It is Federal Reserve Day today with the Fed to release their statement at 11am PST/2pm EST and a press conference 30 minutes after. The press conference with Powell is where all the action on the markets will take place, as traders and algo’s weigh in on every syllable that comes out of the Fedchair’s mouth.

Just last week, financial media reported that Central Banks have splurged $5.6 Trillion on purchasing programs. The European Central Bank then increased their emergency bond purchasing program by 500 billion Euros taking their program up to 1.8 Trillion. We have seen the Bank of England, the Bank of Canada, and just recently the European Central Bank increase their bond purchasing/ Quantitative Easing programs…will the Federal Reserve be next?

Easy money is here to stay. It really cannot end. This is what is driving stock prices much higher. There is nowhere to chase yield in this world.

We know that interest rates will not be going up anytime soon. Canada is holding rates down until at least 2023. The Fed has said that they are not even thinking about thinking to increase interest rates. The question is whether the Quantitative Easing programs increase and remain, or does the Fed begin to taper purchases.

Currently, the Feds asset purchasing program comes in at $120 Billion per month. They say this is to support growth and to meet its inflation targets and full employment. We know this is to keep interest rates low as the debt surges, and quite frankly, to keep assets propped.

Many believe the Fed does indeed increase their asset purchasing program today. However, there is a reason to not expect much out of the Fed today. It all comes down to their growth forecast. Will this change given that the Covid vaccine is rolling out? Will this mean the Fed may take a wait and see approach and wait until next month to make a decision regarding the balance sheet? A lot of drama and storylines going into this decision.

