The team at Bridgewater Associates did an amazing job looking at the quantitative & qualitative variables that affect the future of cryptocurrencies, specifically Bitcoin, as a future reserve currency’ or ‘digital gold’.

In summary, since supply is known (21 million units are hard-coded) and the demand is unknown, bitcoin prices depend heavily on who is buying it.

Most of the buying to date has been from retail investors. In comparison, the market has other participants who have chosen to be idle because of the inflexibility of the cryptocurrency, notably the big-money ones (r/wallstreetbets aside, of course)

- Institutional Investors

- Corporations

- Government-funded organizations

- The Government

These main buyers have only started now to tap into the potential of cryptocurrencies. While this new influx of buyers comes with a hefty war chest of cash, which in turn contributes to the prestige of the demand-side of bitcoin – their interest always attracts the prying eyes of regulators.

It is highly unlikely that corporations and government-funded organizations, or the state will adopt cryptocurrencies in the near future. This is not due to the infrastructure problems bitcoin still has to face but is instead due to safety concerns.

With those aforementioned market buyers being mostly out of the game, this leaves us with the institutional investors as the potential buyer of cryptocurrency assets. This final catalyst has been predicted to only be implemented if hedge fund managers, endowment funds, pension funds, mutual funds, ETF’s, index funds, and many other institutional vehicles adopt the digital asset into their asset allocation model.

Recently this has started to happen, and a cryptocurrency-backed ETF is now publicly available to investors. This ETF vehicle opens up many opportunities, not only for retail investors but also for institutional buyers to purchase an exchange-traded fund that will be in line with their investment mandate.

The Purpose Bitcoin ETF (BTCC) provides exposure to the world’s largest cryptocurrency by investing directly in ‘physical/digital Bitcoin,’ issuer Purpose Investments Inc. said in a statement. The fund will be available in both the Canadian dollar ( BTCC.B up by +4% ) and U.S. dollar ( BTCC.U up by +4%) units.

We know from physics that energy is neither destroyed nor created, but is merely transferred. The same applies in the financial world of asset allocation. Cash cannot be created nor destroyed (unless you are the US Treasury or an arsonist) but has to be transferred into assets, liabilities, or spending.

Investment managers are in the asset management business, so this is the branch of financial science (more of an art to be honest) we shall focus on. Many investment managers have different mandates on what performance and asset allocation they can utilize, but generally speaking, they have the freedom to adapt as new technologies allow them to seek value in creative assets.

Bitcoin has been described as a hedge from fiat currency, meaning it works like a bar of digital gold and could balance against currency risks (like inflation). The economics of gold is pretty simple and similar to bitcoin. Gold has a similarly finite supply and derives its value from demand by hedgers and manufacturers.

This means, if bitcoin is to replace gold as a hedge against inflation, it would have to meet specific standards, namely;

- used as a medium of exchange,

- a store of wealth and

- unit of account.

The most important of the above is number 2, the store of wealth.

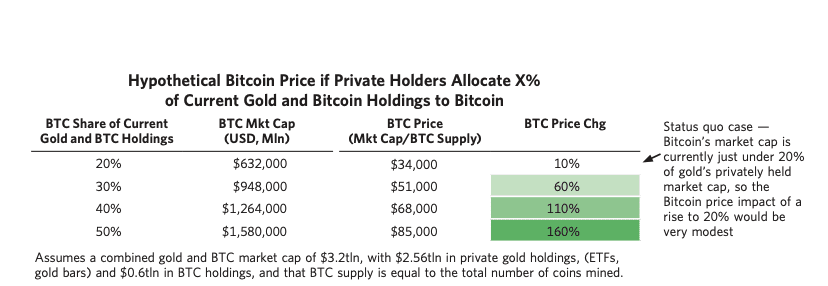

If this was the case and institutional investors utilize bitcoin as a store of wealth, the team at Bridgewater believes that hypothetically, bitcoin’s price could reach $85,000 per Bitcoin – indicating a 160% price change from when they wrote their paper. They got to this point by adjusting bitcoin’s market cap and volume compared to the volume and market cap of gold and transferring a portion of the gold holdings into bitcoin.

