Apple (AAPL), everyone’s favorite California-based consumer electronics company, released its earnings and sales beat for the second quarter of fiscal 2021. Following a successful second quarter, the Company just recently announced a $90 billion share buyback.

Apple crept its way into my heart at the ripe age of 14 when I had just started thinking of my grandiose future as a graphic designer. At the time, my concept of skill and disciple were incredibly distorted. I thought that by just owning the latest iMac, I could make it in the world as a digital artiste. Needless to say, as the result of my inability to learn Photoshop in less than 10 minutes, my dream of becoming a graphic designer died almost as quickly as it was born. However, Apple’s legacy continues to this day as the Company leads the consumer electronics market.

Lets put things into perspective for a second. As of January, 2021, there were 1.65 billion Apple devices in active use around the world. Keep in mind, the global population currently sits at roughly 7.8 billion. Apple undoubtedly commands a global presence, however, a large percentage of Apple consumers are concentrated in North America, with 64% of Americans owning an Apple product as of 2017. Furthermore, according to a survey conducted by the CNBC All-American Economic Survey, the average American household reports owning 2.6 Apple products while some of the wealthiest Americans reported owning 4.7 products per household. With this in mind, Apple products have quite literally become commonplace for most Americans.

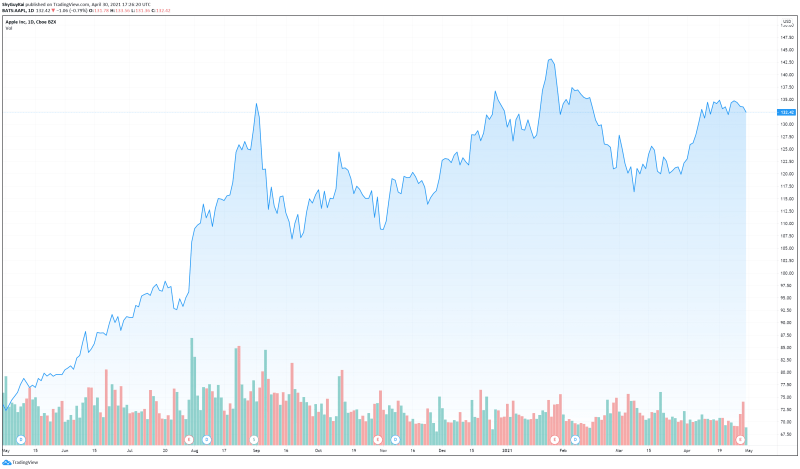

Compared to Wall Street’s estimates, Apple generated $89.58 billion in revenue, dwarfing estimates of $77.3 billion. Additionally, the Company’s earnings per share grew to $1.40 compared to Wall Street’s estimate of $0.99. Out of all Apple products, iPhone sales generated $47.9 billion in revenue compared to an expected $41.5 billion. Overall, Apple saw improvements in both its top and bottom line performance which had many investors and shareholders jumping for joy, leading to a 4% increase in the Apple’s stock following the release of the Company’s Q2 2021 financial results.

I wholly intend this as a compliment, but Apple’s latest performance can be compared to that of a cockroach surviving a nuclear disaster. In this case, COVID-19 represents the atomic bomb while the ongoing semiconductor chip shortage represents the nuclear fallout currently plaguing the world. As automobiles become increasingly dependent on electronic components, a demand for semiconductor chips has quickly been growing in the automotive industry. To rub salt in the wound, the consumer electronics market has seen significant growth following the pandemic as consumers purchase more electronics including appliances, smartphones, and gaming products. With pressure from all sides, the current supply of semiconductor chips cannot meet the current demand.

Despite this, Apple seems to be doing just fine compared to other consumer electronics companies due to its reliable supply chain. Apple also has a strong vision for the future with plans sever ties with Intel, its primary chip provider, in favor of its own M1 chips. Still, things aren’t all sunshine and rainbows for the Company. Apple’s App Store is currently under fire and will be defending various antitrust lawsuits following complaints from Spotify and Epic Games, the creator of “Fortnite”. Furthermore, Apple’s will likely see see its revenue fall as COVID-19 restrictions begin to ease in major markets like North America. However, the latest lawsuits against Apple may be nothing more than a drop in the ocean for the Company, which has 660 million paying subscribers on its App Store platform.

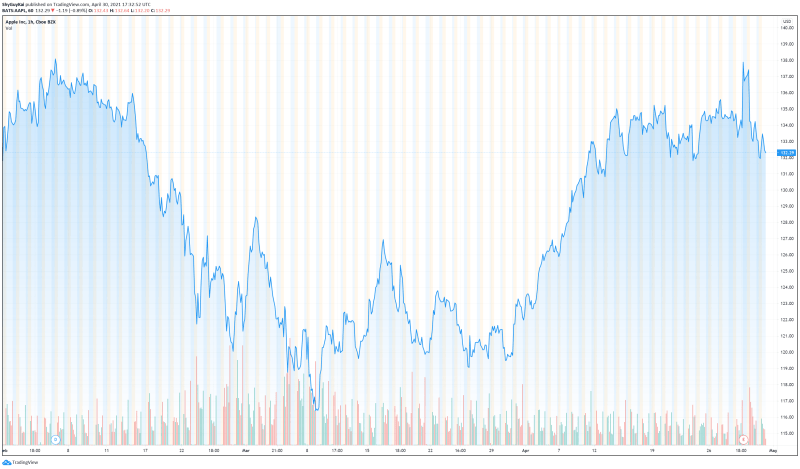

Apple’s share price opened at $131.78 today, up from a previous close of $133.48. The Company’s shares are currently trading at $132.21 as of 1:32PM ET.