“Texas Hold’em, the game that takes a minute to learn but a lifetime to master.”

Mike Sexton

The Game

Poker is a card game in which players wager over which hand is best according to a set of rules and possible random probability outcomes.

The main purpose of the game is:

To layout, as much capital today on bets you feel will bring an adequate return tomorrow (after having done your due diligence with the asymmetric information at hand).

The catch is, your return is also determined by the other players’ strategies in the game. Economists call this phenomenon a dynamic simultaneous game with dominant and dominated strategies.

This game theory dictates that most participants in the poker game would act rationally and play only to maximize their marginal payoff given the available information. With that said, most players are wise to play a weakly dominant strategy where the payoff is still adequate but dictated by the moves made by the whales.

These whales have accumulated a large war chest of cash from a game they say they are well qualified to predict and determine the outcomes by utilizing statistics, skill and luck.

Most market participants, new or old, would agree that the stock market is a quasi perpetual game of poker. Instead of statistics being the biggest contributor to adequate returns, the whales use various techniques to wring value out of the market.

For this added (and in some cases subtracted) value, these whales feel they should be well compensated with 2% for management and 20% on performance (an industry-standard) for beating those who are using a weakly dominant strategy (usually a passive index fund, mutual fund or ETF).

And just as we would in poker with information that is delayed, we are able to make choices using the lagged money flows from these large institutions.

We can do this by simply looking up a Form 13F on the net.

A Form 13F is a quarterly report filed with the SEC by institutional investment managers that have assets over $100M. All US-listed equity securities (including ETFs) in the manager’s portfolio are included and detailed according to the number of shares, the ticker, the issuer name, etc. Short positions are not required to be disclosed on Form 13F.

Let’s use Bill Ackman’s Pershing Square Capital Management as an example.

As of the three months ending on the 31st of March 2021, Bill Ackman’s (better known as baby Buffet & the guy who shorted Herbalife) fund had $10 billion in Assets Under Management (“AUM”).

His fund was concentrated with only 8 US-listed equity securities. The most interesting position being their new entry into Domino’s Pizza (“DPZ”). This new position was about $870 million of the AUM and is in line with his investment mandate :

“Simple, predictable, free cash flow-generative, dominant businesses”

- As of January 3, 2021, it operated approximately 17,600 stores in 90 markets.

- In 2020 they brought in $4.1 billion in sales using $290 million in Property Plant and Equipment. This gives Fixed Asset Turnover of 14X, meaning for every dollar invested in fixed assets they generate $14 in sales

- The day-to-day operations managed to bring in $592 million of organic cash, before $80 million of capital spending on maintaining their brand, in 2020

- They funded their operations using organic cash flow ($590 million) & debt ($4 billion)

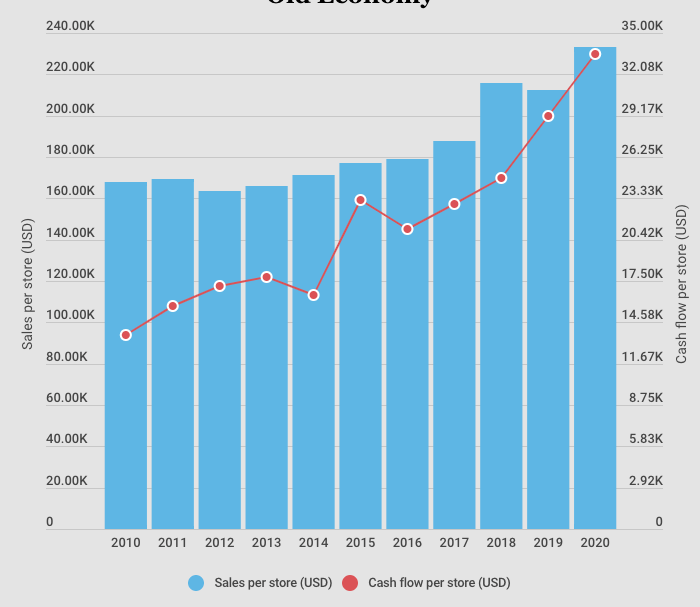

The business has been growing rapidly in the last 11 years (2010 – 2020)

- Sales growth of 9% annually,

- Cash Flow growth of 15% and

- the Number of Domino’s Pizza stores worldwide expanded by 6% annually

To achieve these economies of scale the business benefits from the recognizable brand and any new stores only need the total initial investment that ranges from $119,950 to $461,700.

The franchise agreement lasts for 10 years and is renewable, and the royalty fee is 5.5%. Franchisees should have at least $75,000 in liquid cash available.

Assuming the Initial cost is on the high end at $461,700 the payback period from organic cash flows as of 2020 ($33,552.48) will be 13 years of operations for the franchisee.

If the initial cost is on the lower end at $119,950 the payback period from organic cash flows as of 2020 ($33,552.48) will be 3 years.

In other words, if a franchisee is able to keep their costs low and run their restaurant with gross margins of 25% and operating margins of 15%, they can generate a total of $335,500 in total organic cash flows, before CAPEX of course, from a total initial investment of $119,950 with a cash buffer of $75,000.

Over the 10 year period, this is a compounded Return on Investment (“ROI”) of 11%. This is at a time when the Nominal ROI of the 10 year US bonds is around 1% and the S&P 500 produces a nominal return of between 6% to 9%.

As a Domino’s Pizza shareholder you earn a 5.5% royalty fee from your global team of franchisees over a 10 year period and do not have to worry about operating the restaurants. Your main concern would be bringing in a network effect that needs less CAPEX per unit every year. This network effect allows the brand to earn higher profits on incremental invested capital.

The entire business has a return on invested capital (“ROIC”) of 60%, Return on Assets of 30%, and operating margins of 17% on average in the last 10 years. The company has also consistently been profitable, positive net income and cash flows, since its 5000th store celebration in 2006.

I think Bill Ackman might be onto something here!

P.S It must be confused they are the beneficiaries of some excessive leverage, Total Debt / Assets, of about 3X on average)

What a franchise! Glad to copy and paste this one into my own portfolio.

Unlike the actual game of poker, the stock market is perpetual. Meaning, it has no end. The driving force for most investors should not be to win the game with the highest relative dollar or percentage payouts each time but to survive the game.

One of Warren Buffett’s most profound thoughts on the rules to investing is that we only need two rules :

- Do not lose money

- Do not forget rule 1

Learning from the whales definitely helps our probabilities of success without breaking the cardinal rules. At the risk of sounding braggadocious, one of the things I’m best at is riding coattails. Behind every successful investor (whale) is me, smiling, and taking partial credit.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer: The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.