XRP / Ripple has briefly popped above $1.00 for the first time since March 2018. A monster rally saw XRP pop 44% on the day yesterday, with traders taking the crypto above the psychological important $1.00 level.

The move is being quoted by many as mostly being technical driven without much fundamentals. I tend to agree, but we will expand on this a bit more. Being a technical guy, XRP is getting very exciting.

For those wanting to know what XRP is, check this video out:

XRP is a coin mired with controversy among the crypto circles. You either like it or hate it. And I mean detest it. The reason it is so maligned, is because XRP is seen as the “banker” coin. A centralized token.

If you read my Market Moment article yesterday, I discussed why I am very bullish on Decentralized Finance (DeFi) tokens. Regulations are coming. Many expect this, and have front run this by creating DeFi tokens. I argued that regulations will be bullish for crypto’s as it will allow more institutions (banks and funds), to invest in this new asset class. Think more money. BUT this will then defeat the original purpose of crypto’s: being decentralized and a way to get away from banks and Wall Street. XRP is hated on being the ‘bankers’ coin, but once regulations come, ironically ALL crypto’s price action will be heavily dependent on Wall Street and the banks. In a sense, they become centralized.

I bought XRP / Ripple back in early 2017 when the price was around $0.20 cents. Rode the big pop up to over $2.50. Took some profits, and have held the rest and even added more when prices came back to retest my entry position. Some of the crypto enthusiasts will hate me for saying this, but I originally got into XRP because I knew the space would be centralized.

Central banks have maintained the monopoly to issue money. They will not give that up.

Looking at the XRP’s partners, do you notice something?

Pretty much a major bank in every western nation. And this shouldn’t come as a surprise. XRP is quoted on their own website as being the best digital asset for global payments, offering financial institutions the fastest, most reliable option for sourcing liquidity on demand.

We might hate the centralization that is coming, but we can still profit from it. To be honest, it will just be the hardcore enthusiasts who will upset about regulations and will look to DeFi. Joe Schmoe and Jane Doe have mostly been buying crypto because the price is moving higher and they have been told it is the future. Not necessarily knowing about the original decentralized concept and crypto’s being a way out of the hands of Wall Street, Banks and Government.

