Ethereum (ETH) is about to print fresh new record all time highs very soon as price trades at $2634.54. Honestly, I bet by the time I finish writing this article, we will be at all time highs. Previous all time highs still stands at $2646.20. Readers of Market Moment, or members of our Discord Trading Room would be up nearly 470% if they took an Ethereum trade when I first mentioned the weekly breakout indicating a new bull market back in September 2020.

The fundamentals for crypto still remain the same. In my opinion it is a way out of fiat currency as we know central banks will inflate their currencies to boost exports and create inflation. I have written extensively about this throughout last year, and recently with my take on Coinbase being a Watershed moment for cryptocurrencies. Inflation without a doubt is coming: we are in a situation where there are people with more money, competing for the same number of goods and services since money did not go towards productivity.

My take on Ethereum remains the same as well. Some see it cheap versus Bitcoin…more on this in just a bit. Some attribute this recent rise in Ethereum to Gary Vaynerchuk, or Gary Vee, who is saying to buy as much Ether as you can, and wrote an article titled, “4 Steps to Make Sure You Have ETH in Your Wallet“.

Many see a rise in Ethereum due to its ecosystem, and all the software applications that work. You can create NFTs, and even require Ethereum for Uniswap and DeFi tokens. The mania and interest in both of these are contributing to Ethereum’s rise.

I used Ethereum to buy and stake a DeFi token pre-sale. You can read my experience here. The key takeaway was the speed (slow) and the fees (gaslight fee) which accounted for 30% of my entire transaction! If this remains the case, Ethereum won’t be used as money per se. Too slow and too expensive. However, Ethereum 2.0 is supposed to address and fix these issues. We spoke about this in the last episode of Vishal and Co, where we looked at our top three crypto picks. Cardano was one of them, as it is an improvement on Ethereum…for now.

[youtube https://www.youtube.com/watch?v=3cuZh9K98Zs&w=560&h=315]

