Brace yourselves for an extremely busy week for the Stock Markets and on Wall Street. The week is already starting strong with cryptocurrency recovery headlines, which includes a gap up open on Coinbase (COIN). Add in GDP data, CPI data Biden Tax Plans and the week is sure to be volatile. Oh and how could I forget? We have a Federal Reserve Interest Rate Decision on Wednesday! We will hear from Fed chair Jerome Powell, and the market does not expect much change. However, with the Bank of Canada being the first central bank to shift to a hawkish tone and taper, will the Fed follow along the same lines? With the Bank of England still touting negative interest rates, and the European Central Bank keeping their bond purchasing program unchanged, the Bank of Canada is definitely the outlier. Traders suspecting rising Oil prices playing a large role in the Canadian recovery.

Jerome Powell will probably mention vaccinations being important as the economy returns to normal. The US has done a stellar job getting vaccines distributed so perhaps a recovery is closer than some expect. If we expect the Fed to taper, we still need that consistent 2% inflation (not ‘transitory’). But maybe, the Fed surprises with a much hawkish tone…and the stock markets probably won’t like it.

The Federal Reserve Interest Rate Decision is by far the biggest high risk event for stock markets. But the earnings calendar is STACKED, and broader markets can be driven by individual stock earnings reactions.

Just look at this week’s earnings calendar. Some of the big boys are releasing their earnings. What I want to do for this Market Moment is to look at the overall markets before picking a company releasing earnings for each of these days with a promising set up. Tesla, AMD, NIO. Boeing and Chevron all make the cut.

