Plurilock Security (PLUR.V) announced that they have signed a contract with a California state agency and reported their fiscal 2021 first quarter financial results.

The contract signed with the California state agency is worth $133,000 USD. According to their press release, Plurilock is working closely with the agency to determine the project scope, establish stakeholders, a timeline, and expectations. The contract’s statement of work relates to a security assessment, application analysis and testing, application penetration testing, policy and procedure review and development, network penetration testing, and remediation testing.

The contract signed with the California state agency is worth $133,000 USD.

After the recent Colonial Pipeline ransomware attack, many companies and agencies have likely realized they are exposed to cyber-attacks. If that feeling of vulnerability sticks with this California state agency and Plurilock is able to show them they have weaknesses that PLUR can protect, this contract could develop into something more.

“Plurilock is working with the California agency to ensure their system is secure, particularly as we’ve seen an increase in government agencies targeted by cyberattacks across the United States,” stated Ian L. Paterson, CEO of Plurilock. “This contract is part of our long-term plan to expand across industry verticals, and further solidifies our work to capture additional opportunities within the U.S. government sector.”

They also saw they cash and cash equivalents more than triple in the past year, going from $1,721,179 to $5,848,598.

During the first quarter, which ended on March 31, 2021, Plurilock saw a decline in revenue but saw their EBITDA and cash/cash equivalents increase. Their total revenue was $75,761, which represents a decrease of 27% over the same period in the prior fiscal year. Electronic software license and maintenance sales revenues accounted for 89% of their total revenue for the quarter, with professional services revenue accounting for the other 11%; the breakdown the year before was 81% – 19%, respectively.

Plurilock’s adjusted EBITDA for Q1 was $1,056,397, compared to $494,514 in the same quarter the previous year. They also saw they cash and cash equivalents more than triple in the past year, going from $1,721,179 to $5,848,598.

“Fiscal Q1 2021 saw us accelerate our growth by achieving multiple operational initiatives that have positioned us well for the remainder of the year,” stated Paterson. “Despite the challenging economic environment, we were able to raise over $5M in growth capital from leading Canadian investors, add notable personnel to our advisory board with global cybersecurity experience and put ourselves in the best position we have been in as a Company since we began trading in September 2020.”

“As part of our stated strategy of acquiring accretive assets to complement our existing high margin artificial intelligence products, we completed our first acquisition of cybersecurity solutions provider Aurora Systems Consulting Inc., a company with revenue of $35.82 million in 2020 and strong presence in the U.S. government vertical,” stated Mr. Paterson. “With Aurora, we have dramatically increased our distribution, by adding an experienced sales force, contracting vehicles with access 174 California State agencies and a Government-Wide Acquisition Contract with the US Federal Government, as well as a base of over 140 customers.”

“With cybersecurity threats continuing to rise globally, we will look to accelerate our presence in the industry by expanding our product portfolio and pursuing additional M&A opportunities that can expand our sales pipeline and deliver needed solutions to this fast-growing industry,” continued Mr. Paterson.

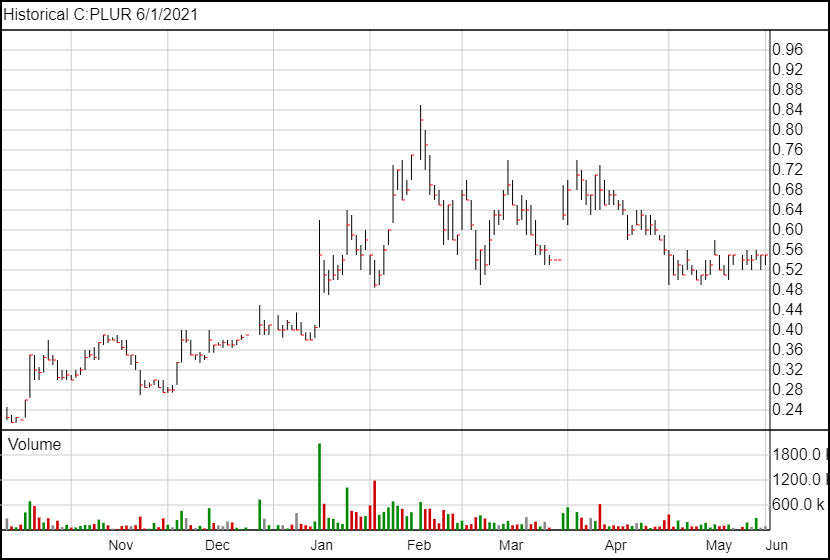

Following the news, Plurilock’s share price has not changed significantly.

Full disclosure: Plurilock Security is an Equity Guru marketing client.