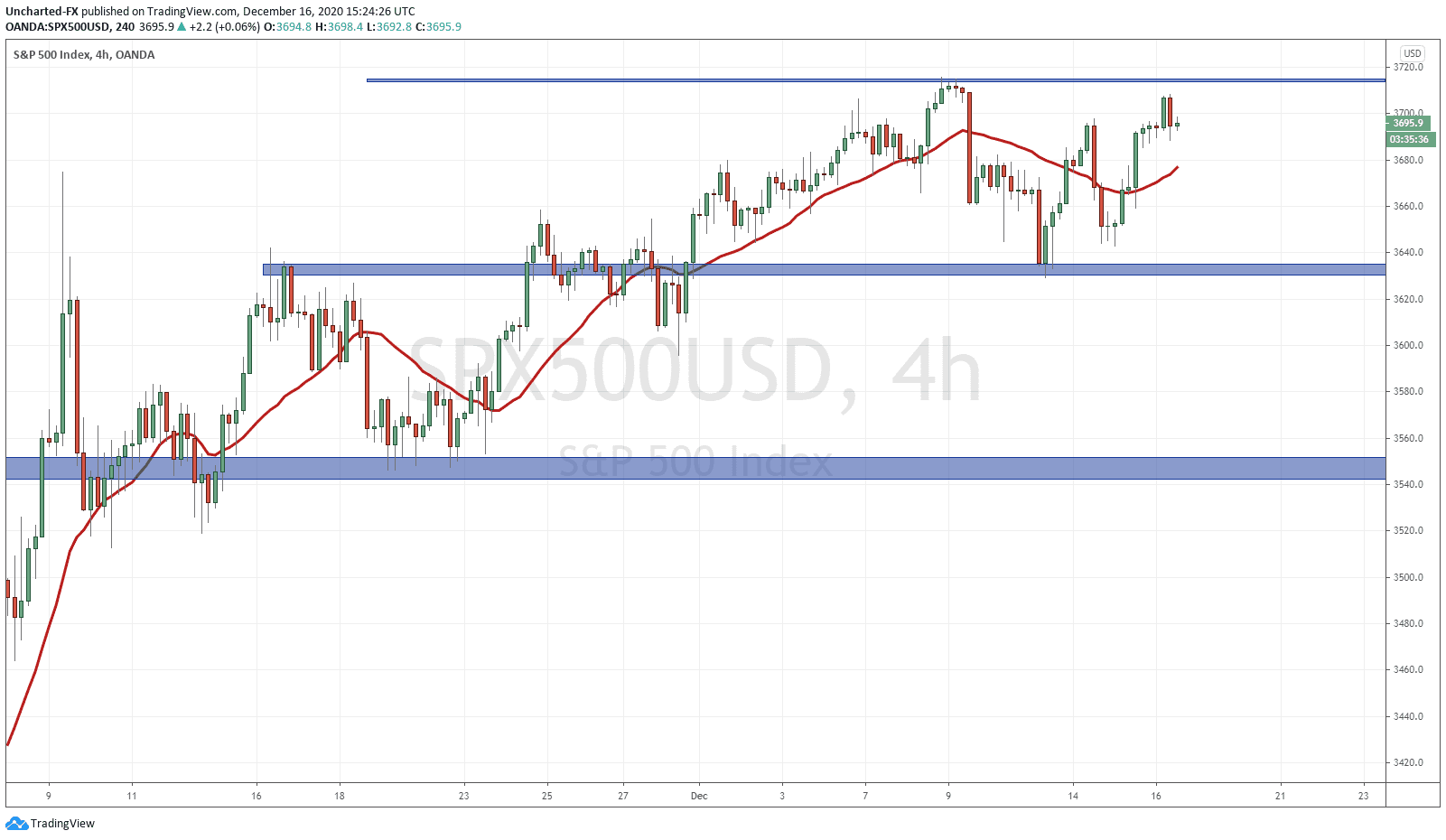

Let’s start with the markets. I have a chart of the S&P 500, but the Nasdaq and the Dow Jones are looking similar. All three markets are testing resistance (price ceiling) just before the Fed decision. Naturally, we would expect sellers to step in here, but the high risk and volatility event such as the Fed rate decision gives us a reason to pause.

If the Fed increases their asset purchasing program, we likely get a breakout. I say likely because the market could very well already have priced this in. Which would mean the market is more interested in the forward guidance and growth forecasts to price in future tapering OR increases.

The analysts who believe the Fed will disappoint today point at the stock markets. They say the markets are getting out of control and the Fed knows it is because of their policies. Time to put a taper to bring markets back to some sort of reality.

