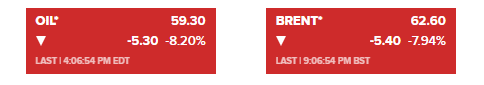

Oil prices have closed nearly down 8% settling at $59.50 for West Texas, and $62.73 Brent Crude. The largest single day loss since April of 2020.

Was there any major news? Nope. No OPEC news. No Middle East news.

This is where a knowledge in technicals pays off.

Regular readers and members of our Discord Trading Room will recall that my Oil price target was $66.00.

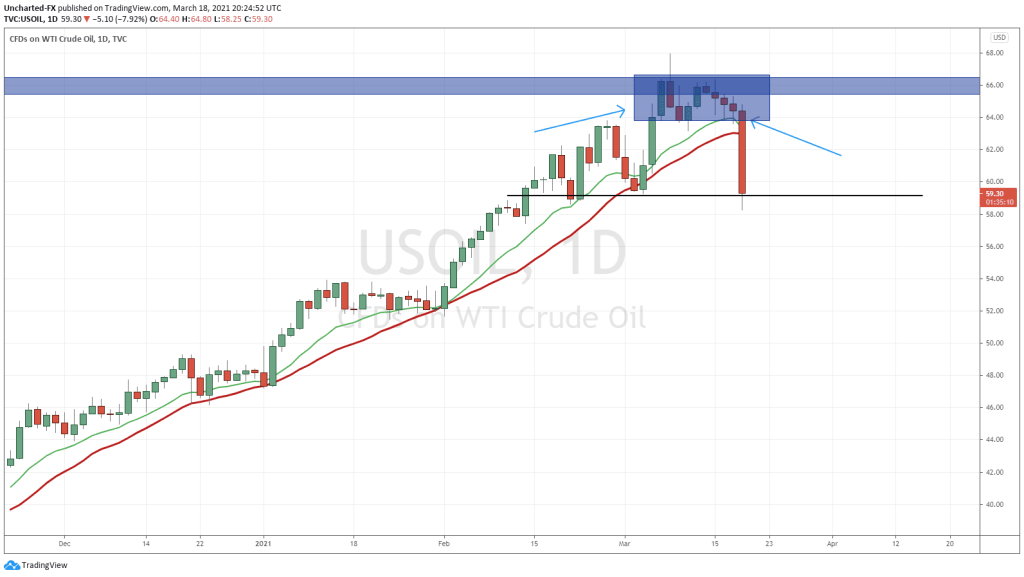

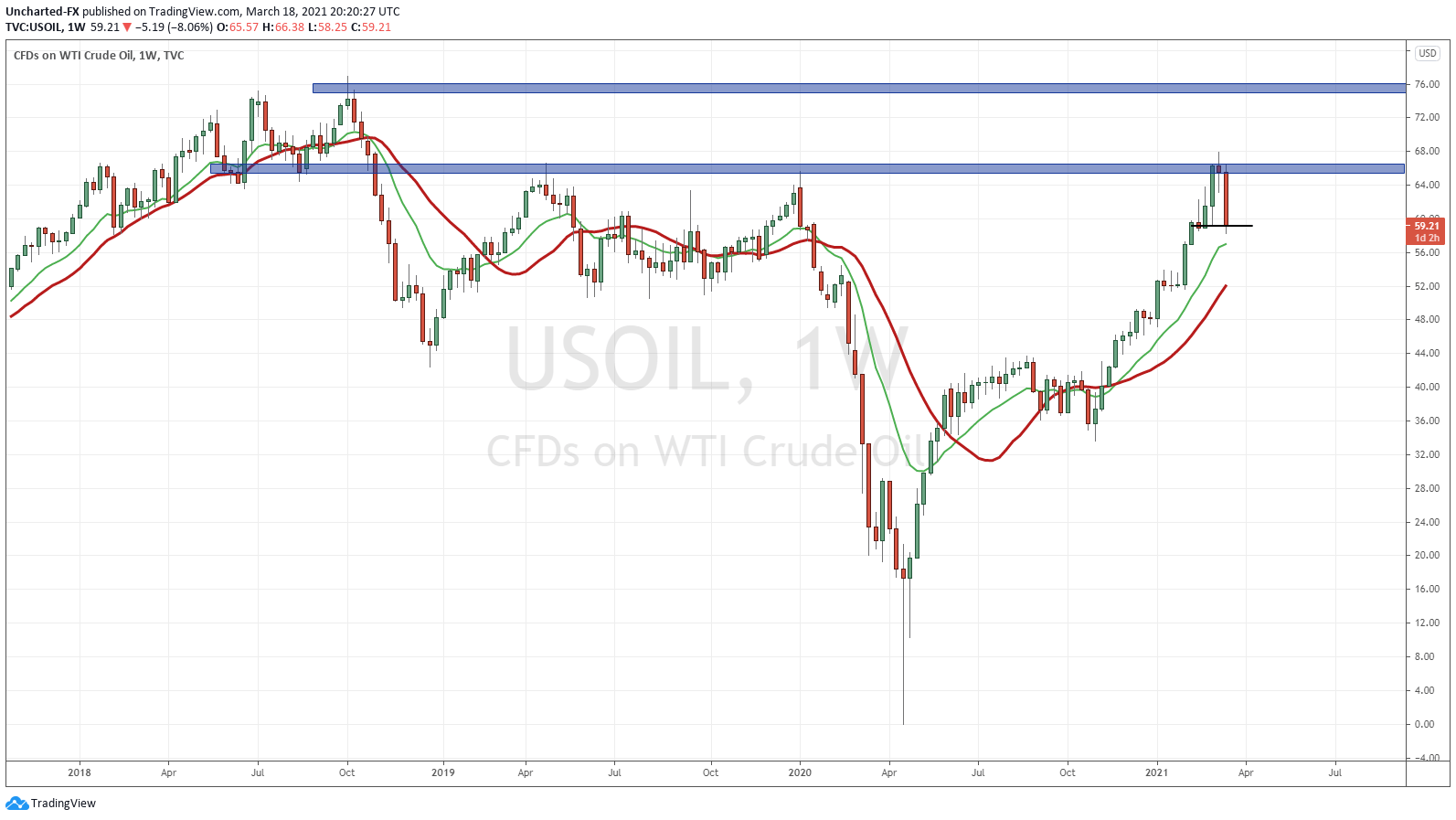

This is the chart I presented in my Market Moment article titled, “Oil Prices Pave a Clear Path to $65“:

