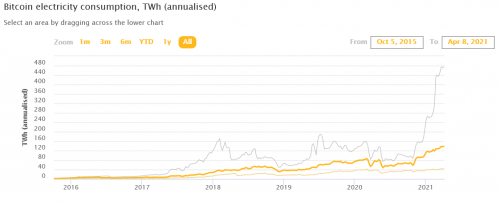

The high price of Bitcoin has started an arms race between bitcoin miners to see which company can scale the largest, while maintaining the lowest overhead. But the unforeseen consequences of that are its contribution to the ongoing environmental calamity brought on by burning fossil fuels to close blocks.

The results are mergers and exorbitant buildouts. But that’s the rule. If you want to stay competitive on this stage, your electrical bill needs to reflect that fact. Where the electricity is coming from is a question that should be on everyone’s lips.

Earlier this week Riot Blockchain (RIOT.Q) inked an agreement to acquire Whinstone US for a mixed cash and shares deal valued at over $651 million. The monetary consideration is secondary to what this adds to Riot’s overall electrical output.

The Whinstone facility is based in Rockdale, Texas on a 100-acre site, hosting miners in three buildings at over 190,000 square feet with another 60,000 being developed. The site has a long term lease with electricity included through a long-term power supply contract. The total power potential for the Whinstone site sits around 750 MW with 300 presently developed.

“The acquisition of Whinstone is the most significant achievement in Riot’s growth to-date and positions Riot as an industry leader in Bitcoin mining, After the consummation of this transaction, we will have created a very clear path for the Company’s future growth. Riot will wholly own the largest Bitcoin mining facility in North America, with very low power costs, and one of the most talented development teams in the industry. Whinstone will serve as the foundation of Riot’s Bitcoin mining operations, upon which we will drive our goal of increasing the American footprint in the global Bitcoin mining landscape,” said Jason Les, CEO of Riot.

Low-cost electricity in a high risk state.

Two months ago, Texas power grid nearly collapsed because a cold snap brought snow and rolling blackouts across the stage. Millions of Texans were without power. Texas doesn’t usually see the types of temperatures it did this year. The coldest it gets usually is from 0-5 degrees Celsius, according to WorldTravelGuide.net, which really isn’t enough to cause system failure and blackouts.

But we’ve seen all manner of unusual weather over the past twenty years, haven’t we? And the source for these peculiar and extreme weather patterns, the wildfires and the hurricanes and the cold snaps, has been—oh it’s on the tip of my tongue—it rhymes with mobal shwarming.

Right.

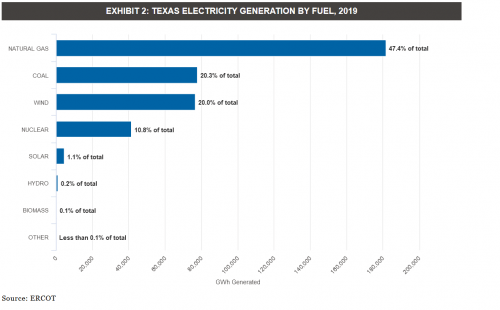

Anthropogenic climate change. It’s probably not helpful that the majority of Texas, which generates the most power of any state in the U.S., does so through burning fossil fuels.

You could easily point at Texas’ problems here as a result of their power policies, and therefore an occurrence of natural consequences, but what happens in Texas re: fossil fuels, effects everyone. That’s the nature of this global village thing people keep going on about, and that brings us back to Bitcoin mining.

The acquisition of Whinstone is a transformative event for Riot and its shareholders. Riot views Whinstone as a foundational element in its strategy to become an industry-leading Bitcoin mining platform, on a global scale. Upon the closing of this acquisition, Riot is expected to be the largest publicly-traded Bitcoin mining and hosting company in North America, as measured by total developed capacity.

Bitcoin mining consumes an estimated 128.84 terrawat-hour (Twh) per year of energy, which is more than countries like Ukraine and Argentina, according to the Cambridge Bitcoin Electricity Consumption Index, a product of the University of Cambridge. China carries 60% of the blame for this but that doesn’t let companies like Riot off the hook.

According to the authors of the latest study,

“The growing energy consumption and associated carbon emission of bitcoin mining could potentially undermine global sustainable efforts. Without any policy interventions, the annual energy consumption of the bitcoin blockchain in China is expected to peak in 2024 at 296.59 Twh and generate 130.50 million metric tons of carbon emission correspondingly.”

The anticipated costs are expected to surpass the electrical output of Saudi Arabia or Italy by 2024.

The point of the matter is that we can’t control what China does. The Chinese government is preparing another crackdown—this time on Inner Mongolian Bitcoin miners—and regardless of their actual motives, that’s probably good news. But we do have some say over what companies do here from either the regulatory side or through where we put our dollars.

I know where I’m not putting mine.

—Joseph Morton