Straya

As someone who had more than a few fuckups investing in the Canadian cannabis space, the idea of being able to do it all over again is wildly intriguing.

I think Australia could present that opportunity.

Australia’s cannabis industry is projected to have long-term potential. The legal cannabis market in Oceania is expected to be worth US$1.55 billion by 2024, with Australia accounting for 79 percent of the region’s market, according to Prohibition Partners.

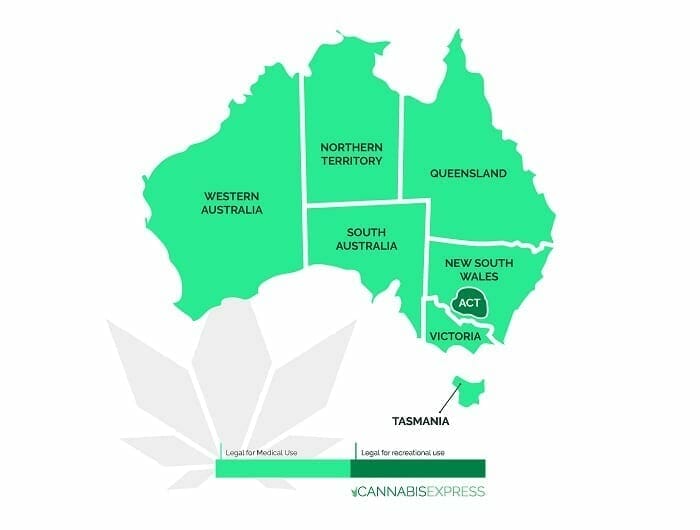

There have been several recent catalysts for Australia’s growing cannabis industry including the UN’s reclassification of cannabis, the ACT (Australian Capital Territory) legalizing cannabis for personal use, and Australian pharmacies gaining the ability to distribute cannabis.

The country also inhabits 25.3 million people who collectively have one of the highest cannabis consumption rates in the world, according to the WHO.

The drug remains federally illegal. Under the federal Criminal Code Act 1995, it’s an offense to possess cannabis and can carry up to two years in jail.

However, with fast-growing support of legalization, there is hope that the political climate will change. On a local radio station, Australian Health Minister Greg Hunt said, “We’d like to be potentially the world’s number one supplier.”

Three Australian states/territories: The ACT, Northern Territory, and South Australia decriminalized cannabis for personal use three decades ago, and in the ACT a household can grow up to 4 cannabis plants.

Advocates have pointed to the unwillingness of many doctors to prescribe it, as well as the special access arrangements doctors must follow, as hurdles to broader use of the drug.

Ugly ass medical brands

Medicinal cannabis was legalized in Australia in 2016, but investing in it has its limitations. Australia saw roughly 30,000 medical cannabis approvals for patients in 2019, health authorities expect that number to climb to at least 70,000 in 2020 at the current rate of growth, but these are still very small numbers in terms of companies achieving any kind of significant short-mid term revenue, but, this is where the attention in the sector is right now.

In the early days of the Canadian cannabis industry, two trends that died really quickly were: ‘medical cannabis’ and ‘funded capacity’.

Medical cannabis simply because the rec market was so much bigger, and funded capacity because it was so ambiguous and no one thought about future price compression. Most companies now in Australia are only talking about the medical side of the sector, just like they were in Canada in 2015.

I am more looking for that future rec opportunity.

Who is building a brand?

Who is developing unique products?

Who actually has an audience?

Who will get the market share?

Beyond fundamentals, these are the questions I am asking when looking at cannabis companies in emerging markets. And I get that the industry is all about the medical side now, but I think there’s room to start creating some sexy shit too, even if it’s for a future M&A target.

I’m looking for one of these companies to really grab onto Australian culture and run with it. Create something unique that Australians can identify with, because right now it’s all international imports. With a culture so heavily invested in weed, this seems like a slam dunk long term.

