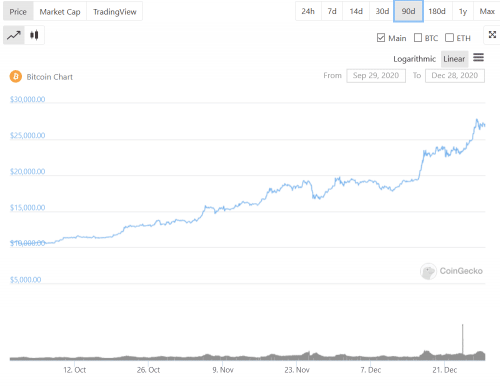

Bitcoin’s zoomed to a new all-time high of $28,601.89 over the Christmas season, likely fattening the wallets of hodlers while causing a nasty case of regret in everyone who didn’t get in when it was $2,000 about a year and a half ago. But there was some uneasy rumblings throughout the cryptosphere about what it is that’s caused the chief cryptocurrency to climb to such heady heights, and all signs point to the same place: We need to talk about Tether.

Tether, or the USDT coin, was created originally as a straightforward way to digitize the US dollar for use on cryptocurrency exchanges. It’s since found wide use on most of the world’s biggest exchanges, including Bitfinex, Binance, Poloniex, Kraken, and plenty more. It has three jobs: to remain pegged to the United States dollar while acting as a portable unit of exchange; serve in capacity as a gateway between different cryptocurrencies; and also between crypto and fiat. It’s a coin with a lot of utility.

But the principle problem here is that it’s probably artificially propping up bitcoin’s value. There are a lot of crypto-enthusiasts out there willing to brand this claim as ‘fake news,’ but the evidence certainly seems to say that this isn’t Bitcoin’s breakout moment, but instead yet another bubble that’s going to bring horrific consequences when it collapses.

Let’s consider this report, which closing inspects bitcoin prices between certain points in time and notes that the price spikes come within two hours of new delivery of Tether to cryptocurrency exchange, Bitfinex. The statistical inference here is that it’s likely that Tether is being used to directly manipulate the price of Bitcoin, and at present, up to 80% of Bitcoin’s present value could be a result of Tether infusions.

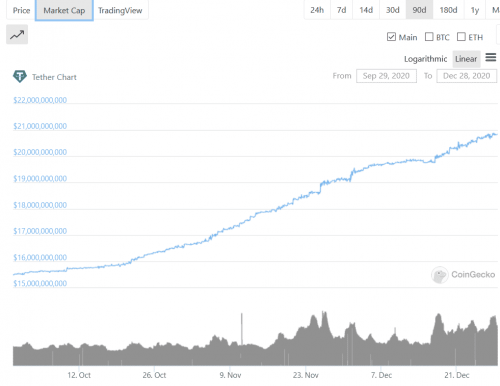

Let’s compare the ninety day charts of Tether and Bitcoin respectively:

The correlation between rises in Bitcoin and subsequent printing of new Tethers is obvious. It’s not exactly cold, hard statistical proof, because of the old first-year university canard about correlation not equalling causation, but it’s enough to draw suspicion.

The Hong Kong based company, iFinex, claims that they presently hold enough reserve currency in USD to cover all of their coins in circulation, but they have never been audited. Furthermore, as yet, there are no applicable accounting or auditing standards for the cryptocurrency world, and therefore no way of knowing whether Tether is telling the truth. Except maybe common sense. They have also admitted in the past to being approximately 74% backed by cash and equivalents. And by other equivalents, they usually mean other cryptocurrencies, which don’t keep a stable price point by definition.

Consider for a second that if you were to inherit a large amount of money, you could theoretically go to the bank where it’s being held and request it in cash. You’d get the side-eye and the bank manager would try his or her utmost to talk you out of it and finally concede that the bank doesn’t have that kind of scratch lying around, but it has a legal responsibility to get it to you in a timely manner, and they would. Tether has no such responsibility. The inverse of the situation wouldn’t hurt the company any. They would likely be able to handle any shortfall an individual investor may have, and they claim to have no responsibility to make the Tether to USD swap anyway.

But we’re not talking about one investor here. We’re talking about a run on the system. If enough people lose confidence, maybe due to an economic crash or maybe last year’s flash crash during the first wave of the coronavirus when China put everyone on lockdown, including bitcoin miners, and the price of BTC cratered, then Tether will lose a large portion of its value. People will want to get out en mass and there’s a strong probability that Tether Limited won’t be able to pay up.

The biggest risk, though, isn’t a failure to respond to an economic crisis. Instead it’s getting shut down by regulators. Not only are they in regulatory hot water with the New York Attorney General over an accusation of moving money from its Tether reserves to cover a $850 million shortfall in missing funds on its Bitfinex exchange, but they may have to answer to federal legislators before long as well.

Three U.S. House Democrats proposed new legislation that would provide some regulatory framework for stablecoins by requiring issuers like Tether or Facebook’s Diem to get a banking charter and insurance from the Federal Deposit Insurance Corporation (FDIC). This would be the final answer as to whether or not Tether Limited actually has the amount of reserve currency they say they do, and if they don’t, then the consequences could be interesting.

“Digital currencies, whose value is permanently pegged to or stabilized against a conventional currency like the dollar, pose new regulatory challenges while also represent a growing source of the market, liquidity, and credit risk. The bill intends to protect consumers from the risks posed by emerging digital payment instruments, such as Facebook’s Libra and other Stablecoins currently offered in the market, by regulating their issuance and related commercial activities,” the bill’s three Congressional sponsors, Rep. Rashida Tlaib, Rep. Jesús “Chuy” García and Rep. Stephen Lynch said in a joint statement.

Other stablecoins have FDIC backing, and keep compliant with their respective regulations, including the PAX token—a stablecoin used by Paxos—and the Gemini Dollar, which is backed by USD, and the core coin of the Winklevoss Twins owned Gemini Exchange. Both of these are set up as trusts in New York State and hold respective funds in FDIC-insured third-party bank accounts. They’ll never see third place in the coin-size-by-market-cap game, but they also don’t expose their users to unforeseen risks either.

What does this all mean for the future of Bitcoin and cryptocurrency in general? It likely means another bubble burst—likely sooner than later—as the majority of the funds propping Bitcoin’s price will reduce (if not outright evaporate) when the truth is revealed about Tether Limited.

—Joseph Morton