LiteLink Technologies Inc (LLT) integrating truck driving and artificial intelligence!

Taking a break from some of the high-profile highflyers in today’s market (GME, TSLA, AMC, BB ) we’re going to take a moment to appreciate the collaboration between artificial intelligence and trucking.

I know at first this seems absurd. Who in their right mind would have thought a company would profit from the marriage of AI and traditional trucking? When we think traditional trucking, we’re thinking big rigs, late nights, and sketchy gas stations – nothing technologically apparent there.

LiteLink Technologies Inc (formerly AXS Blockchain Solutions Inc) is a business that is tearing up the market with its innovative technology. Their common stock is up nearly +1450% (yes, you read that right).

This Vancouver based firm offers several services in the software development and consulting sectors. The business is dedicated to revolutionizing the trucking and payments industries by creating applications with artificial intelligence, smart contract technology, and digital remittances.

The Company is developing two main products 1Shift Logistics and the uBUCK voucher service.

1Shift Logistics (“1Shift”) is an end-to-end logistics management solution that enables real-time transparency & tracking. On top of that, it also enables peer-feedback and regulation. Users can make tactical and strategic decisions based on accurate, real-time data to stay ahead of the competition.

Former CEO Ashik Karim believes their technology has helped hundreds of thousands of truck drivers navigate their logistics more efficiently. He estimated that back in 2011, truckers used an average of $10,000 a month on logistics and had to access these services from various third parties.

Because of this high cost, LiteLink saw a major business opportunity to create platforms that would integrate the needs of the trucking industry in one easily accessible source. They created one application that did everything for truck drivers. The video below does a better job of describing the platform for those interested in the details.

1Shift improves resource allocation and efficiency through planning tools and historical analytics, directly improving profitability. The 1Shift model was designed to support the “mom & pop” shops as well as the largest logistics companies in the world with ease.

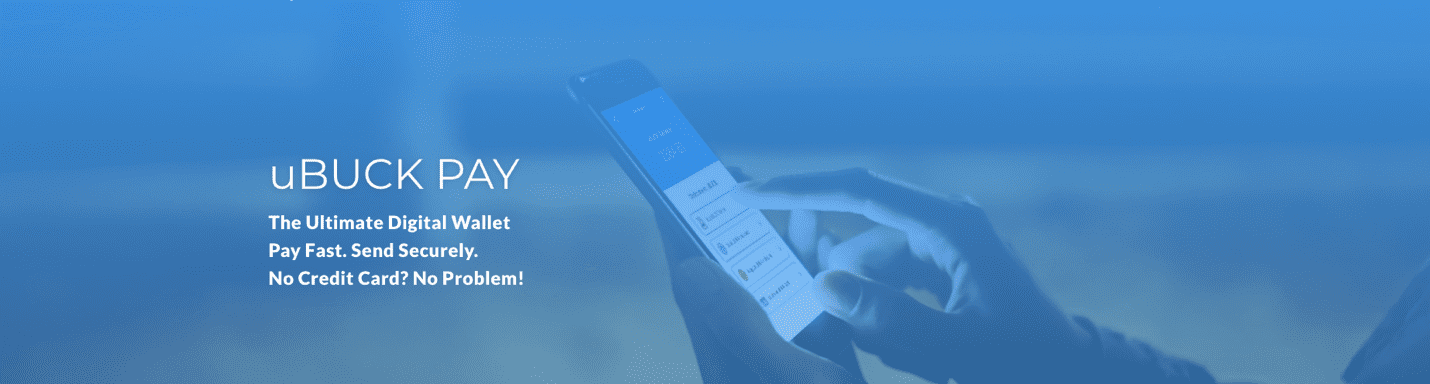

Their second flagship platform is the uBUCK voucher, a prepaid voucher that allows you to top-up accounts and make payments with absolute security. Vouchers may be redeemed for uBUCK cash to make payments to friends and family around the world within minutes. Basically, the system works the same way as Venmo, PayPal, etc. The prepaid voucher system is a new and upcoming system that is aimed to target people that are either unserved or underserved by the banks, especially those constantly traveling through less populated or urban areas.

