In today’s Market Moment post, I want to carry on my outlook for 2021. Yesterday, I laid out why I am bullish on Gold because both the fundamentals and technicals align, and are set to repeat a move similar to 2008. This morning I want to talk about Bonds and Interest Rates.

My long time followers and readers (and especially those who are members of our Discord Trading Room) know two things about the bond/credit markets:

1) They are by far the largest markets in the world even dwarfing the Stock/Equity Markets.

2) If you want to know where the Stock Market is going, look at the 10 Year Bond Yield ( TNX ).

Of course, some argue that things have changed due to central bank money printing propping assets up. 80 Billion per month in fact by the Federal Reserve . This is to ensure that interest rates remain suppressed. Many people do not know how this works. The central bank prints money by buying bonds. It buys the bonds, and then money is credited to banks/dealers etc. New money has now entered the system.

Historically, government debt made the majority of pension funds because they were the safest asset. Bonds are (were) held for yield. For example, say you owned decade plus year government debt before 2007, your 1 million would be netting you between 50-80k per year depending on the interest. Post Great Financial Crisis ( GFC ), that 1 million would bring in less than 30k per year and even lower today.

Pension funds need an average of 8% per year. You are not making that in bonds. Pensions have thus had to add more risk, ie: buy stocks. In fact, the average person retiring had to do the same. Since you could not buy bonds for long term yield, this money went into the next safest asset: real estate, which is why we have seen real estate prices rise around the world (cities and countries that make it easy for foreign money to enter have seen a much faster rise). Back in the day, a financial advisor would not tell you to put all your money into stocks when you were close to retirement. Today you really have no choice.

