The metals we follow most closely here at Equity Guru—Gold and Copper—have been putting on quite a show of late.

Gold, after printing a weekly close above its 200 SMA and slicing through a downtrend line that has held prices in check for months, launched an assault on the $1900 level.

Gold boasts a busy chart—gunwales of price patterns and hard-fought breakouts.

So where does the precious metal go from here? Calling the short-term swings in a bullied market is a mug’s game, but if pressed, I’d say we trade substantially higher—at least a yard by year-end.

Dollar weakness and a recent inflation spike are at the root of this bullish price action.

The Fed is in a real jam here. It can’t pull the trigger on higher rates (its only real defense against inflation). To do so would kill the economy’s momentum. It would appear that no matter what the Fed does, it’ll be behind the (inflation) curve.

Gold is a no-brainer in this environment.

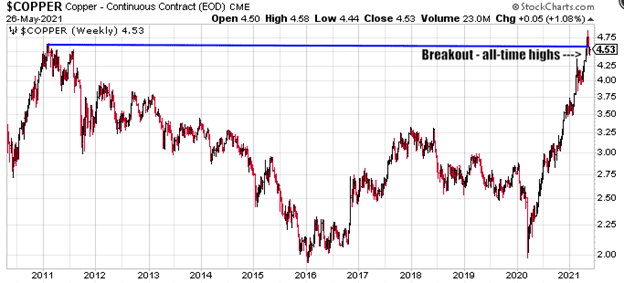

The price action in Copper has been even more dramatic. Note the steep price trajectory on the far right of this (11-year) chart.

After printing a sub-$2.00 low just over a year ago, this malleable metal—a metal with superb thermal and electrical conductivity properties—is currently consolidating recent gains after smashing through all-time highs north of $4.50.

The Greenside

Few can argue that we’re in the very early innings of a structural bull market in commodities, one that can only intensify as the global economy accelerates its push to electrify.

And there can be no green revolution—no global decarbonization—without Copper (Cu).

Electric vehicles (EVs), EV charging stations, wind turbines, hydro flywheels, solar panels, cooling units (the International Energy Agency says worldwide demand for air conditioning is expected to triple over the next 30 years)… ALL are in greater demand and ALL require heaps of copper.

When you consider that the global EV fleet could hit 230 million by the end of the decade, this according to the IEA’s Global Electric Vehicle Outlook, and the fact that nearly 200 lbs of the red-orange metal go into your typical EV before it rolls off the assembly line floor (electric vans, buses, and trucks require substantially more), the steep price trajectory noted above may represent only the very early phases of price discovery.

Where could Cu prices ultimately peak over the next decade? Some analysts see $15 per pound by the end of the decade.

Sound outrageous?

A few (supply) stats to consider:

- The lion’s share of the world’s primary Cu supply comes from only 20 mines.

- The world has less than 20 years’ worth of (economic) copper reserves remaining.

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare).

- Future copper projects – the 19 largest development projects on deck – run grades averaging roughly 0.5%.

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average.

To meet the growing demand for Cu, these lower grade projects will need to come online, and that will require a price well north of its current $4.50-ish trading range.

Cu Juniors on the hunt

Shrewd investors are scouring the junior landscape in search of Cu companies worthy of a re-rating, or those in the early stages of discovery.

Picking the right vehicle (pun intended) could pay off handsomely.

An illustration: one of my favorite charts in the junior arena…

Filo Mining (FIL.V) tagged a monster high-grade CuEq hit at its Filo del Sol project in recent sessions—858 meters at 1.80% CuEq—and shareholders were handed multi-bagger gains.

Arizona Metals (ARZ.V), an Equity Guru client I’ve been covering closely for the past eight months, is another ExploreCo benefiting from these compelling Cu supply/demand dynamics as they push their flagship Kay Mine Project further along the curve.

Clearly, there’s an appetite for Cu discoveries in this arena.

A Copper ExploreCo with resource expansion, exploration, and re-rating potential

A re-rating event occurs when an undiscovered asset suddenly gains recognition from the market and is assigned a higher valuation based on its (previously ignored) fundamentals.