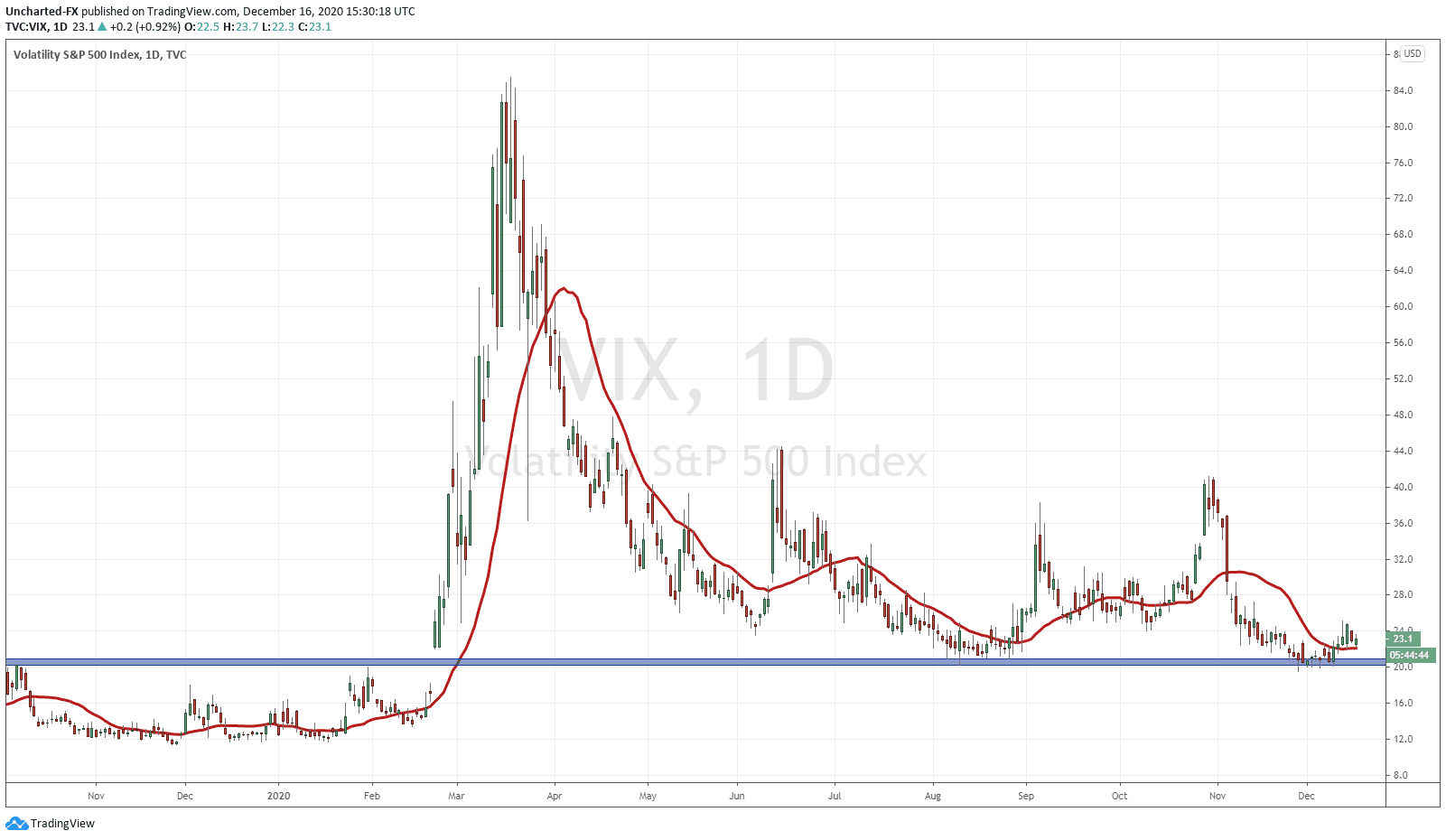

The Volatility Index (VIX) has people talking. We have once again pulled back to support pre-covid epic market sell off levels. We are seeing a bit of a bounce at the 20 zone. Question is whether this is just a technical trade? Or if market participants are expecting some volatility to return? Meaning stock markets drop.

I would be more cautious if the VIX breaks above 25. Then we would have some sort of pattern.

