*Current stock price as of January 11, 2021, is $CAD 18.46 ( up by 11% since the report was published)

Polaris Infrastructure Inc is a Canadian-based company engaged in the acquisition, development, and operation of renewable energy projects in Latin America.

Polaris is a $CAD 290,000,000 company that generated $CAD 19,971,000 in profits (up by 37% since 2019) utilizing $CAD 182,513,000 in net tangible assets. Before you say it, I know these numbers just being plotted like that don’t mean much. But to put this into perspective, we can find a performance metric that best illustrates how phenomenal this return is.

Over the last 10 years on average, the entire Toronto Stock Exchange has had a return on tangible equity (“ROE”) between 8% – 10%. This means for every $1 invested by S&P/TSX 60 shareholders, the index brought back between $0.08 – $0.10 in earnings.

Comparatively, Polaris had an ROE in 2020 and 2019 of 11%. Your only hope as a Polaris investor going in was that the company will reinvest your money, bringing back an equivalent amount (related to ROE) of market value. Markets are not perfect, so this is not always the case, but on average the two numbers have a strong positive correlation.

Keep in mind the following this index consists of very large, very profitable, and very well-known companies like :

- Shopify (SHOP) with a market cap of $CAD 184,000,000,000 and ROE of -10%

- Royal Bank of Canada (RY) with a market cap of $CAD 153,748,000,000 and ROE of 13%

- Toronto Dominion (TD) with a market cap of $CAD 135,027,000,000 and ROE of 12%

- Canadian National Railway (CNR) with a market cap of $CAD 104,108,000,000 and ROE of 17%

- Enbridge Inc (ENB) with a market cap of $CAD 85,890,000,000 and ROE of 8%

- Brookfield asset management (BAM.A) with a market cap of $CAD 74,033,000,000 and ROE of -0.11%

- Bank of Montreal (BMO) with a market cap of $CAD 64,184,000,000 and ROE of 8%

- Bank of Nova Scotia (BNS) with a market cap of $CAD 82,504,000,000 and ROE of 9%

- Canadian Pacific Railway (CP) with a market cap of $CAD 63,139,000,000 and ROE of 30%

- Barrick Gold (ABX) with a market cap of $CAD 184,000,000,000 and ROE of 13%

You probably didn’t need as long of a list of companies as an example, some might say it’s overkill, but I think my point is clear. The index is no pushover. If a company is consistently able to beat profitability metrics for the index over time, you are “assured” you are analyzing a good business.

But before we all get excited and go out and buy Polaris stock, it is best we briefly look at the latest management and discussion report, which ended September 30, 2020. Hopefully, by taking a look under the hood we can see what is pushing this high profitability.

Polaris Infrastructure Management’s Discussion and Analysis Highlights.

“We delivered a consolidated 142,194 MWh of energy during the third quarter of 2020, of which 118,857 MWh What is contributed by our geothermal facility in Nicaragua and 23,337 MWh was contributed by our hydroelectric facilities in Peru”

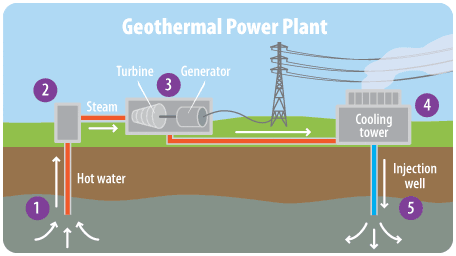

Currently, they operate a 72 MW Geothermal facility in Nicaragua. Geothermal energy is the thermal energy generated and stored in the Earth(see diagram below). In 2007 and 2010 the installed geothermal electric capacity of Nicaragua was between 87 to 88 MW. Data from Energía Limpia XXI indicate that Nicaragua’s geothermal potential is one of the richest in Central America and is estimated to be between 1,500 and 2,000 MW of potential power generation capacity, a resource that could meet national demand and even facilitate energy exports to other countries in the world