Technical Tactics

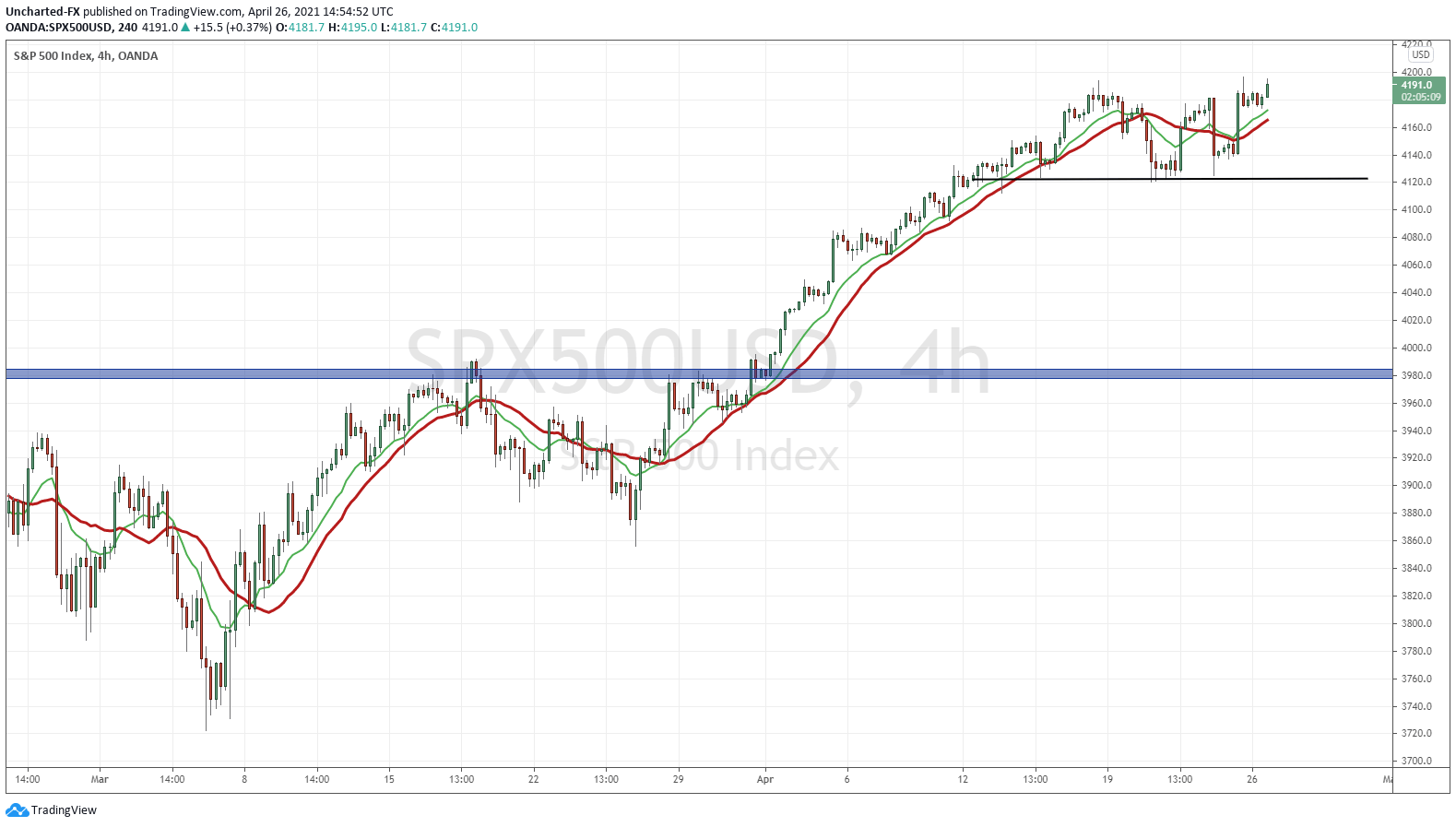

US Stock Markets keep moving higher. My readers and our Discord Trading Room members should not be surprised about this. There is nowhere to go for yield, and barring some Black Swan event, Stock Markets can move higher. Pullbacks are still normal, but the uptrend will likely hold as the dips are bought.

The S&P 500, and the Dow Jones which looks similar, are retesting a resistance zone of previous highs. A breakout takes us to new record highs. It sounds like I repeat myself every week.

Is there a chance of a reversal or a pullback? Sure. I actually wanted to see the S&P pullback to 4000, but it did not happen. But some technical orientated eyes can see that the trend might be flattening out on the 4 hour chart. You can see a dominant uptrend slope to the left, and then price beginning to range now. If we do not get a close above 4195-4200, price could head lower to 4120, maintaining the range. Keep this in mind, but I will be sure to keep you updated here and through our Discord Trading room.

