Yesterday, I posted the charts of Silver for our Equity Guru Discord Trading Room members and stated that I was taking an initial entry on the metal. Lot of technical confluences, but the fundamental case remains the same.

A lot of talk on Bitcoin making record highs. The cryptocurrency is over 23,000 USD as I write this. There are reports of whales and some private funds purchasing, but not many people are asking why. Is it just to chase yield? Pretty extreme to chase something over 20k, but the same could be said for stocks such as Tesla and others. Could it be for adoption? Will more cryptocurrency be used for transactions and will more corporations get involved just like Paypal? Possibly.

Looking at it through the lens of macroeconomics, I see it a little differently. Either, this is a move frontrunning a digital currency which we know central banks are talking about, and even have ready in the case of Canada. Or, and this is the most probable reason, it is a move out of fiat currency.

I have warned my readers about the currency war. All central banks are racing to the bottom attempting to weaken their currencies to boost inflation and trade and also to manage the debts with cheaper currency. We witnessed the European Central Bank increasing their emergency bond purchasing program by 500 billion Euros to a total of 1.8 Trillion Euros. The Euro still popped against the US Dollar.

The Fed spoke yesterday, and nothing really has changed. Interest rates will remain low until 2023, the Fed will use all tools available, asset purchasing program will not change as it aids in meeting the Feds dual mandate of maximizing employment and reaching their inflation targets. The Fed did not increase their purchasing program as many were expecting. The change? The Fed’s growth forecast for 2021 is now 4.2% factoring in the Covid vaccine. Economic activity will not get back to pre pandemic levels until people find it safe to go out. Jerome Powell also reiterated that Fiscal policy in the form of government stimulus is needed.

The US Dollar continued to drop, much to the demise of the European Central Bank as the Euro broke out higher. Expect the ECB to cut rates deeper into the negative in an attempt to weaken the currency.

In this type of macro environment, the chase for yield and protecting your purchasing power are key. The stock market is the only place to go for real yield here, and backed by central bank monetary policy, they will continue to move higher unless some black swan event occurs, or central banks bring them back to reality by reverting to tightening (stopping their purchasing program, and begin selling off assets on their balance sheet).

As currencies weaken, it takes more of that weak currency to buy something. This is inflation. Protecting your purchasing power is perhaps the most important thing to consider right now. The confidence crisis in governments, central banks and the fiat currency are incoming. The move in crypto is a sign to be prepared. I do expect money flows into hard asset commodities, Gold and Silver being key.

I wrote a set up on Gold yesterday, The criteria for our breakout could be met today. But I want to take a look at Silver.