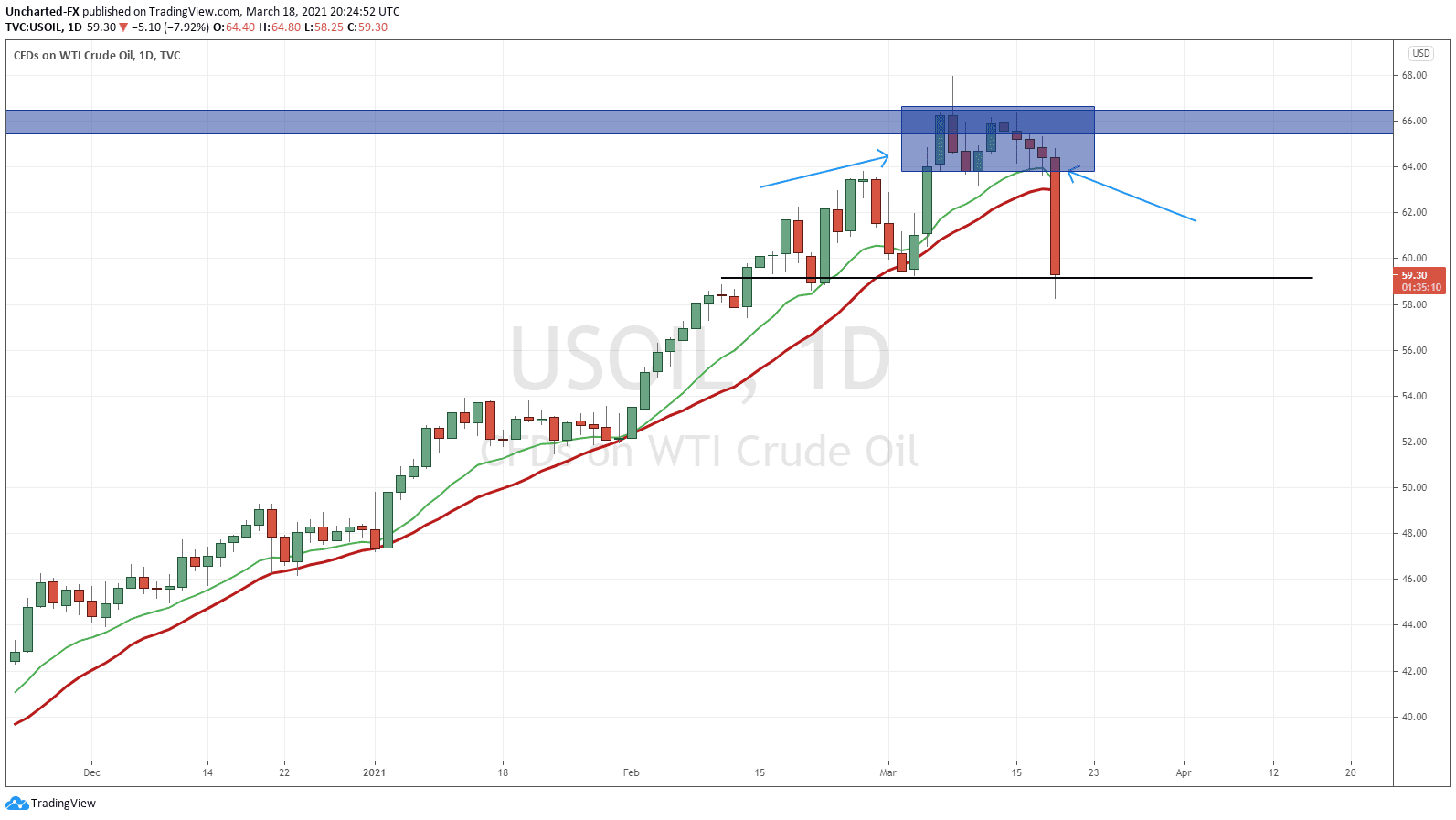

And now for the update today:

We reached our target resistance zone which plays a part in todays 8% drop.

