On February 19, 2021, Tocvan Ventures (TOC.C) announced that it has started the next phase of exploration at the Pilar gold-silver project in Sonora, Mexico.

The stock surged 16% on the news.

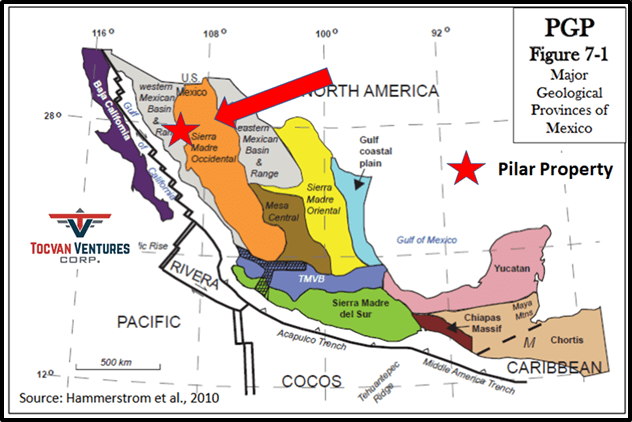

“Tocvan’s flagship Pilar Gold Project is located along the historic Sonora gold district within the Sierra Madre Occidental geological province,” wrote Equity Guru’s Greg Nolan on May 14, 2020.

“Sonora is a friendly jurisdiction steeped in the mining culture,” added Nolan, “It’s currently credited for nearly 37% of Mexico’s annual gold production (the country’s largest Au contributor).”

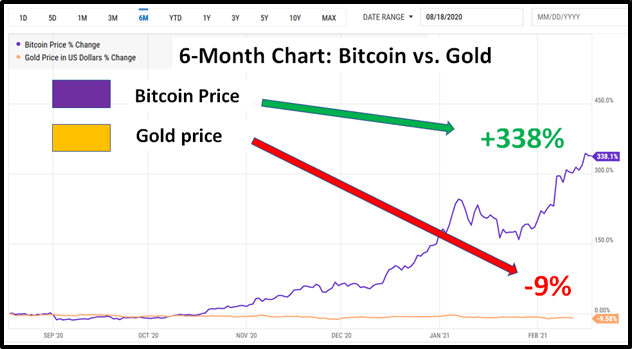

Can we deal with elephant in the room?

Is gold even a thing any more?

Or has Bitcoin condemned gold to “horse & buggy” status?

In recent times, undeniably, Bitcoin has been a better investment.

Historically, when any commodity or asset class is flooded with speculative investment from newbie investors – the bubble has popped – leaving an army of grievously wounded investors.

The Bitcoin price may not crash.

But if it doesn’t, that will be a first.

Gold has a long track record as a store of wealth.

Shaved flakes of bullion have been found in Paleolithic caves dating back to 40,000 B.C.

“Foul cankering rust, the hidden treasure frets,” wrote Shakespeare in 1602, “But gold that’s put to use – more gold begets.”

Gold demand rises and falls, but it never dies.

The following 2.5-minute corporate video gives an excellent overview of Tocvan’s current business objectives.

“Tocvan Ventures is an early-stage natural resource company that acquires, explores and develops mineral properties and works to advance them towards economic production for the benefit of shareholders.

We have two projects being explored and de-risked the polar gold project in the Sonora region of Mexico and the Rogers Creek property in the mining district of Southwestern British Columbia.

“Pilar is a highly mineralized gold property with very promising geophysical anomalies featuring a low sulphide epithermal deposit located on the Sierra Madre Occidental trend.

“Rich nearby mines with the same geology and metals are either already in production or have obtained production financing with relatively limited technical work.”

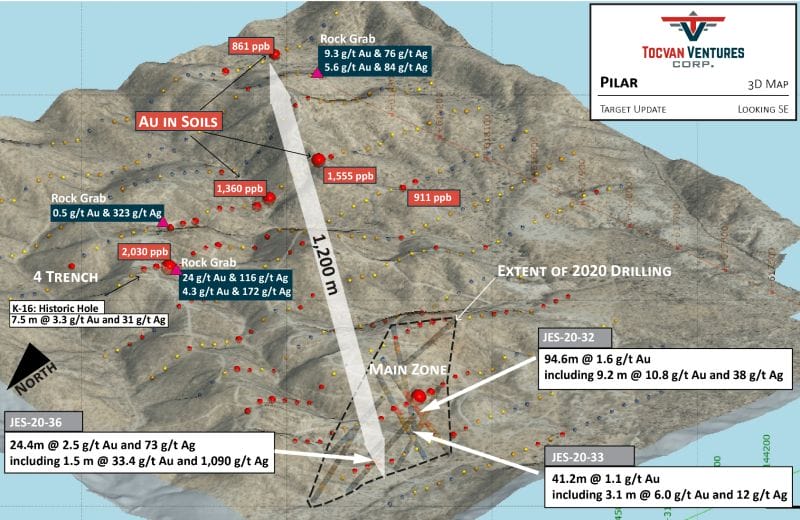

The work program announced February 19, 2021 will include detailed mapping and sampling of key targets across the Pilar gold-silver project.

The program’s objectives are “to advance key targets to drill-ready status for a phase 2 drill program planned in the next couple of months.