BioPharmaCannaTech means nothing to me, I want something cool that the population will grab onto, even if it’s 5 years down the road. Companies can start building their brand right now before there is a wif of legalization.

Man, remember the CanniMed hostile takeover from 2018? Whatever happened to those guys?

Lol.

Yuck.

90% imports? That’s heaps mate

Australia presents such an interesting opportunity because the demand for the product is already there.

According to Marijuana Business Daily, industry group, Medicinal Cannabis Industry Australia (MCIA) estimated that at least 95% of current prescriptions and approvals for medical cannabis are being supplied by imported products.

The health department, for its part, estimates about 10% of prescriptions involved locally cultivated and manufactured products in 2019, the first-year federal license holders started local shipments. The remaining demand was met by international companies, mostly from Canada.

This tells me that there is loads of room for local Australian companies to establish their brands within the country, but none of the big names seem to really be talking about that yet.

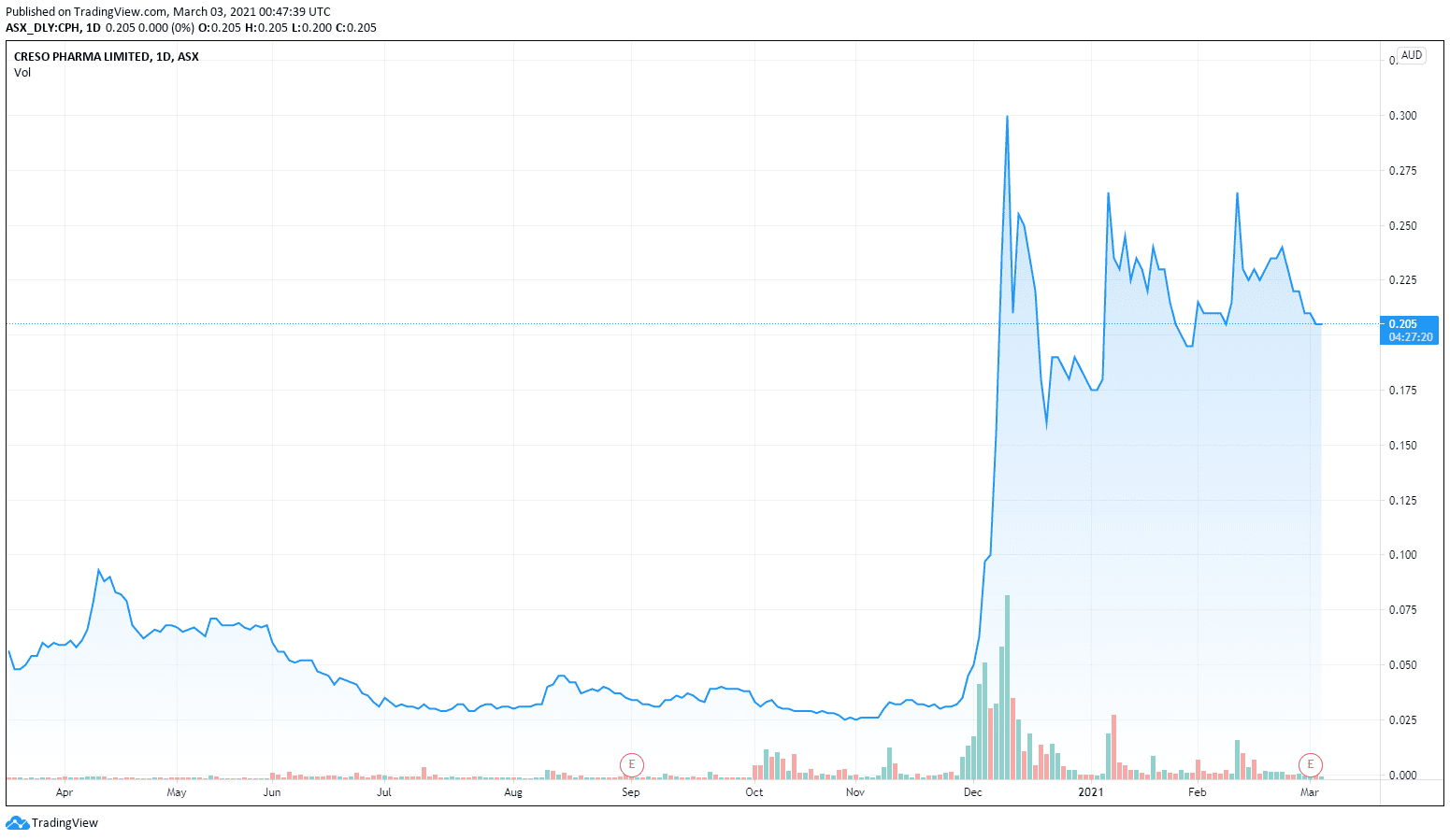

Creso Pharma (CPH.ASX) is a big name in the space, with a market cap of $209.8M AU. They were the first company to import medical cannabis into Australia, but are expanding their international footprint.

Their brand cannaQIX has a diverse product line of human and animal cannabis products that they distribute in Switzerland, UK, Germany, The Netherlands, and South Africa. Creso also operates companies in Colombia and Canada. Mernova Medical, the Canadian arm of Creso is run by two former Canopy (CGC.N) execs.

This seems to largely be what the bigger companies are doing, again it’s pretty CanniMed-ish.