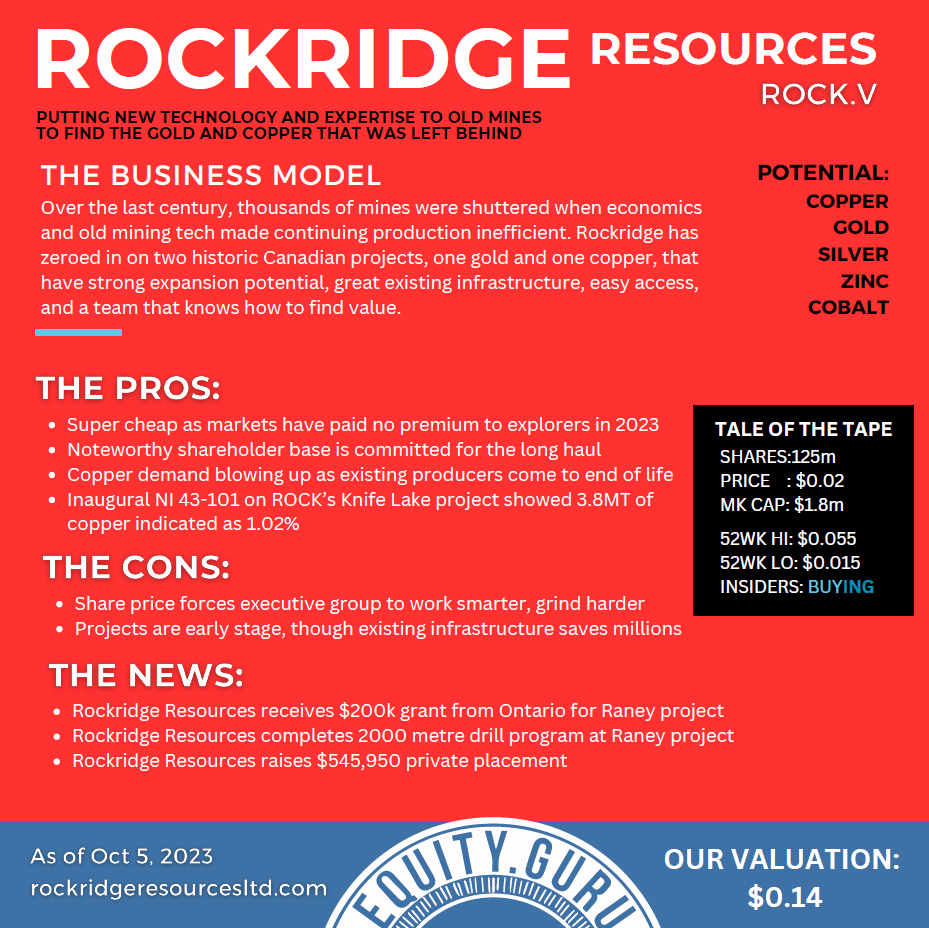

Rockridge Resources (ROCK.V) has both Copper and Gold in its project portfolio.

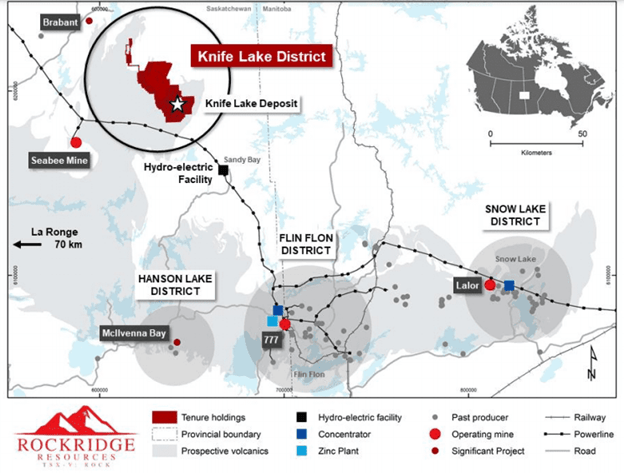

The Company’s flagship asset—the 55,471 hectare Knife Lake Project—is located in mining-friendly Saskatchewan, currently ranked #3 by the venerable Fraser Institute.

‘Jurisdictional risk’ is a weighty consideration in this age of geopolitical uncertainty. Fraser’s Annual Survey of Mining Companies is one of the better shortcuts to getting a handle on the “Investment Attractiveness” of a jurisdiction, be it a country, state, or province.

