Global equity markets opened yesterday on the news a new strain of Covid in the UK. US equity markets fell overnight, only to have a nice recovery during trading hours. On our Discord trading group, we are still awaiting for a possible leg lower (technically called a lower high). The real action was in Europe.

The European market session occurs before the US open, and many traders look to European equity performance to gauge how US markets will open. The reports of the new Covid strain broke some patterns on European indices, which we will take a look at in just a second.

The UK markets deserve some attention since that is where the news came out. London immediately went back into lockdown, into tier 4, their highest lockdown level. But there is one other major high risk event coming down the pipeline. Well to be fair, has been ongoing since January of this year. Brexit.

A lot has been said about the UK and the European Union (EU) coming up with a deal many times, but none of it has materialized. The main issue being negotiated is paying taxes or tariffs when goods are bought across EU borders. If there is no trade deal, companies will have to pay these tariffs, making goods more expensive. There are also other issues such as sharing information and data on safety, medicine and security. Currently, the big sticking point is fishing rights.

The big date is December 31st 2020. The deadline for a deal. Time is running out, and things between the UK and the EU are far from settled. If there is no deal, prices of goods would increase in the UK. Delays in shipping etc will also be an issue. The Brexit supporters say this will be alleviated because the UK will be free to strike more trade deals with other nations around the world.

Here are some of the changes which would occur if there is no deal as reported by the BBC:

-

People planning to move between the UK and EU to live, work, or retire will no longer be automatically allowed to do so

-

The UK will apply a points-based immigration system to EU citizens

-

Travel rules are changing, so check your passport is still valid, that you have health insurance and the right driving documents

-

The UK will no longer make such big annual payments towards the EU’s budget

-

Arrivals from the UK will stand in a different queue at passport control in EU countries

-

Businesses trading with the EU will face a lot more paperwork

Being a currency trader, the British Pound fluctuations have been noteworthy. Not really a stable currency. If you are running an export/import business in the UK, it is very tough to calculate your profits in regards to forward guidance and future expectations. In fact, many financial businesses did not want to deal with the currency fluctuations and have left to Frankfurt.

My opinion on Brexit takes into account the EU as a whole. Many people think it is falling due to monetary policy. Nations like Greece, Portugal, Italy, and Spain (also referred to as the PIGS), need to boost their economy and the way to do that is by lowering interest rates and weakening the currency. Something my readers are familiar with in this on going currency war as all central banks are trying to weaken their currency. The only problem in the EU is that nations do not have that power. The European Central Bank does. There are of course some nations apart of the EU that kept their currency such as the UK, Sweden and Denmark.

Knowing this, Brexit would set a precedent for nations wanting to leave the EU. Greece perhaps would be inspired by this, so would Italy. The EU has an incentive to punish the UK. Make the whole ordeal as bumpy as possible, and hoping the UK economy suffers once they leave which would dissuade other EU members from following the UK.

If there is a no deal Brexit by the end of the year, it can be a market moving event. If things turn around, and a deal is reached, it would be unexpected and have a major reaction to the upside in European markets. No deal is priced in, while a deal is not. Of course, maybe we get news that the deadline is further extended. Has happened before, it can happen again.

But enough of the fundamental backdrop, let’s take a look at some European equity charts!