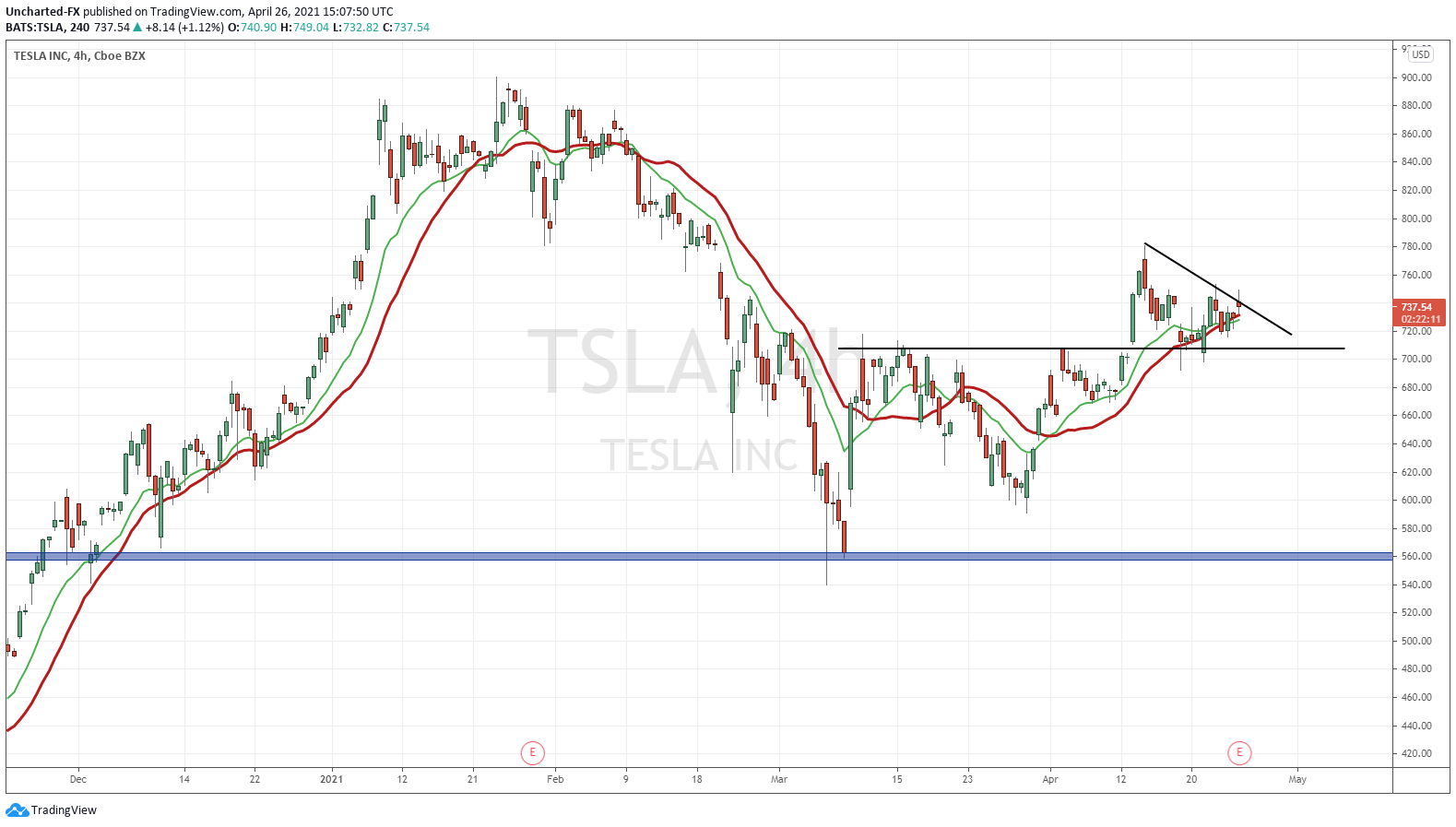

Tesla’s (TSLA) Earnings are due post market today (Monday). This is a technical set up I covered recently, and our $700 support is STILL holding. The anticipation for this one is palpable. Being one of the largest stocks on the S&P 500, a rally would cause the entire S&P 500 to move up.

Technical wise, we have a wedge forming as you can see on the chart. A break would easily take us to the $800 zone.

Keep in mind that Tesla did announce record deliveries for Q1, smashing previous records and estimates. This should be signaling more profits.