This would be the most likely outcome if bitcoin is posed as a replacement for gold. But…

“…Bitcoin faces challenges that at least for now could slow broader adoption by institutional investors. We’d highlight three in particular:

-

“Bitcoin remains an extremely volatile asset, and its future purchasing power remains a fundamentally speculative proposition. Compared to established strongholds of wealth, such as gold, real estate, or safe-haven fiat currencies, Bitcoin faces a much wider range of outcomes in terms of its future value.”

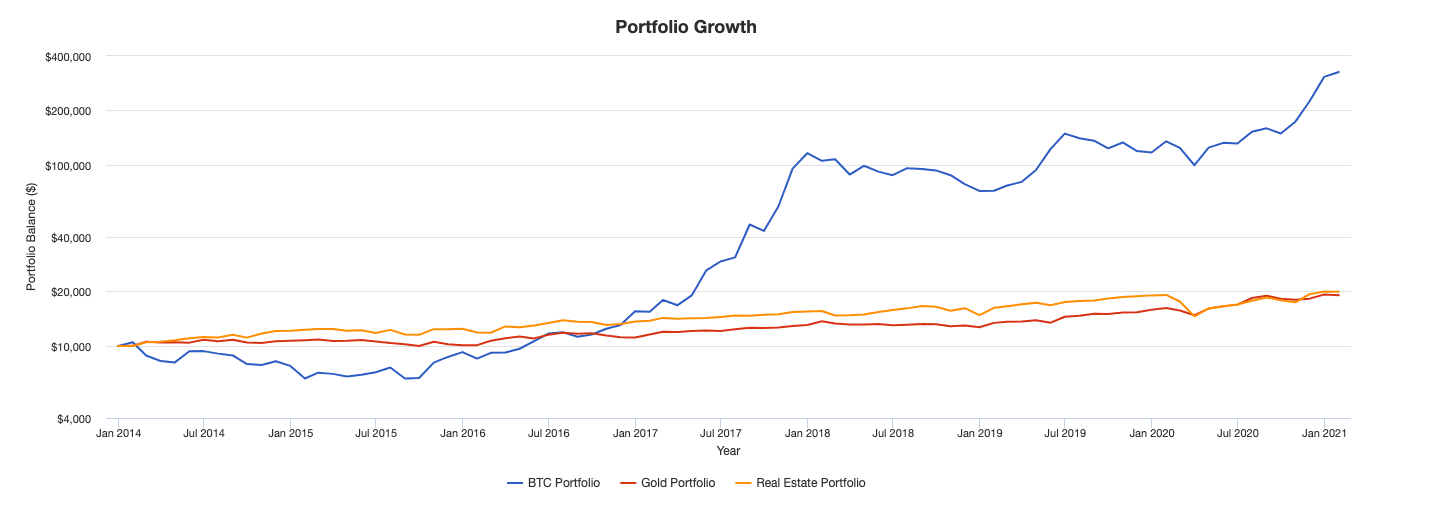

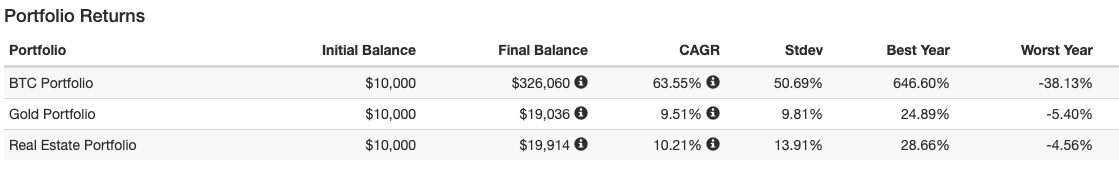

The team at Bridgewater believes that bitcoin’s future purchasing power still remains fundamentally speculative because of how volatile it is as an asset. So, to test this I ran a backtest from January 2014 to January 2021 and assumed we had invested $10,000 in three portfolios.

- BTC Portfolio – 50% Vanguard 500 Index Fund ETF & 50% in BTC

- Real Estate Portfolio – 50% Vanguard 500 Index Fund ETF & 50% in REITs

- Gold Portfolio – 50% Vanguard 500 Index Fund ETF & 50% in GOLD

Portfolio (a) containing the Bitcoin investment turned our initial $10,000 into $326,060 giving us a compounded annual growth rate of 63.55%. In its best year, it returned 646% but in the worst year was down by 38%.

