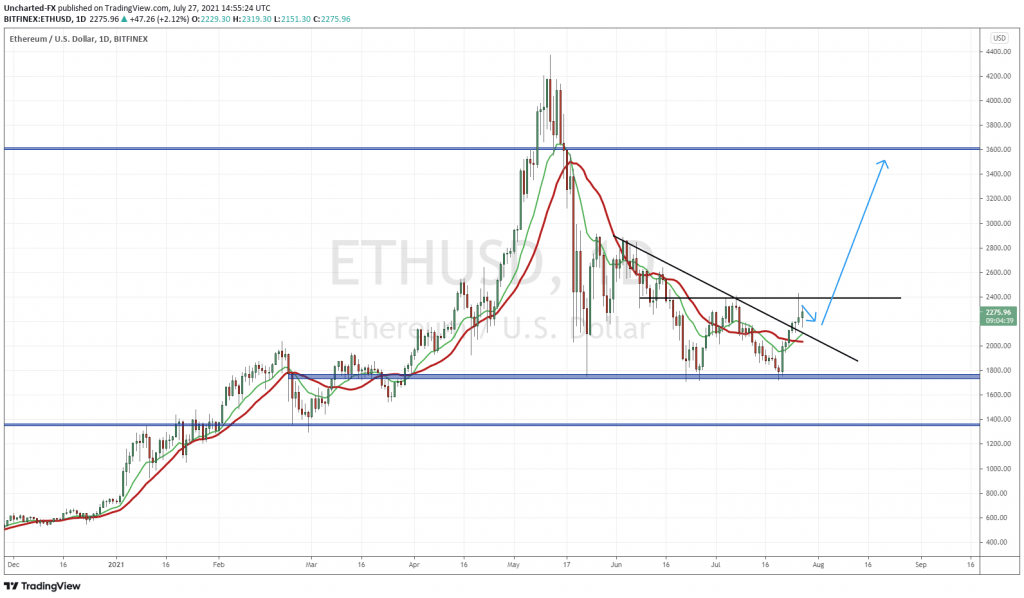

Looking at the daily chart, we can point out many confluences which increases our probability for a bull run. We have crossed over my moving averages, we have closed above a downtrend line, and we are printing what appears to be a double bottom pattern with an engulfing candle at $1800 support. Trading is the business of probabilities, and these confluences definitely increase the likelihood of higher prices!

The double bottom is one of the quintessential reversal patterns. Think of it as a “W” shape for those new to technicals. It also must occur after a downtrend. We have all of this which means that Ethereum is on the verge of starting a new BULL RUN.

But the pattern has not triggered just yet! What is required for the trigger is a break and close above $2400. Our resistance zone or neckline. We were close yesterday, but instead, sellers defended it. Either today or in the next few days, Ethereum should retest this resistance once again.

There is a possibility that Ethereum heads down to retest the trendline around $2000 (a nice whole number too) before rising and retesting $2400. But if $2000 does not hold, it is likely we continue to range or drift lower.

The break above $2400 would trigger a move to $3600 and then new record highs. This would not only apply to Ethereum, but Bitcoin and other crypto’s. A new bull run is on the horizon but we must await the trigger. Maybe it will be the Fed to talk down the US Dollar which gives us the break? We will have to wait and find out!