Technical Tactics

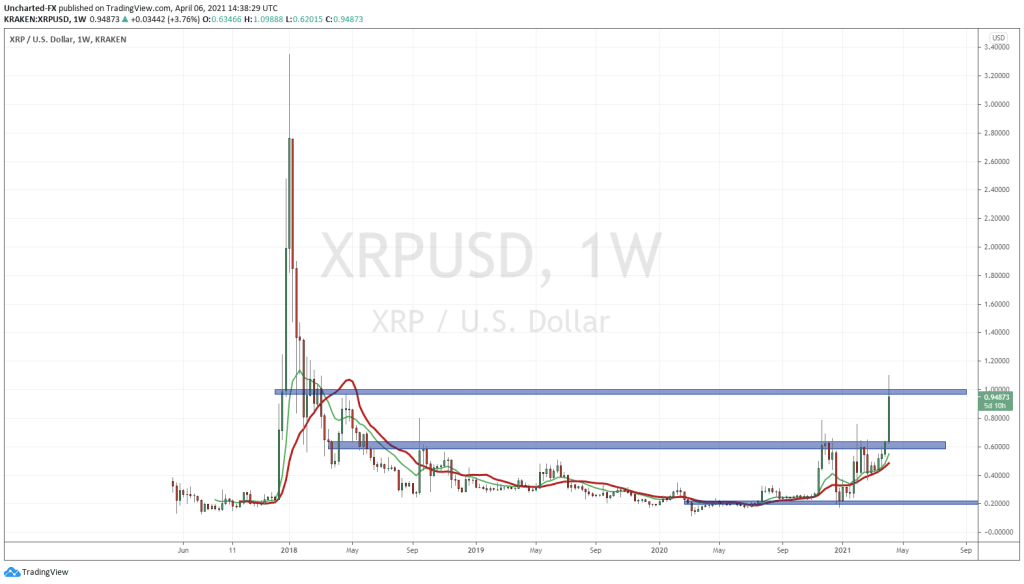

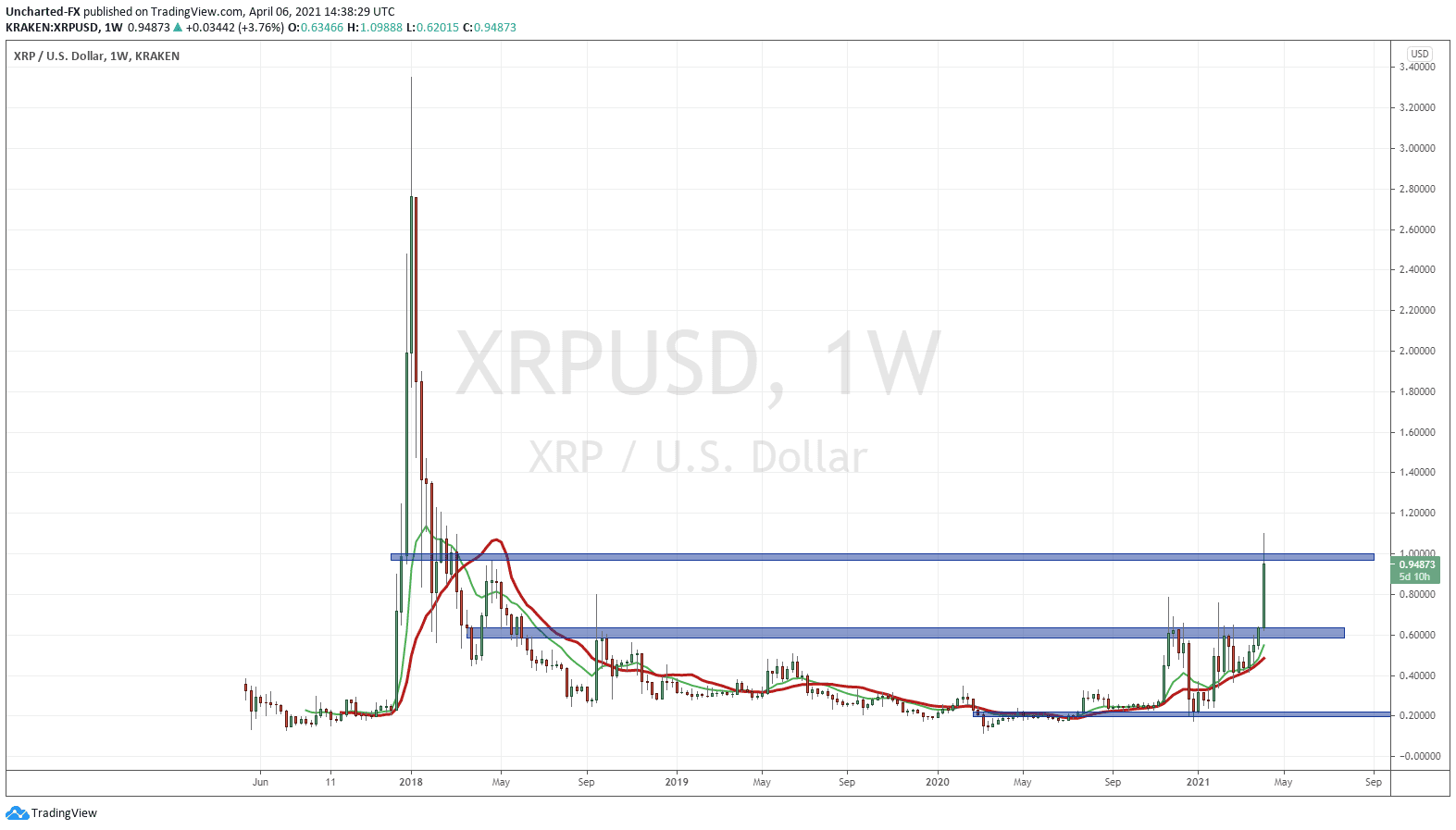

I love this weekly chart. The Market Structure is just pointing to more gainzzz. People are going to be aping (the new technical trading term) into this.

