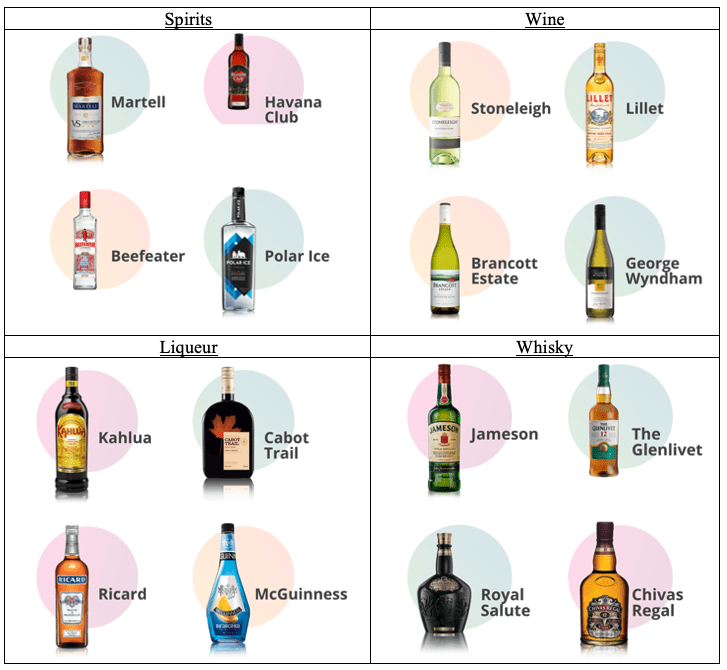

Corby Spirit and Wine Limited is a Canadian alcohol manufacturing and distribution company based in Toronto. It offers a diverse portfolio of brands ranging from Spirits to Whiskies – some you’re likely to be familiar with, like the ubiquitous Beefeater gin.

Corby Spirit and Wine Brands

Since demand for their products is pretty defensive, meaning people will buy their products during any economic climate, the company tends to have very predictable and stable cashflows. Over the last 10 years, cash flows have grown by 6% per year, and earnings by 3% but they have experienced a slight decrease (-0.6%) in their revenue. Even with this reduction in revenue over the past decade, the business has been able to sustainably generate over CAD$ 100 million every year in sales.

Let’s get into more of the accounting because I know you love this stuff. Over the last 10 years, the business has been able to generate a return on assets of 11%, return on equity of 14% and return on invested capital of 26%.

Wow! This business sounds fantastic yet simple.

Having gone through all that, it’s a standard procedure that we need to do our own valuation for the stock, while already knowing that the cash flows have been able to grow by a CAGR of 6% from CAD$ 33 million to CAD$ 44 million. Assuming these cash flows persist at historical levels, growing ever so slightly, in line with a growing population, drink more alcohol over time, we can assume the stock will sell anywhere between $17 to 21 per share. This means on average the business should have an average share price of $19 per share.

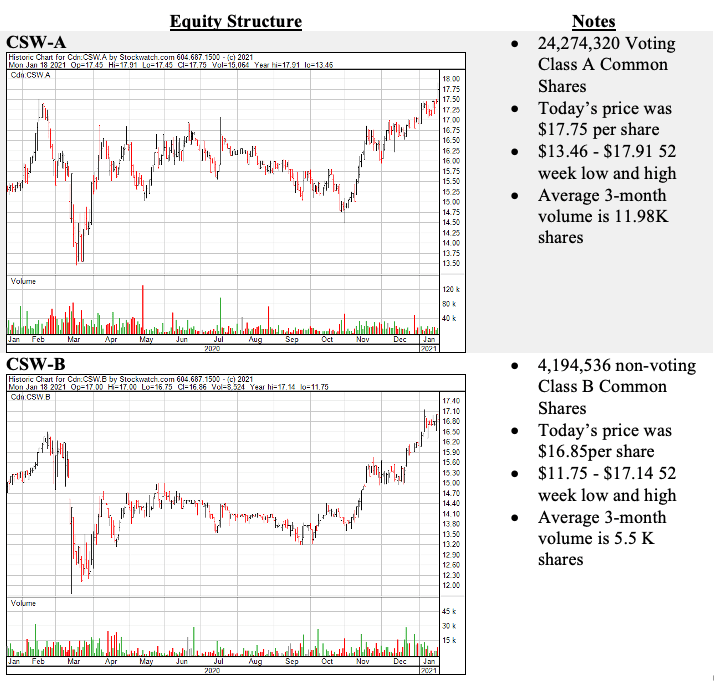

Today’s stock price for both classes of shares is presented below.

We can see that the only difference between Class A and B is that there is more class A shares outstanding, improving the liquidity, and the Class B shares do not have any voting privileges. These are the major differences between the shares and, because of this, the Class A-shares have a premium on them for the right to vote and for extra liquidity of about $ 0.9 per share.

