The drama in the markets for the past few months have been Shakespearean: To Taper or Not to Taper, that is the question. When does the Fed start raising rates? Are we heading into economic recovery? How will the Fed act with US Jobless Claims still ticking higher? US Non-Farm Payrolls missed expectations. Does this mean the Fed will NOT hike rates? Oh, the latest Fed projections are saying rate hikes at the end of 2023. Wait a minute, Fed President Bullard now saying the Fed will have to raise rates sooner than that due to inflation?

I share your pain.

But the main focus throughout this drama has been the one word to rule us all: INFLATION

Inflation data has been breaking records. And we broke some more today with the highly anticipated June Consumer Price Index (CPI) data. I say highly anticipated but every inflation data out until the Fed actually hikes interest rates will be highly anticipated.

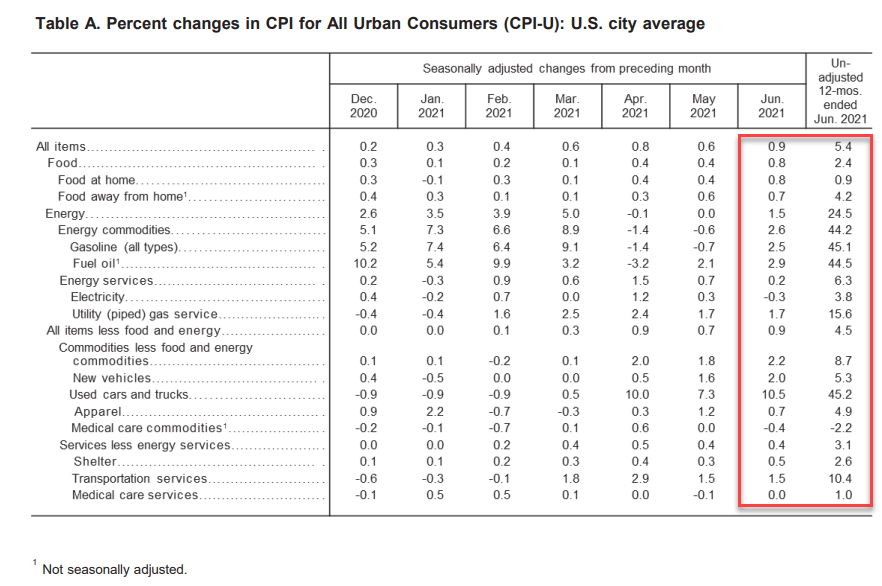

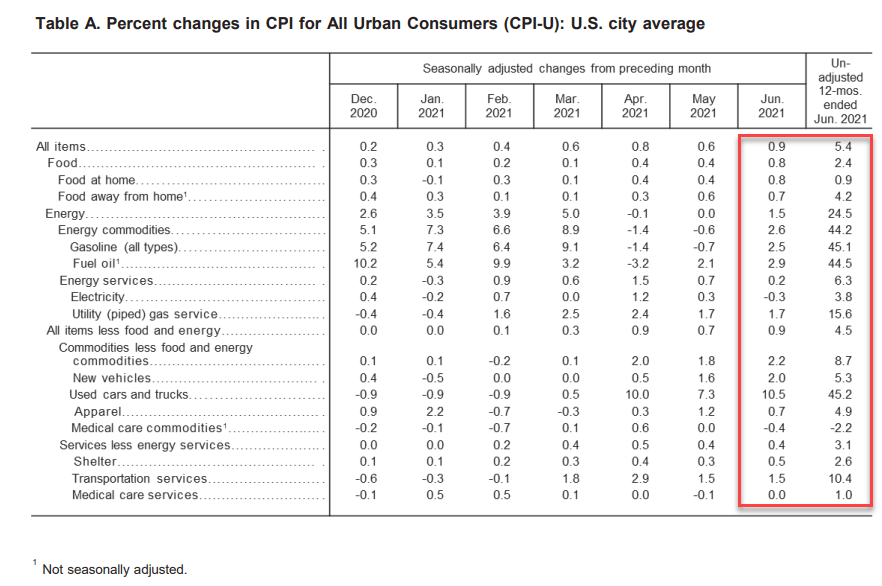

CPI for June came in higher than expected at 5.4%. The biggest monthly gain since August 2008. Excluding food and energy, inflation increased 4.5%, the largest move since September 1991. Both data prints came higher than expected, beating analyst expectations.

