The first thing you need to know about Manganese X Energy (MN.V) is that they are looking to fill a big hole in North American mining. Or rather, they want to dig a big hole and extract manganese from it, a resource that no North American mine currently produces.

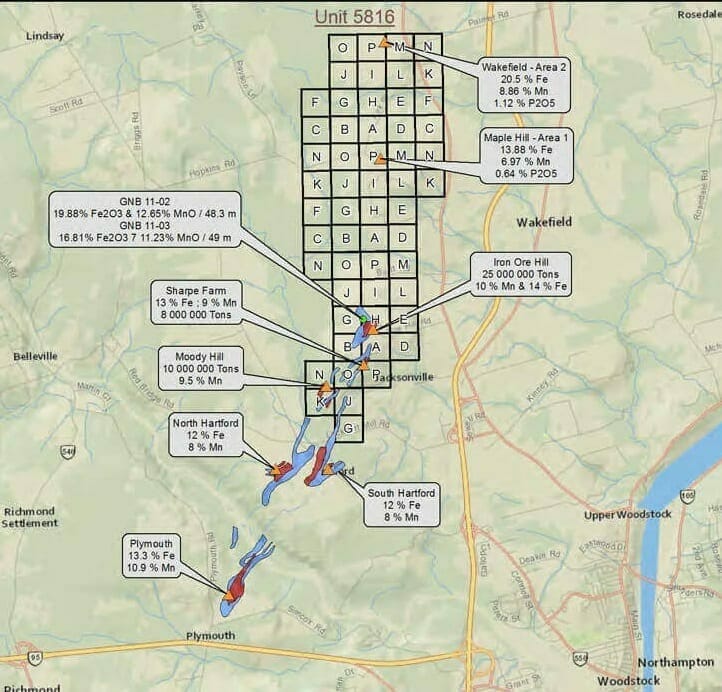

Their flagship property, the Battery Hill Project, located in New Brunswick near the American border, is one of the largest manganese resources in North America, with approximately 194 million tons. New Brunswick is consistently rated near the top of the Fraser Institute’s ‘Policy Perception Index’, which rates how favourable the area’s policies are towards mining institutions.

In an independent report on the project, a geologist estimated Manganese X could produce more than 80,000 tons of manganese annually for 40 years, meaning MN.V could profitably get 3.2 million tons of manganese out of the ground. That is more than $6 billion worth of Mg.

Currently, ~1 million tons of Manganese are produced every year, so MN.V would be making a significant impact on the market if their mine was operational.

But what makes Manganese X worth paying attention to is not just that they are sitting on billions of dollars’ worth of manganese (although that is certainly worth noticing), it’s that they could become an indispensable source of an increasingly vital resource. To understand why, we’ve got to talk about electric vehicle (EV) batteries.

Right now, as EVs become more popular, there are fierce debates over what kind of batteries we should be using to power EVs.

Many people wanted to use cobalt in the batteries, but there are problems scaling up cobalt batteries, and cobalt is rare, expensive, and toxic.

Then people tried substituting cobalt with nickel, but there was one problem: it made the batteries more flammable. Generally, people don’t like it when their cars catch on fire, and Tesla probably doesn’t want more of these videos floating around.

Which is where manganese comes in. Lithium-manganese-oxide has a structure which is more porous, causing it to ‘breathe better’. This causes lower resistance, leading to more power, greater efficiency, and allows the battery to stay cool. All very good qualities for a battery to have.

Right now, lithium-manganese-oxide batteries are not the more popular batteries, but nobody really knows what’s going to work, and because of manganese’s advantages, it has a fighting chance of being the most popular battery for electric vehicles going forward.

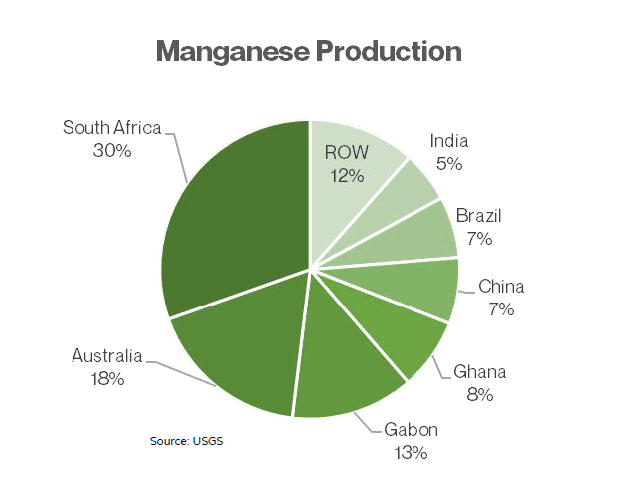

Which brings me back to Manganese X Energy. Even if manganese isn’t the main component of EV batteries, it may still play an important role, and currently North America is totally reliant on other continents for their manganese.