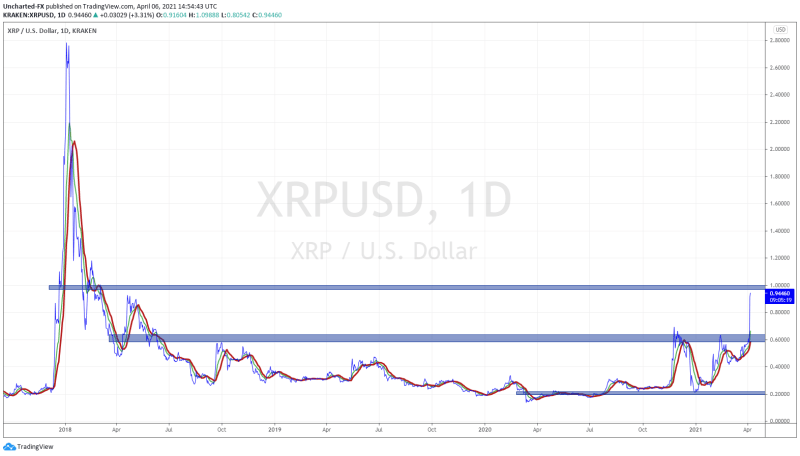

Right off the bat, notice that this weeks candle has NOT closed, but is enormous behind yesterday’s 44% rally. One key take away is that XRP is under the resistance zone of $0.60 just a few days ago. This break has taken us well above that. $0.60 is now our new support. As long as price remains above $0.60, we remain bullish and the uptrend will continue. This weeks candle MUST close above this support. If we sell off and close back below, it points to a very weak XRP.

The next resistance zone is the all important $1.00 zone. It would be an added bonus if we closed above this by the end of the week, thereby penetrating through two major resistance zones. But I will settle for a close above $0.60, and then an eventual close over $1.00 in the weeks to come.

My original thesis on being bullish on crypto’s in this cycle was a run out of fiat money knowing what central banks and governments are doing. Money printing and spending will not stop. It remains to be seen whether this money goes to productive uses, meaning producing more goods and services. If it does not, we get a situation where there is people with more money competing for the same number of goods and services. This is inflation.

This thesis is still valid, and gaining strength day by day. To this day, I remind people that is what Tesla’s SEC filing for its purchase of $1.5 Billion Bitcoin mentioned. It is a way to diversify out of US Dollar holdings, and purchasing GLD and Gold is not out of the question.

To end this off, I want to leave you all with this question to ponder on. With a break above $1.00 on Ripple where to next?

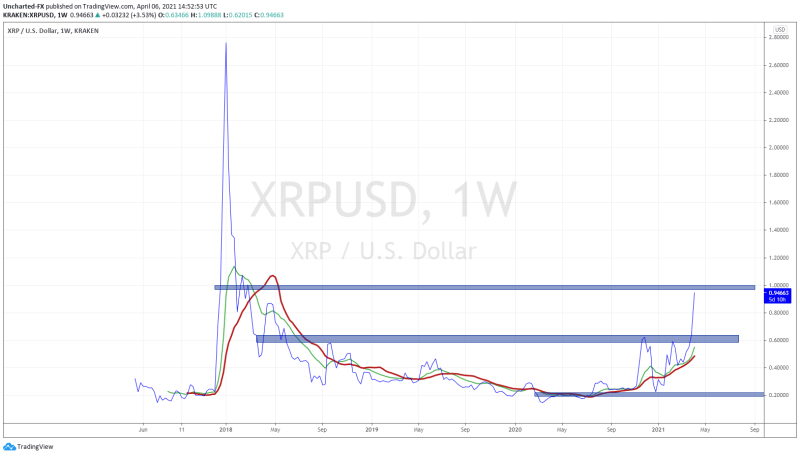

Using a line chart on the weekly, I do not see any resistance until previous record highs near $2.78.

Taking it down to the daily chart, and we can see some resistance reaction targets at $1.20, and then $1.60 before reaching previous highs.

Exciting market structure developments on XRP, and we will be sure to follow this over on our Discord Trading Room.