It’s difficult to overstate the importance of a project’s zip code when shortlisting stocks in the junior exploration arena.

High-risk jurisdictions—those with twitchy governments at the helm—have been known to put the kibosh on mining claims, development projects, and even operating mines once all of the heavy-lifting is done. Venezuela, Kyrgyzstan, Zambia, Zimbabwe, Bolivia… the list is waaaay too long for my liking.

Jurisdictions with fair, time-tested mining codes merit special standing when conducting your due diligence in this Wild West of a sector.

The Institute

The Fraser Institute, a think-tank that analyses jurisdictional risk, recently released its Annual Survey of Mining Companies. This survey ranks a jurisdiction—country, state, province—according to its “Investment Attractiveness”.

This report presents the results of the Fraser Institute’s 2020 annual survey of mining and exploration companies. The survey is an attempt to assess how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration investment. The survey was circulated electronically to approximately 2,200 individuals between August 6th to November 6th, 2020. Survey responses have been tallied to rank provinces, states, and countries according to the extent that public policy factors encourage or discourage mining investment.

This annual survey also serves as a “report card” to governments regarding the draw of their mining policies.

According to Elmira Aliakbari, director of the Institute’s Centre for Natural Resource Studies:

“The Fraser Institute’s mining survey is the most comprehensive report on government policies that either attract or discourage mining investors.”

Fraser’s Top Ten

According to the survey, the top jurisdiction where mining is concerned, is Nevada. Arizona moved into 2nd place, from 9th a year earlier. Saskatchewan climbed eight spots, from 11th in 2019 to 3rd in 2020. Western Australia dropped to 4th after holding top-shelf status last year. Alaska dropped to 5th from 4th. Rounding out the Top Ten are Quebec, South Australia, Newfoundland & Labrador, Idaho, and Finland.

Quebec is currently ranked #6 by the esteemed Institute.

It would appear that Quebec is not satisfied with the status quo and has recently announced a strategic initiative—an action agenda—it believes “will reinvigorate the mining industry and solidify Québec’s position among the leaders of responsible mining development.”

Québec seeks to reinvigorate its mining industry with favourable investment policies

Incentivizing mineral exploration and development in the province is a shrewd move by the Quebec gov’t…

“One-fifth of Canada’s mining output comes from Québec and the resources exploited there are the most diverse in Canada: 15 metals and 13 minerals are produced and upgraded there including lithium, rare earths and apatite. In December 2020, Québec had 22 mines in operation and four mines in maintenance. Currently, some 29 development projects are under study.”

Quebec’s partiality for all things mining is next-level. SOQUEM, a subsidiary of the Quebec government (Investissement Québec, to be specific) actually partners with junior exploration companies to help push projects along the development curve. A very recent example:

Here’s the thing: if you can find a company in a prospective geological setting within an under-explored region of a mining-friendly jurisdiction, like Quebec, your chances of tagging a significant new discovery rise considerably.

X-Terra Resources (XTT.V)

X-Terra has a number of highly prospective properties in its project pipeline. I don’t know if management would agree with me 100%, but in my thinking, the Troilus East Project is the Company’s flagship.

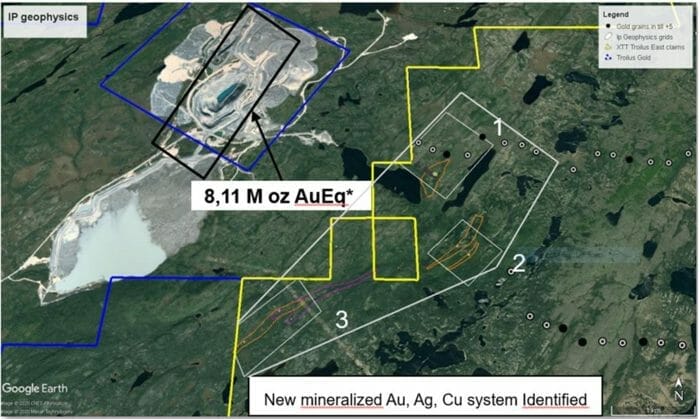

Troilus East is located along the underexplored Frotet-Evans Greenstone Belt in northern Québec. And importantly,

the project shares a common border with Troilus Gold’s (TLG.T) 8.11 million ounces AuEq resource—a resource that appears destined to grow (perhaps significantly so).

Troilus East is wholly-owned, royalty-free, and encompasses some 93 square kilometers.