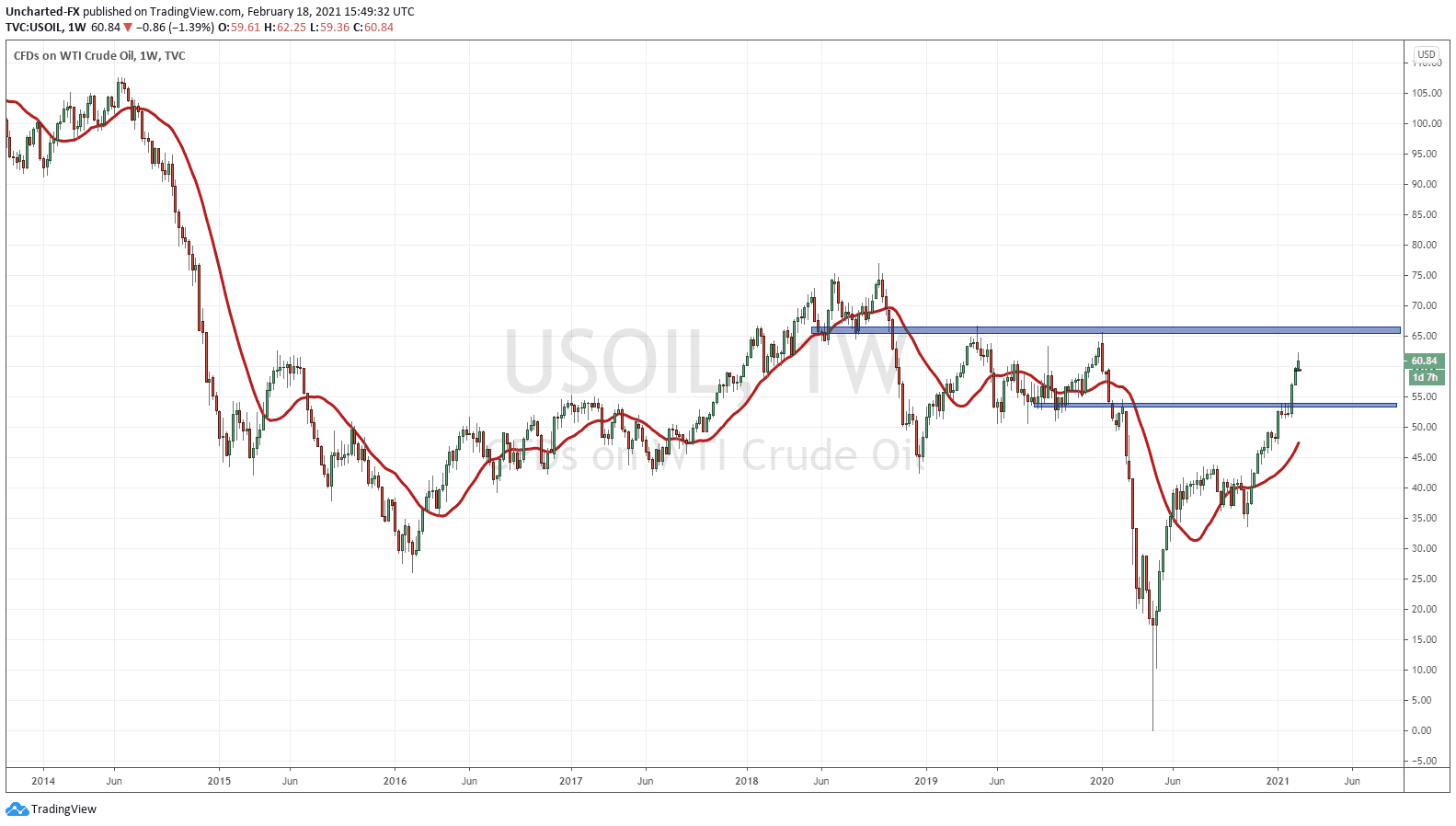

Resistance zones are price ceilings. They are zones that traders target when they take long positions. The $65-$66 zone was a major resistance zone on the weekly chart. Very powerful. Many longs closed for profit there.

Let’s take a look at the daily chart.

Notice how price ranged for 9 full trading days? This resistance zone was providing a wall for the bulls. Oil price could not breakout. The breakdown finally occurred today on the intraday and sellers piled in on the break. Boom down 8%.

Is there more room to the downside? This is what I will be looking for.

Right off the bat, if we climb back over $66.00, the uptrend continues.

However, I am watching for a reversal set up on the daily chart. As you can see, I have drawn out a hypothetical bearish set up scenario which factors in a head and shoulders pattern.

Where prices are testing now, the $59.25 zone is a support zone (price floor). It is our previous higher low swing, which means that Oil remains in an uptrend as long as we hold above this price. We remain above on the close today. Going forward, I expect to see a relief rally, and then things get interesting next week. Watch for a roll over and then a subsequent break below $59.25 for Oil to begin a new downtrend. Our first target will be $52.00.

On the fundamental side, we have heard that OPEC has maintained production. Oil remained propped on the ‘economy re-opneing’ play. It was the real vaccine play.

Others look at the oil price rise as a run to commodities and hard assets. We know the Fed will be printing more money. As the currency gets devalued, you will want to be in commodities. The Gold bulls are attributing this Oil pop on the weaker dollar.

Whatever the case, the technicals do not lie. Major support and resistance zones (I refer to zones with 3 or more touches) attract prices like a magnet. For a technical trader they are key pivot points in regards to a potential reversal. Watch them. They provide answers to major moves like today.