To taper or not to taper, that is the question. Expect this Shakespearian Fed tragedy to play out on the world financial stage for much longer. And the Stock Markets will eat up and react to every word.

Last week, I discussed Fed Chair Powell’s comments. Words such as ‘strengthening’ indicated the Fed may taper sooner rather than later. However, Powell convinced markets that the FOMC is still not even thinking about thinking of tapering. In summary, proper Fed speak to say the economy is recovering, but still not strong enough for any tapering of bond purchases.

Earlier this week, I covered the comments which closed last week by Dallas Fed President Robert Kaplan. Kaplan is not a voting member of the FOMC, but he contradicted the comments of Fed Chair Powell. Stating that he sees imbalances and excess in financial markets and real estate and the Fed should be talking about tapering. The Stock markets printed red on Friday on fears of future tapering.

But we haven’t even gotten to the best part.

Stock Markets had their worst day in May (so far) with the Nasdaq leading the way dropping 1.92%. The Nasdaq is now in dangerous territory. Read my technical tactics below to find out why.

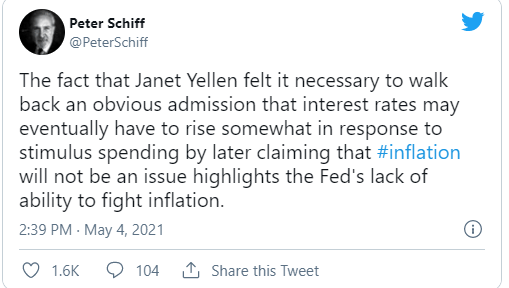

Stock Markets fell on Treasury Secretary, and previous Fed Char, Janet Yellen’s comments regarding tapering.

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat,” Yellen said during an economic forum presented by The Atlantic. “Even though the additional spending is relatively small relative to the size of the economy, it could cause some very modest increases in interest rates.”

Markets puked. So much so that Janet Yellen walked back her earlier comments:

“Let me be clear it’s not something I’m predicting or recommending,” Yellen says about rates, flip-flopping her earlier perspective entirely.

She added that if there is an inflation problem she is certain the Federal Reserve can be counted on to address it.

This flip flop did not go unnoticed by retail traders. The Fed brrrrrrr money printing machine walks on.

Long time readers are familiar with my take. The Fed seems to be stuck. Markets and other assets have been propped in this low rate environment. Everyone expects the Fed to be supportive, because if they don’t, the market will pull off a taper tantrum. This could affect institutions, pension funds, leveraged funds, decimate retail traders. The danger would be Fed tapering causing a financial crisis.

Yellen flip flopping on comments just to keep markets from selling off says everything.

In terms of interest rates: can the Fed hike rates? With all the debt out there, governments need to service the debt with lower rates. It seems that taxes are going to be moving higher…in the green tax form. With citizens burdened with debt, can they afford higher rates and higher taxes?

This is why the Fed is stuck. They have talked themselves between a rock and a hard place. Any talk of tapering is causing stock markets to flush. The Fed is not supposed to care about what the stock markets do, but lately it appears as if they get their signals from the asset markets. They are trying to keep them propped. A journalist straight up asked Powell at the press conference, “Is the Fed afraid of a taper tantrum, are they afraid there will no buyers of treasuries when the Fed stops purchasing?”. The Fed will never admit it, but I think they are definitely afraid of a taper tantrum.

We have all been hooked to cheap money. Chasing yields for return has caused money to flow into the stock markets and other assets. Everyone is thinking the party is not over, and the Fed cannot taper nor raise rates significantly. This will not end well.