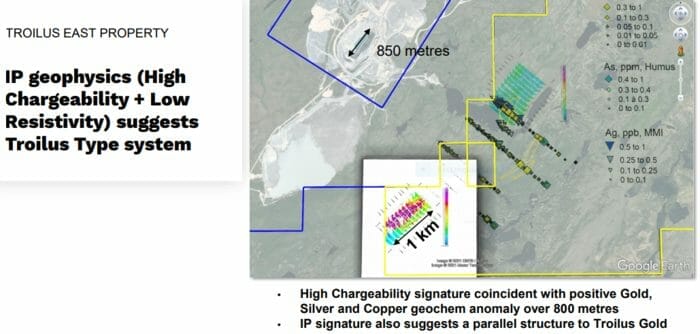

Earlier this spring the Company launched a ground-based geophysical campaign—Induced Polarization (IP for short)—to follow up on very positive geochemical results that delivered up to 100 x background values.

Both projects—Troilus East and the 8.1M AuEq oz colossus next door—hold in common a mixed sequence of intermediate volcanic rock interlayered with dioritic intrusions.

Quoting a late April press release…

The IP survey (100 metre line spacing) totaling 19-line kilometres has identified a one kilometre long complex anomaly pattern. The anomaly is centered on a strong conductor coincident with a kilometric gold in soil anomaly combined with a polymetallic copper, silver and tungsten signature. Previous exploration programs returned Cu-Ag-W values from various lithologies corresponding to a regional mafic to felsic contact. Alterations such as silicification, calc-silicates and biotite rich assemblages were recognized in the field and compared with the Troilus Gold project located about three kilometres north-west of X-Terra’s Troilus East property (see X-Terra press release dated December 30, 2020 and March 15, 2021).

The high chargeability – low resistivity anomaly shows a complex shape embracing an apparent width varying between 50 and 400 metres. The anomaly is centered on a strong conductor which can be followed along strike for over 800 metres. The grid aims to test the superimposed geochemical and geophysics anomalies and it represents about one third of the favorable ground previously outlined.

Upon further review of the Examine governmental data base, X-Terra was able to conclude from the historical IP survey completed over the Troilus area, that the Troilus deposit is developed between strong conductors. The position of the Au-Cu mineralization corresponds to wide chargeability responses explained by 200 metres to 1kilometre wide alteration halos. However, this relationship must be perceived on the regional scale study. The IP coverage done by X-Terra is along those lines: testing a favorable parallel trend that is similarly orientated northeast-southwest like the nearby Troilus gold deposit, close to a regional fault and coincident with electromagnetic anomalies.

Establishing a positive correlation between geochemical and geophysical anomalies increases the odds of success with the drill bit. Also, these regional structures—major faults—often influence the subsurface flow of fluids, acting as a trap for mineralization.

X-Terra holds 93 square kilometers of parallel geology—with the same geological characteristics—as the 8.11M AuEq resource next door… 93 square kilometers of highly prospective terrain that has never received a proper probe with the drill bit.

Roughly four weeks back, X-Terra mobilized a diamond drill rig to Troilus East, using Troilus Gold’s road access as a staging area.

X-Terra Resources Begins Drilling at Troilus East

According to this late May press release…

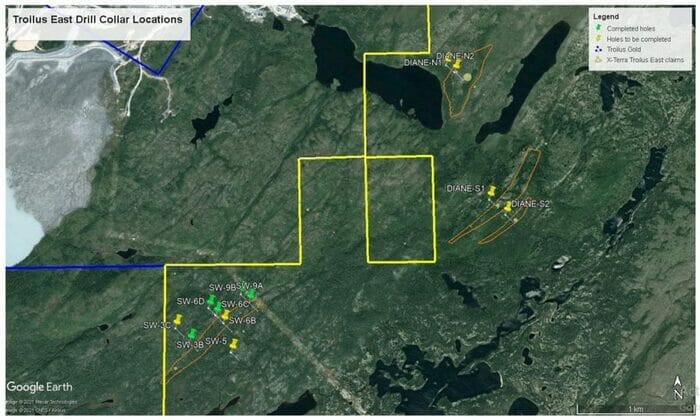

The drill program consisting of 12 holes and will commence over the high priority anomaly where eight (8) drill holes will be completed, followed by two (2) holes at the north-east grid and two (2) holes at the south east grid, both of which will be testing geochemical anomalies recently identified (see X-Terra press release dated December 30, 2020). This drill program is anticipated to take approximately three (3) weeks to complete.