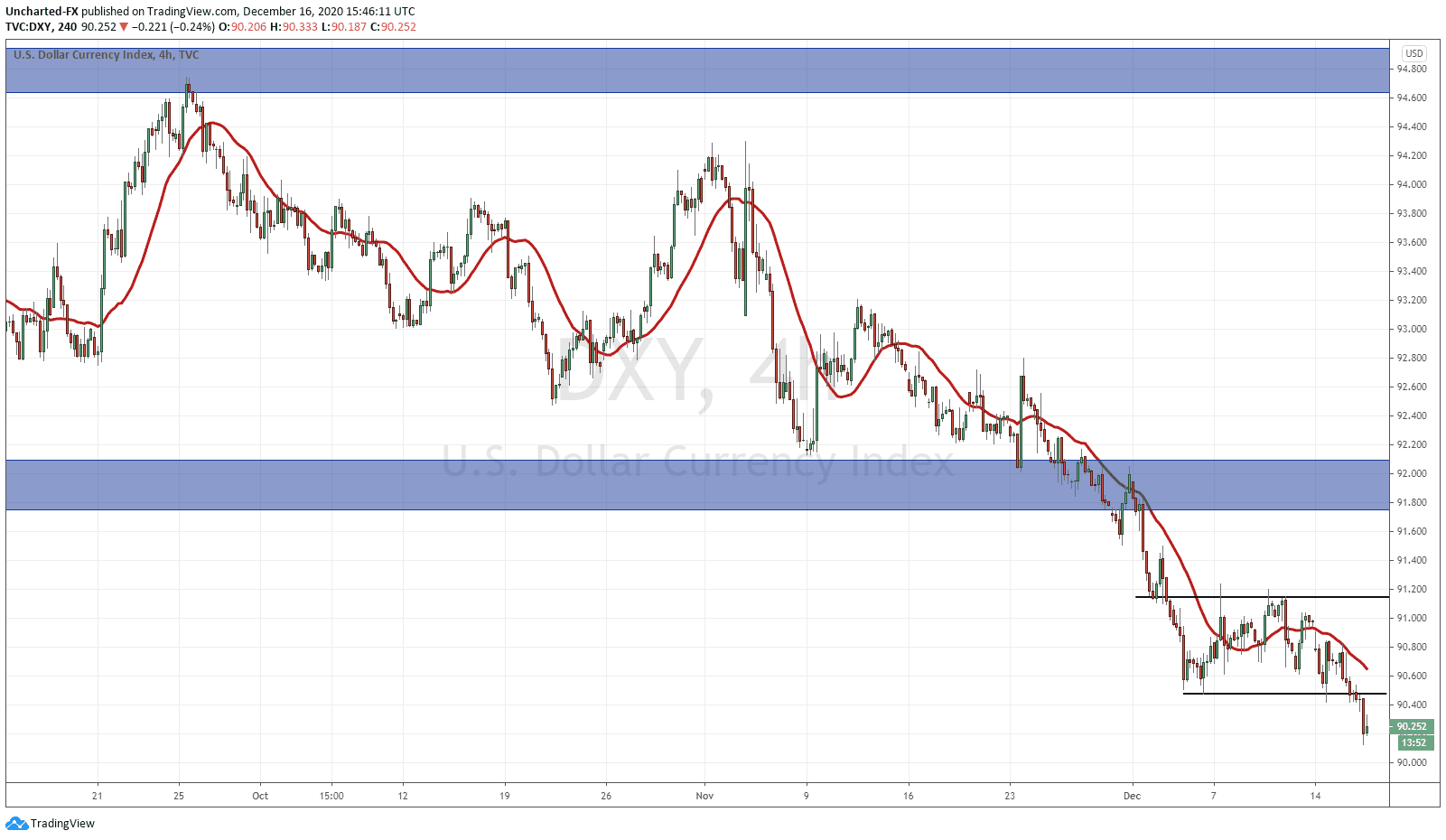

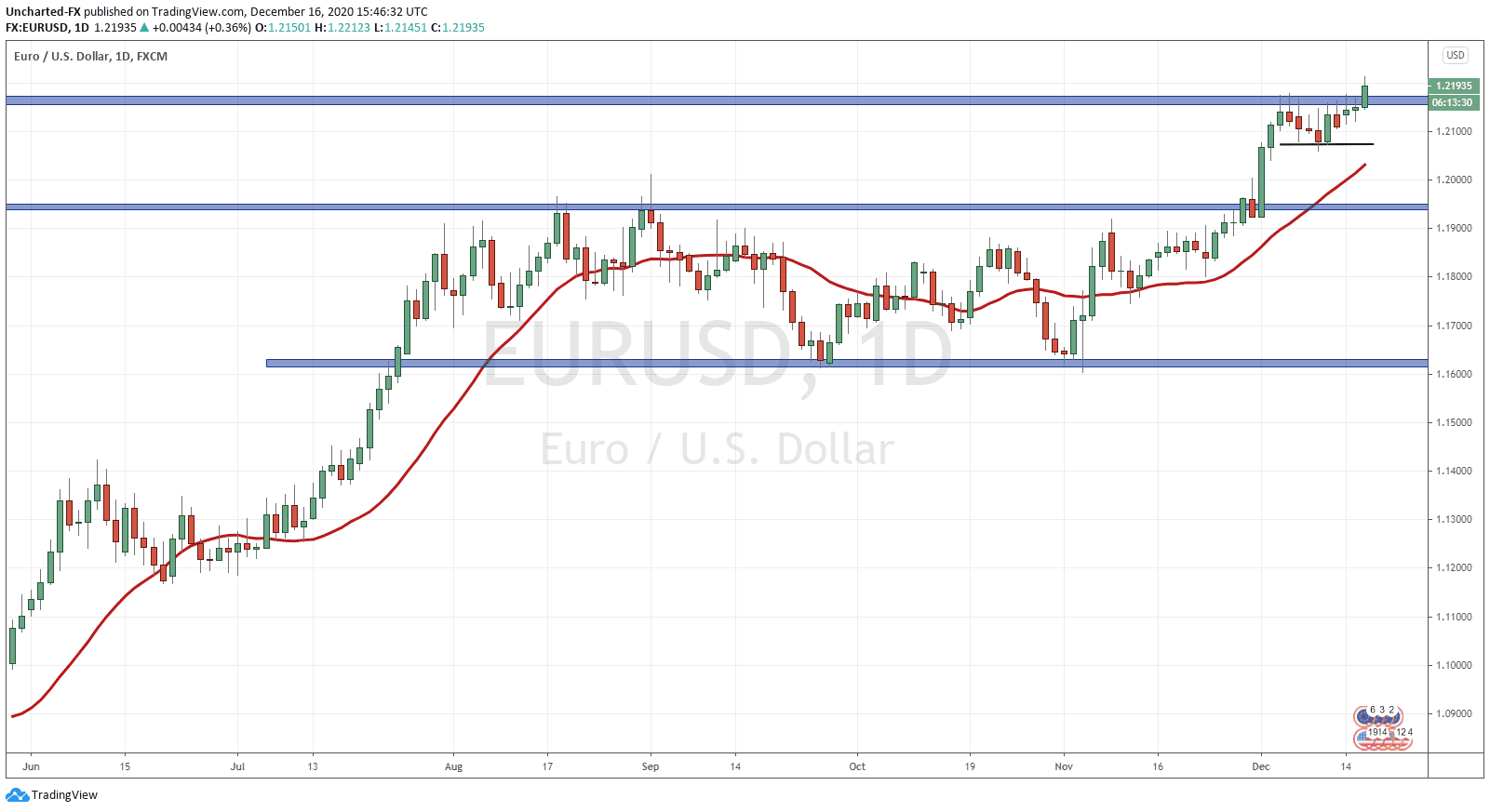

These next two charts are the most important. I have talked about the currency war. All central banks are cutting rates and attempting to weaken their currencies for inflation and in an attempt to boost the economy. Europe, being a heavy export union, wants a weaker Euro to boost exports. The ECB has failed to talk the Euro down, even when they say they have plenty of tool kits.

I believe the ECB increased their purchasing program as an attempt to weaken the Euro. It failed. All they can do now is to cut interest rates deeper into the negative, which will occur next year.

If the US wants a weaker Dollar, then they will respond to the ECB by also increasing their purchasing program, for if they do not, the Dollar strengthens, but whether that causes an entire reversal versus just a pullback/relief rally, time will tell.

For that, I watch the EURUSD, the most traded instrument on the planet. The EURUSD is breaking out, but could reverse by the end of the day closing back below resistance. For the longer term, a break below 1.2075 would hint to a possible reversal on the US Dollar.

Does the Dollar drop on an increase in the Fed’s purchasing program AND congress stimulus? This is the million dollar question. Market analysts are divided on this question. Has the Dollar already dropped because it has priced all this money printing and stimulus in? ( I tend to be in this camp), or do we see more rapid selling in the Dollar when the news is released?

Watch the US Dollar and the EURUSD. They will be key for monetary, macro and geopolitical events going forward.