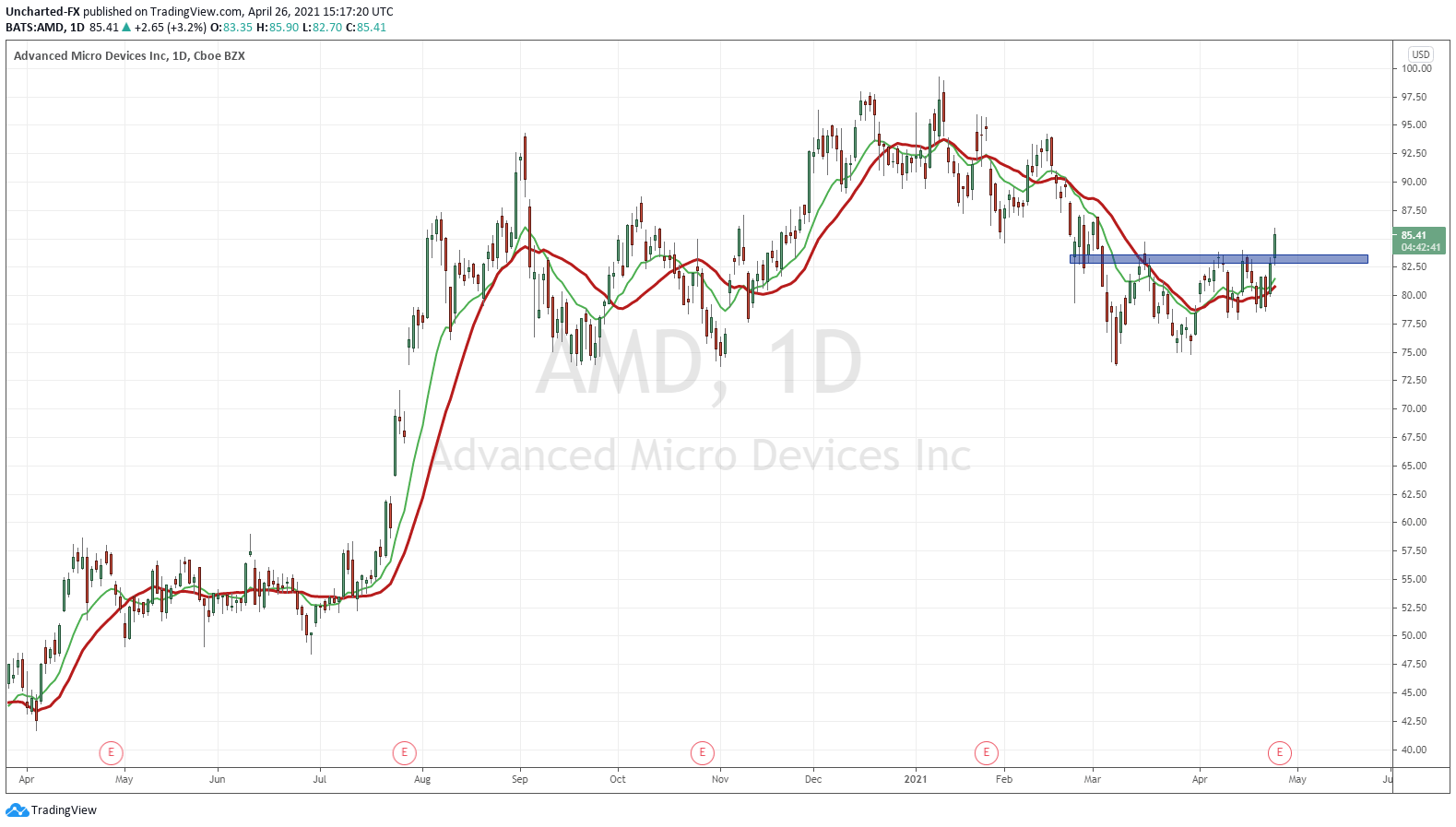

AMD is my pick for Tuesday earnings. The chart set up is looking great. Today’s close above $82.50 would be a breakout. $95.00-100.00 would be the next targets to the upside.

Intel reported bad earnings, which has the market predicting that AMD and other semi-conductor companies will gobble up Intel’s market share. An earnings surprise will do a large part in confirming what market analysts are predicting.

Wednesday is going to be the big one. Not only do we have earnings from Apple, Facebook, and Shopify, but we also have the Federal Reserve Interest Rate Decision.

