On June 17, 2021, Baru Gold (BARU.V) responded to “recent rumours and negative media attention focused against Baru and its upcoming gold production project on Sangihe Island in North Sulawesi, Indonesia.”

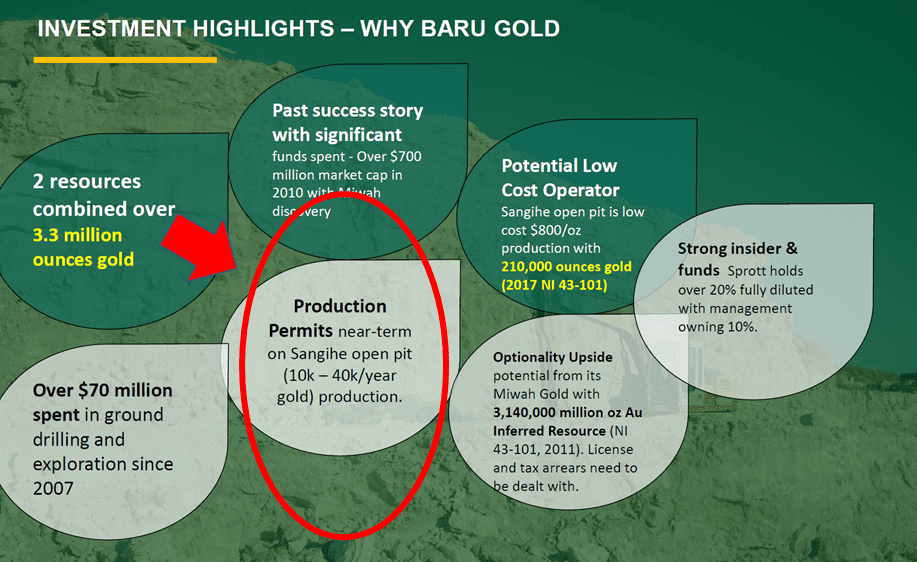

The Sangihe gold-silver project has an existing National Instrument 43-101 inferred mineral resource of 114,700 indicated and 105,000 inferred ounces of gold as reported in the Company’s “Independent Technical Report” dated May 30, 2017.

Thirty percent of Sangihe is held by three Indonesian corporations.

The other 70% stake is an Indonesian-domiciled subsidiary of BARU.

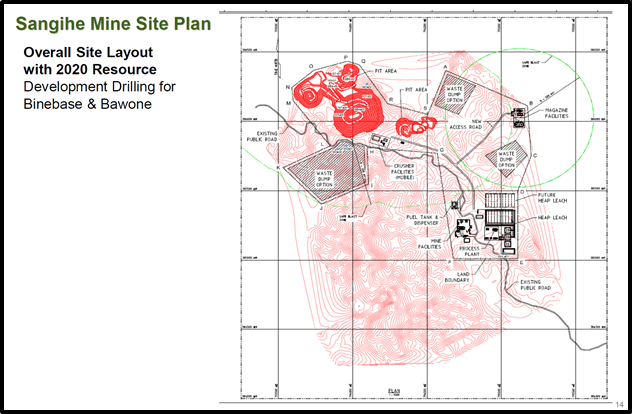

On December 16, 2020 Baru appointed Mr Fatchil Amal as the Mine Technical Manager for the Sangihe gold project.

Approved by the Indonesian government, Amal’s duties are “to ensure compliance with all legislation related to safety, health, environmental impact, and conservation of mineral resources”.

The presence of Mr. Amal has not quieted local critics of the proposed Indonesian gold mine.

In fact, over the last three months, the individual voices got louder, and have been amplified by negative media coverage. There have even been suggestions that Baru is responsible for the death of a local politician.

Before we get into the meat of the accusations – and BARU’s response – let’s pull back for a wider-angle view.

If a foreign corporation was planning to build a mine in your back yard, you would probably be anxious.

And not without reason.

Things do go wrong.

In 2019, Vale’s Brumadinho dam in Brazil collapsed killing 270 people.

