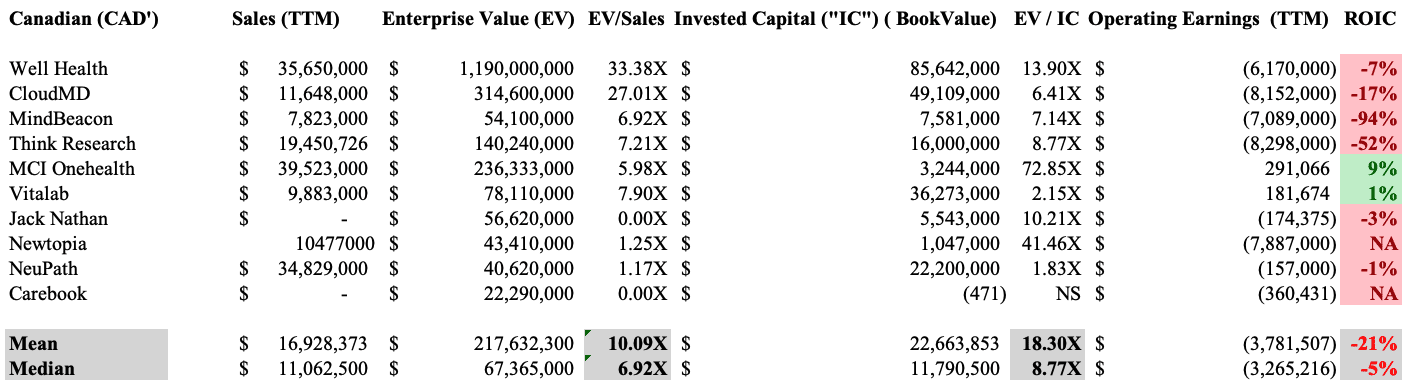

Most people have recognized that the businesses in the list below are the top investments of the last decade or so. To be honest I’ve noticed so many new investors jump into these stocks just because of their notoriety.

It’s probably best not to look at platforms like tik tok for your financial advice, but I can’t help but watch a constant stream of people doing silly dance crazes, it just pleases the soul.

But I feel as the market trends down today it’s important we recognize some of the limitations of the investment techniques used on popular platforms. One of the biggest flaws I’ve seen is the ‘buying the dip fallacy’ on these particular stocks no matter what the price is. To be honest I think a lot of people use this technique no matter what’s happening even if it’s an ‘up’ day.

I must confess, by looking at the numbers in the table above it’s pretty clear that in the last 10 years if you had made an investment in the stocks of any of these businesses you would have done exceptionally well especially Tesla and Netflix stockholders.

For example, if you had bought $1000 in shares of Netflix 10 years ago and added nothing to your initial principle you would have just above $75,000 today. If you had done the same with Tesla, you would have just below $150,000!

This does put a thorn in my side, especially if my premise is that these are good businesses but (insert Reddit joke) I don’t like the stock.

This brings me to the actual statement that I feel should be followed by any individual or institution that invests in individual companies :

“A great business can be a bad investment if the marketable securities of said business are bought at an inappropriate price.”

On the surface, this seems simple enough to understand, but from current market trends, I think there is a disconnect somewhere. So, I’m going to do what every market participant does and offer my opinion on what I think the statement means but you’re always free to disagree.

At first glance, the most important parts to understand here are what a great business is, what a bad investment is and what an inappropriate price.

“A great business…”

This is probably the most important part of the sentence. In my opinion, this is the only part of three statements that can be consistently measured by quantitative and qualitative data. I’m not going to be ‘that guy’ and get all preachy about cash flow or gross margins as the quintessential element for qualifying a great business. On the contrary, I’m going to offer my own definition of what a great business is.

Nonetheless, in my definition, there are tried and tested ways to know that what you are describing is a great business using traditional methods like cash flow and gross margins.

I feel a great business is one that can be understood by the market participant after conducting some due diligence. Once the investor has understood their business, they need to have an appreciation of the long-term and short-term economics of the business and its overall industry.

This is the best definition as it allows the investor to appreciate companies that they have a statistical significance in when it comes to understanding the economics of the underlying business.

“…bad investment…”

Now that we have an understanding of what a good business can be. We can also appreciate that just because the business meets certain standards does not mean it automatically qualifies as a good investment.

For it to be a good investment the price has to be appropriate.