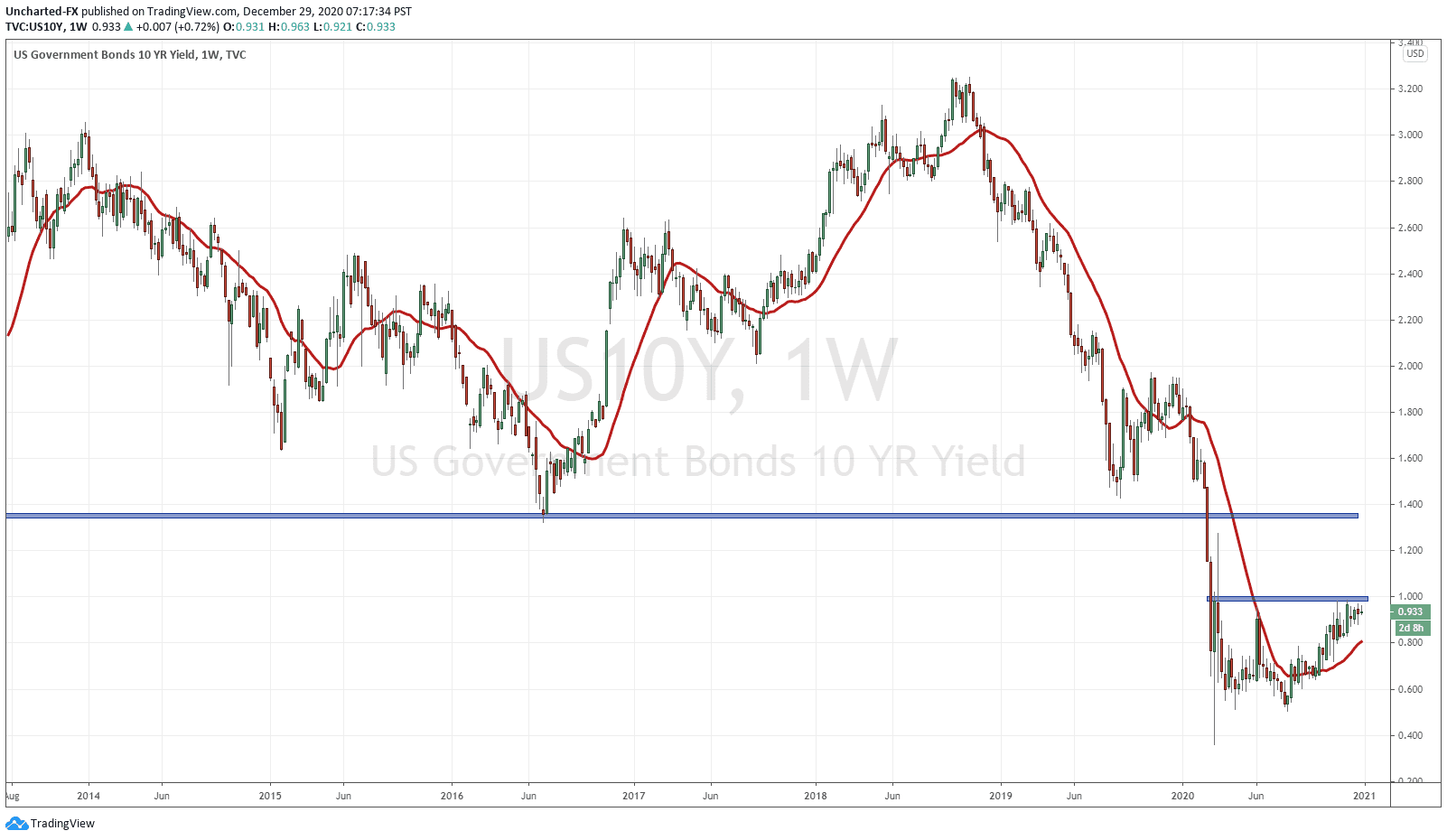

Before I discuss the weekly chart for the 10 year yield and what this implies for 2021, a quick lesson on what this chart shows us.

This chart indicates the yield on bonds, NOT the price of the bond. Therefore bond yield and bond prices have an inverse relationship. When the price of Bonds drop, the 10 year yield chart moves higher (rates spike), when the price of bonds pop, the 10 year yield moves lower (rates drop). Remember our good friends the central banks? Well this is the alchemy: buy bonds through Quantitative Easing (QE) to drop interest rates and keep them suppressed.

Large funds and those studying to be fund managers are well versed in the asset allocation model. The percentage of portfolio’s mainly in bonds and stocks. In the GFC crisis, we heard the term risk off and risk on a lot, and is still used today. A risk off environment is when investors sell stocks to buy bonds and other safety assets. A risk on environment is the opposite: investors are buying stocks and other riskier assets and dumping bonds and safety assets.

The VIX has primarily been used to gauge when there is fear in the market and whether we are in a risk off or risk on environment. Gold and the US Dollar as well. But why not just look at the 10 year yield itself?