The largest jump in inflation came from used cars and trucks. In fact, this category comprised about one-third of the total CPI increase. Energy came in second which is understandable due to the higher Oil prices…which in fact means food and other items will get expensive as transportation costs increase.

Many ‘contrarians’ and those versed in economic textbooks have said that inflation is going to sky rocket due to excessive money printing. The Federal Reserve sees it differently. They harken back to QE and the money printing which caused NO inflation. To the Fed, money velocity, or the rate at which money travels through an economy ( just a fancy way to say people spending money) is the key. Transitory inflation is what we keep on hearing from them. That this inflation is just temporary. It will go away, and we will be back below the 2% Fed target.

Transitory inflation is due to the fact that consumers are spending money as economies re-open. They are spending money on goods, at such a rate that supply chains cannot catch up. Prices are rising. Once consumer start shifting purchases from goods to services, inflation will drop.

My readers know my opinion on this inflation stuff. We are in a situation where there are people with more money competing for the same number of goods and services. Prices will go up. Productivity is what had to be focused on. On a contrarian side, read my recent Market Moment regarding deflation. There are three charts I look at to let me know whether we are going down the inflation path or the deflation path.

We have Fed chair Jerome Powell testifying tomorrow and the day after (July 14th-15th), so perhaps he can clear up the inflation debate. But we as investors and traders need to be asking: is this transitory inflation narrative coming under question? Is the Fed wrong? Is inflation here to stay and will continue to rise due to the money printing and the fact that productivity is not increasing? To be honest I think the narrative is coming under scrutiny now from Market analysts.

Technical Tactics

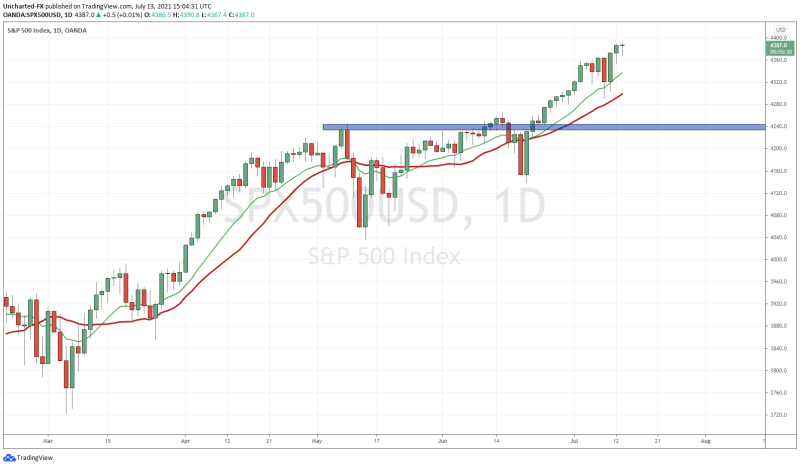

What does this all mean for markets then? Well, stock markets can continue to rise higher. Even Billionaire Fund managers like Paul Tudor Jones, Stanley Druckenmiller and Ray Dalio have come out saying inflation will be a problem. In terms of markets, stocks will continue higher until the Fed actually raises interest rates. But then, this brings up the issue of a taper tantrum, a large market sell off once the Fed raises rates. Essentially proving stock markets are only rising due to cheap and easy money.

The S&P 500 and the Nasdaq printed new record highs on the release of the news. The Dow and the Russell are much weaker. Boeing seems to be affecting the Dow.

So now people are asking but wait a minute? If inflation is ticking higher, and we expect the Fed to raise rates, shouldn’t markets fall on a taper tantrum? We can go back to those Billionaire fund managers and say that the market just doesn’t care. It is calling the Fed’s bluff, and will only react once the Fed actually hike interest rates.

Or something entirely different. I was tuning into CNBC this morning and many people were confused that markets were rising with this inflation data. When asked why this is happening, market analysts said: people are confused. Not really what you want to hear.