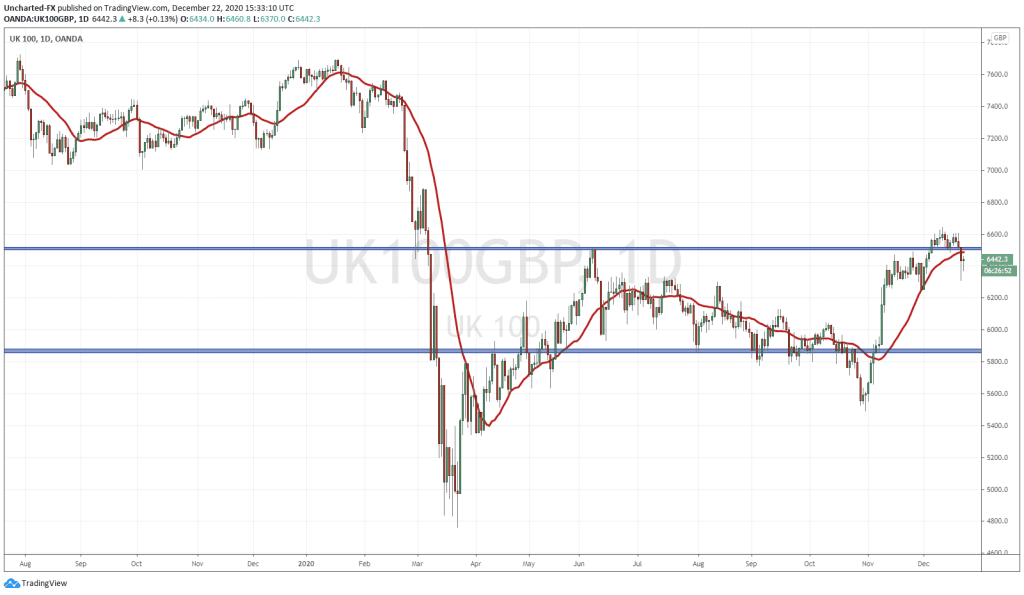

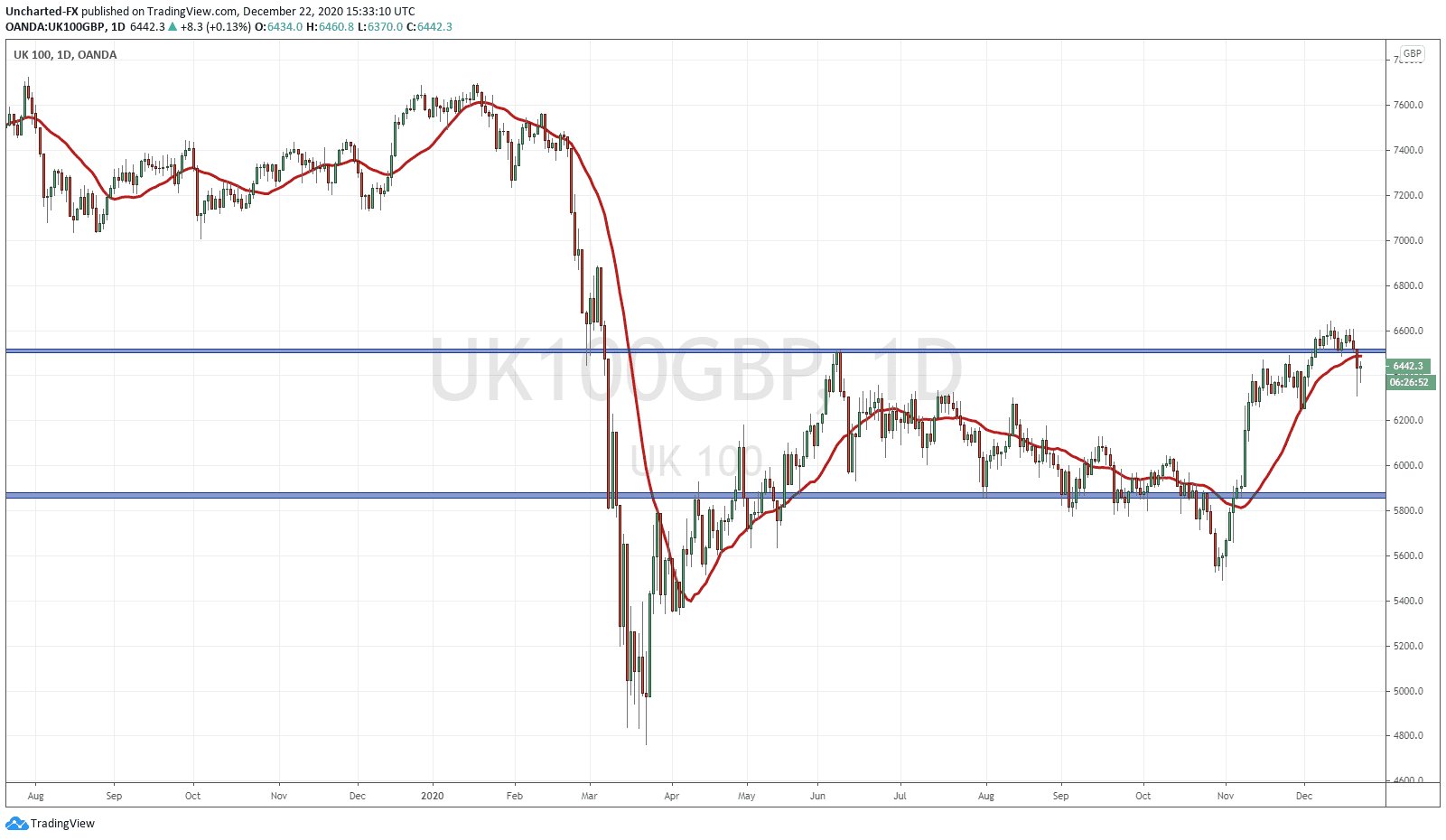

Seems right to start off with the UK FTSE. British markets printed a breakout above the 6500 zone, but the momentum did not come. Price struggled to remain above the new support zone and yesterday, we actually closed back below 6500. A failed breakout.

What we are now watching is for what was once support, to now be resistance. You will hear me say this a lot in this Market Moment post as most European markets are showing similar patterns. Taking it down to the lower timeframe (4 hour), I am watching for price to retest this 6500-6520 zone in order to see if sellers step in and take the FTSE lower. A no deal Brexit and border issues due to this new covid strain could be that trigger.

