Here. She. Is.

I have received 23 emails anticipating this article and at least half of them are not from family and friends. Which is to say, I have never felt more desired in my life.

As you surely know, this GameStop surge is quite momentous (seeing how it has infiltrated even the most financially averse, art-ridden social media pages – i.e., my own).

For one, it is the first time since the 2008 financial crisis that the sector has been deemed newsworthy outside of itself – and dare I say, sexy?

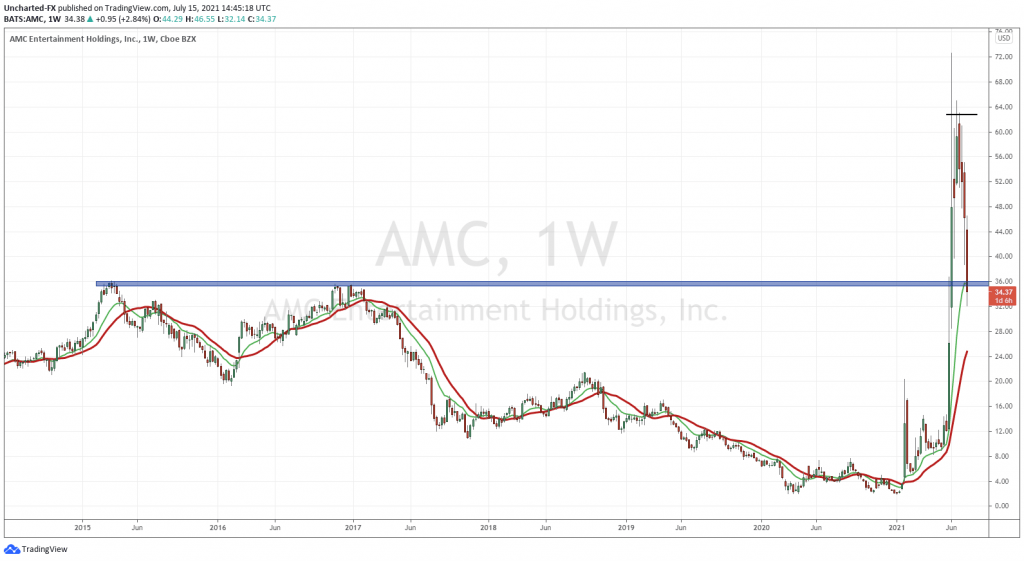

Two, a Reddit subgroup called WallStreetBets became popular and took with it the nostalgic likes of GameStop, BlackBerry and Nokia. This is like if Billy Ray Cyrus opened a club that exclusively played Achy Breaky Heart (where the English language went to die) – and it then became the most popular joint on earth. This is to say, a wildly uncool thing (Reddit) somehow made other wildly outdated things (like BBM), the hot, trending topic of the week.

And for three, in all sincerity, it is a moment to pay witness to the viral spread of ideas, the determination of community being vastly undervalued, and the ways in which Wall Street will commit shocking violations in plain sight in order to protect the wealthy.

So, let me try and succinctly explain to you the GameStop saga before a man named Chad does without asking.

Majorly Simplified:

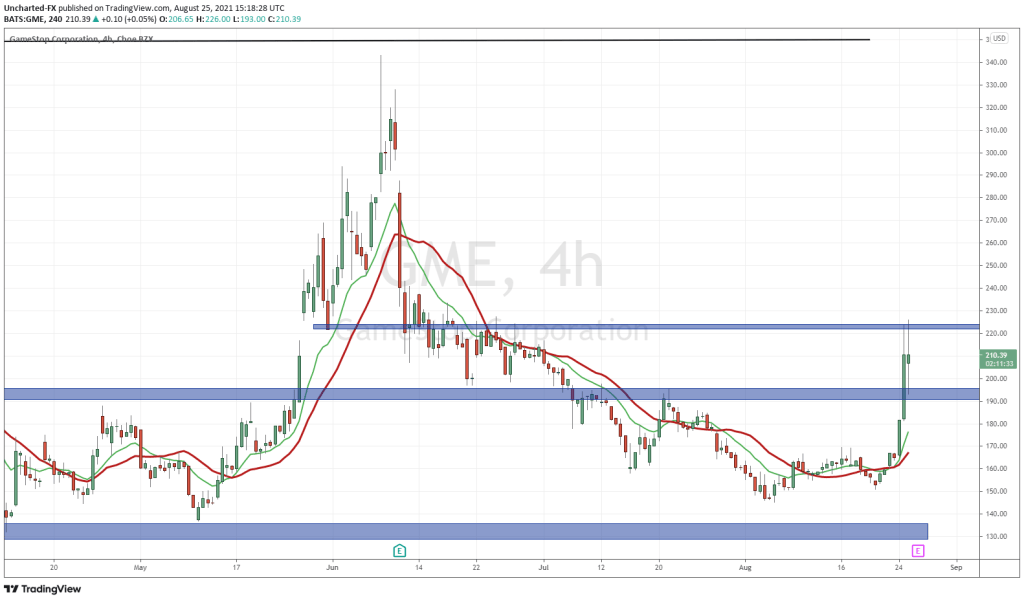

In case you missed it (and if so, what rock are you hiding under and could I join?) the everyman investor used a Reddit message board to boost the stock price of video game retailer GameStop. Deep-pocketed hedge funds viewed GameStop as a mall-dinosaur destined to go the way of capri pants (deservedly) and record stores. Nostalgic gamers and small investors alike didn’t much care for their childhood to be bet against so aggressively and decided to buy a ton of GameStop stock. This rose the price as much as 3,000% which, in money speak: the market cap went from $300 million in August 2019 to $20 billion at the end of January 2021. In turn, it caused a few Wall Street hedge funds that had heavily “shorted” the stock to lose billions.