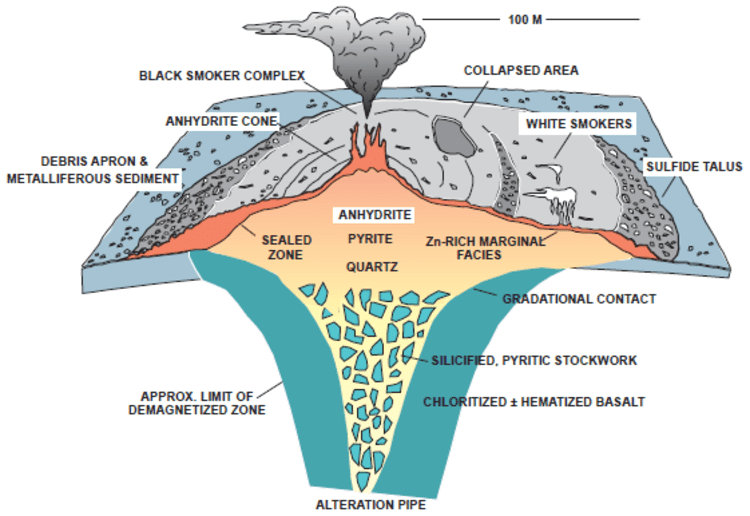

Knife Lake is a Volcanic Massive Sulphide (VMS) setting in the (regional) vicinity of the prolific Flin Flon and Snow Lake Mining Camps.

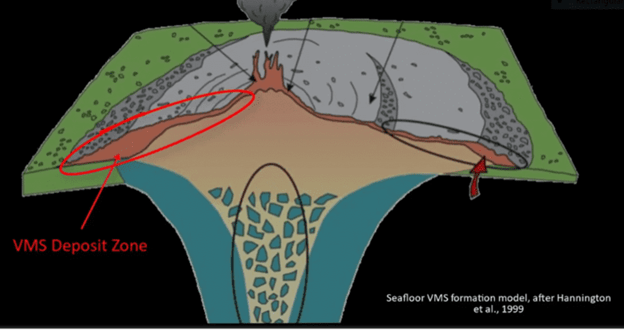

I’m a big fan of VMS settings. Spawned by volcanic hydrothermal events in submarine environments, they almost always occur in clusters—where there’s one deposit (or lens), there are often others. And though they often vary in scale—ranging from one million all the way to 100 million tons—these polymetallic orebodies can hold huge concentrations of metals due to their rich nature.

The Flin Flon camp has produced >170 million tons of sulphide ore from 31 VMS deposits worth in excess of $25 billion dollars.

Knife Lake is best characterized as an advanced-stage VMS project. First discovered in 1968 by Straus Exploration, the project has undergone multiple phases of exploration over the years.

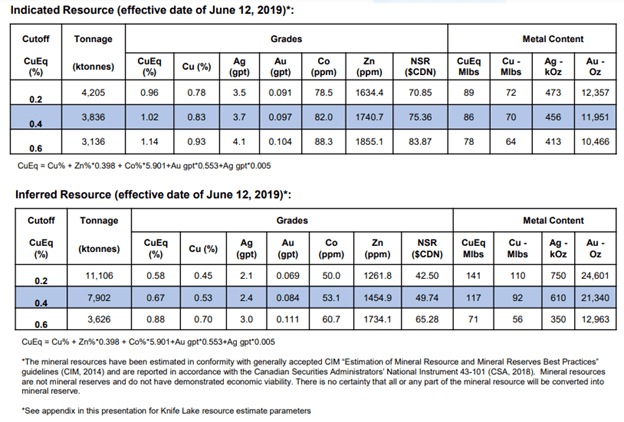

Anchored by over 300 drill holes, the current resource stands at 3.8 MT @ 1.02% Cu Eq in the Indicated category, and 7.9 MT @ 0.67% Cu Eq Inferred.

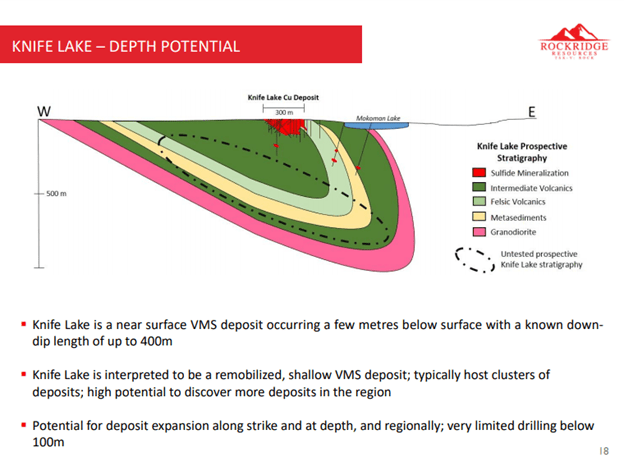

The Knife Lake Project is interpreted to be a remobilized VMS deposit. The stratabound mineralized zone is approximately 15m thick and contains copper, silver, zinc, gold and cobalt mineralization which dips 30° to 50° eastward over a known strike-length within Rockridge’s claim area of 3,700 metres, and a known average down-dip extension of approximately 300 metres.