Technical Tactics

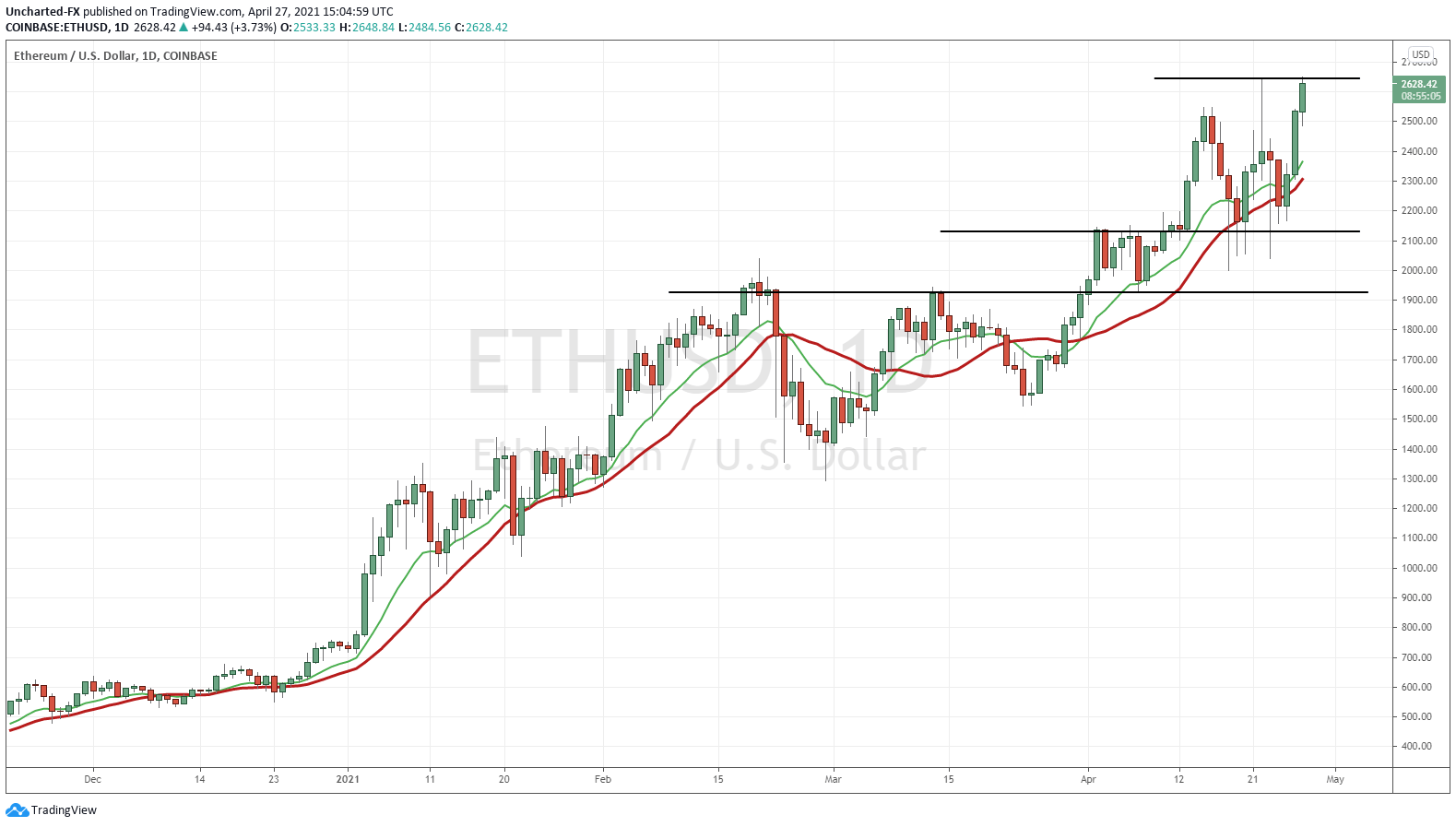

Ethereum is set to print a record close AND yes, I haven’t even finished the article and Ethereum has created new record highs hitting highs of $2648.84. I don’t think we are done yet. $5000 is possible…more on this later as it deals with the feature chart. The support levels that I would watch in case of a pullback are $2100 and $1900. Both are flip zones, areas that have been both support and resistance in the past. In case of a drop, watch buyers to step in at these levels to buy the dip.