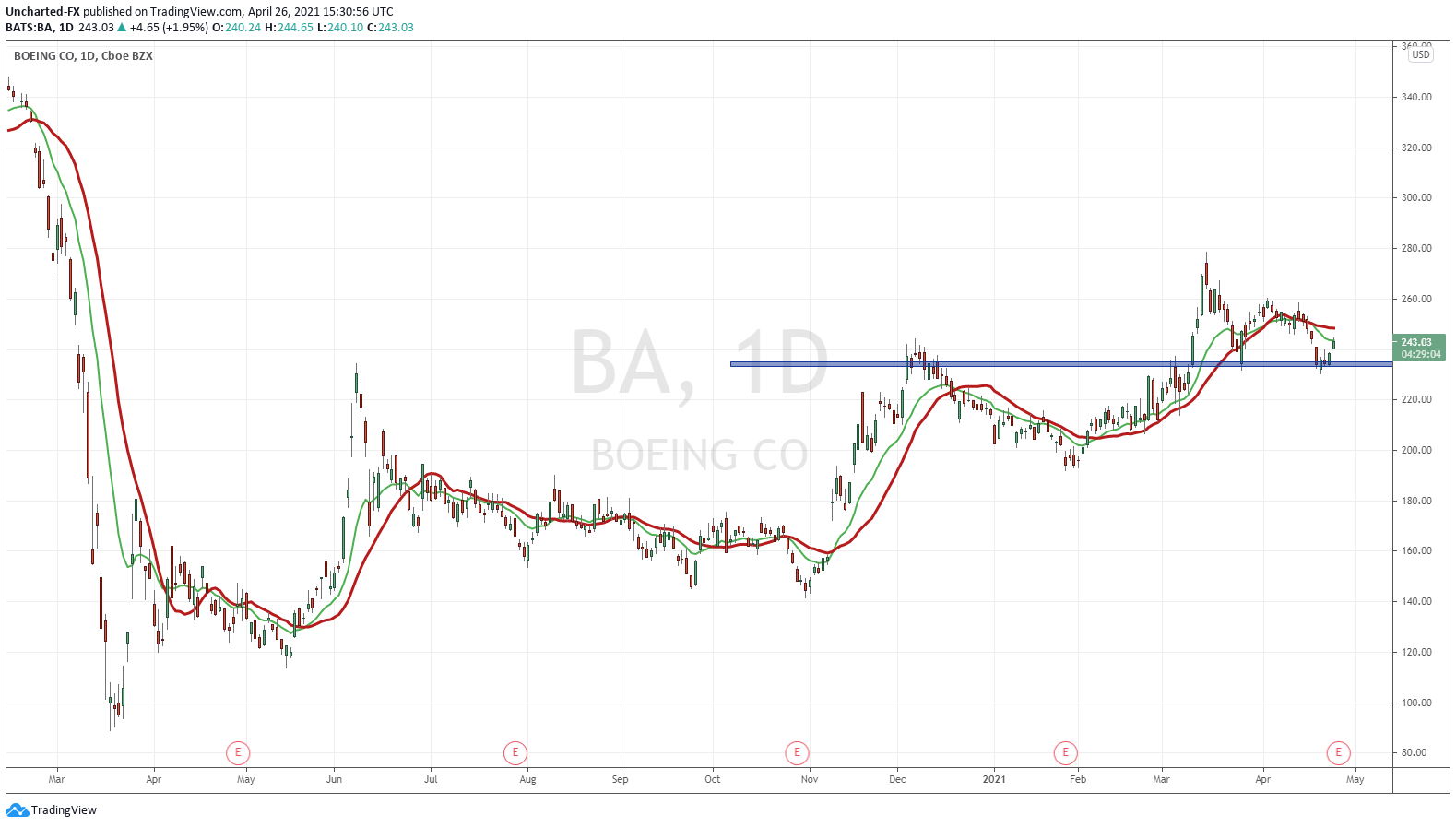

My chart pick for Wednesday is Boeing. $230 is support, and with a break above recent highs at around $277, Boeing’s next price targets are $300 and higher. We have seen some orders come in, but recently some news regarding Cathay Pacific cutting orders. Anything travel related has had a nice pop on vaccinations and summer travel. Technicals on this looks great, but a close below $230 doesn’t bode well.