Knife Lake is predominately Copper (approx. 80%).

It’s important to note that this deposit could evolve into an open-pit scenario as the mineralization lies near surface. This, and its predominant Cu nature, offers good leverage to buoyant metal prices.

There’s an element of intrigue surrounding the Knife Lake project as the current resource may represent only “a remobilized portion of a presumably much larger “primary” VMS deposit.” This, based on general observations regarding the deposit’s mineralogy, mineral textures, and metal ratios.

A much larger (and richer) deposit may lie in close proximity to the current resource, or it could lie at depth.

In this next slide, the black hatched oval feature (below the deposit) could represent be the real guts of the system.

Homing in on this primary deposit is a core objective as management continues to probe Knife Lake’s subsurface stratum. We should see this (deeper) target tested later this summer.

There’s excellent discovery potential here for satellite deposits and what may ultimately lurk at depth (most of the historical work consisted of shallow drilling centered around the deposit area).

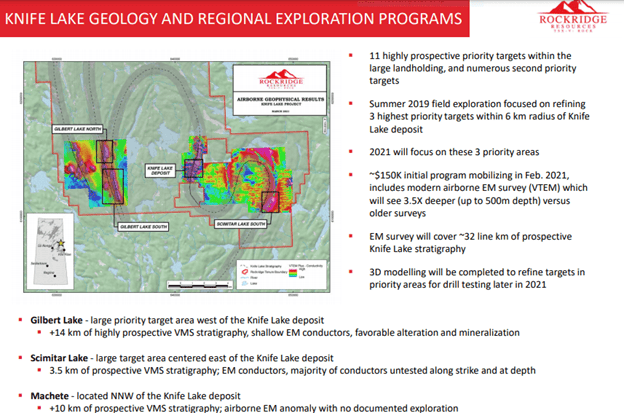

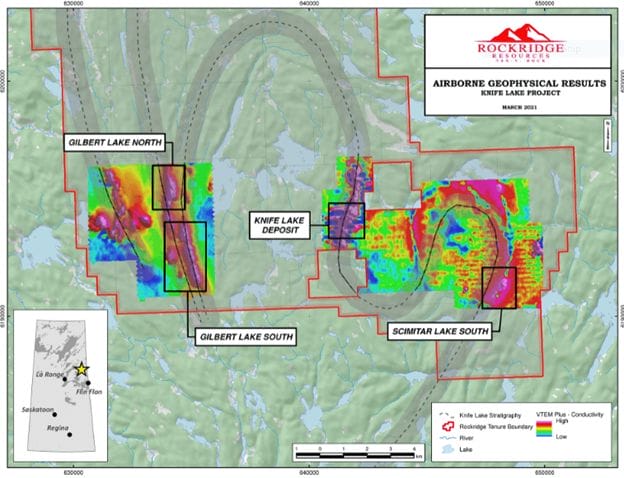

Concerning Knife’s regional potential, there’s a total of 11 high-priority targets, the upshot of a combination of extensive groundwork and geophysics.

A limited 2019 Knife Lake drill program delivered the following highlight:

2.03% Cu, 9.88 g/t Ag, 0.19 g/t Au, 0.36% Zn, and 0.01% Co (2.42% CuEq) over 37.6 meters beginning at 11.2 meters in hole KF19003. That’s a solid hit.

There’s been a fair amount of activity on the Knife Lake property in more recent months. A campaign of geophysics was launched in mid-February of this year to lay the foundation for a Phase-1 drill program.

On March 18th, the Company mobilized a drill rig to the project with multiple targets in its crosshairs—targets generated via the above-noted geophysics.

Rockridge Commences Drilling Program at Knife Lake Copper Project, Saskatchewan

Evidently, the Rockridge geos liked what they saw coming out of the ground—they liked the core—and on March 31st, they extended the Phase-1 drilling campaign to 2100 meters.

Rockridge Expands Drilling Program at Knife Lake Copper Project, Saskatchewan

Highlights from this March 31st press release:

- Expanded drill program from 1,600 meters (6 to 8 drill holes) to 2,100 meters (10 to 12 drill holes) in the fully-funded program;

- Drilling will focus on discovering VMS style copper deposits along newly defined conductors as well as at the Knife Lake VMS deposit;

- Gilbert Lake North and South targets, where very little historical exploration has been carried out, have begun to be tested with encouraging mineralization intersected in the first few holes;

- Infill drilling is also planned in the immediate area of the 2019 maiden resource at the deposit.