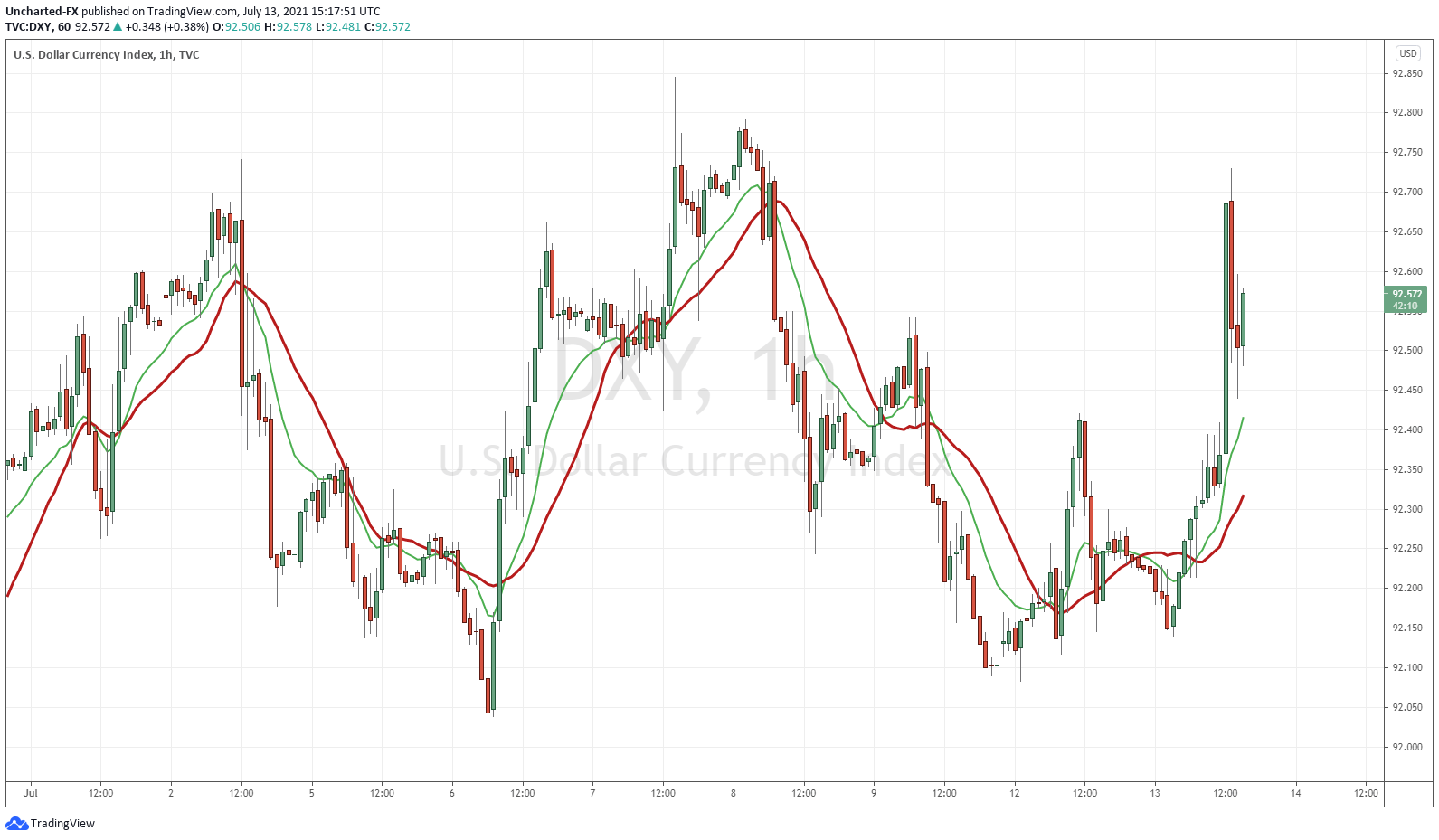

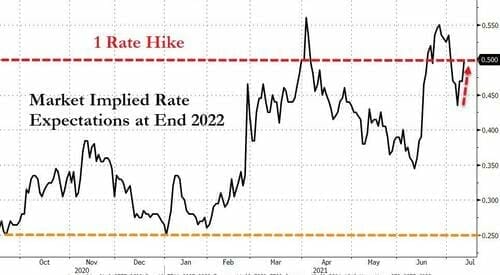

What did rise backed on inflation data was the US Dollar. Now this is interesting. Either the Dollar is rising due to a move into risk/safety, OR it is the market pricing in a rate hike. Based on interest rate differentials, we would expect the Dollar to rise because holding Dollars will reward you more with higher interest rates compared to other currencies.

Zerohedge is saying that the Dollar is popping due to a rate hike expectation at the end of 2022. The market is pricing in an interest rate hike sooner rather than the Fed’s 2023 estimate. But will the Fed ignore all of this?