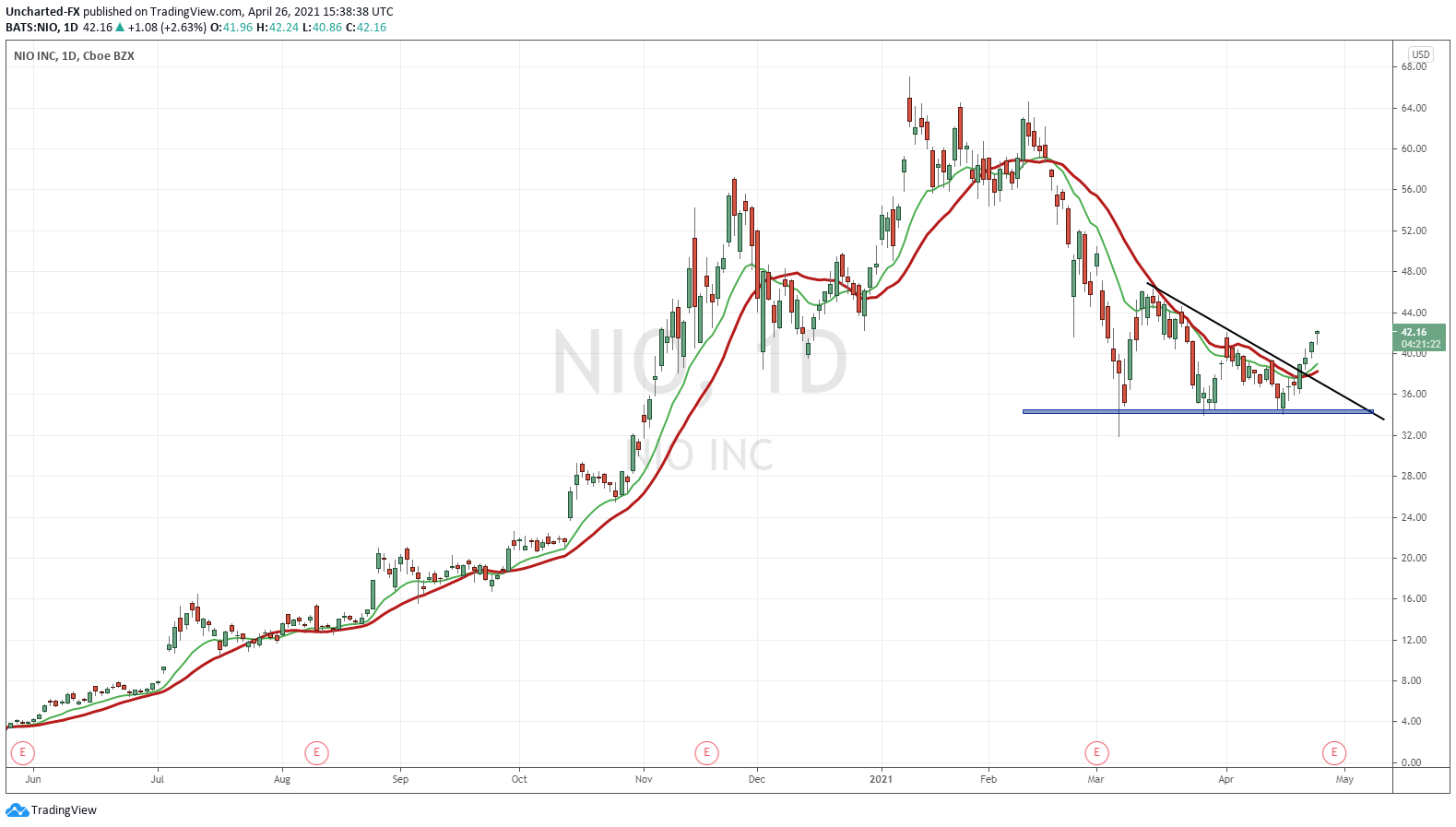

We have Caterpillar, Twitter, and Amazon releasing earnings on Thursday, but Chinese EV maker NIO has the best looking chart to act on. Some triple bottom price action with a trendline break. Things are looking bullish leading up to earnings.

We have recently seen a major asset manager, Munich Ergo Asset Management GmbH, buy more shares of NIO, and what many traders are speculating is when Cathie Wood’s ARK decides to pick up shares. Currently, ARK is playing Tesla as their way to play EVs.