What is short selling?

Since the simple act of buying and selling isn’t enough for the man’s club that is the stock market, they thought – let’s make an addendum.

I will explain short selling with only figures I understand:

Gertrude Stein is holding some shares of GameStop.

Picasso, as her friend, is feeling bold and asks if he can borrow her stock, he says:

“Don’t worry, I know I appear unhinged, but I promise to give it back”

Gertrude is too cool to care (ugh, love her). She lets him borrow.

Picasso sells GameStop to a lesser Parisian artist for 20 euros.

Problem is, he still owes Gertrude her stocks (!!!) (by a given date they’d agreed upon).

Picasso has to buy back the stocks but believes he can buy it at a lower price – he is betting against GameStop (a fair bet, it is wildly out of vogue and displeasing to the eye).

When the stock goes down, Picasso buys it back for only 5 euros.

He gives it back to Gertrude, remains a man of his word, and pockets 15 euros.

This is the art of the short sell.

What is a short squeeze?

This term has been tossed around an inordinate number of times these past few weeks and only makes me think of orange juice or otherwise something sexually unpleasant.

A so-called “short squeeze” means that not only do short sellers (our Picasso’s) have to buy the stocks at a higher price than the price at which they borrowed and subsequently sold them at – but their buying ends up driving the stock price even higher. This then triggers more short sellers to close their positions by buying the stock back as well – and so goes the squeeze.

Like Augustus Gloop in the chocolate pipe. (I spent 10 minutes trying to sort a visual and appallingly this was the best I could do).

How did Wall Street respond?

Cue kicking and screaming.

On January 28th, Robinhood – a popular brokerage having gained notoriety for democratizing trading to the ‘regular people’ by making it cheaper to trade – limited the ability of its users to trade GameStop and other “vintage” companies targeted by Reddit investors. Accusations abounded of Robinhood investors allegedly being forced to sell their GameStop shares – which, coupled with the new inability to buy more, plummeted the stock price.

You’d be right in thinking this seems like convenient timing, since coincidentally billionaire hedge funds were then able to close out their shorts at better rates than originally predicted, while our everyman was locked out (your tinfoil hat is looking pretty solid there, my friend).

Robinhood’s behavior has resulted in bipartisan criticism from lawmakers who claim that the brokerage was favoring big institutional traders over small investors. You know something unkosher is going on when Ted Cruz retweets AOC stating, “fully agree”.

In simple terms, Wall Street couldn’t take that the people beat them at their own game, so decided to flip the Monopoly board before they had to give up all their money. And further, laughably, horrifyingly justify it as a means to protect the “little man”. As if the middle-lower class Redditors couldn’t wrap their tiny brains around the dangers of volatility in the market and Robinhood, as an act to safeguard, blocked them from continuing to trade.

Lecture: Volatility cannot only work when it suits the insiders. Volatility cannot only be managed by the rich. You can’t change the rules without telling anybody in the middle of the game.

I.e., Ken Griffin, founder of the billionaire hedge fund Citadel made $6.7 billion on the volatility of the pandemic. (In all fairness, these people have yachts, COVID-”safe” private parties and mansions to pay for).

And no, the brilliant literary irony is not lost on me. The investing app titled after the legend of the heroic outlaw stealing from the rich and giving to the poor? Only for the investing app to quite literally steal from the poor and give to the rich?

No fiction could ever compare.

The real story of Frank Merentino:

Frank Merentino is a 40-year-old carpenter from New Jersey.

Robinhood sold 16 of his GameStop shares without his consent.

He tried to cancel but the sale went through. He says he lost over $2,000.

“I just got on this GameStop thing out of luck really, and now I got screwed. I’m not an expert on Wall Street stuff, but I know if I walked down the street and took something out of somebody’s pocket, I know where I’d be.”

PSA: discount brokerage houses should never arbitrarily sell someone’s stock without their consent.

Why is this resonating beyond a business story?

In what should not at all be a surprising turn of events, company valuations in the public market should be determined by the public. It is what the entire concept behind free markets are. And yet, there is an ever-present fact that we all, for our sanity, choose to ignore: the 1% runs the world.

This story appeals because of the pent-up anger and helplessness surrounding the power structure that the financial industry perpetuates. It is a classist, corrupt system. And in this moment, by way of an old video game store, ‘ordinary’ people were able to feel what it was like to have their ideas taken seriously.

Why should I keep reading your articles on investing if the system is so corrupt?

I have no valid argument as to why you should read me specifically at all – as I’ve said, I painfully lack the credentials. However, if you take anything away from this article let it be this: Investing. Is. Not. Trading.

This GameStop saga is the story of a high-risk casino inspired by vigilante justice. I love my SJW just as much as the next girl, but unless it is in the sole vein of political statement, this type of trading is not recommended. Because, and I hate to be the bearer of bad news, Wall Street will always win these runs, just as casinos will always come out on top. And the Americas will continue to beat their capitalist drum, pandering always to obscene wealth and unchecked power.

All of this, coming to a TV set near you, starring none other than Netflix teen heartthrob Noah Centineo. (I mean, I can’t even make this shit up).

And the system, as always, churns on.

Until next week.

Click this link, if you’re so inclined, to subscribe for your weekly finance updates! (But please do, it will help my rep)

https://madelyngrace.substack.com