“…bought at an inappropriate price”

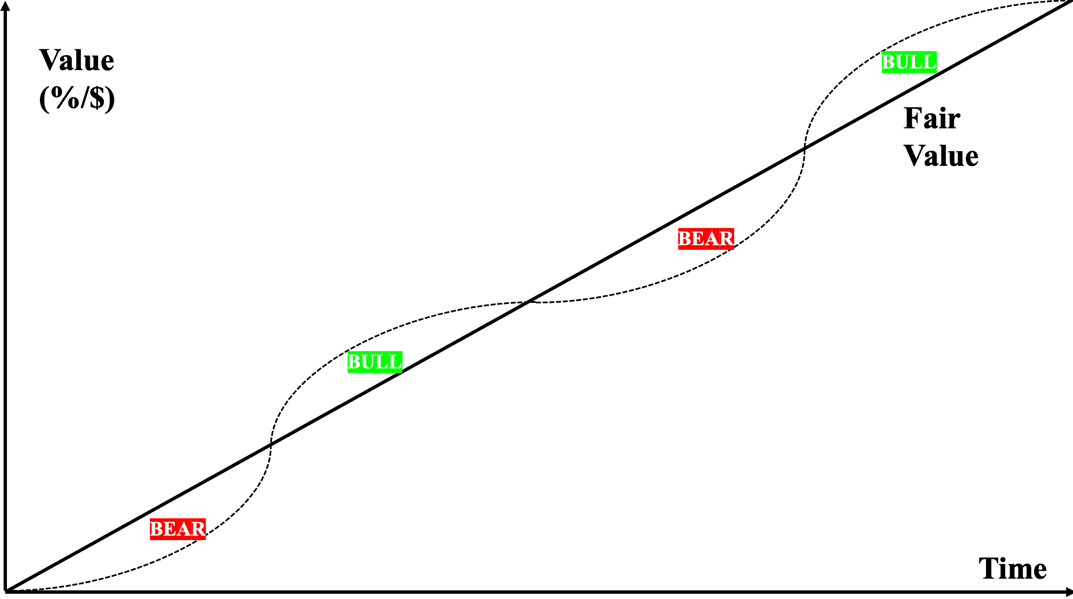

It’s usually easier to do backward induction and find inappropriate prices than it is to find appropriate prices. Over most investors’ careers, stock prices are inappropriately priced. This is due to the supply and demand dynamics in the market over the short term and the fundamental value over the long term. The stock market has a tendency to overreact during market cycles. This means when it is optimistic and business profits are booming along the market overreacts to any good news, this goes for bad news as well.

Some economists believe that we have a psychological bias towards the downside compared to the upside. They have noticed a tendency by market participants in an exchange market to react more to a reduction in the value of $1 compared to an increase in the value of $2. We enjoy profits less than we fear loss!

As investors, we simply hate having red days and tend to do the opposite of what we’re actually supposed to be doing in those moments having an adverse effect on our total earnings. This means we buy more stock when we see a positive value than when there’s a reduction in value. Academics have fine-tuned this by defining investment risk as a negative return (negative volatility) on an individual asset or portfolio.

Of course, I can tell you all theories in the world but what would really emphasize the point would be a live example from a recent crash where the market overreacted and under-reacted to information.

Intel and “yield degradation” saga of 2000

“A great business…”

Intel is an American multinational corporation and technology company headquartered in Santa Clara, California, in Silicon Valley. It is the world’s largest and highest valued semiconductor chip manufacturer on the basis of revenue and is the developer of the x86 series of microprocessors, the processors found in most personal computers.

“…bad investment…”

We all own some sort of personal computer today, and we might not need to know the inner workings of the device and how it actually works to understand and appreciate how Intel makes money. Most people can appreciate that there is some sort of infrastructure behind their personal computers. This recognition of the infrastructure allows people who have an edge on the industry to understand what is going on in the underlying business, but anybody could pick up an Intel 10K and read into the business as well.

The business is obviously a good business because it’s still around today, but back in 2000 it reached a high price of $74.00 per share and at the end of the year the stock was down to $30 per share. This was during the .com era where people were buying up technology just because it had .com at the end.

- Boo.com

- 3Com

- Chemdex.com

- eToys.com

- Flooz.com

As people’s optimistic view of a new age of technology and innovation increased, stock prices reached abnormal valuations. At one point the S&P 500 was selling for 45 P/E. The average P/E in the last 10 years has consistently been around 14-16 times earnings. Meaning the market had a premium of just over 300%!