Now to the financials. It’s logical to tell yourself that all this innovation and high-flying stock prices must mean the business is generating an equivalent amount of retained earnings and profits for shareholders. If you dig into the details (actually don’t, I’ve summarized it here for you), you’ll see that it’s all to the contrary. As of the nine months ended November 30, 2020, LitLink generated a total of $2643 in revenue, while utilizing $673,398. This was a decrease in revenue of 98% compared to the same nine-month period in 2019 (and an even greater reduction in usable assets of 44% from $1 million to $600,000).

The majority of this reduction in total revenue is due to the coronavirus (surprised?). Because business is slow, the management team has opted to raise money through notes payables (debt) and lease obligations. Their total liabilities have ballooned by 147% from $503,281 to over one million dollars. These liabilities directly affect the economic value of the business over time.

Usually, debt obligations are just that, obligations to pay your debt! Most of the time firms like LiteLink have interest rates on their debt between 3% to 10%. These high debt obligations come from the fact that the business has uncertain cash flows. Usually, to cover this shortfall in cash flows the business has to put up collateral to cover those interest payments if the economic climate reduces earnings.

These interest payments indirectly come from the pockets of the shareholders, reducing the operating earnings and retained profits. This compounding of negative earnings is reflected in the deficit of – $22 million on LiteLinks’ most recent balance sheet. This is the best representation of value destruction at work. Shareholders are currently in the hole by about -$573,243.

So why is the stock up by over 1000%?

Their last press release was in September 2019, so there is nothing material that has occurred. Is it because of the well-crafted story and the integration of artificial intelligence and blockchain technology? No, it was simply financial engineering magic.

CEO Peter Green announced that the firm will be conducting a reverse stock split. As of February 2, 2021, the common shares of the company will commence trading on a post-consolidation basis. There were 178,421,776 common shares of the company outstanding on the day of the announcement and the new structure would have approximately 71,368,710 shares outstanding. This action consolidates the number of existing shares of stock into fewer, proportionally “more valuable”, shares.

The reason for this consolidation is not clear in the CEO’s press release. It could be for a number of reasons and often signals a company in trouble since it raises the value of otherwise cheap shares.

The main benefit of a reverse stock split is that :

The new consolidated per share figures prevents the ticker’s removal from major exchanges. Usually, stock exchanges have a stipulated guideline on the minimum price for a stock to be listed. If the stock consistently falls below this minimum and remains lower than the threshold level over a certain period of time, the business risks being delisted – and losing access to that associated credibility and investment funds.

Most market participants don’t favor reverse stock splits because it indicates that the stock price has gone rock bottom, and the executive team and the board of directors are attempting to inflate the prices artificially without any real material business actions. (this financial maneuver is the polar opposite of what Tesla did).

This sort of situation happens when a business has already printed too many shares to raise capital and is not able to raise capital through day-to-day operations. This printing of shares reduces the intrinsic value of each share owned and makes the market pessimistic about the future prospects of the firm even when it has a great innovative product.

What does this teach us as investors? I personally feel that it teaches us to watch a few things when analyzing an investment in “penny stocks”.

The first thing to watch for is how much corporate managers and directors are printing of the common shares to the open market. If you think about it, you don’t want to be involved with a business that willingly reduces its intrinsic value by printing too much of its own “currency”.

This sort of rapid printing has happened in larger economies, for example, Zimbabwe in 2008 and 2020 when inflation reached over 1000%. This meant that each Zimbabwean dollar was worthless as they printed more. The same mechanical behavior is evident in the excessive offering of common stock to the public.

The second lesson is that, if a business continues to print shares, but is unable to bring back an equivalent amount of operational efficiency over time, this is an early sign of a firm that might not be a great investment.

It’s always good to remember that a great business can be a bad investment if bought at the wrong price with managers that think like renters and not like owners.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.