Portfolios (b & c) holding gold and real estate turned our initial $10,000 into $19,000, both giving a return of almost 10%. In their best years, they brought back 24% and 28%, and in their worst years, they went down by 5% and 4% respectively.

To be clear, this short period does not do justice for gold or real estate, because over an extended period of time, Gold and real estate have performed better than in the 2014 to 2021 period. This longer-term track record for real estate and gold has allowed them to be included in asset allocation models as a hedge against inflation or stagflation at times when the general market is distressed.

This is a quality of bitcoin we haven’t seen just yet as the currency is still pretty correlated to other asset classes. Not only is it correlated to other asset classes, but it also has a high standard deviation, which is a measure used by financial academics for market volatility. This high market volatility could affect the purchasing power of the security if buyers are jumping in and out of the medium of exchange. This could be the effect of lack of data since Bitcoin is only about 10 years old.

2. “Bitcoin still faces meaningful regulatory tail risks and lacks any of the underlying government backing or deep history that would provide a more fundamental baseline of future demand. While greater regulation might help Bitcoin gain broader institutional acceptance, it could also trigger selling by some of its largest existing owners who prioritize a lack of public oversight around the asset.”

Cryptocurrencies are not legal tender in any jurisdiction; they, unlike the conventional currencies issued by a monetary authority, are not controlled or regulated and their price is determined by the supply and demand of their market.

This decentralized mechanism has given bitcoin its value so far, and if this freedom is infringed upon by the state, those attracted to this realized philosophy of a decentralized currency may feel bitcoin’s attractiveness fall apart.

Since this part of the regulations is still unclear and uncertain, there is honestly not much to add. Nonetheless, government regulation takes many years for a consensus decision to be made, and this is an opportunity cost for anybody who is interested in the asset during the period.

3. “While there have been improvements, current levels of liquidity still constitute real structural challenges to holding Bitcoin for large traditional institutions such as Bridgewater and its clients.”

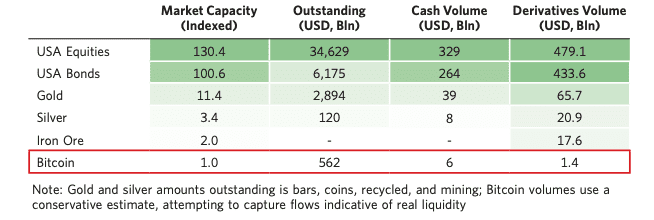

The table above was derived straight from the Bridgewater paper and indicates a measure of volume or liquidity utilizing different instruments on different securities. Bitcoin’s market capacity is dwarfed by that of US equity, US bonds, gold, silver, and iron ore in all of the instruments used to trade securities.

For smaller investors, this might not be an issue as there is no need for them to buy large blocks of bitcoin. This does make it more difficult for large traditional institutions to buy bitcoin at attractive prices since any of their purchases will directly affect the current price (which to be fair, could be true for smaller market cap companies, and isn’t a blockchain-exclusive impact).

This in itself triggers unattractiveness to the cryptocurrency asset because it is highly unlikely institutional investors will get the best price possible in the market. If the traditional institutions are able to buy large quantities, the second-tier issue would be selling. Illiquid assets are very risky to sell once the price is below their required rate of return which could force a fire sale in bitcoin, further depressing the price.

I think it’s wise that I state boldly: I’m no professional in cryptocurrency assets. To be frank, I wouldn’t even claim regularly I fully comprehend what’s happening in the capital markets on any given day. I pull from those who have studied the asset with more depth than myself, so as to sharpen my understanding of what’s actually deriving the value of the asset class.

Having done that, I think it is wise for retail investors like myself to be very cautious about speculative asset classes like bitcoin. It would be wise to wait for institutional buying to get involved after regulations have been put in place, that will allow the bitcoin market to work more “efficiently” – and ground our projections.

Once that has happened, a keen understanding of how the crypto assets will work in your portfolio will have to be judged on an individual basis. Some might prefer the cryptocurrency and others will go for more traditional instruments like gold and silver.

I am in the minority here because I believe it is better to hold productive assets like a farm or real estate.

But as always, only time will tell who is right so go forth and buy all the crypto kitties you want!

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.