It’s Fed day! And boy is it a big one! All the data we have seen come in the last few weeks: the higher than expected inflation numbers (both CPI and PPI), US job numbers (NFP) missing expectations, and US Retail Sales missing the mark, is now being assessed by the Federal Reserve. The market will finally hear what our central bank overlords think about it.

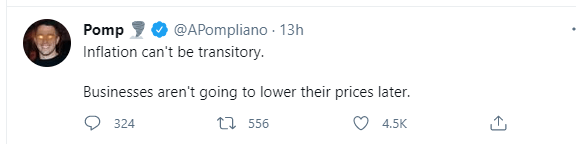

So far the narrative has been, yes inflation is rising, BUT this inflation is TRANSITORY. What the Fed means by this is that prices are only rising due to the re-opening of the economy. Economists believe that this transitory inflation will disappear once consumers stop spending on goods, and transition their spending on services. This is what the Fed believes as well, hence why they are saying that the key will be CONSISTENT inflation over 2%…after transitory inflation disappears.

But will the market buy it? We have had billionaire fund managers like Stanley Druckenmiller and Paul Tudor Jones come out and gave their opinions on inflation. Go all in the inflation trade (buy commodities, buy crypto and buy gold).

My readers know that it appears as if the Fed is stuck. They will likely continue to inflate this market with cheap money. This got a boost when last week, the Bank of Canada and the European Central Bank, mentioned that they will continue their easy money policy into next year.

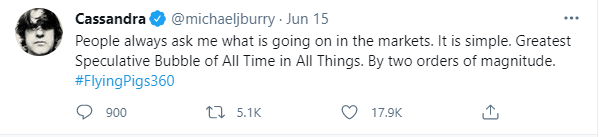

Even Dr. Michael J Burry, from the Big Short fame, returned to Twitter to drop this:

The fear is that since this whole thing is propped up by cheap money, any mention of eventual tapering and the raising of interest rates, will cause stock markets to sell off heavily. Create a taper tantrum. Since this is the case, the Fed is not likely to surprise anyone. If they are going to taper, they will let us know months in advance. The $100 question is does that happen today?

A reminder the Fed announcement is at 11 am PST/2 pm EST, while the press conference is at 11:30 am PST/2:30 pm EST. The wording at the press conference will be key. I bet Jerome Powell is practicing his speech right now. He somehow has to convince the markets that the economy is recovering, but current economic policy has to remain in place. Once again the excuse will be transitory inflation, and the Fed needs more time to observe this data. To be honest, I wouldn’t be surprised if this meeting turns to a non-event. Late Summer, or the September Fed meeting will be the big one.

This being said, what would the market like to hear versus what it would not like to hear?

Bad: If the Fed decides to stop or slow down bond purchases (taper) or they have a change of plan which comes from the interpretation of recent data (oh man inflation is rising, we might need to hike before December), markets will sell off. But I don’t think this is likely.

Good: Things remain the same. Powell does not come off as hawkish as the market thought he would (need more data since inflation is transitory). He essentially repeats things he has said in the past, and the market accepts it. This is the likely case.

There will be a time when the markets stop buying what the Fed says. This is why I think the latter Fed meetings as mentioned above will be key. If the Fed keeps using the transitory inflation excuse, but inflation data still keeps coming in above 5%, the market will lose confidence in the Fed. The market will believe it is real inflation from monetary policy and the Fed is not acting.