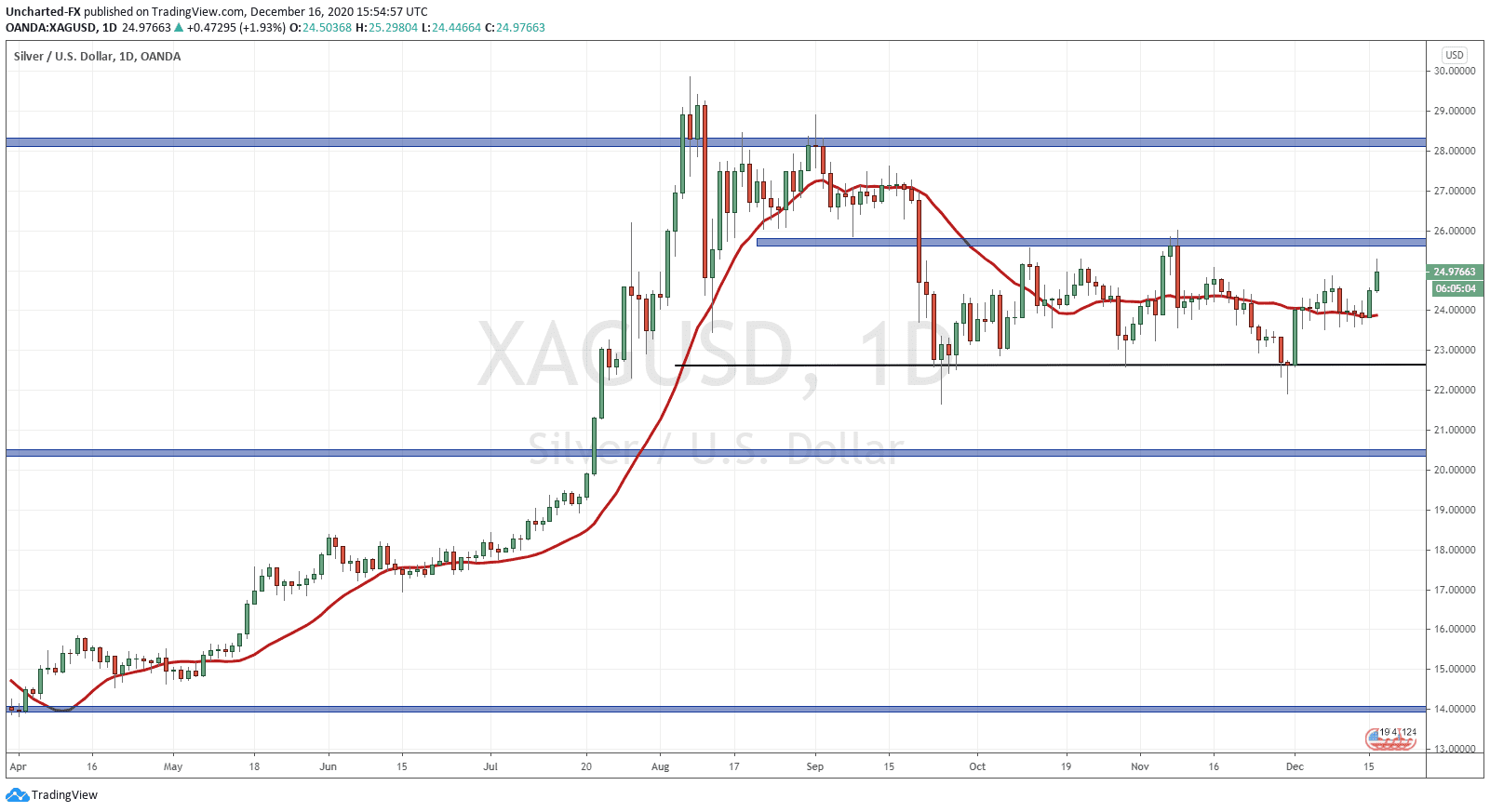

Last but not least, the precious metals.