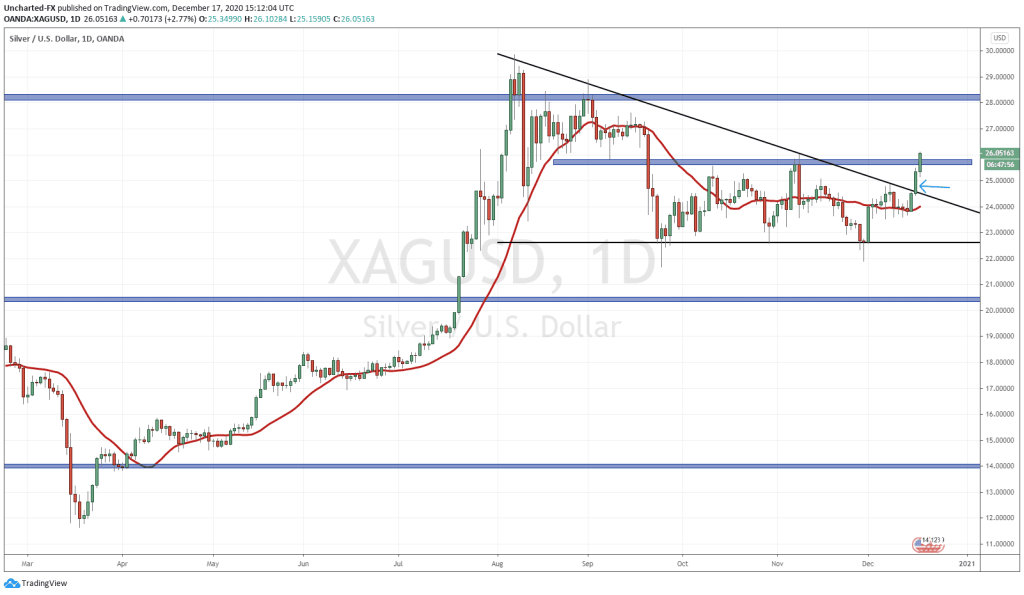

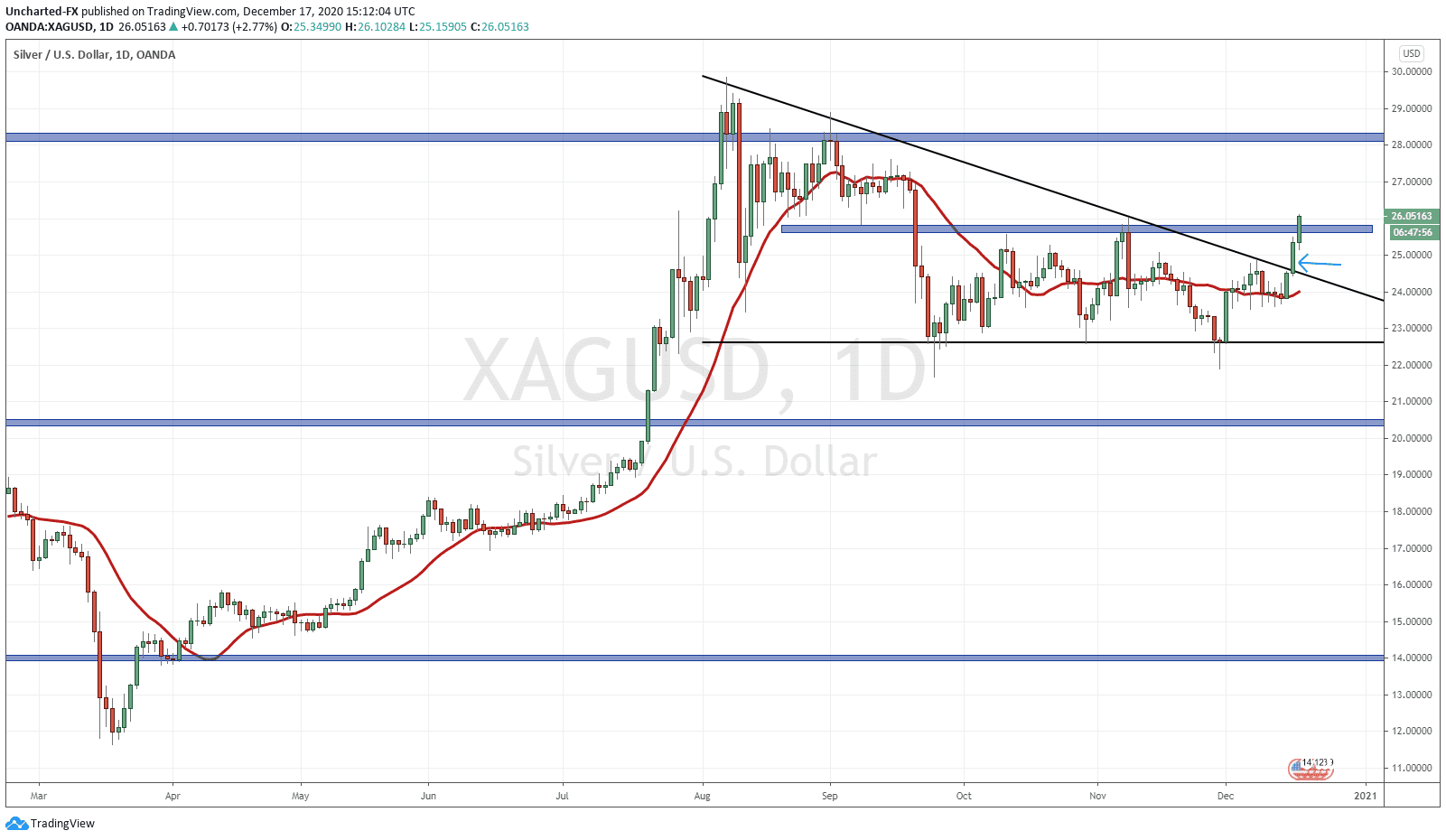

As mentioned earlier, an initial Silver entry trigger was confirmed yesterday and given to our Discord members. The arrow points to the breakout above a downtrend line. This type of set up was our entry for stocks such as Village Farms and Blackberry. Just pure market structure.

My initial entry yesterday was a small one, with my stop loss just below the breakout under the trendline. My game plan is to add more to my position today.

So why did I not take my full position? As much as I like trendline breaks, I still favor support and resistance levels. They are very important. Silver still needs to confirm a break of the resistance zone just above 25.75. We are penetrating through that currently.

Now, the key will be to await for the candle CLOSE above this resistance. That will be our trigger to add. We have 5 plus hours left on the US markets, this can very easily reverse and sell off giving us a close back below resistance, and the breakout would not be confirmed.

My initial targets as a trade will be 28. I emphasize trade. Silver and Gold are still my favorite long term holds given the macro themes and currency war playing out.

The question being posed about Silver is the fundamentals for the move. I think it is being answered now with the move in Gold currently. Some analysts look at Silver purely as an industrial metal. Because copper, iron ore and other base metals have been ripping (the economic recovery play? Or the China play?) Silver had to join in on the party. Others see Silver being bullish due to the green infrastructure play. Governments will at some point announce massive infrastructure plans to get the economy going again. Green infrastructure is a no brainer because you can use green taxes levied on the people, who won’t complain, and say it is all for going green. Silver will be an important commodity in solar panels to increase base load power.

I still look at Silver as a monetary metal. Why? Because it is more correlated to Gold than it is to Copper. It tends to follow the moves of the monetary metal Gold. Once again, this move out of fiat means assets such as Gold and Silver will see a bid up. More money printing and cheap money cannot stop and will not stop. It is only a matter of time before people realize this.