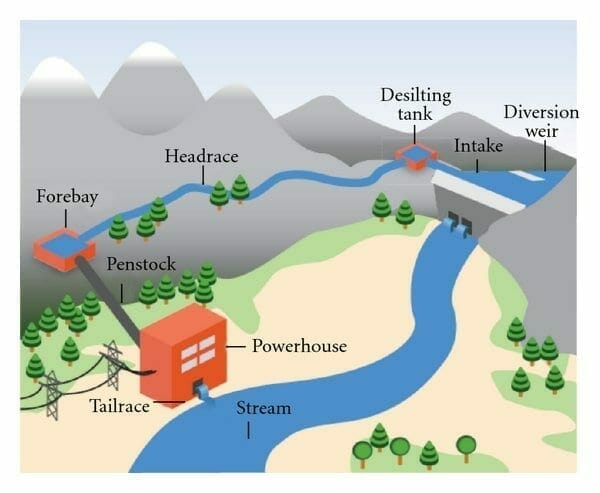

On top of the facilities in Nicaragua, Polaris owns and runs three run-of-the-river hydroelectric facilities in Peru, with approximately 5 MW, 8 MW, and 20 MW capacity each. They recently just finished construction of the two hydroelectric facilities in late November 2019 and commenced commercial operations sometime in December 2019. (Talk about corporate efficiency! Someone hire them for COVID vaccine distribution)

Both of their operating facilities are in Latin American nations with rapidly growing energy needs and governments that have stated mandates and economic policies aimed at supporting the growth of domestic renewable energy sources.

Such underlying factors create a general economic and political environment that is very supportive of the renewable power projects that Polaris holds. This can be very beneficial as seen by the growth in revenues experienced by the business over the last few years.

“We generated $CAD 17,000,000 in revenue from energy sales for the period ended Sept 30, 2020 .”

For the nine months ended Sept 30, 2020, the business returned $CAD 56,249,000 in revenue, up by 5% since Sept 30, 2019. Even with the global pandemic entering a second phase the business has been able to sustain and grow its revenues.

Many analysts on Wall Street believe the energy production sector is recession-proof. This belief comes from the fact that the consumers who demand the product will need it, no matter what happens to the underlying economy. In the context of energy, this makes sense. No matter what else is happening, you still need to pay your electricity bill.

It is also highly beneficial if you have a consumer base that is becoming wealthier and spending more money each year. This is the case with most Latin American countries as they become more developed and their appetite for electricity increases.