Confidence in Kinfe’s subsurface potential bolstered, on April 12th, the Company announced having staked additional ground in the region, upping its hectarage by 70% (from 32,663 hectares to 55,471 hectares).

Rockridge Stakes Additional Ground at the Knife Lake Copper Project, Saskatchewan

Based on encouraging observations made during the current drill program the newly acquired claims are considered to be highly prospective for VMS mineralization. The staking completed has added to the land package south of the Knife Lake deposit and Gilbert Lake target areas, which is where most of the drilling in this current drill program has been focused. Additional claims from this staking have also strengthened the land package to the northwest of the Knife Lake deposit where base metals have been encountered historically. The southern property border is now only 5 km from a high-voltage powerline.

Jonathan Wiesblatt, Rockridge CEO:

“The increased project area by 70% and expanded winter / spring drilling program is a clear indication of our overall confidence in the future success at Knife Lake. The most recent drill program is focused on new, highly prospective regional targets 5 – 6 km west of the Knife Lake deposit area. These new target areas, known as Gilbert Lake South and Gilbert Lake North, were previously undrilled and drilling in the current program has intersected visual indications of VMS-style mineralization. Through the staking of additional ground at Knife Lake we have added highly prospective stratigraphy to the project including the southern strike extension of both the Gilbert and Scimitar trends.”

Continuing its disciplined approach to exploring its district-scale property, the Company is using good science in its pursuit of additional VMS pods in the region. Management is currently waiting on results from a downhole geophysical (EM) program—downhole EM has been very effective for other operators in the Flin Flon camp next door.

Aside from the downhole geophysics, we have Phase-1 Knife Lake drill results on deck.

Rockridge also has a Gold asset—the Raney Gold Project—some 2,800 hectares located ~110 km southwest of the prolific Timmins Gold Camp of Ontario.

An early 2020 exploration program, one that followed up on historical drill results (best historic intercept returned ~6.5 g/t gold over 8 meters), tagged a highlight interval of 28 g/t gold over 6 meters (uncut) from 95 meters depth. Nice hit.

We’ll take a closer look at Raney another day.

Management

As I keep repeating, management is everything in the junior exploration arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and competent capital market types—things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

Rockridge has the technical side and the capital markets side covered. There’s tremendous depth in this Rockridge crew.

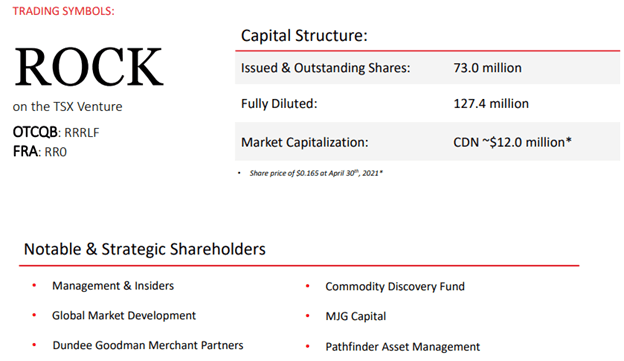

The Company has a tight cap structure…

Management collectively owns just under 10% of the shares—values are aligned.

The Company currently has roughly $900k in the bank, enough to launch a Phase-2 drill campaign later this summer. A modest FT (flow-through) financing may be necessary if they choose to push it hard.

Another avenue the Company will explore is optioning out its Raney Gold project, an option that will likely include a cash component that will be used to accelerate its Phase-2 Knife Lake campaign.

Final thoughts

Price catalysts going forward include Phase-1 Knife Lake drill results (imminent), news of a Raney joint venture, and an upcoming Phase-2 drill campaign scheduled for August or September. It’s during this summer campaign that we’ll see Knife’s depth and regional potential further explored.

Rockridge represents an interesting speculation for its district-scale exploration upside, and a potential re-rating of its current resource base.

END

—Greg Nolan

Full disclosure: Rockridge is an Equity Guru marketing client.

Postscript: In an interesting development roughly 150 kilometers to the south of Knife Lake, Foran Mining (FOM.V) struck a deal worth $100M with Fairfax Financial Holdings to help push its McIlvenna Bay project further along the development curve—McIlvenna Bay is a world-class VMS orebody.