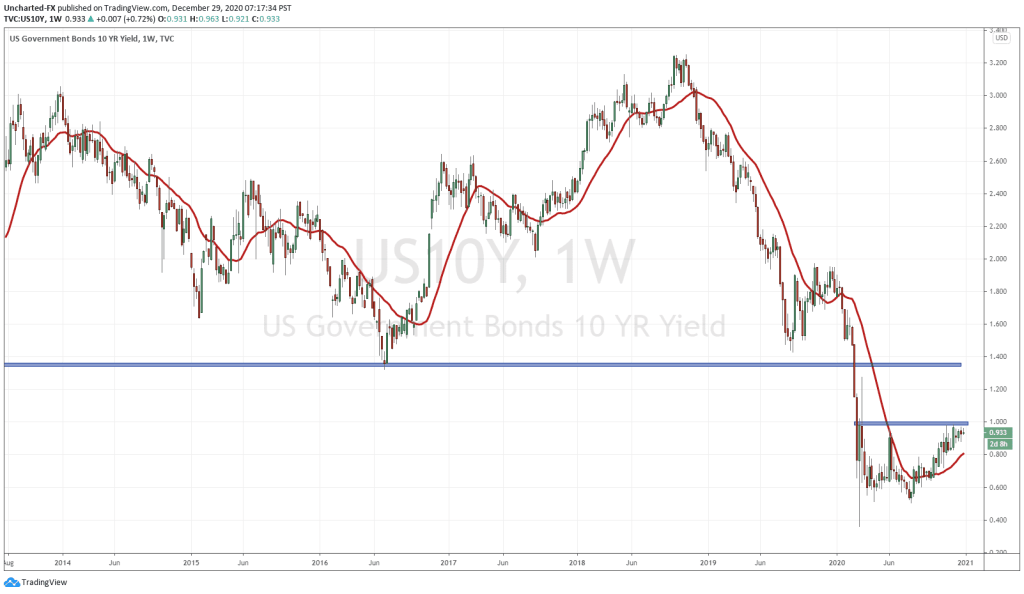

Back to the weekly chart of the 10 year YIELD. Currently, they are yielding 0.933, but a reversal pattern is forming. If we get a weekly candle close above 1%, we get a breakout, and we can see yields pop to the 1.33% zone. Remember: this move would mean that bonds are SELLING off. This means that money is LEAVING the bond market, and ENTERING the stock/equity markets (and perhaps other markets such as commodities etc).

This move in higher yields is pointing to HIGHER stock markets. Again, my followers know this is what I have been predicting since markets began making new highs. There is nowhere to go for yield. Stock markets will continue higher until a black swan event occurs.

Now let us look at the flip side. Central Banks.

There is a currency war occurring between central banks, and the US Dollar and the Fed are winning. Why do nations want a weaker currency? Generally, the way to boost inflation and to increase exports in an attempt to revive the economy was by weakening the currency. By the way, the classical economics definition of inflation is a weaker currency, meaning it takes MORE of a weaker currency to now buy something thereby increasing the price. Hence why when the US Dollar moves lower, it means it takes more Dollars to buy something including stocks.

The European Central Bank (EBC) wants a weaker Euro . The Eurozone is largely an export union, a weaker Euro makes European exports competitive, and the ECB hopes this would boost the economy, and boost European exports translating to more profits and more jobs etc. The problem? The Euro does not weaken when the ECB attempts to talk it down. They have increased their ’emergency’ bond purchasing program to 1.85 Trillion Euro’s . The Euro shot higher.

What option does the ECB have left? To cut interest rates deeper into the negative. Thereby making the interest rate differential between the EU and the USD larger in hopes that money would flow to the USD rather than the Euro on the EURUSD.

So now you are probably asking why would investors/traders still be buying European bonds when they are yielding negative? Meaning you will lose money for holding them for the 10 year or more term.

Bonds have become a hold for capital appreciation rather than yield.

Remember, if central banks cut rates lower, the bonds that you were holding issued in the previous higher rate environment become more valuable than the bonds issued in the newly lower rate environment. Bond prices move up as rates drop lower!

Many are expecting this to happen next year. The ECB’s next option in the currency war is to cut rates deeper into the negative in an attempt to weaken their currency. The Bank of England has made it no secret that they are also looking to go negative in 2021. Will the Federal Reserve follow tit for tat to counter the ECB? If the Canadian Loonie, the Australian Dollar, the Kiwi Dollar keep strengthening against the US Dollar , will the central banks in those nations cut into the negative to attempt to weaken their currencies? This is the currency war, and I believe money is already pricing this in. The move out of fiat: going into Bitcoin, Gold and other commodities.

