Valeo Pharma (VPH.C) has announced a non-brokered private placement of up to 4,000 unsecured non-convertible debentures units a a price of $1000 per unit for maximum gross proceeds of $4,000,000.

“We are appreciative of the continued support from insiders and investors close to the Company in this placement…This financing will strengthen our balance sheet at a time of three important product launches for Valeo, Enerzair® Breezhaler®, Atectura® Breezhaler® and Redesca™. Commercialized through two distinct sales forces, these products are key drivers to our growth over the coming years,” said Steve Saviuk , Valeo’s Chief Executive Officer.

Valeo is a Canadian pharmaceuticals company with a focus on respiratory diseases, neurology, oncology and hospital specialty products. The Company recently entered into an commercialization and supply agreement with Novartis Pharmaceuticals for the Canadian commercialization by Valeo of two asthma therapies. Valeo is now positioned as one of the leading Canadian respiratory companies following various negotiations and agreements. Valeo’s latest private placement will further cement the Company’s position in the Canadian pharmaceuticals market.

Compared to stock investments, debentures are generally considered to be low risk. This is due to the fact that debentures offer investors assurance on their returns. Nonetheless, debentures and stock options are both intended to create funds for a company. In the case of Valeo, the Company is relying on Debenture Units, each consisting of one unsecured non-convertible debenture of the Company in the principal amount of $1,000. Additionally, each Debenture Unit will include 200 Class “A” Share purchase warrants entitling the holder to purchase one Class “A” Share of the Company at an exercise price of $1.60.

Nitty gritty details aside, Valeo plans on using the net proceeds of the private placement for working capital and general corporate purposes. More specifically, the Company intends to use this financing to bolster its balance sheet in preparation for several major launches including Redesca™, Valeo’s low molecular weight heparin (LMWH) biosimilars. With numerous launches on the horizon, Valeo is positioned nicely to see some significant growth in the near future.

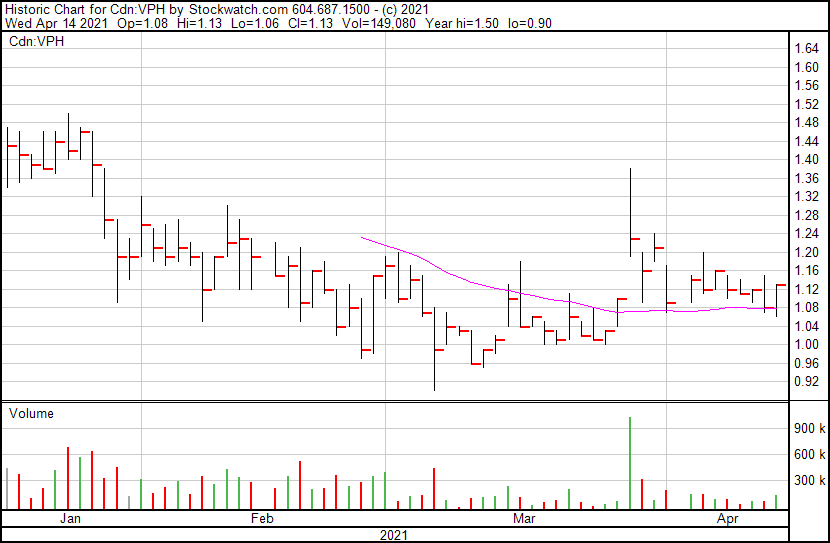

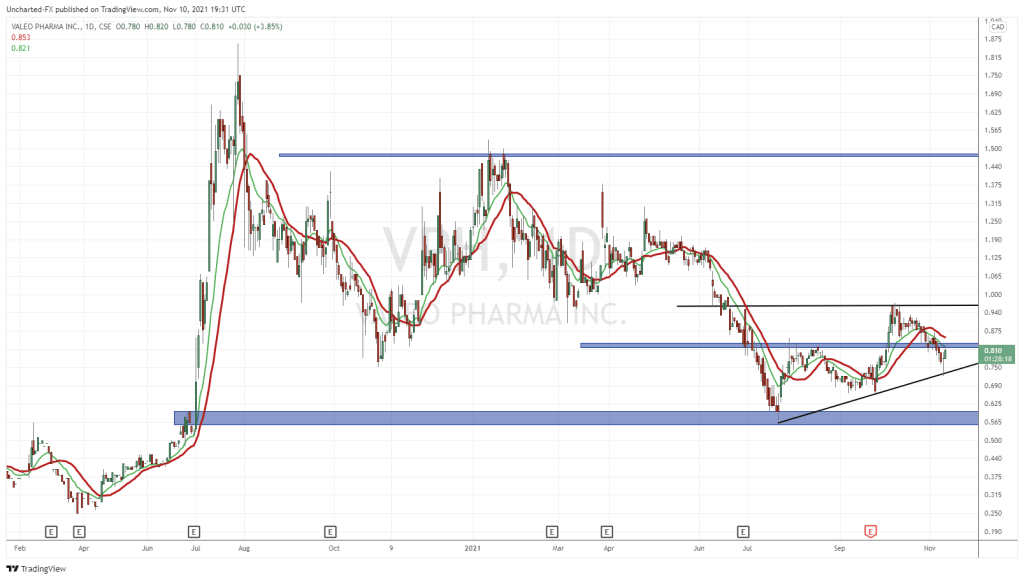

Closing of the private placement is expected to occur around April 23, 2021 and is subject to regulatory approval including that of the CSE. With this in mind, Valeo is worth keeping an eye on in the coming weeks as the Company prepares to launch a diverse array of medical products. In light of recent news, Valeo’s stock has already seen some growth.

Valeo’s stock price opened at $1.08 and reached a high of $0.11 at 11:10AM ET. Valeo is up 4.63% and closed at $1.13 today.

Disclaimer: Valeo is a client of Equity Guru.