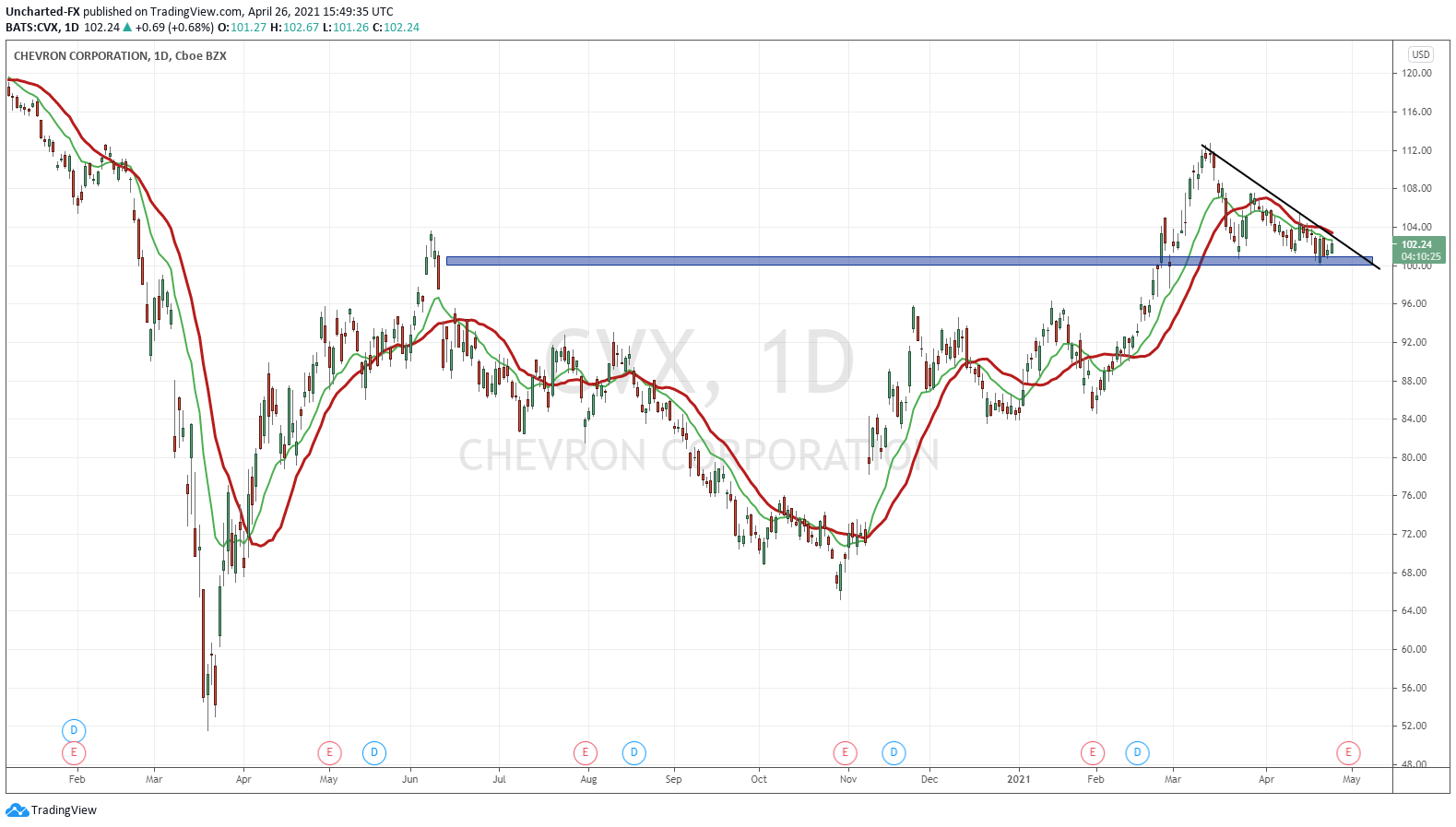

And to end this wild week, Chevron (CVX). The last time I looked at Chevron, we were ranging, while Oil prices were rising higher. The before and after is what we hope to do for all our positions.

Chevron is hovering above the all important $100 zone. A triangle pattern is forming. A break and close above the trendline, perhaps even backed or initiated by earnings, will cause a bull run targeting prices above $116.00. With higher Oil prices AND a shift into green energy with hydrogen technology, Chevron is one to watch and I would say perhaps the best big oil corporation play.