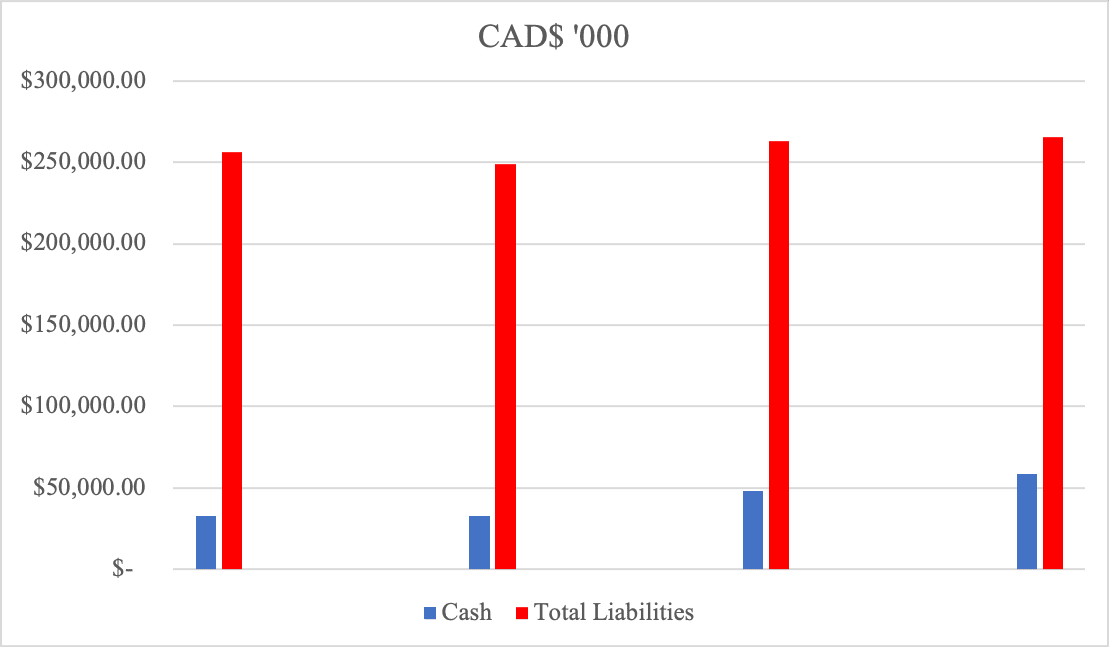

“Consolidated cash balance of $CAD 58,600,000.”

This stability in revenue means the business only has to focus on its costs. Since it does produce a commodity good, it is very difficult to differentiate this good from other companies. The only way a business can succeed if it sells a commodity is to control its costs and have a management team with an abundance of experience.

Although it would be fun to go into the analysis of the management team at this moment, we’re just trying to look at the economics of the firm. From the chart above it is obvious the firm needs to constantly reinvest the money to pay off some of its debt. It does have a sustainable and growing cash pile and they can use it to expand & maintain operations or give back to shareholders.

Since there isn’t much room for growth, the business has opted for the second option, paying back shareholders in the form of a cash dividend. Their dividend mandate for the foreseeable future is as follows:

“We remain focused on maintaining a quarterly dividend. We declared and paid 2.4 million in dividends during the period ended September 30, 2020, and will pay the 19th quarterly dividend of $CAD 0.15 per outstanding common share on November 30, 2020 .”

Knowing that the cash flow of the business is sustainable and growing slightly because of the economics of the Latin American region, we can come up with an evaluation that is somewhat close to reality.

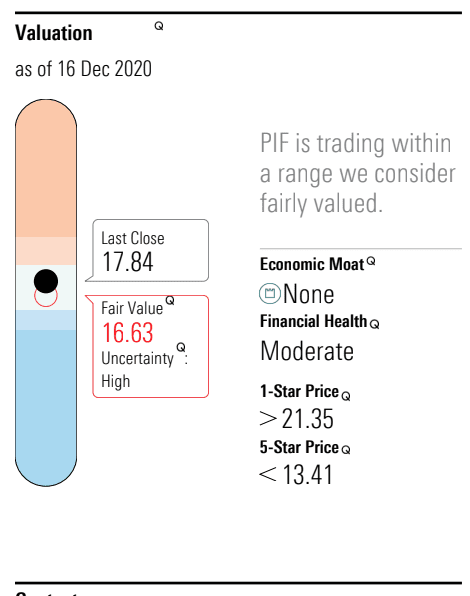

I quickly ran the numbers in a constant Discounted cash flow model and came up with a value of $ 13.59 at a 10% growth rate, and $ 19.03 at a 15% growth rate. Meaning on average the intrinsic value will be around $ 16.31 just below the Morningstar analysts’ valuation.

The discrepancy between our figure and theirs is probably because of minuscule arithmetic differences. With a valuation, you could always be wrong, but it is always good to have a rough approximation.

The actual valuation itself is not important (why the heck did we just go through all that for nothing: the answer is, I’m a nerd, and my editor wants it), but what is important is what the implication of that number means.

“ Great businesses bought at the wrong price can be bad investments”

Although Polaris seems to be a great business, the entire market seems to have fully priced this into its common stock. This is just what happens when too many intelligent people are looking for investment in opportunities in a market that has very few great businesses. In other words, this isn’t a hidden gem, but a stock that’s relatively properly priced. No rapid stock growth to be found here – in fact, the current price is slightly overvalued.

This doesn’t mean you should give up on this company completely. It just means you might have to forego the purchase today and look for other opportunities to deploy your capital in the short-term. This is the game of investing ( I personally don’t like calling it a game, makes it seem like a gambling machine ), your analysis and timing may never be right at the same time.

I feel that the biggest problem faced by investors most of the time is not an inability to select great businesses, but a lack of patience in buying the stock of great businesses at appropriate prices. This last part takes patience.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.