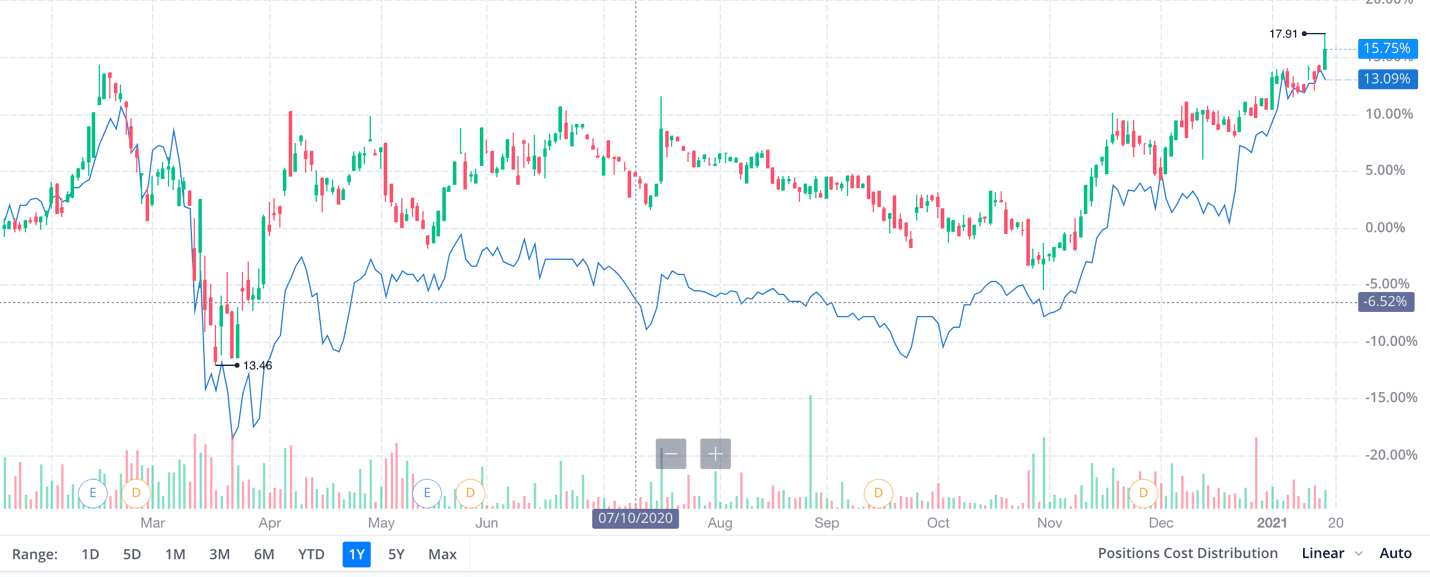

The shares have consistently traded with a fair spread ( A class is red & green and B class is the blue line), but this has narrowed over time. The reasons for this are many, and pinpointing one isn’t greatly beneficial. That said, we can assume a few things about how investors feel about the two classes of shares:

- Investors are willing to buy the Class B common even with the lower liquidity and lack of voting privileges, because the economic benefit is far greater than the cost, and :

( Economic Benefit { Dividends and Capital gains } minus Economic Cost { The premium and commissions}= Marginal Benefit of the Purchase of the CSW-B common )

- Investors who buy the Class A common are willing to pay the higher price for the right to vote on operational matters and other rights they may exercise to increase the economic worth of the firm. As of 2020, the company is 51.6% owned by Pernod Ricard (RI.EPA) a French company that produces alcoholic beverages. Meaning 50% of the profits not distributed to common shareholders of all tranches in the form of dividends will be booked as net income on the books of Pernod Ricard.

In September 2020 Pernod Ricard received approximately $ 2.6 million before taxes in dividends and have retained earnings held by CSW of $2.3 million. These retained earnings are held by CSW and hopefully reinvested in capital projects that will increase the market value by a ratio of 1 to 1( meaning one dollar in retained earnings produces one dollar in market value).

So, how does the investor today pick between these two options? Frankly, for the average investor with no special knowledge in this industry, we’d say go with Class B – don’t pay extra for a right you honestly wouldn’t be exercising (gotta be honest with yourself on this front). You should always of course look into the dividend rights for Class A and B – they’ll be clear on what percentage rate of dividends you’ll be receiving, and certainly, you’re more protected and favored if you have a vote. But unless you own a significant portion of shares, you probably won’t have too much of a say in operational matters.

That’s a pretty much standard method of decision-making when deciding between share classes. Let us know what are some of the best investments you’ve made where the share class really mattered!

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.