Brazil

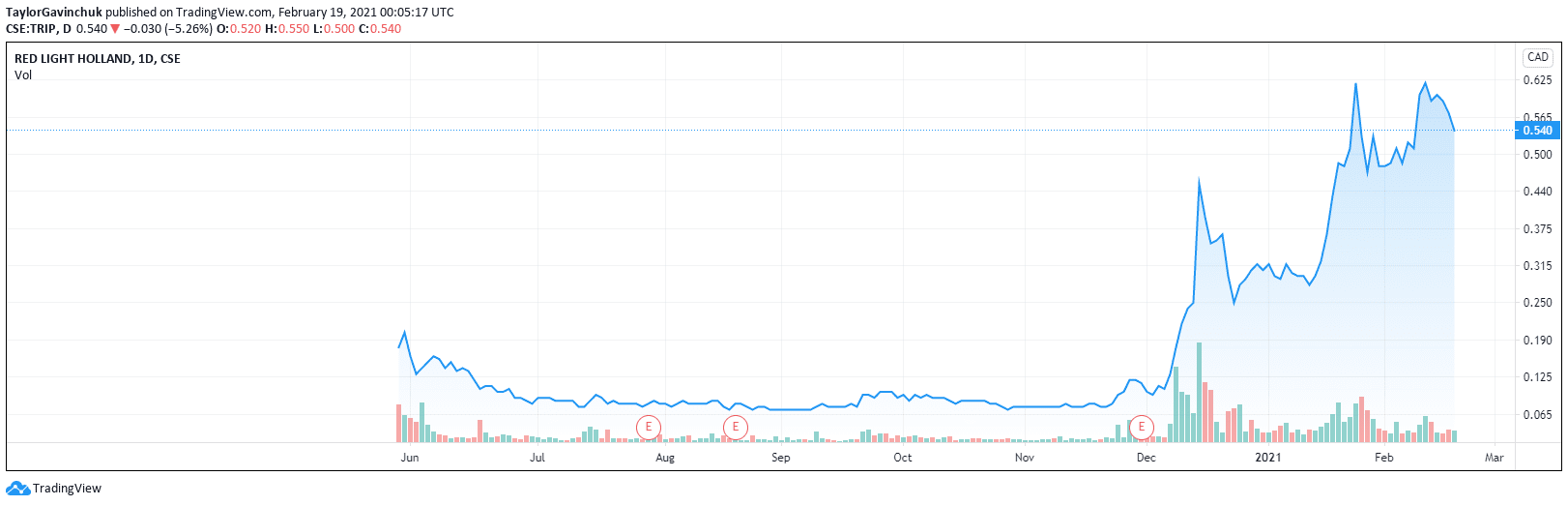

Red Light Holland (TRIP.CN) is going in the opposite direction of most of the psychedelics space.

It’s a gamble, but if it works it pays off.

Red Light Holland is looking to build a brand straight out of the gate, while letting other companies handle costly clinical trials. One one way they plan to scap is by entering into new rec markets, like Brazil.

Will selling psychedelics in countries like Brazil be profitable?

It’s hard to say.

Brazil does have a long history with psychedelics, as Amazonian tribes like the Huni Kui used ayahuasca in their ceremonies thousands of years ago. The World Ayahuasca Conference was eve held in the Brazilian Amazon last year. However, mainstream Brazilian society isn’t really taking about psychedelics all that much.

Brazil is known for having a strong counterculture and arts scene, so hopefully, at least in the short term before psychedelics really take off, there is an immediate market to penetrate.

Red Light Holland is partnering with Disruptive Pharma, a company with a foothold already in Brazil through their website mypharma2go.com. Their intention is to use Disruptive Pharma’s distribution, health technology, and knowledge of growing magic truffles.

Brazil has not decriminalized narcotics.

However, in 2006 Brazil changed its approach to those caught with drugs for alleged personal use. Although still a crime, instead of imposing prison time as a form of punishment, laws were created for alternative punishments.

The same punishment applies to those who, for their own use, plant, cultivate or harvest crops for the preparation of a small amount of substance or product capable of causing physical or psychological dependence.

To determine whether the drug was intended for personal use, the judge must consider the nature and quantity of the substance seized, the place and the conditions under which the actions developed, social and personal circumstances, and the person’s conduct and prior behavior.

Brazil isn’t the only new and emerging market Red Light Holland is going after, they are going after Jamaica as well, and are currently headquartered in The Netherlands where they sell products like a microdose kit.

A rec market?

While there is space to build a brand within psychedelics, almost all the capital is flowing to companies with large-scale medical plans, clinical trials, and new novel drugs. The Red Light Holland folks see this opportunity as cannabis 2.0, that there is an opportunity that the bigger biotechs are ignoring, or simply don’t have time for.

If MindMed (MMED.NE) spends 200M dollars to prove that psilocybin does xyz, companies like Red Light Holland could potentially benefit from that research as it proves the efficacy of their products, with no cost to them.

It’s almost like they get to outsource R&D for free, the problem is, however – access to the rec market, however big that may be.

Some spots like Oregon, and potentially California could open up, how much market exposure is that really?

And how often will you be raising capital?

The share structure is getting a bit wonky at 289M shares outstanding and only 7.9% insider ownership.

Sure, they don’t need nearly as much cash as a Compass Pathways (CMPS.N) or a MindMed.

Their CEO Todd Shapiro is an unknown in the public markets, which could be a cause for concern for investors. However, he does have Bruce Linton as an advisor who does seem pretty involved.

In terms of scaling a psychedelics company, I think Linton is a really good fit based on his previous role at Canopy.They have a good story right now, but, many other lifestyle brands can enter the market, and without patents or IP, they could lose value if they don’t make the right moves to stay relevant.

Lifestyle brands as future M&A targets

In cannabis we saw more and more hip, non-sciency/medical/biotech-y companies entering the space with a promise of a sexy brand, and lean ways to growth hack new and emerging opportunities. With so many companies entering the space, differentiation was really tough, it had to be done with brand and story.

Once the industry realized brand trumped funded capacity, bigger and more established companies like Canopy started buying up smaller companies like HIKU.

I do trust Linton as an advisor when it comes to scaling a company, especially one that requires follow tight regulations. Their story could get muddy if formidable competition enters the race.

If Red Light Holland can continue to be an attractive asset with a good story, I also see it being a potential M&A target for some of the bigger fish in this space if they want to pivot to the rec market due to potential regulatory changes, it’s totally within the realm of possibility.