Technical Tactics

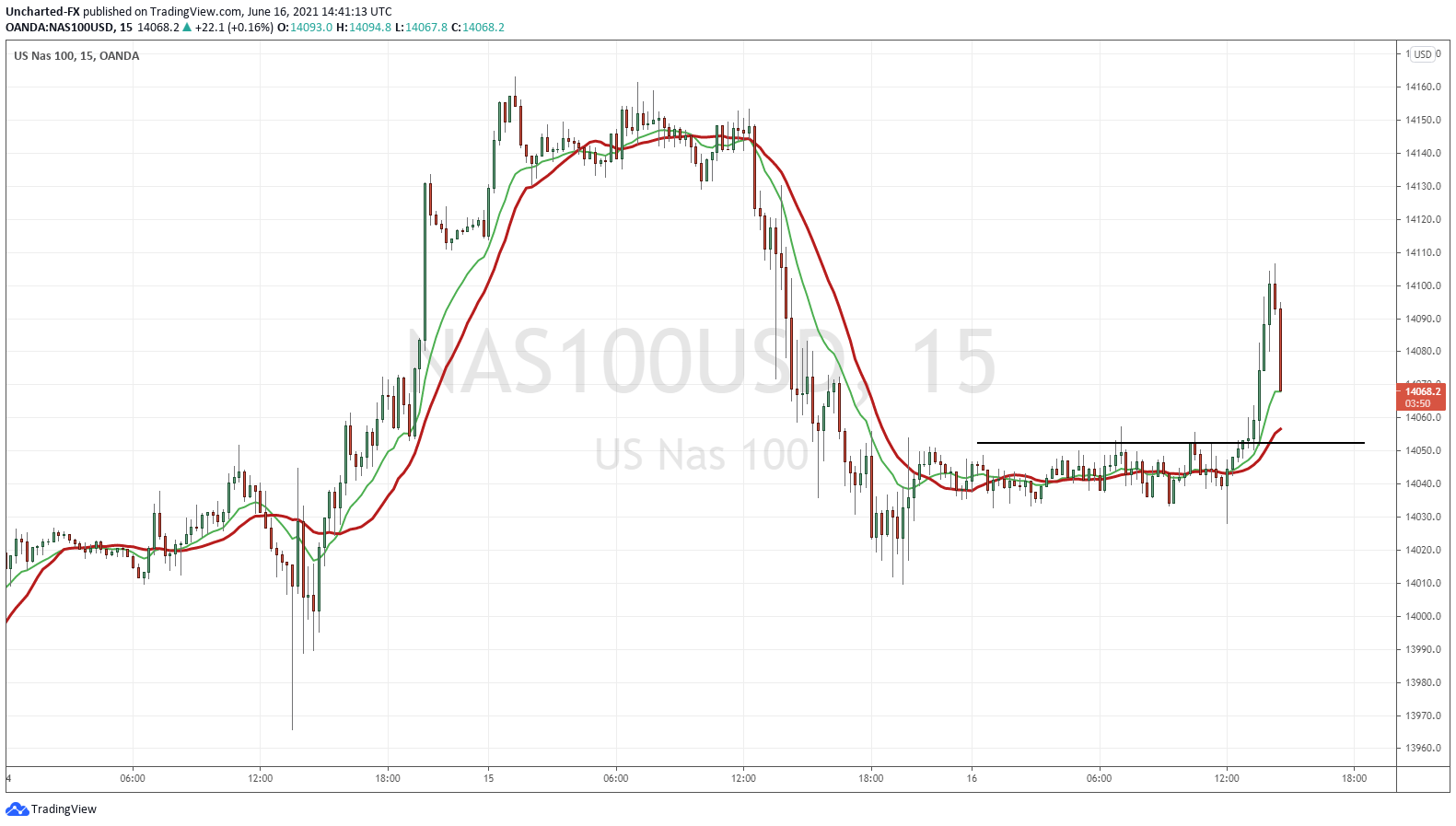

Let’s start off with the equity markets. If the markets like what the Fed says, they will continue to rip higher. In yesterday’s Market Moment, we looked at the Nasdaq breakout. The support and resistance on the longer term charts remain valid.

Going down to the 15 minute intraday chart of the Nasdaq, you can see we actually had a strong breakout this morning. But now price is pulling back. Perhaps markets are on edge before Powell, or this is just a typical breakout pattern. If you recall, breakouts tend to pullback to retest the breakout zone before continuing higher. This means we should expect to see buyers step in around 14050. The Fed can either buoy this breakout or destroy it.

