It has been quiet from the WallStreetBets crew. Until Yesterday, where we saw an amazing pop in Gamestop (GME) in the last hour of trading, even seeing a pop of 103% after hours!

In fact other WallStreetBets (WBS) favorites including BlackBerry (BB), Koss Corp (KOSS), AMC Entertainment (AMC) and Naked Brands (NAKD) saw nice green daily candles at the close. A combination of the WSB retail crowds ‘holding the line’, and a lot to do with Jerome Powell easing market fears of inflation and interest rate hikes, which saw US Stock Markets pop and saw the Dow Jones breakout into all time record highs.

Is this a Short Squeeze round two?

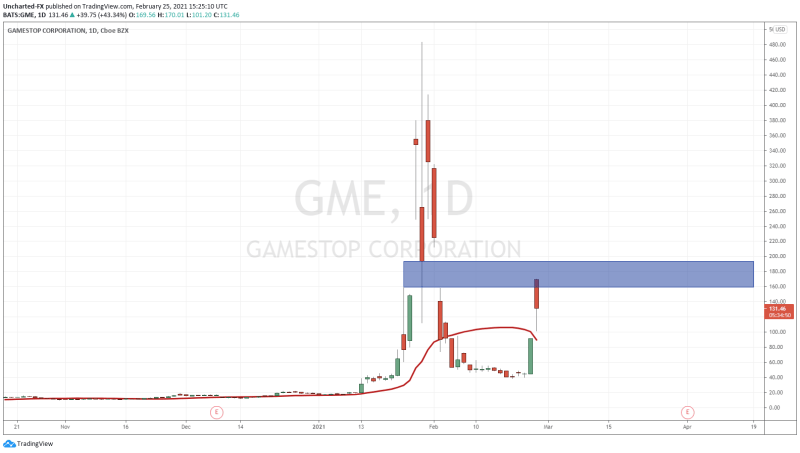

Going to shortsqueeze.com, the short interest is nothing compared to levels during the first epic short squeeze, but still enough to create a substantial move. The short percent of the float for GME comes in at 30.23%, and there is no data available for AMC.

In terms of some fundamentals for the ‘meme’ stocks, Gamestop (GME) yesterday announced the departure of their CFO Jim Bell…and financial media is attributing the 103% pop on this news.

The company announced Tuesday that Bell will resign on March 26, with reports suggesting that Ryan Cohen – GameStop investor and co-founder of online pet food retailer Chewy — and the board forced the move in order to accelerate its transition online.

On the AMC side, we have had news that theatres would be allowed to re-open in the state of New York starting next month.

To be honest, if I were to take a trade on these two, it would be AMC. As you will see shortly, the technical chart looks better in comparison to GME, and this fundamental news on re-opening can give the stock some more momentum.

Before we delve into the technicals, a reminder that AMC was meeting our market structure reversal pattern when the stock was trading around $2.00. Way before the WSB crew jumped on it. The support bounce at $2.00 was given to the members of our Discord Trading Room, which can be joined by clicking on the Discord icon at the top of the page with all the other social media icons.

On the Canadian side, Cineplex (CGX) has been our AMC sympathy play. I wrote about the chart a few weeks back, and will do an update soon. Cineplex has broken out and triggered the trade as discussed in that Market Moment post.