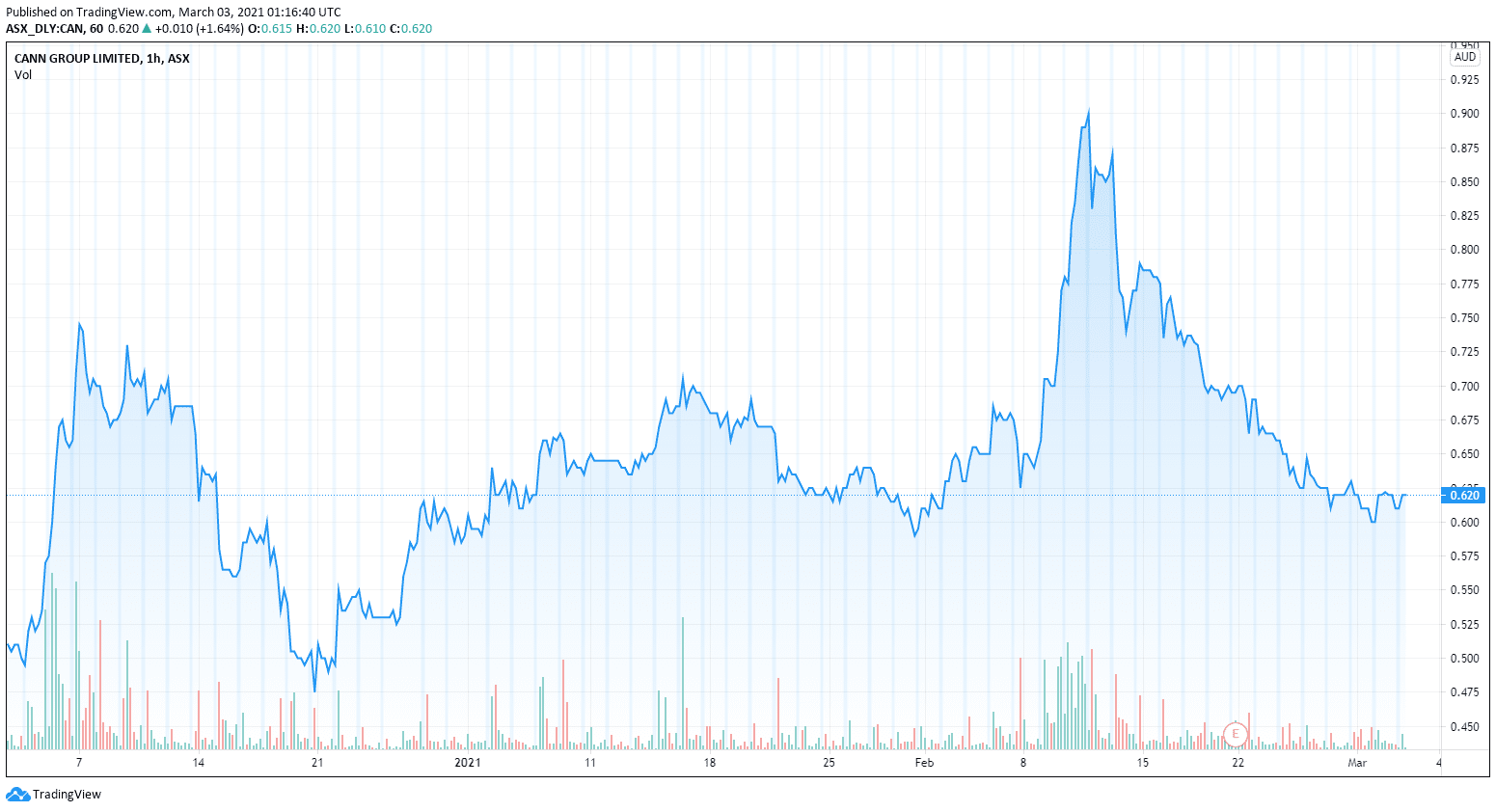

Cann Group (CAN.ASX) is another big name. In 2017, the company was granted Australia’s first cannabis research licence, as well as the first medicinal marijuana cultivation license. The company’s market cap currently sits at $190M AU, with 274M shares outstanding.

The company is projecting 8-10M in revenue this year.

Creso Pharma (CPH.ASX)

Cann Group (CAN.ASX)