Key Target Areas:

- Main zone extension:

- 800-metre southeast extension of the Main zone:

- Historic drill hole JES-18-03: 13.5 m at 5.6 grams per tonne gold and 22 g/t silver;

- 800 metres of anomalous soils with values ranging from 106 parts per billion to 911 ppb Au;

- Rock grab samples including 9.3 g/t Au and 76 g/t Ag;

- 800-metre southeast extension of the Main zone:

- 4-Trench:

- 600-metre trend that includes the 4-Trench zone highlighted by:

- Historic drill hole K-16: 7.5 m at 3.3 g/t Au and 31 g/t Ag;

- 600 metres of anomalous soils with values ranging from 118 ppb to 2,030 ppb Au;

- Rock grab samples including 24 g/t Au and 116 g/t Ag;

- Network of historic artisanal workings.

- 600-metre trend that includes the 4-Trench zone highlighted by:

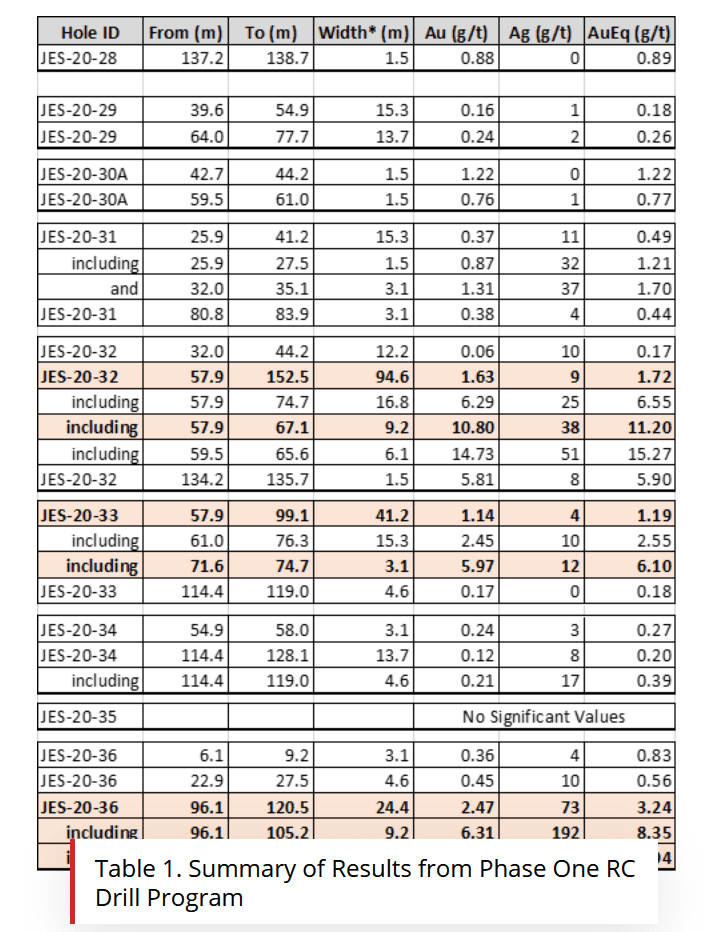

“The results released last week for our phase 1 drill program show the potential to grow the known extent of mineralization at depth and along strike,” stated VP of Exploration, Brodie Sutherland.

“The high-grade gold and silver intercepts provide evidence for deep-rooted structures, which we are just starting to uncover,” added Sutherland. “Detailed mapping and sampling of the surface expressions of these structures will aid in drill targeting as we move towards a phase 2 drill program.

In addition, the 4-Trench zone provides the opportunity to discover a parallel trend to the Main zone of equal significance.”

The Pilar gold-silver property is interpreted as a structurally controlled low sulphidation epithermal project.

Three zones of mineralization have been identified in the northwest part of the property from historic surface work and drilling:

- The Main zone

- North Hill

- 4-Trench

Structural features and zones of mineralization within the structures follow an overall northwest-southeast trend of mineralization. Over 19,200 metres of drilling have been completed to date. Significant results are highlighted below from previous operators:

- 17,700 m of historic core and RC drilling; highlights include (all lengths are drilled thicknesses):

- 0.8 g/t Au over 61 m;

- 53.5 g/t Au and 53 g/t Ag over 16.5 m;

- 9.6 g/t Au over 13 m;

- 10.2 g/t Au and 46 g/t Ag over nine m;

- 2,650 m of surface and trench channel sampling; highlights include:

- 55 g/t Au over three m;

- 28.6 g/t Au over six m;

- 3.4 g/t Au over 50 m;

In this MMC news Video, President and CEO Derek Wood shares his insights on the Tocvan, Mexico and his philosophy of raising money.

“Mining is risky,” states Wood, “And I don’t just mean from an investing standpoint. The actual act of mining is risky. Doing exploration work with drills and machinery. It’s risky, it’s very volatile. We try to make that that risk justified given our potential return.”

“We have all kinds of options for financing right now. We want to make sure we have enough money to execute the exploration program, but we don’t want to raise too much money because I still consider us way undervalued”.

Tocvan rose 16% today, from .62 to .72.

With 24.5 million shares out, TOC now has a market cap of $17.7 million.

Full Disclosure: Tocvan is an Equity Guru marketing client.