Technical Tactics

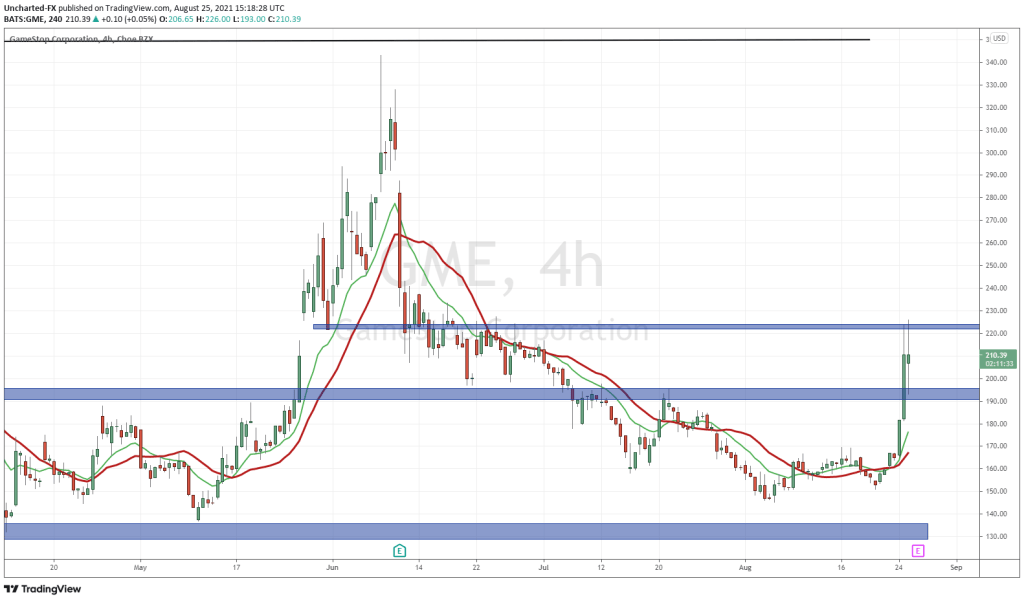

Reacting to the GME pop yesterday, I mentioned to our Discord Trading Room members that GME popped after hours right into the gap between $160-$195. Ideally, we would have wanted to see an open above the gap. Why do I say this?

Gaps are powerful resistance and support levels. In this case, the gap acts as resistance or a price ceiling. We tend to see sellers enter here and battle against the bulls. So I am not surprised we are seeing a retreat here, and a red candle.

In trading, you have probably heard the term ‘gap fill’. It is exactly how it sounds. Price rises and fills the gap. In the case of GME, this would mean a close back above $195, and therefore filling the gap. Gap fills are extremely bullish because it indicates that this wall of sellers and bears have been taken out. We tend to see a momentum higher once the gap is filled.

So going forward, I would watch to see if GME surges and makes a run up to $195. You could even front run the filling of the gap if price action is strong and then ride the momentum.

In terms of support zones…well there really isn’t a strong level to work with. Some would argue the $90- $100 zone since it is a psychological number. Just changing my chart from a candlestick chart to a line chart shows me a zone of interest back down at $63. But perhaps GME ranges for a few days to create a better support level that we can work with.