Technical Tactics

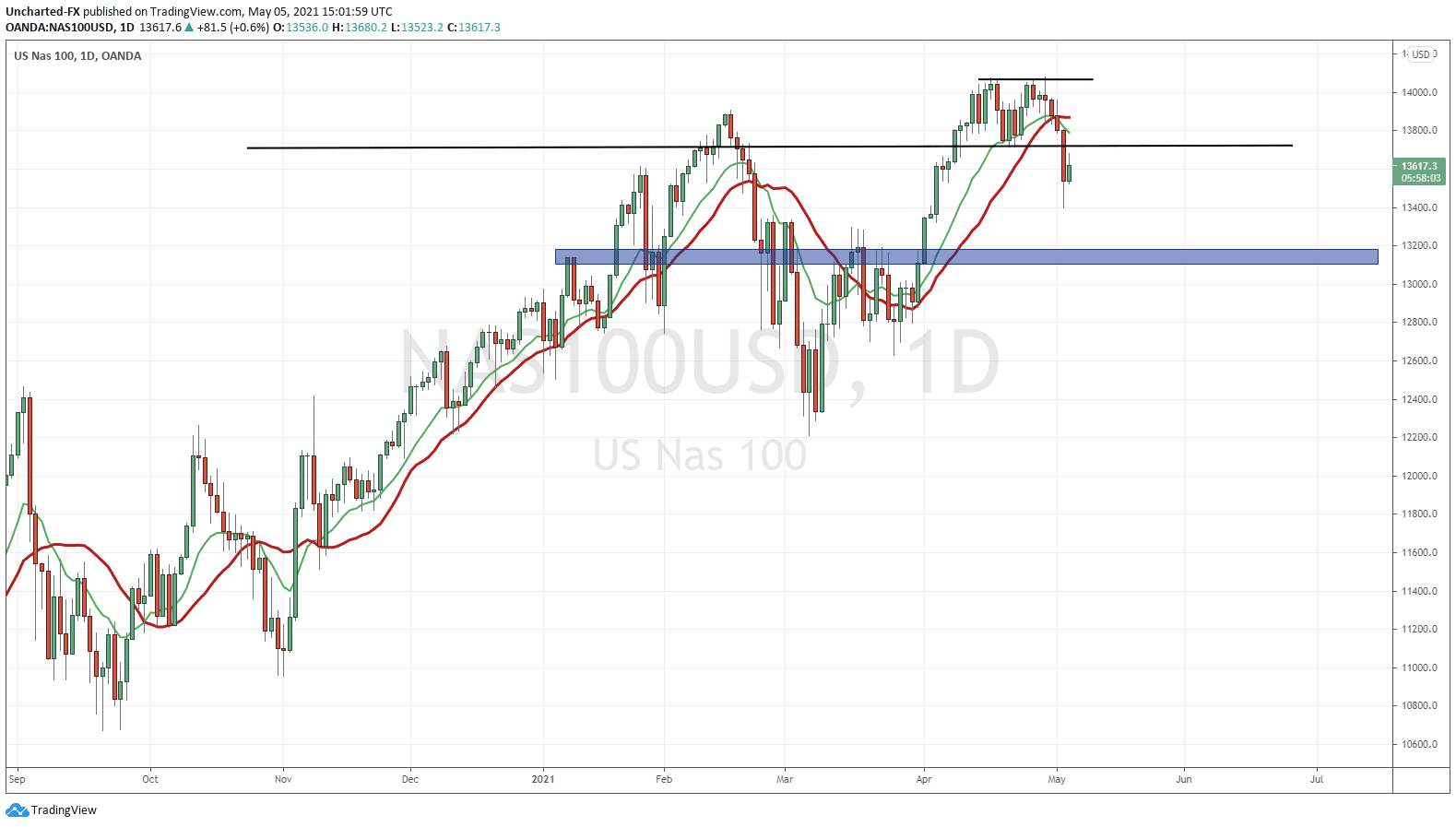

Of all the equity indices I am watching, the Nasdaq is displaying breakdown reversal properties. Not great if you are a bull.

The Nasdaq has ranged for two weeks as can be seen on my daily chart above. Even printing a Double Top reversal pattern, which looks like an “M”. This is one of our favorite topping and reversal patterns.

Yesterday’s close below the support at 13710 was the trigger. In order to get back on the bullish train, we would need the Nasdaq to climb and close back over 13710. This would then be a false breakdown. It would trap the bears.

Today’s daily candle is green, but you can see that sellers are stepping in near the retest of 13710.

