OrganiGram (OGI.T) has launched Indi and Edison Cannabis prerolls, two new recreational cannabis products offered by the Company.

“Indi is Organigram’s ode to indicas and the potency, value and flavour they can offer adult consumers…Our goal is to evolve Indi over time, including more indica strains and limited-time offerings, providing indica users with a curated collection of interesting indica products,” says Greg Engel, chief executive officer, Organigram.

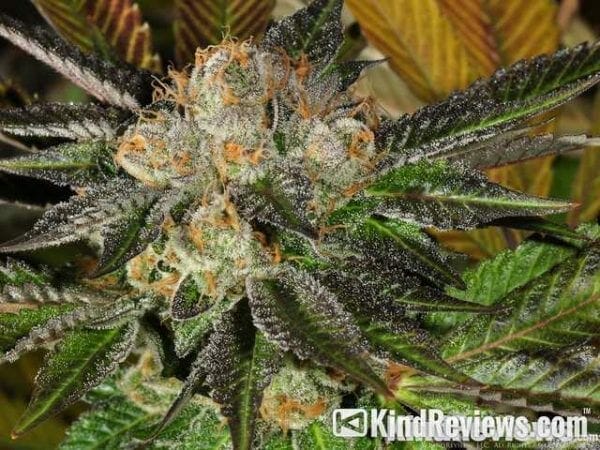

OrganiGram’s Indi is a specialty brand focused on indicas as you may have been able to guess from the name. The Indi brand is intended to curate a lineup of potent, interesting and celebrated indica cultivars and is catered towards indica connoisseurs. Skyway Kush is the first strain in the Indi portfolio and features a spicy, herbal and diesel aroma with earthy undertones as well as some top terpenes. If you were worried about Indi’s quality, rest assured OrganiGram’s Indi products offer a range between 20% percent and 23% THC flower. Moreover, Indi flower is packages in rooms with standardized humidity levels adhering to the Company’s freshness standards.

Organigram’s Edison Cannabis indica prerolls Black Cherry Punch, Ice Cream Cake and Slurricane are also making their debut. Edison prerolls were initially launched in the 3.5-gram format, however, the Company’s latest products will be available in a package of three 0.5-gram prerolls. While Black Cherry Punch and Ice Cream Cake offer a THC range of 18% to 24%, Slurricane offers a slightly lower THC range of 17% to 23%.

“We continue to build a genetic portfolio that differentiates us in the marketplace…When we pair the physical properties, potency and terpenes found in each plant with the strain’s preferred growing environment, we can optimize both the process and the quality of the product. In this way, Organigram will continue to bring the best products to market for both retailers and consumers,” says Mr. Engel.

That’s cool and all but what does this mean for you, my fellow investor? OrganiGram is no stranger to the cannabis prerolls scene. With this in mind, the prerolls market is one of the hottest, with sales surging 50% in the last year according to Headset, a cannabis analytics firm. This makes prerolls the second fastest growing product in the cannabis market with sales increasing 47.1% from $640.1 million in 2019 to $941.6 million in 2020. OrganiGram also saw an increase in its sales growth in the Canadian adult-use recreational market in Q1 of 2021. Compared to Q1 of 2020, the Company’s Canadian adult-use recreational gross and net revenue grew 42% to $22.5 million and 30% to $16.8 million respectively.

Overall, OrganiGram has seen significant growth in the new year by attempting to revitalize its portfolio and introduce a variety of new SKUs. Aside from the Company’s latest Indi and Edison Cannabis pre rolls, OrganiGram plans on releasing an additional 14 SKUs by the end of Q2 2021. Furthermore, British American Tobacco recently invested $221 million into OrganiGram providing the Company with funds to accelerate its strategy.

OrganiGram’s stock price opened at $4.10 and reached a high of $4.34 following the news. The stock price currently sits at $4.23.

Hexo (HEXO.T) Aurora (ACB.T), Organigram (OGI.T) shareholders totally bewildered by this common colour