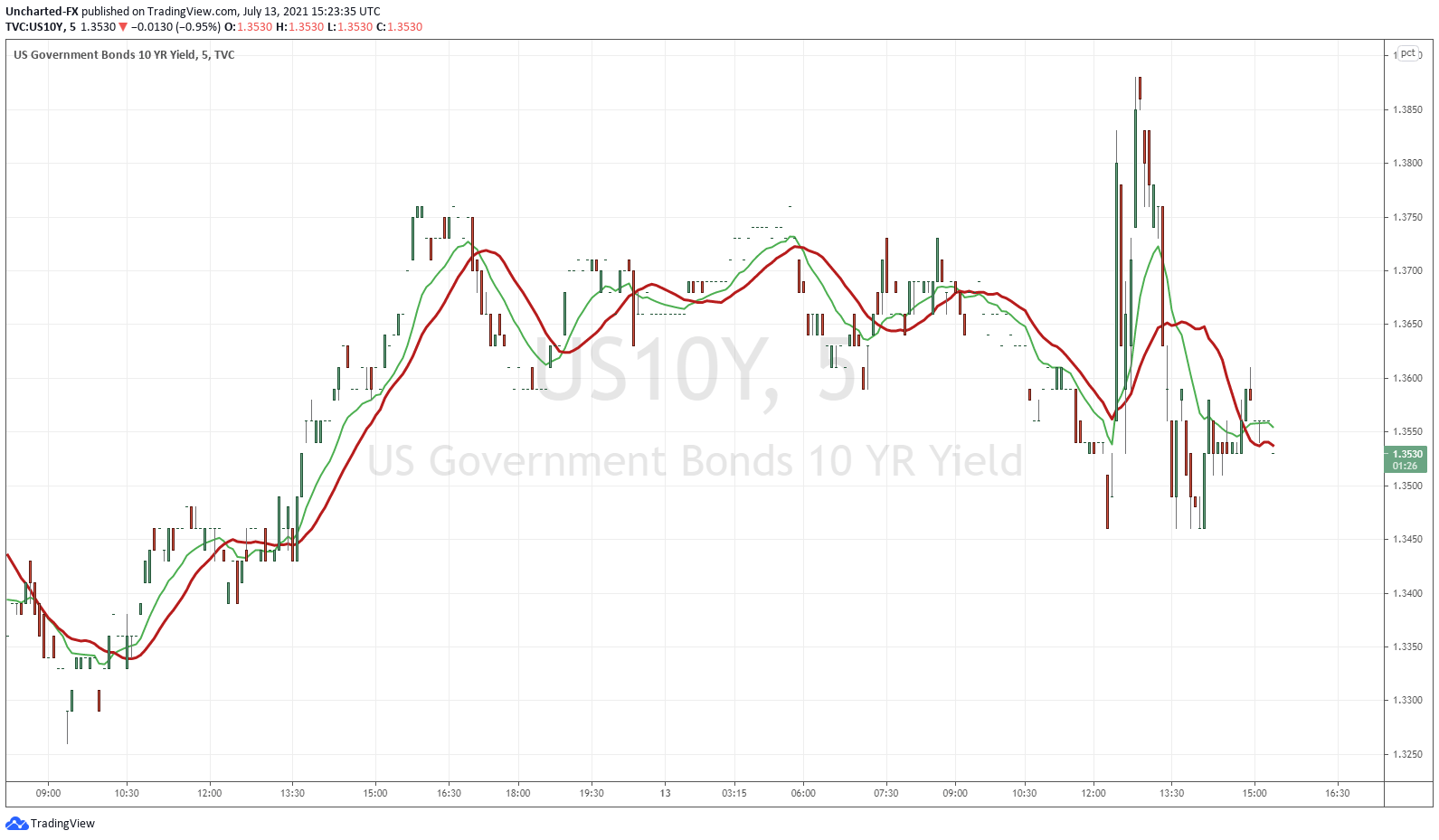

Bond yields initially rose (sell off in bonds) but have given up their gains. Adds more confusion.