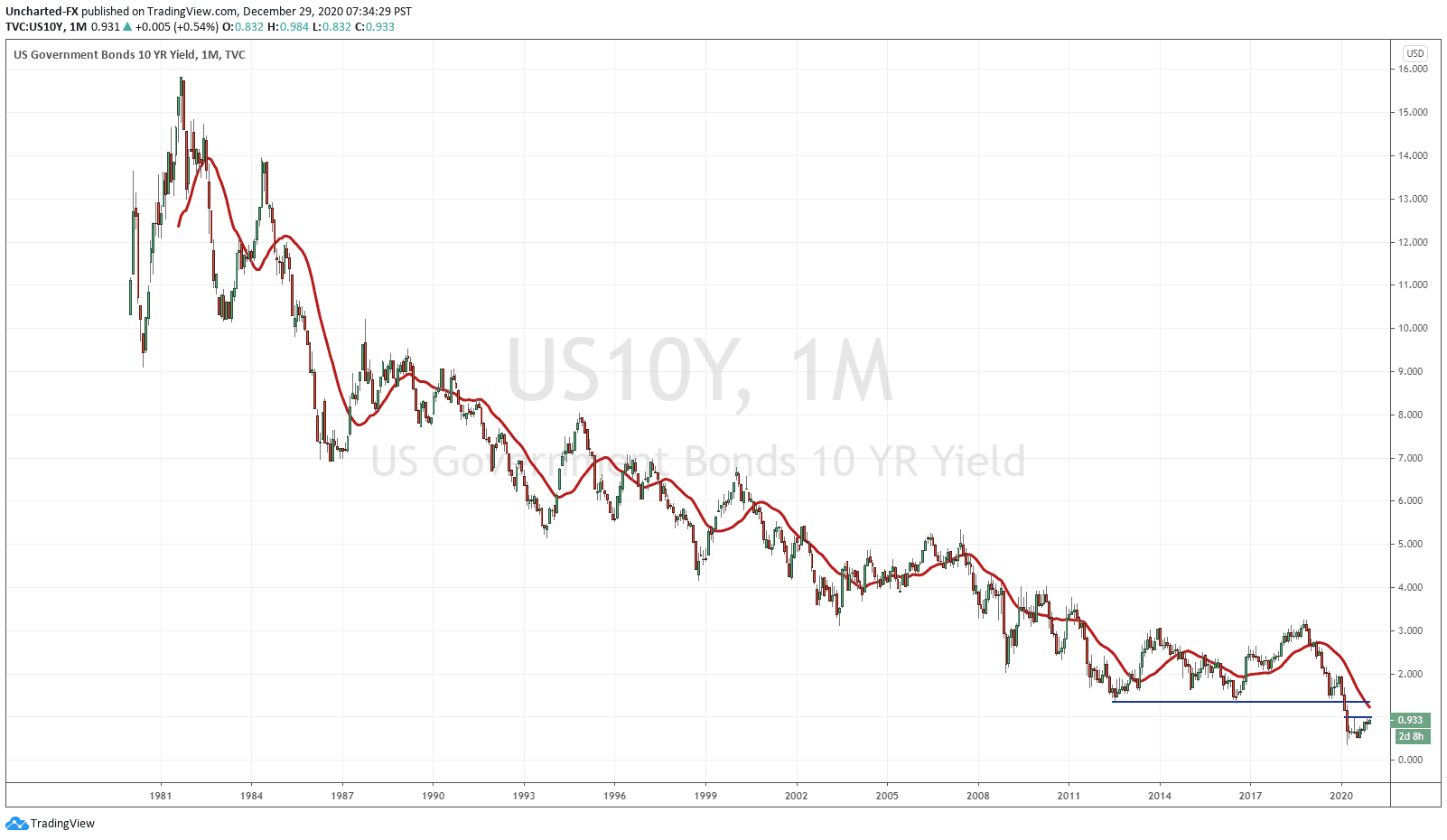

Going back to our weekly chart of the Ten Year Yield, it is possible that this bottoming pattern reverses and moves lower if negative rates become a reality in the US. This would continue our long term down trend in bond yields. You see this clearly when I zoom out on the monthly chart:

To be quite frank, interest rates will have to be suppressed lower and forever. The world had a lot of debt before, but has even more due to the monetary and fiscal response against Covid. Money printing cannot and will not stop. The US passed a stimulus for $600, and talks are already beginning for a $2000 stimulus check. More will come.

Negative rates are appealing because it means that governments can service the debt at a lower rate. A weakening currency is also great for debtors because it means they can pay back debt with cheaper currency.

This is why in a very weird way, many investors and traders are bullish bonds and see at least one more large move, as bond prices increase due to more rate and deeper negative rate cuts. Insane I know, but this is the kind of world we live in.

Once again, highlighting yesterday’s post: this is why you want to be in Gold , Silver , Bitcoin and other hard assets. The trade will be out of fiat as traders anticipate the next moves made by central banks in this currency war. The currency will be devalued and the game will be about protecting your purchasing power.

One more message I will leave you with, and perhaps a controversial one at that. There are many that believe markets have a way to correct themselves. That even with all this central bank manipulation, prices and rates will correct to true or fair value. This would imply double digit interest rates as bonds sell off heavy and interest rates spike. What I like to call the ‘cuckening’, and will be my sign to short stock markets hard. Now I am not saying this will happen anytime soon, but it is something to keep in mind. If such an event would occur, it would be the largest wealth transfer in history, and billions of people would be ruined.