Then, just the other day, on June 22nd, the Company dropped the following headline…

X-Terra Resources Provides Observations From the Drill Core

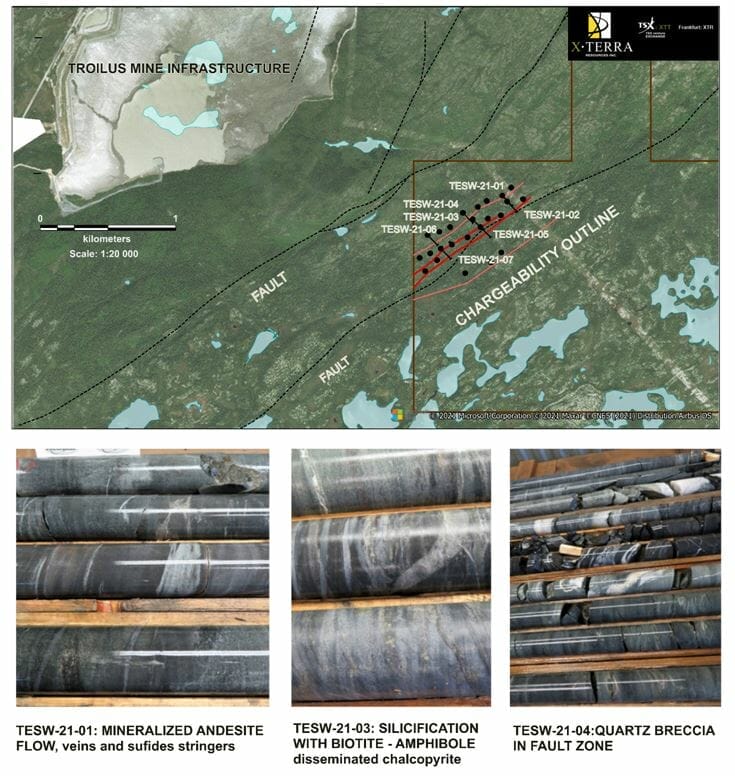

According to this press release, the Company has completed five of the 12 holes planned for this first phase of drilling. Ranging in depth between 150 to 200 meters, these first five were positioned along the high priority anomaly located on the southwest grid (map below).

“The program was designed to focus around a strong 1-kilometre-long chargeability anomaly, exhibiting an apparent width of between 200 metres and 400 metres. It straddles an area which was difficult to explore and only had limited surface work due to poor outcropping conditions.”

Re the map below, note the legend (top right), the scale (bottom right), and the proximity to Troilus Gold’s 8.1 million AuEq resource (top left). Note the holes completed (green thumbtacks) and the targets that remain to be drill tested (yellow thumbtacks).

The drill grid corresponds to the south-west part of the “Smoke” target. Previous prospecting and soil sampling works gave strong proximity indicator of a mineralized system at about three kilometres directly south-east of the former Troilus open pit. The new system identified covers a strike length of approximately two kilometres where polymetallic sulfides occurrences were sporadically sampled. X-Terra noted that sporadic samples over this area returned copper grades up to 0.25% Cu, silver grades up to 8.0 g/t Ag, zinc grades up to 0.7% Zn and 0.11 g/t Au, or 0.43g/t AuEq (see X-Terra press release dated August 13, 2020).

X-Terra wants to highlight that copper and silver grades from drill results recently disclosed by Troilus Gold Corp (TLG) in its press release dated June 6, 2021, are in the same range as these first surface results obtained from the Smoke target. In addition, the host rocks, alteration and mineralization style are also considered similar (please see Troilus Gold Corp’s press release dated September 10, 2019).

Observation summary

The drill grid crosscut an important lithological sequence. This sequence highlights a progression starting at the north-west side by andesitic flows interlayered with more felsic brecciated flows, which comes in contact with a ten-to-twenty-metre layer of felsic tuffs or sediments, which is locally graphitic. The sequence is intruded by a mafic intrusion marked by continuous composition variations from andesite, quartz rich gabbro to a more mafic counterpart.

Structurally, even preliminary, the whole sequence could be interpreted as folded with a sheared and faulted contact. The fine grain and laminated felsic units acting as a non competent layer molding the mafic unit to create a structural doming effect. Strong ductile deformation associated with a shear band overprints the contact, evolving to a tectonic breccia in the more fragile felsic unit.

The drill grid has yet to cover the entirety of the alteration system which spans approximately the entire width of the chargeability anomaly. The combination of alteration minerals observed includes biotite, muscovite, tremolite, sericite, garnet and aluminous silicate which is concentrated in bands of a few metres, distributed throughout complex assemblages indicating superimposition of events or zoning patterns.

Mineralization

Mineralization

Disseminated iron sulfides (pyrrhotite and pyrite) are common throughout drill intervals in varied lithological and alteration contexts. Chalcopyrite and sphalerite are also noted in intervals ranging from 5 to 20 metres.

Overall, the intermediate volcanics can be considered as the main host rock for the polymetallic sulfides, presenting as stringers, laminations, disseminated clots in contact with centimetric quartz veins or fractures. In addition, foliated and biotite rich altered gabbro also hosts significant amount of disseminated pyrrhotite, reaching locally 10% in association with trace amounts of chalcopyrite.