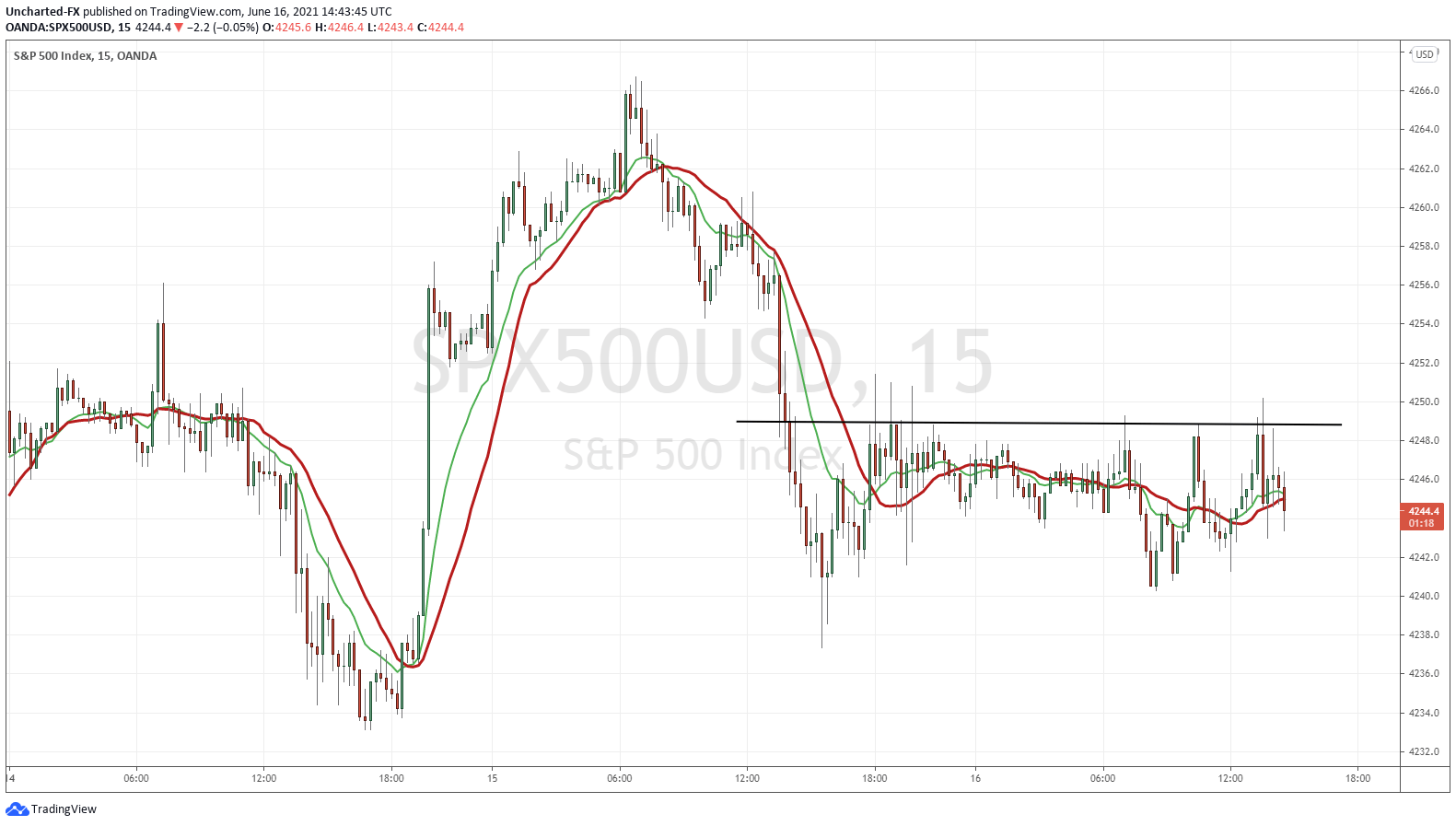

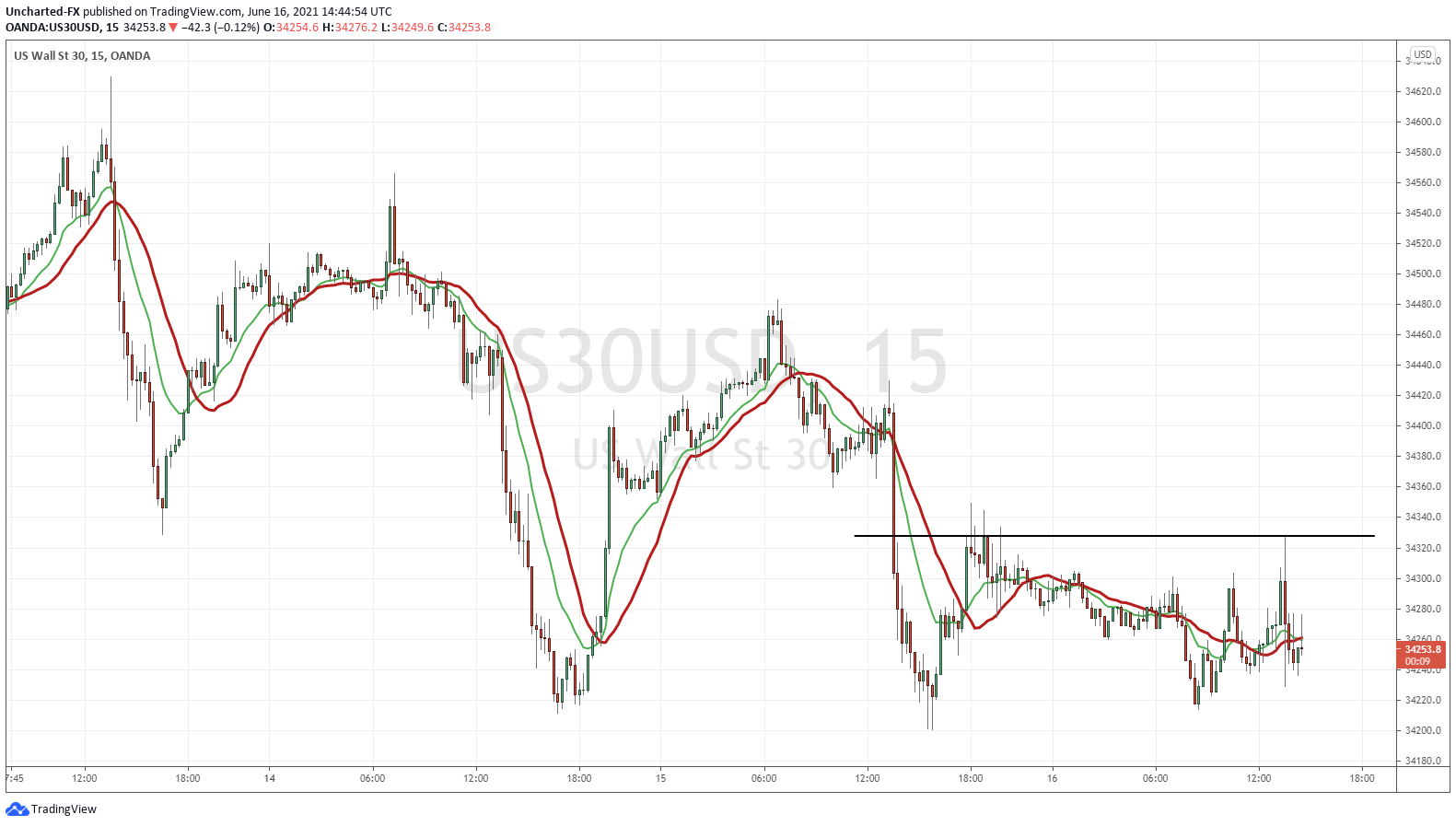

Meanwhile both the S&P 500 and the Dow Jones remain in a range on their 15 minute charts. This is what I would expect before a Fed announcement. Markets on edge and ranging. Sure, we can predict what the Fed will say, but we never know how the markets will react to it. This is why many traders tend to just wait until after the Fed to take positions, leading to lower volume running up to the meeting.