“…bought at an inappropriate price”

The current price of $60 per share is still below the high in 2000. Meaning investors who bought at the high price of $74.00 per share overpaid. Over the last 20 years, those who bought the Intel stock are down -16%. More likely than not, those who did buy at the peak sold their stock at a loss at the first sign of distress in the market realizing a loss of greater than -40%.

In the same period, revenue grew at a compound annual growth rate (CAGR) of 6% per year from 43 billion to 77 billion in 2020. The company grew free cash flows by 7% per year from 11 billion to 21 billion in the same 20-year period.

Not only was Intel profitable and generating sustainable cash, but it also grew its equity base by 5% every year from 50 billion in 2000 to 81 billion in 2020.

This means those investors who speculated in the stock at the highs of 2000 are yet to break even on their stock purchase although the business has been consistently profitable and growing over the last 20 years. In the same period, Intel has established itself as a market leader and a multinational brand. But the purchase of this great business in 2000 made it an unprofitable investment.

Those of you who are more cunning will notice a purchase at the low point of 2000 at $30 per share would have generated unrealized gains of +83%. Same stock different outcome. However, it is obviously not that simple, because of the bias to red days we discussed above.

Knowing this I ask the reader to look at the businesses in the table above and go through this simple 2 step process with me to appreciate that we might be experiencing the same optimism we did in 2000 in certain companies today.

(This section can be skipped)

**********************************************

Business – is an American technology conglomerate that was founded by Mark Zuckerberg in his University dorm in 2004. He is currently the largest shareholder and the chair of the board meaning his interests are those of a landlord and not a renter in the company. Facebook has been able to consistently go grow cash flow and revenues over the last 10 years.

Price – its stock is up 500% over the last 10 years and is trading at a P/E multiple of 25 times earnings.

Amazon

Business – is an American technology and e-commerce conglomerate that was founded by Jeff Bezos in 1994. He is currently the CEO and the chair of the board meaning his interests are those of a landlord and not a renter in the company. Amazon has been able to consistently go grow cash flow and revenues over the last 10 years

Price – its stock is up 2000% over the last 10 years and is trading at a P/E multiple of 74 times earnings.

Apple

Business – is an American technology conglomerate that designs, develops, and sells consumer electronics, computer software, and online services. It was founded by Steve Jobs, in a garage in 1976. Apple has been able to consistently go grow cash flow and revenues over the last 10 years.

Price – its stock is up 1500% over the last 10 years and is trading at a P/E multiple of 33 times earnings.

Microsoft

Business – is an American technology conglomerate that was founded by Bill Gates in 1975. It develops, manufactures, licenses supports, and sells computer software, consumer electronics, personal computers, and related services. Microsoft has been able to consistently go grow cash flow and revenues over the last 10 years.

Price – its stock is up 600% over the last 10 years and is trading at a P/E multiple of 35 times earnings.

Netflix

Business – is an American streaming platform that was founded by Reed Hastings & Marc Randolph in 1997. Netflix has been able to consistently go grow cash flow and revenues over the last 10 years.

Price – its stock is up 6000% over the last 10 years and is trading at a P/E multiple of 90 times earnings.

Business – is an American technology conglomerate that was founded by Larry Page & Sergey Brin. Google has been able to consistently go grow cash flow and revenues over the last 10 years.

Price – its stock is up 500% over the last 10 years and is trading at a P/E multiple of 34 times earnings.

Tesla

Business – is an American is an American electric vehicle and clean energy company Founded by Martin Eberhard and Marc Tarpenning.

Price – its stock is up 18,000% over the last 10 years and is trading at a P/E multiple of 1000 times earnings.

**********************************************

It goes without saying, but I shall say it anyway, that I could be completely wrong, and this bull market will continue for the next 10 years allowing these companies’ stock to skyrocket even more. The GameStop(GME.NY) fiasco sheds light on the fact that the market is fundamentally weak, and people are finding many reasons to extract value from it. This sort of dumpster diving has proven to be an inaccurate & ineffective way to view the market. In the long term, those who take part in short-term speculation tend to regret their choices when they have less time to invest later on in their lives and need to ‘make-up’ lost realized gains.

It’s fun watching your portfolio go up +50% in two days and you feel 50% smarter, but just remember if the opposite happens you have to feel 50% dumber.

“A great business can be a bad investment if the marketable securities of said business are bought at an inappropriate price.”

“A great portfolio of businesses can be a bad investment if the marketable securities of the said portfolio are bought at inappropriate prices.”

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.