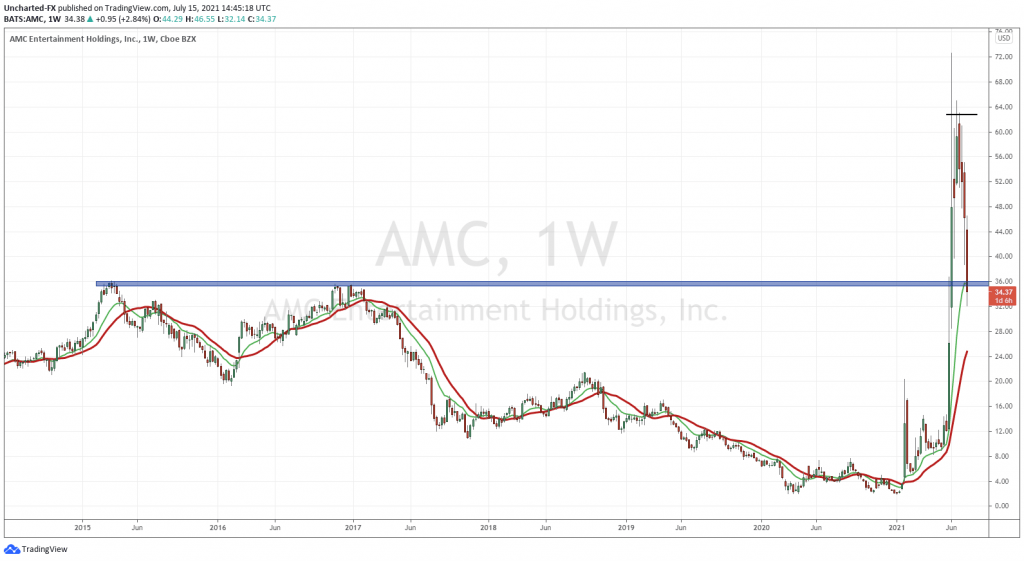

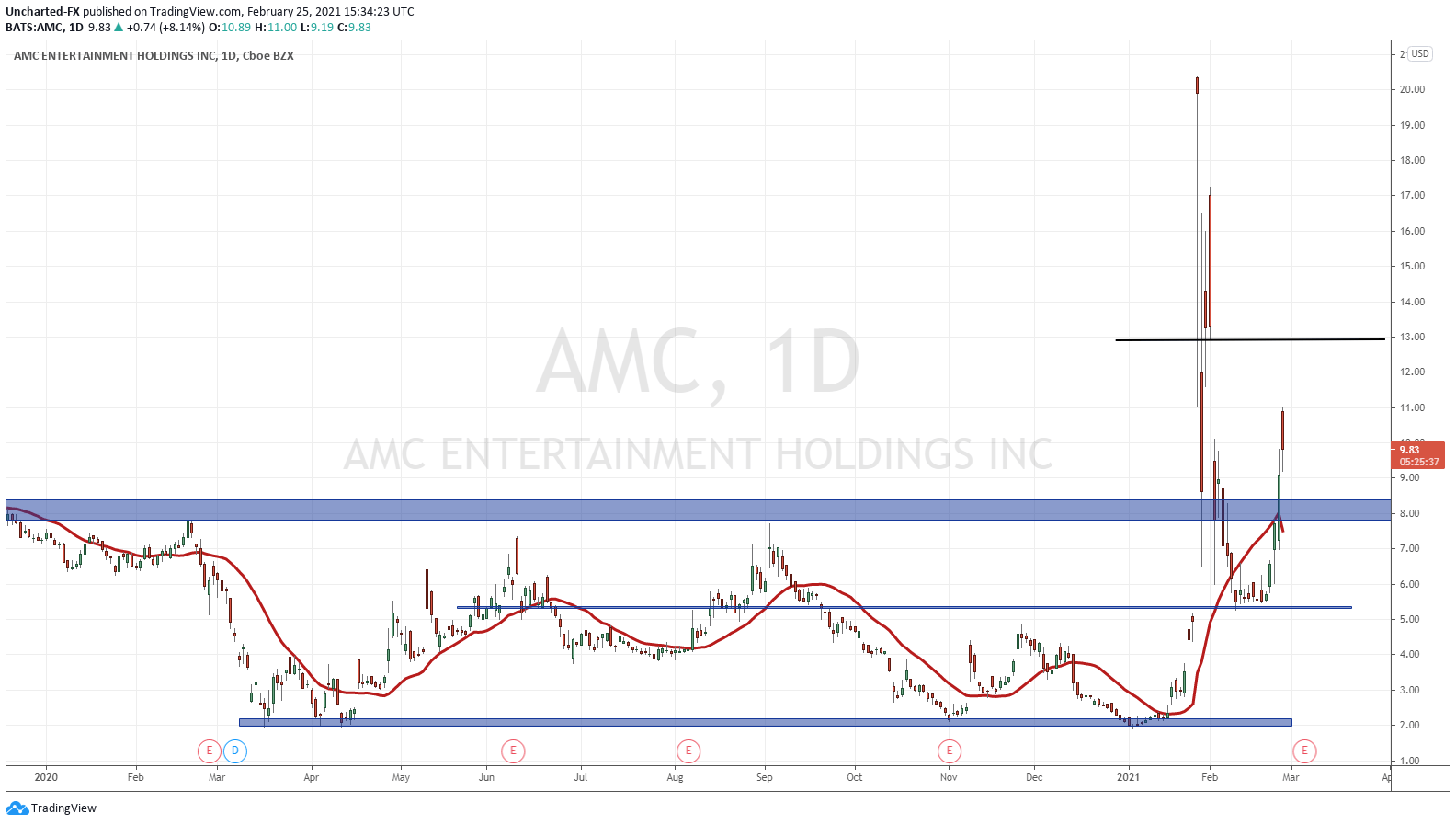

This is a chart that looks much better. I think AMC is a better chart to trade as we have good support levels, and breakouts to work with.

Firstly, notice where price currently is. Yes, there is a gap as well, and sellers are stepping in. $13.00 needs to break in order to see this gap filled.

I want to direct your attention down to $5.00. It was a major flip zone for us, which we have been watching for sometime. It was actually our first take profit target before the WSB momentum. Notice how the stock ranged above $5.00 for 8 trading days. Support held, and buyers stepped in.

I now want to direct your attention to $8.00. This is our major resistance zone. In the initial short squeeze move, we were hoping that buyers would step in at $8.00. After a few days battling at that level, the sellers managed to break support and drive prices lower.

Now, we have resurfaced back above $8.00 with yesterdays close. This is very significant, and an important technical breakout. We want to maintain candle closes above $8.00 for this bull trend to continue its momentum.

As long as price is supportive above here, we can fill the gap and continue higher. The chart looks good, and the fundamental news about re-opening is great. Let’s also not forget that movies like Godzilla vs Kong and Zack Snyder’s Justice League are coming out next month, and there is a populace itching to go out and do normal things again. The fundamentals seem a bit more based in reality compared to GME.

The only thing that can go wrong is an overall broader stock market sell off… or brokers restricting trades.