Close to the fault system, pyrite bearing quartz and quartz-feldspar veins reaching up to one metre appear, where variably altered volcanic host rocks become more deformed, laminated to brecciated.

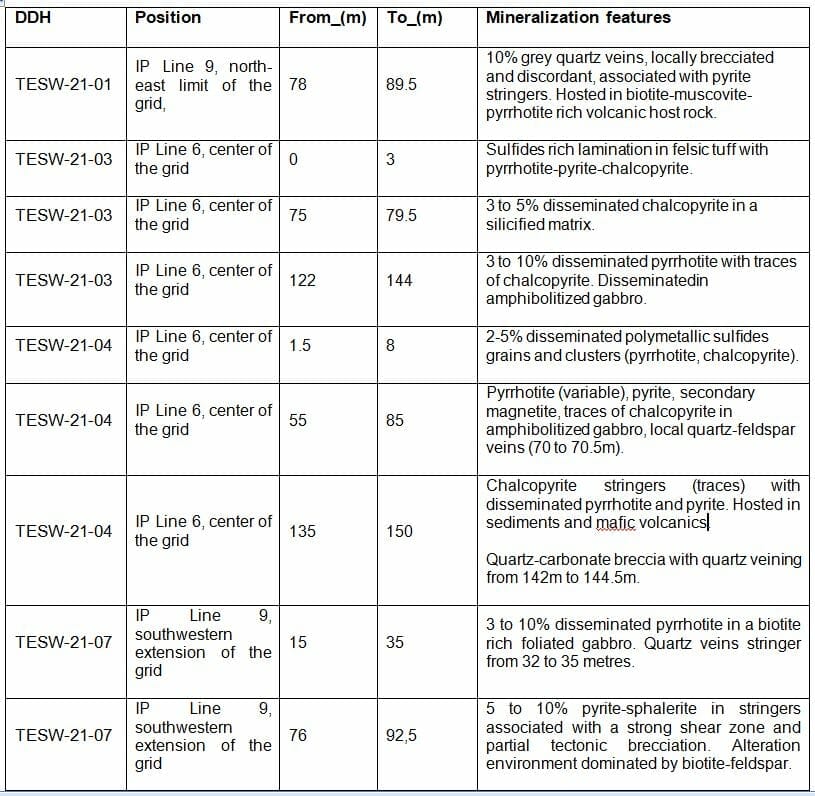

The following intervals are preliminary and reflect sulfides concentrations, mostly where chalcopyrite mineralization was observed, or where obvious vein networks were intersected. Observations are from holes TESW-21-01, TESW-21-03, TESW-21-04, TESW-21-07 which were readily accessible at X-Terra’s core shack facility.***

These visual observations represent positive cues. They let the onsite geo know they’re in the right rock.

Final thoughts

Drilling at Troilus East is ongoing.

These first five holes will be shipped off to the lab next week.

The lab in Saint-Germain is telling the Company “twenty to twenty-five business days” turnaround for gold assays, but they’ll also be checking for copper, silver, nickel, zinc, and arsenic, so it may take a little longer. Early August for this first batch would be my best guess.

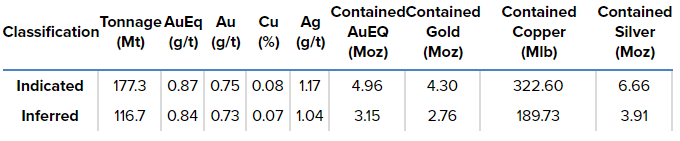

It’s important to keep in mind that the 8.1M ounce-count next door is AuEq (gold equivalent)… it’s a polymetallic deposit consisting of gold, copper, and silver. The individual grades are modest but the combination of all three metals make for a solid PEA, with significant leverage to buoyant metal prices…

X-Terra is hoping to tag similar values, and so far, the indications, both geochemical and geophysical, are lining up neatly.

Without a doubt, Troilus Gold is watching this drill campaign closely (probably an understatement).

If X-Terra hits at Troilus East, aside from expectations for positive price trajectory, I suspect its days will be numbered. Troilus Gold recently took out UrbanGold, a common neighbor to both companies, in an all-stock deal worth approximately C$19.

X-Terra has a market cap of $7.15M based on its 79.45 million shares outstanding and recent sub-dime close.

END

—Greg Nolan

Full disclosure: X-Terra is an Equity Guru marketing client.

*** X-Terra believes it provides initial validation of the perspectivity of the high priority anomaly at Troilus East, readers are strongly cautioned that the information in this press release is of a preliminary nature and the visual mineralization observed has not yet been assayed. Also, the intensity of visual mineralization should not be used to estimate grade of commercial viability at this stage.

Mineralization

Mineralization