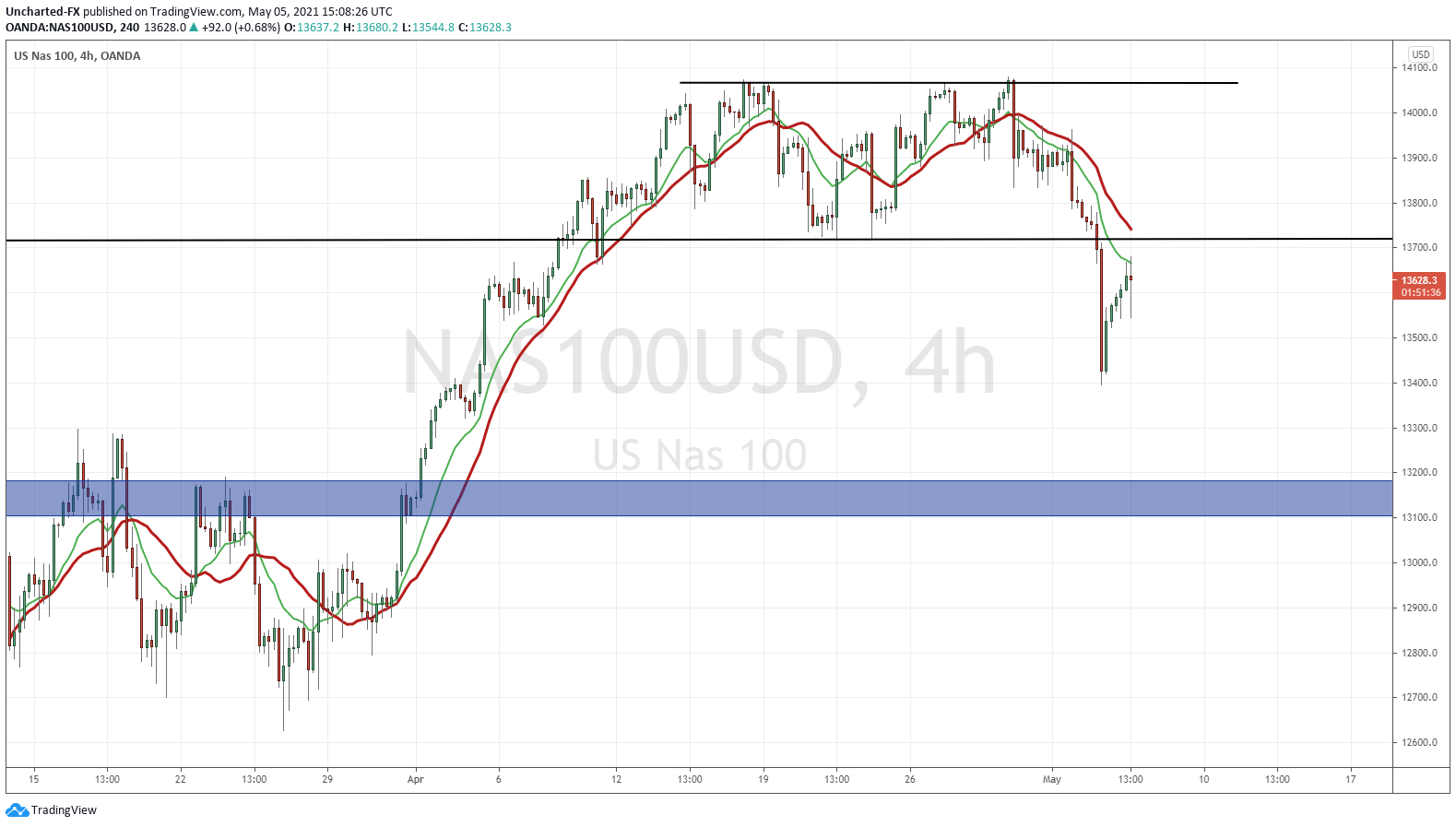

Going down to the 4 hour chart, and you can see why the break below 13710 was important. Look at that range.

As my readers know, prices don’t move in a straight line. Trends move in waves. We call these lower highs on the downtrend.

This is what I am looking for on the Nasdaq 4 hour chart. There is a battle between the bears and the bulls close to our retest zone. I am waiting for the 4 hour candle close (10 am PST/1 pm EST) to determine whether the bears take the Nasdaq lower for another wave.

We have 3 Fed Presidents speaking today. They might do enough to get markets propped back up. I am sure most of them will be talking about inflation and why the Fed will not be tapering anytime soon. Some damage control.

But if bears continue the pressure, I would be targeting the 13000 zone for my first take profits level.