Let’s start with Silver. We have been in a range between 22.60 and 25.75. Support has held and faked out many sellers with the large wick. If the Dollar drops on the Fed decision, we would like it to get a close back above the 25.75-26 zone. This would signify the end of the consolidation, and a new uptrend.

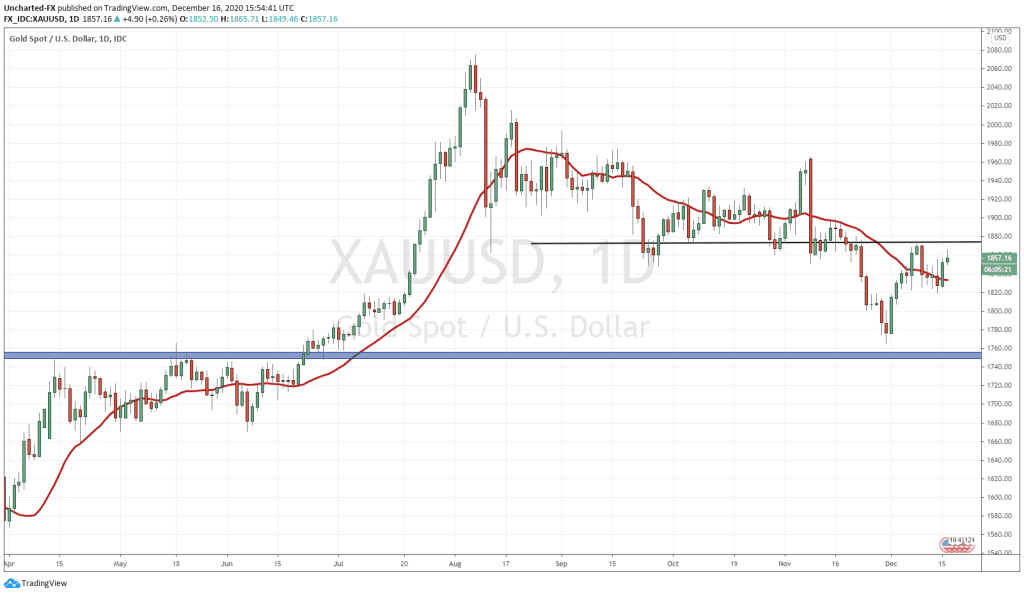

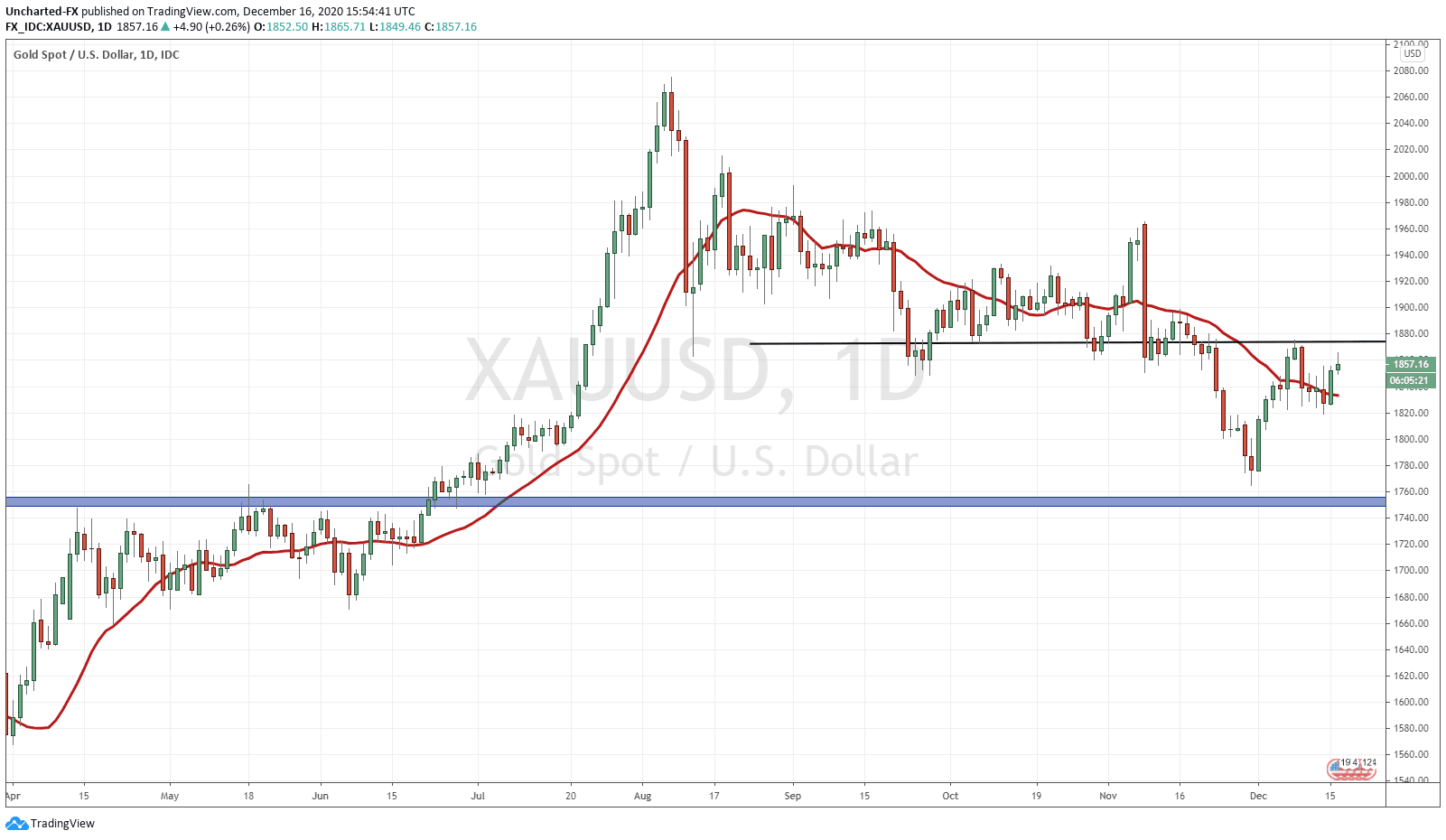

Gold on the other hand deserves a closer look. Some of its luster is being lost due to the rise of Bitcoin. New record highs on the digital currency by the way. Many say this is to adoption, but I still think the rise in crypto’s is a move out of fiat currency front running the monetary policy coming down the line.

Gold gave us some hope with a close above 1860, and looked like it was going to break back above resistance. Nope. Got a fake out move instead even with the US Dollar dropping. The reason for the drop in Gold is due to covid vaccine and investors now moving out of risk off assets. People are not afraid anymore.

The chart of Gold is setting up nicely. Some would even say there is a cup and handle reversal pattern forming. The trigger? A close back above 1875. This could happen today after the Fed decision. Technically, we would also nullify the lower high, meaning that we are now in a new uptrend.

I still like Ray Dalio’s explanation on why one should be long Gold. In the classical economics school, Gold is a currency. In a world where all central banks will be racing to the bottom to devalue their currencies for inflation purposes, hard assets like Gold are ways to protect one’s purchasing power. Bitcoin falls in this category too, not as a hard asset, but it is a way out of fiat. The paper contracts do pose a problem because it allows metal prices to be manipulated. But go to your bullion dealer and you sometimes see line ups on down days for Silver and Gold.

Money printing and more cheap money cannot stop and will not stop. And more importantly, there is a currency war occurring among the central banks. The Fed could fight back against the ECB by following along and increasing their purchasing program: a tit for tat move. Central banks originally were created to become lenders of last resort. They are now morphing into some of the most powerful institutions in human history and becoming the buyers of last resort.