During the early days of the Covid-19 pandemic, people were (rightly) concerned about the fact we got most of our PPE from other countries, like China. People talked about how it was crazy to rely on other countries for key resources, but we are still doing the same thing with Mn, which is a key resource for the production of EV batteries. Luckily, the tides around this are shifting, and President Biden signed an Executive Order last month aimed at shoring up and diversifying America’s key supply chains. With Manganese X’s mine only a few kilometres from the US border, they could gain a real boost from the https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration’s efforts to strengthen their supply chain.

The Battery Hill property has three main historic mining zones, with two other promising areas.

In a report for the Canadian Instituted of Mining and Metallurgy in 1957, K.O.J. Sidwell made estimates about the Battery Hill projects reserves. They estimated the Moody Hill zone (between the N and K squares) has a potential 10 million tons, the Sharpe Farm zone (the lower P square, near O, B and A) has a potential 8 million tons, and the Iron Ore Hill zone (between the lower H and A squares) has a potential 25 million tons.

An independent report estimated the average annual cost of running the mine would be $133,019,647 and the revenue would average $272,955,738 per year. You don’t have to be a math genius to see that the expected revenue is more than double the expected cost.

Additionally, Manganese X is involved in the mining of graphite, another key resource for the production of EV batteries. In 2019, they purchased the LAB Graphite Property, near Mont-Laurier in southern Québec. Although some further investigation is needed to know how much graphite this property will produce, it does lie adjacent to the south of TIMCAL’s Lac des Iles graphite mine, a world class deposit that was once producing 25,000 tonnes of graphite annually.

On top of all that mining, Manganese X owns a disinfectant HVAC (heating, ventilation, air conditioning) company. Disruptive Battery Corp, a MN.V wholly-owned subsidiary, are creating an HVAC system that aims to disrupt the airborne transfer of pathogens through air systems. With research stipulating Covid-19 may transfer through air conditioning, this technology is as important now as ever.

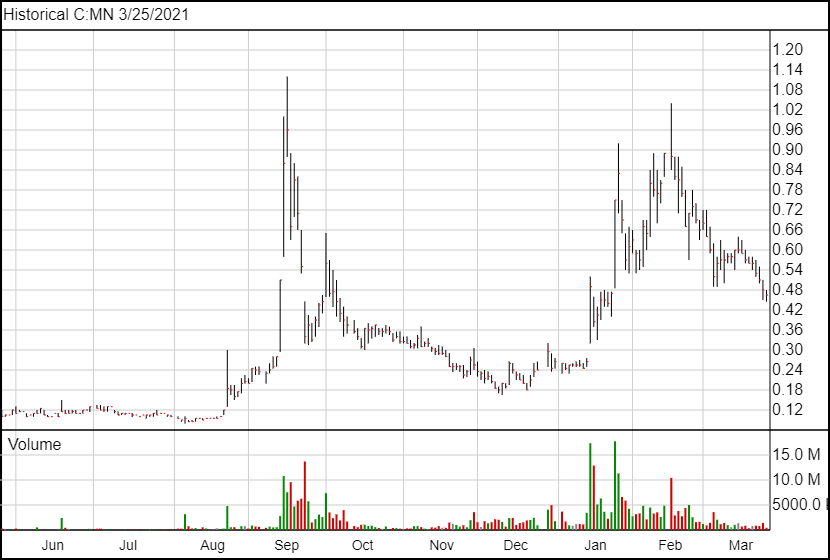

Manganese X’s share price has broken the $1 barrier twice in the last year, first in September then in February. Fully-diluted, there are 137.2 million shares of MN.V, and the stock is currently trading at $0.47.

Full disclosure: Manganese X Energy is an Equity.Guru marketing client.