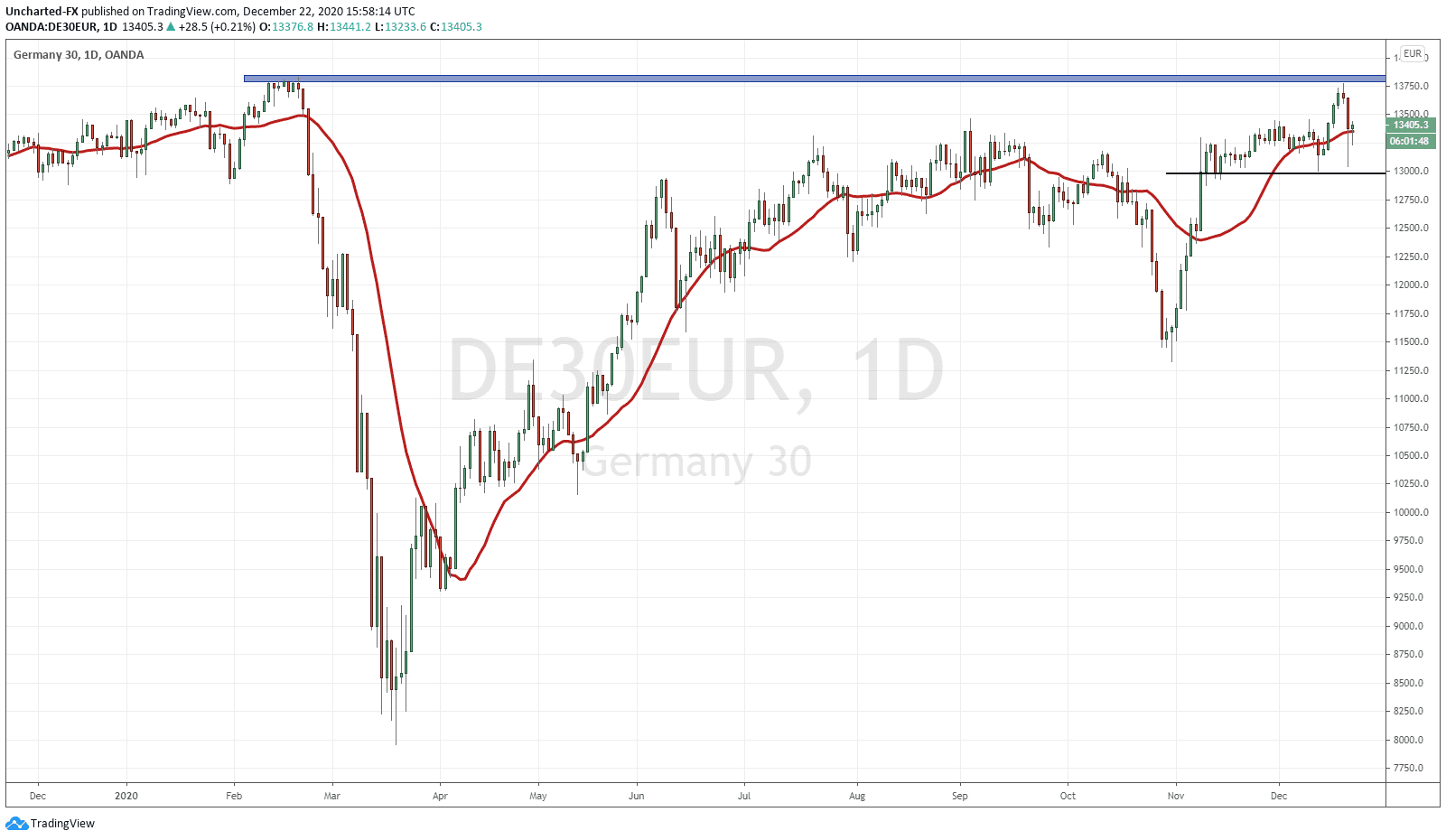

The German Dax is what many look at when they talk about European markets. Germany is the lynchpin, and the ECB is next door to the German Bundesbank. Germany is a heavy export nation, which is why many claim the ECB monetary policy has Germany in mind…some go as far to say they run the ECB.

The Dax is a few points away from breaking into new record high territories. Unlike other European markets, the Dax is the only European market to recover fully and is knocking the doors of new highs. Looking a lot like the Japanese and US markets.

So far, sellers are stepping in. It is a big resistance zone, but what I am worried about is a reversal pattern here. Specifically called the head and shoulders pattern. There is a possibility for price to roll over here and break below 13000 which would trigger the reversal pattern. This is what I am watching for to enter short.

The French CAC also created a breakout, but on the 4 hour chart, the market has ranged since mid November. Yesterday, the CAC broke below support and currently price is pulling back to retest the breakdown zone as resistance. Make or break here. Either sellers step in and we create another leg lower, or we close back above the breakdown zone creating a false breakout.