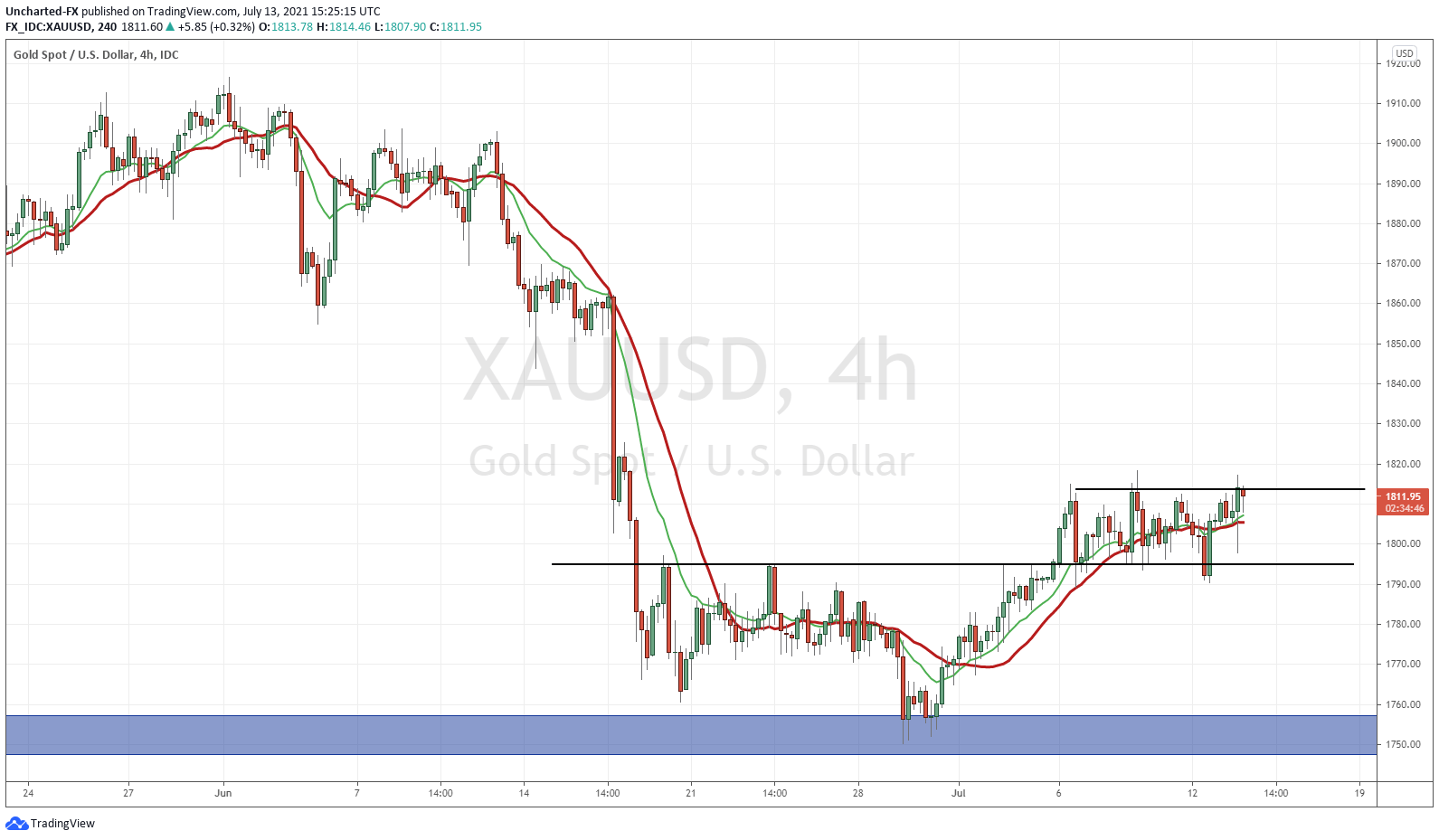

Gold initially sold off intraday, but is making a recovery. Longer term chart is hinting at a breakout. Would make sense as Gold is seen as an inflation hedge…but if it falls under pressure due to the rising US Dollar, then deflationary pressures could be winning out. Once again, I point you to my inflation vs deflation article linked earlier above.

So in summary, we are getting to the point where the market is now beginning to question the transitory inflation narrative. How much more longer can the Fed keep riding this? The economy has been re-opened for many months now, yet the transitory inflation is not disappearing. If this is the case then what is the problem? Is there a larger supply chain issue, or has the Fed just printed way too much money. I believe it is a mix of the two (people with more money spending it on the same number of goods and services).

But the biggest worrying aspect is how long can the Fed keep confidence? If they are wrong on this transitory inflation, and inflation persists, will markets begin pricing in a confidence crisis? Historic times that we are living in.