In 2014, Imperial Metals’ Mount Polley tailings pond dam collapsed, sending a 25 million cubic metres of toxic slurry into Polley Lake.

That same year, an explosion in a Turkish coal mine, killed 300 people.

Mine disasters – in the context of industrial activity – are like plane crashes in the context of travel.

These rare deadly catastrophes burn indelibly into the public consciousness.

In fact, driving is 70X more deadly than flying, and cigarettes kill 66 X more people than mining.

“40 years ago, the world’s large-scale mining industry was just as unsafe as artisanal and small-scale mining,” states the World Bank on May 5, 2021, “However, today, large-scale mining is one of the world’s most safety conscious industries”.

“A Non-Government Organization (NGO) has posed several serious allegations against Baru Gold through prominent media sources including CNN, BBC, and CNBC,” reports Baru.

“These allegations include polluting the environment, underpaying locals for their land, illegally pushing the Sangihe mining project ahead, and endangering the habitat of a certain breed of flycatcher bird,” added Baru.

“This NGO has blamed the Company for the unfortunate passing of a local politician, who recently opposed the Sangihe project,” added Baru, “The Company wishes to clarify that this person’s untimely passing was due to natural causes.”

Baru points out that it has received “ongoing support from the federal government and the Mining Minster of Indonesia”.

Baru believes some of the negativity originates with local illegal miners.

Key Baru criticisms of illegal miners:

- dump mine tailings into the ocean

- destruction of reefs

- destruction of mangroves

- use of mercury in rivers and oceans

- Largely non-residents of Sangihe Island

- Intimidation of locals

- Non-tax payers

It would be naïve to suggest that international corporations are reliable custodians of the environment.

In fact, there is an argument to be made, corporations are psychopathic in nature.

But their size and visibility create a powerful disincentive for bad behaviour.

Put bluntly, an increasing number of retail investors refuse to invest in companies that do shitty things.

“ESG (Environmental, Social, and Governance) assets may hit $53 trillion by 2025, a third of global Assets Under Management (AUM),” states Bloomberg.

Systematically dumping mercury into a river is bad business.

“Sustainable mining methods requiring Canadian companies to operate in the most environmentally, socially, and economically responsible way at home are now being adopted by other nations around the world, thanks to the support of domestic mining companies and the Canadian Trade Commissioner Service (TCS),” reports Canada Action.

“Artisanal gold mining is one of the most significant sources of mercury release into the environment in the developing world, with at least a quarter of the world’s total gold supply coming from such sources,” reports Pure Earth, “The gaseous mercury is inhaled by the miners and often by their immediate family, including their children”.

You can look at the illegal miners on Sangihe Island as polluting outlaws – or blue-collar entrepreneurs trying to feed their families.

In ideal solution would be to institute a version of the program in Peru, that offers their 300,000 artisan miners a way to come in out of the cold.

Artisanal and small-scale gold mining in Peru has expanded past the typical definition of a “low-tech, subsistence enterprise” stated Science Direct, “Peru created the Integrated Registry of Miner Formalization (REINFO), a database used to register miners who were in the process of formalizing”.

These Peruvian Mom & Pop miners take their ore to small sanctioned (environmentally approved) processing mills.

Inca One Gold (TSX-V: INCA, OTC: INCAF) is a Canadian-based mineral resource company and mineral processing company with two gold milling facilities in Peru, servicing government-permitted small-scale miners.

Baru – in this admittedly parallel universe – could process the ore from the “formalised” Indonesian artisanal miners.

Baru Gold claims that it is “not aware of any local residents opposed to the project”.

Baru has hired over 20 principally local employees and contractors, and expects to provide over 200 high quality jobs also principally from the local community”.

“To be clear, and to highlight the misrepresentations being made, the Sangihe project has not yet started construction,” pointed out Baru in the June 17, 2021 press release, “And therefore it is impossible for the Company to have caused any environmental damage.”

Full Disclosure: Baru Gold was a marketing client of Equity Guru. We believe their side of the story has merit.