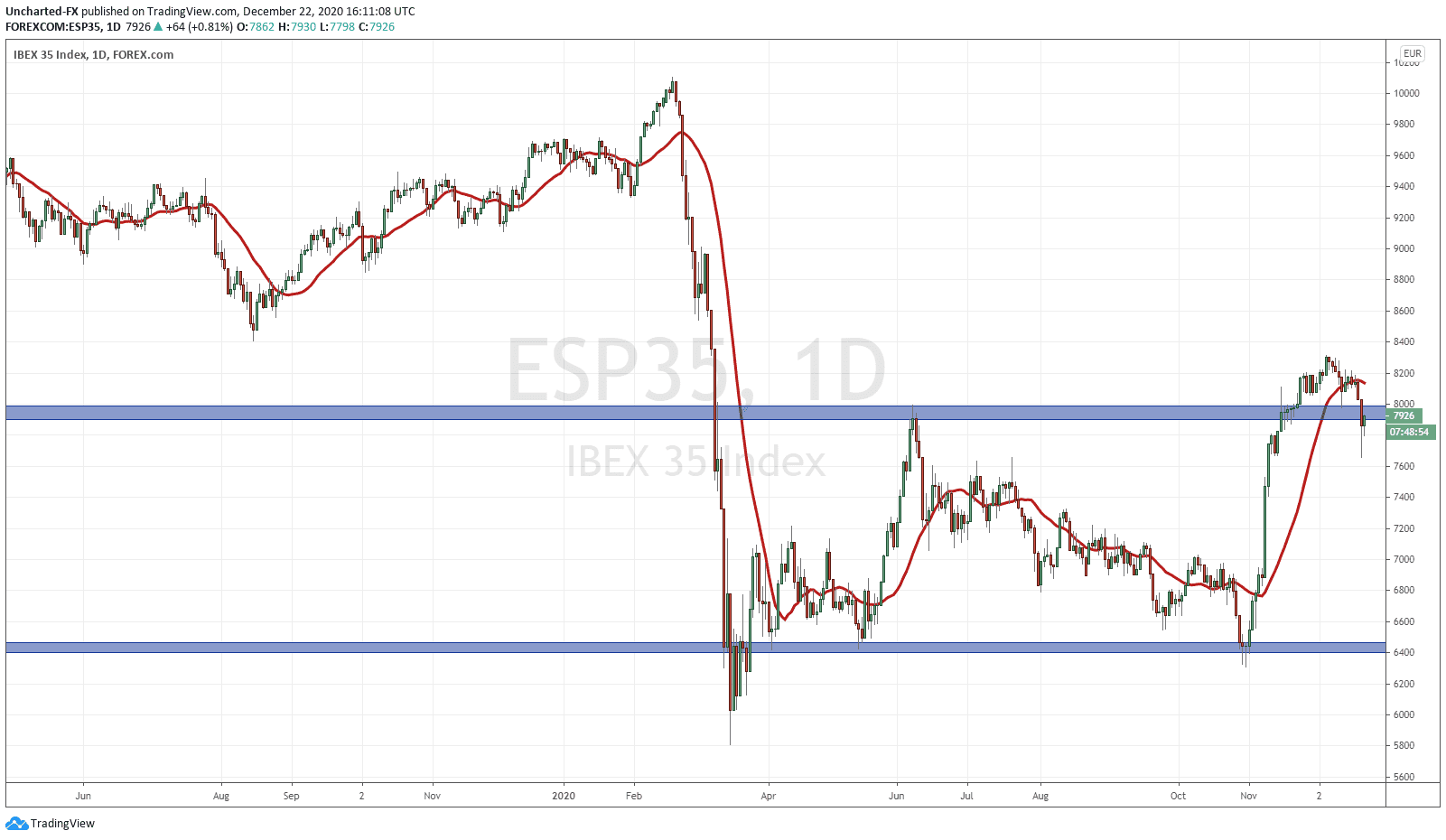

The Spanish ESP35 is similar to the UK FTSE. WE had a breakout above the 8000 zone, and yesterday we broke and closed back below. A false breakout. Momentum did not carry price higher as much as expected.

Once again, taking it down to the lower timeframe, I am watching for the retest at resistance right now. Does price roll over here at 8000, or do we close back above and carry an upward momentum?

The Brexit deal, especially an announcement that a deal has been reached, is something the market is not expecting and would cause European markets to shoot higher. As mentioned earlier, the market is pricing in no deal as that is what Prime Minister Boris Johnson has told us. Potentially setting up for a volatile year end for European markets.

After that, I will be intrigued more so due to my yield theory. Money is moving into stocks because they are the only place to go for yield. Many, including me, was thinking that foreign money would flow into US stocks…but we are not seeing a rise in US Dollars to back that claim up (as you would need to buy US Dollars to buy US stocks). If US stock markets and Asian stock markets seem over valued, does money begin to flow into ‘cheap’ European stocks?