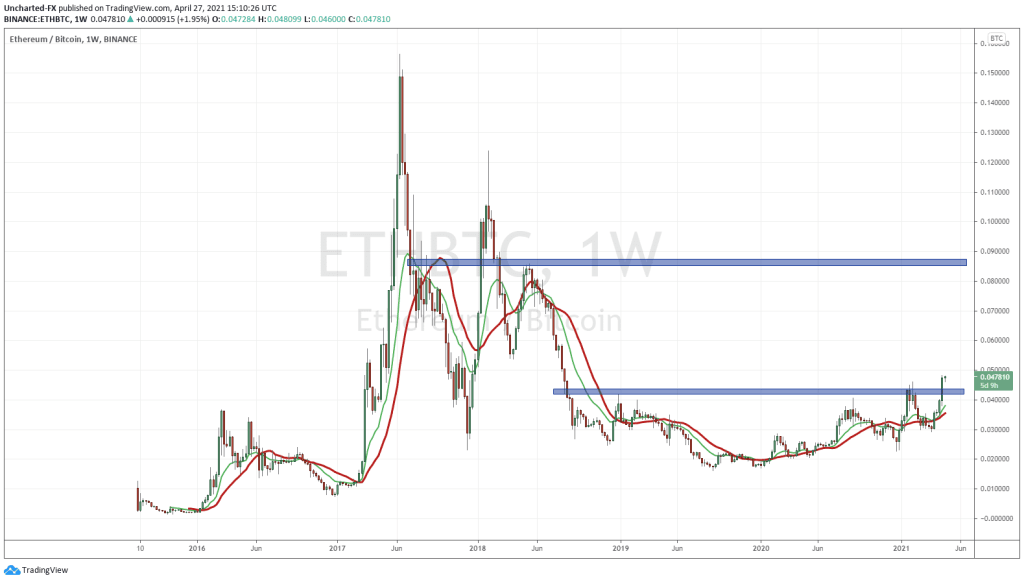

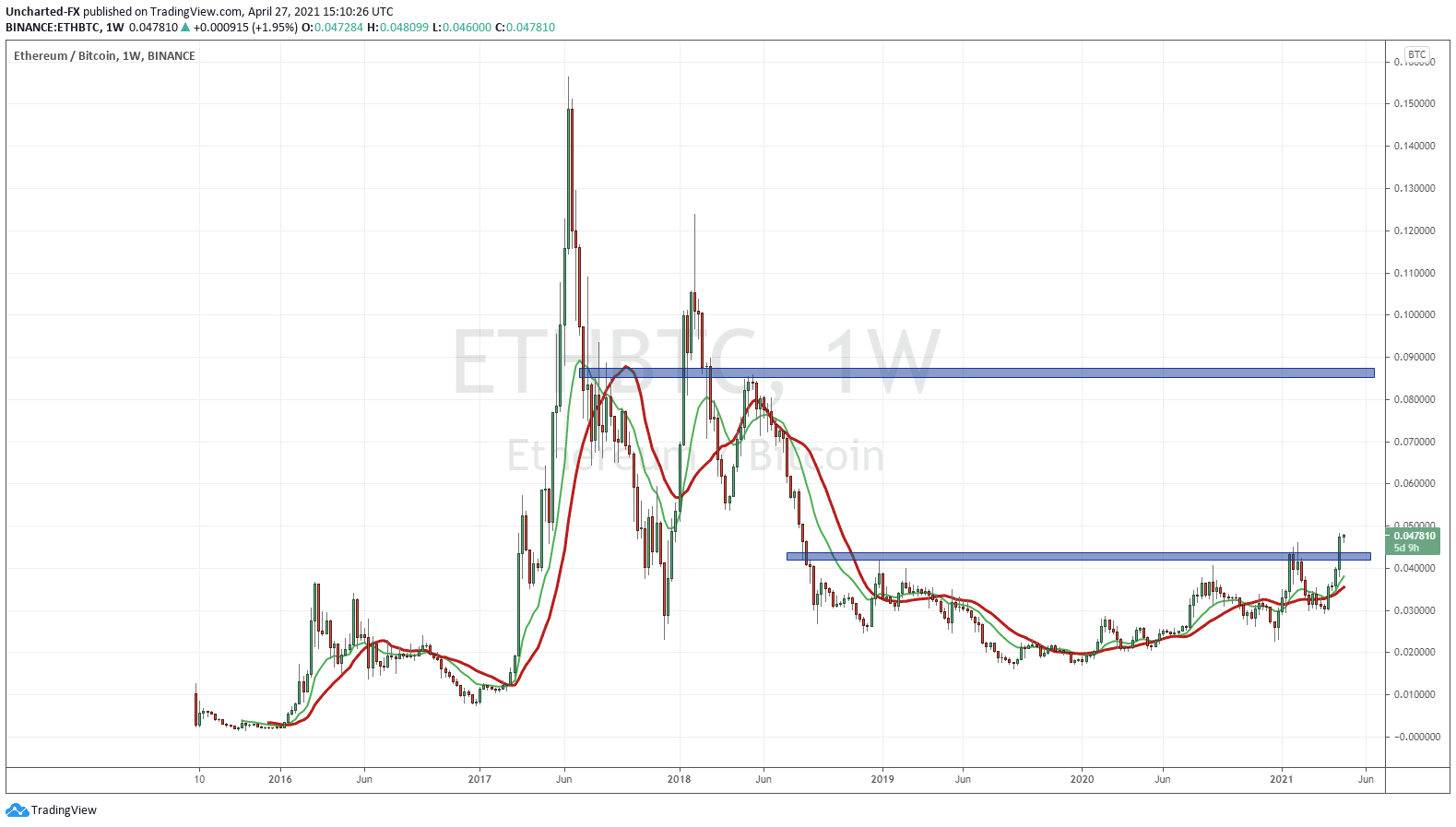

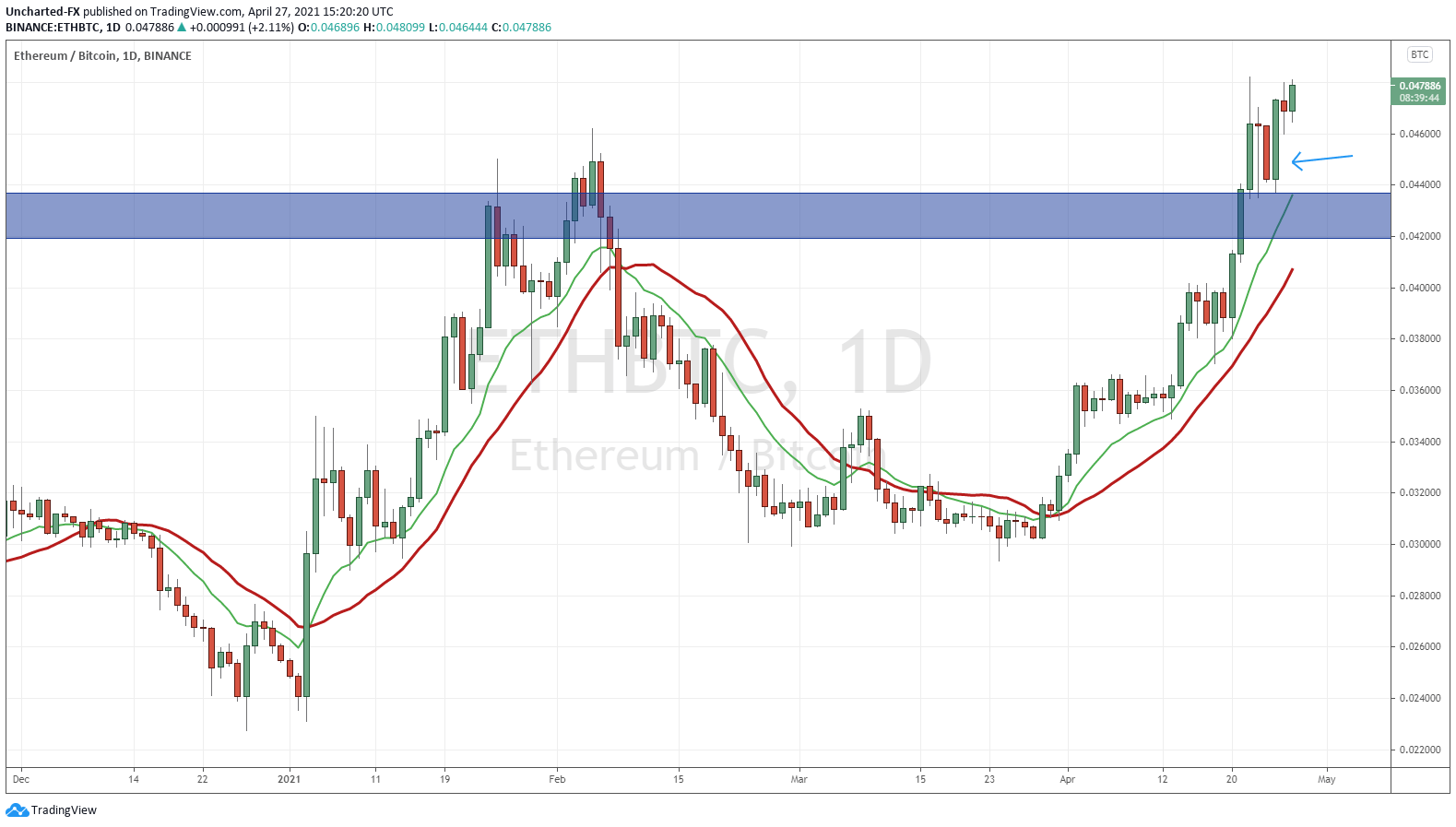

But the chart that warrants your attention: ETHBTC

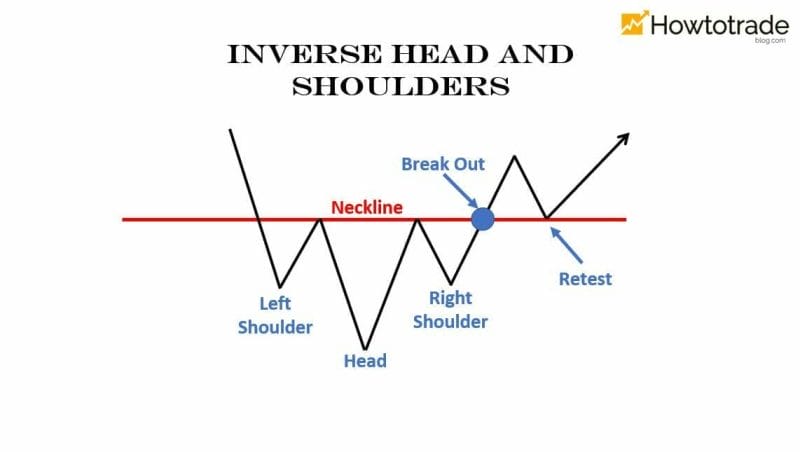

For those with a technical eye, the weekly chart of ETHBTC has printed a reversal pattern known as the inverse head and shoulders. No not the shampoo, but a very powerful and high probability reversal pattern. Something our readers and Discord members are very familiar with, as we use the same patterns to trade crypto’s, indices, stocks, forex and commodities. We have accumulated major gains based on this pattern.

The most recent weekly candle close created new recent highs breaking above 0.043500. The daily chart also confirms a retest:

For those that are a bit confused about what ETH/BTC means, it is the same as reading a currency pair. For the Gold bugs, think of it as XAU/XAG. As an example let’s take USDCAD, or the US Dollar versus the Canadian Dollar. The first currency (USD) is known as the base currency, while the second currency (CAD) is known as the quote currency. You read it as: 1 USD equals this much CAD.

On the charts, when USDCAD is rising it means the base currency, or the USD is getting stronger (appreciating) against the CAD which is weakening (depreciating). When USDCAD is dropping, it means the quote currency, CAD, is getting stronger (appreciating) against the USD which is weakening (depreciating). Do the same with ETH/BTC with Ethereum being the base currency, and Bitcoin being the quote currency.

What does this all mean? That Ethereum will be gaining against Bitcoin. Looking back at the weekly chart of ETH/BTC there is a LOT more room to the upside. Bitcoin seems to be the safe haven, while Ethereum is being bought for applications such as NFTs and DeFi. As long as this occurs, Ethereum will be seen as ‘cheap’. Pricing out Ethereum vs Bitcoin eclipsing all time highs on ETH/BTC, this would lead to an Ethereum price above $5000. Buckle up, it is going to be quite the ride.