More than terrorism, drugs, racial animus and acts of God, cancer has always been with us. It’s humanity’s number one enemy throughout history—it’s only recently that we’ve learned what little we know, and devised rudimentary strategies on how to secure its defeat.

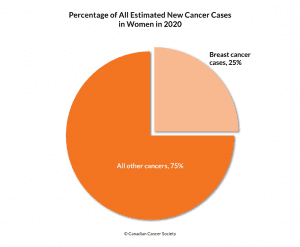

The statistics are harrowing. Do a headcount next time during your commute then divide by three. That number of people on the bus or subway will get cancer in their lifetime. The number for breast cancer is 1 in 8. In 2021, it’s estimated that 281,550 new cases of breast cancer will arrive in the US.

I’ve got cancer in my family right now: metastatic liver and pancreatic cancer. Two years ago they gave him six months to live, so instead of easing off on the behaviours that got him into that mess in the first place, he shrugged his shoulders and doubled down. Good for him. What’s it going to do? Kill him faster?

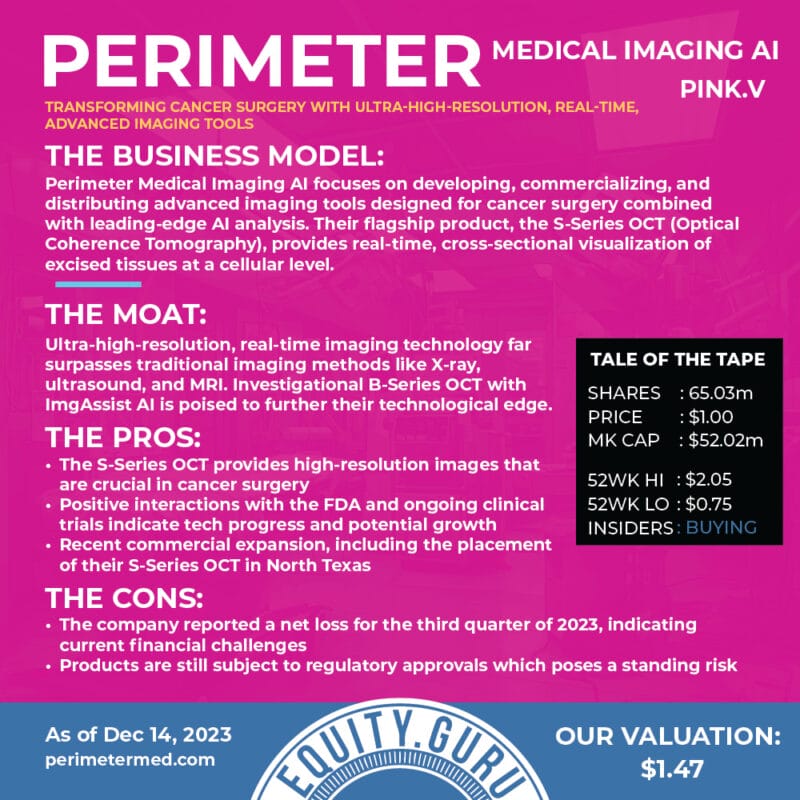

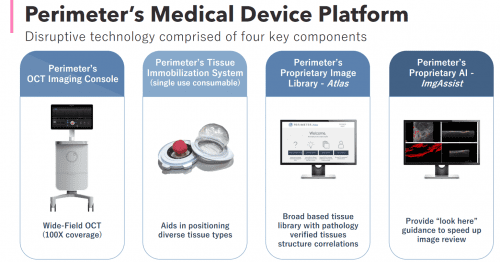

For the rest of us, though, we still get on the bus every day and look around at the people around us and wonder which of us are going to get the call. That’s why I think companies like Perimeter Medical Imaging AI (PINK.V) are important—because they’re lining up to fight the odds. There’s the usual pecuniary considerations an investor should make as part of their due diligence, and we’ll get into those, but it’s not like there isn’t always going to be a solid demand for anything that fights cancer.

The company’s mandate is to transform cancer surgery with advanced imaging tools. They’ve recently announced that Dr. Beth DuPree, a surgeon operating primarily out of the Northern Arizona Healthcare Verde Valley Medical Center, is expecting to 100 patients in a study to determine the efficacy of Perimeter’s Optical Coherence Tomography (OCT) Imaging System during breast conserving surgery.

“Our hope is that the data generated from this study will further validate the potential clinical benefit of bringing ‘real time’ margin visualization into the OR to assist surgeons with their decision making. In addition, we have worked closely with clinician users to ensure that the Perimeter OCT Imaging System can be easily integrated into current intraoperative workflows,” said Jeremy Sobotta, Perimeter’s chief executive officer

Removing a cancerous growth from beast tissue is called a lumpectomy. The intention behind one of these surgical procedures is to save as much of the breast as possible without compromising the patient’s health and reducing the percentage change of the cancer returning. The surgeon’s goal here is the total removal of the tumour to prevent regrowth, and it’s achieved by excising the tumour and a surrounding layer of healthy tissue. In medical jargon, they call this a “margin.” If the surgeon doesn’t get “clear margins,” then there might be residual cancerous cells which can regrow the tumour, thereby requiring more treatment.

The study’s aim is to show that surgeons can use Perimeter’s OCT Imaging System during a procedure to aid in their decision making regarding whether or not they need to take extra tissue. The study will also determine the time required to re-excise while in surgery instead of a follow-up procedure. The data will also be used to determine the percentage change of a patients requiring a second surgery. This study is the follow-up on a successful collaboration between DuPree and Perimeter, which drew compelling data from a smaller pool of 20 patients in 2020.

It reminds me of the women in my life: my wife, my mother-in-law, my sister and my grandmother. My co-workers and friends. The number is more than eight, which means that statistically one of these wonderful, intelligent and charming women will find a lump in their breast one day. It’s enough to make you sick to your stomach.

But instead of giving into the helplessness, you have an option at your disposal. There are plenty of companies out there that make promises based on a tired business model or pointless tech, but few offer a chance to make some money while helping out in a good cause.

The financial data we promised earlier:

- Operating expenses for the three months ended Sept. 30, 2020, were $2,201,256 compared with $2,323,233 during the same period in 2019.

- The net income for the three months ended Sept. 30, 2020, was $800,030 compared with a $1,843,303 loss in the same period in 2019.

- For the nine-month period ended Sept. 30, 2020, cash used in operating activities was $5,617,948.

- As at Sept. 30, 2020, cash and cash equivalents were $9,065,685 and investments were $2,930,660.

- As of Sept. 30, 2020, the company received $1,220,666 (U.S.) of the $7,446,844 (U.S.) available from the CPRIT grant to fund activities related to the first year of its Atlas AI project.

- As at Sept. 30, 2020, Perimeter had 38,866,728 common shares issued and outstanding and 9,039,775 warrants outstanding with a weighted-average exercise price of $1.55. Of those warrants, 3,446,696 with an exercise price of $2 are subject to accelerated conversion if the common shares of the company trade above a $3 15-day volume-weighted average price on the TSX Venture Exchange.

A good cash position and a positive income trajectory, and a good cause. You can throw it into another go-nowhere cannabis company peddling the next CBD facial wellness cream, or put it somewhere where it might do some good, while standing a chance of bringing in a good return later on.

As for that person in my family with cancer—he’ll probably pickle the thing with booze and outlive us all, having run over the edge of the cliff a year and a half ago like Wile E. Coyote. The old bastard just refuses to look down.

Perimeter paper is up $0.11 today and presently trading at $4.35.

—Joseph Morton

Full disclosure: Perimeter Medical Imaging AI is an equity.guru marketing client.