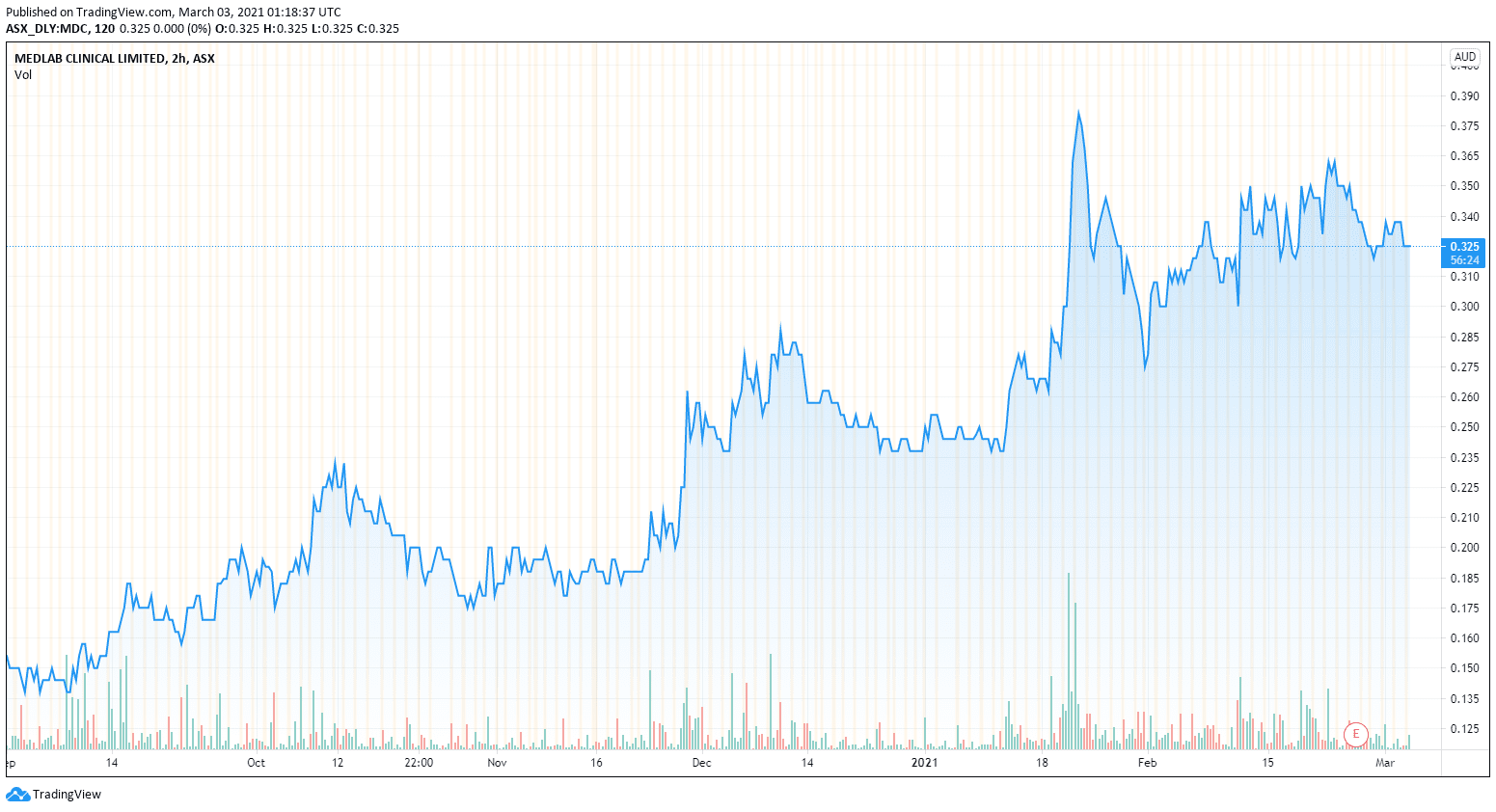

Medlab Clinical (MDC.ASX)

What’s the John Dory?

Old time cannabis investors may be concerned that top dogs in the space are only projecting $8-10M in revenue.

It totally makes sense to see the Australia scene as too small with just not enough growth potential to get excited about. The types of products they can sell in the EU are limited, and largely based around hemp CBD products that contain no THC, at least as of today.

While I am most excited about US cannabis right now after the political landscape has changed, along with catalysts like the FDA reclassifying cannabis which will open up new opportunities for banking transactions, a quickly changing political landscape (Dems running the show).

But most importantly it means potential capital raises from bigger, more traditional funds who were previously afraid to touch it. Not to mention a population of 350M+ people.

I don’t expect to see the same madness we saw here a couple of years back with Tilray shooting to $300 CAD per share in the Australian market. But I wouldn’t be surprised if these penny stocks make a run over the next few years because of the catalysts I mentioned earlier.

Australian cannabis has potential, so is investing in this sector worth it?

Some may be skeptical, this seems like a long shot that’s pretty far out, a lot of external factors have to line up with regards to laws and regulations changing, and that does not happen fast, but as an investor, I want to get in long before any of that happens.

This is definitely a long play as legalization is far away, but it may not be totally out of sight. While my focus is on the US cannabis market, specifically multi-state operators, some of these smaller countries might be nice under the radar penny stock YOLO plays that could become profitable way down the line.

I continue to be bullish on cannabis globally, so I see Australia is a nice side bet on a much bigger strategy.

So you went from ranting about how the AMPD was getting unfairly shorted to selling every share you had in 5 days ? What you do with your shares is 100% your business, it just seems like a quick 180 and it seems like you are not telling the full story here. Normally, I wouldn’t care, but with how close you are with the management of AMPD it’s borderline manipulative.

Full disclosure : I own share in AMPD and will buy more when I have a chance.

Where did you see me saying I sold every share I owned?

I’m buying, bruh.