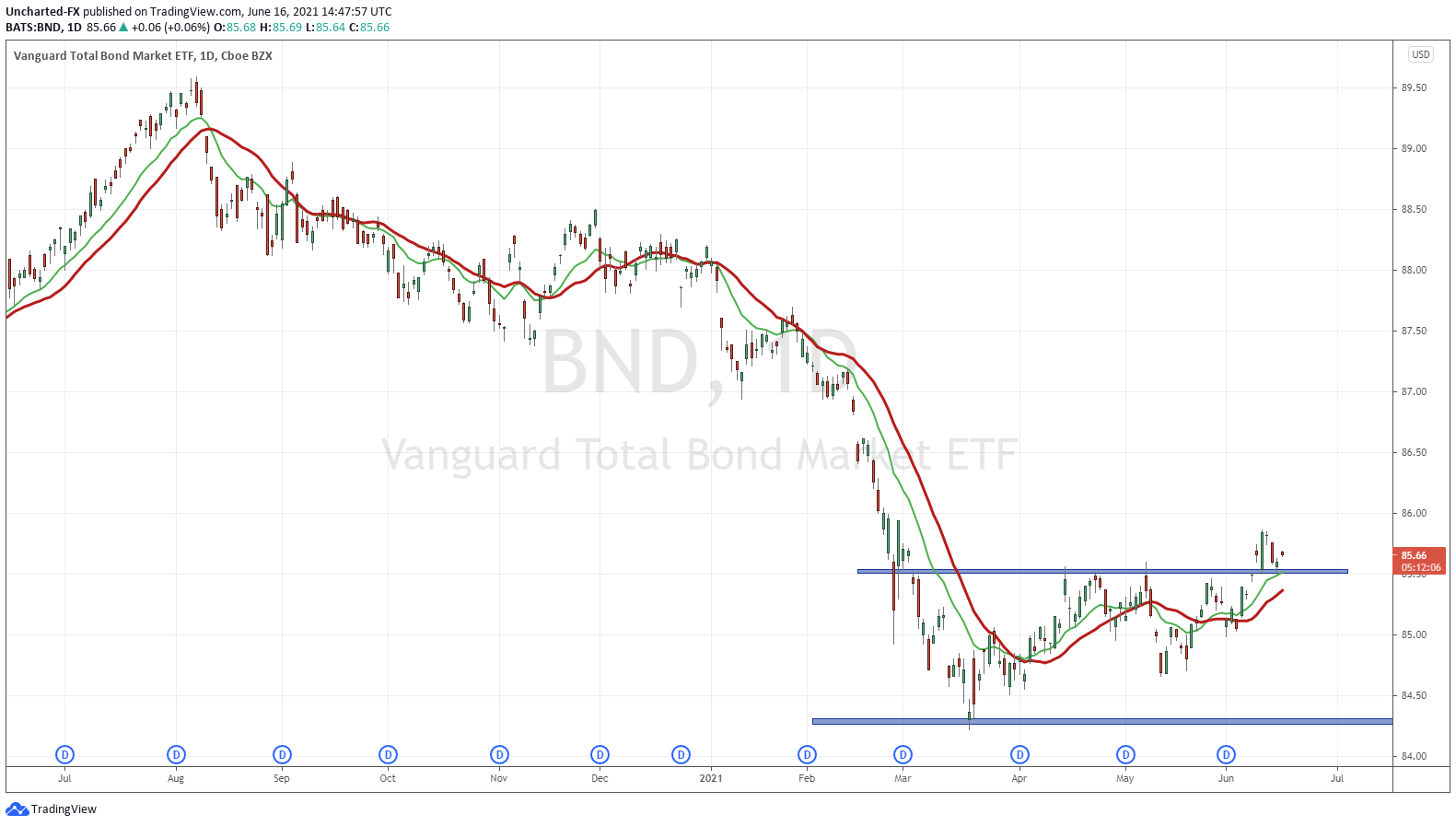

But the Bond market is what I will be watching:

The BND ETF has been mentioned in past posts and over on our Discord Trading Room. We had the breakout, and price then pulled back to retest the breakout zone. It is still holding above, which means a move higher is likely.

This means two things. Either markets are pricing in LOWER interest rates in the future, or this is a risk off move. In the first case, you would be buying bonds knowing these bonds will be worth more at these interest rates. This goes back to the new idea of bonds being traded for capital appreciation rather than for yield. In the second case, there is fear in the markets. Money is leaving the stock markets for the safety of bonds.

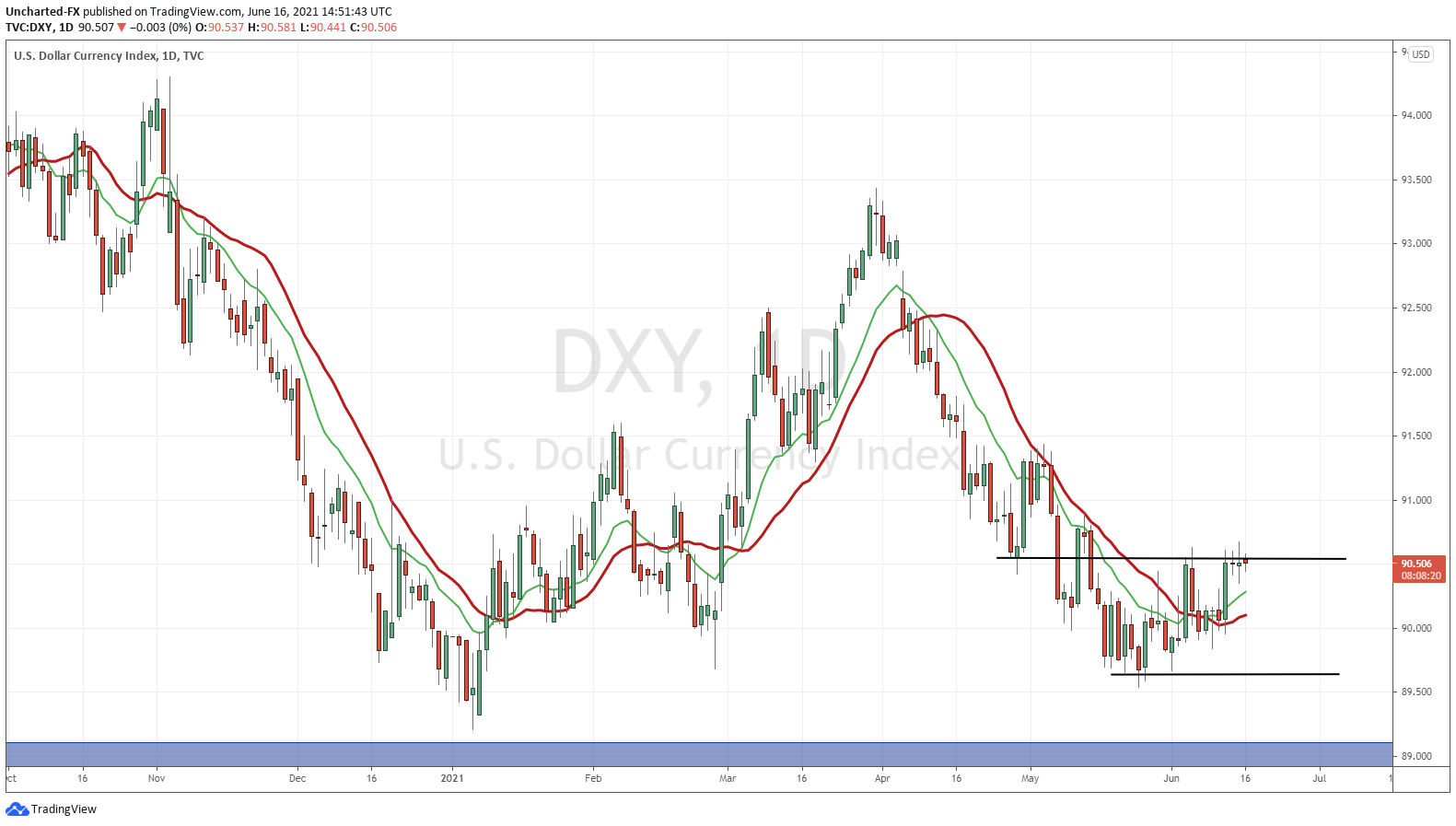

Add in the US Dollar rising with Bonds, and you have the final ingredient for our risk off soup.

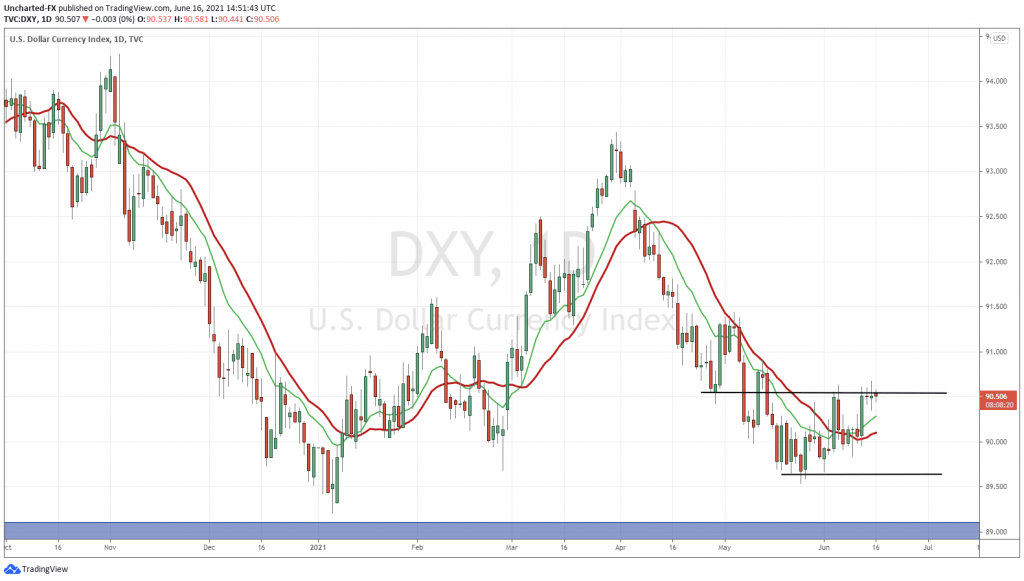

The US Dollar chart is the one to watch. It appears to be on the verge of a breakout. Either because of interest differentials (if the Fed is likely to hike in the future), or fear as the Dollar is still the reserve currency and seen as safety. In this currency war world, many central banks what a weaker currency. The definition of inflation that I adhere to is the weakening of a currency. It is not that goods are becoming expensive, but the currency is getting weaker which means it now takes more of a weaker currency to buy something. Does the Fed slap the US Dollar down before the breakout much to the annoyance of Dollar bulls?

For those who have never observed price action during a Fed meeting, do yourself a favor and watch the US Dollar chart on the lower timeframe during the Fed meeting. You will see some incredible 1 minute moves.

The market has been anticipating this Fed meeting for sometime. The ball is now in the Fed’s court.