E-sports is a sector to keep an eye on. As a gamer myself, I can see how huge esports is getting. The sponsorships, the leagues, the money prizes are huge. Dedicated esports arena’s are being built. Finals of the game League of Legends even drew in more viewers than the Super Bowl. Top gamers are pretty much celebrities racking in hundred of thousands to the millions. When you take a look at streams on twitch, the top viewed are gaming channels. Even celebrities and sport athletes are running game streams on twitch in their free time. It is all a part of the otaku/nerd culture which includes gaming, board gaming, anime and things such as Dungeons and Dragons and Warhammer which are as popular as ever. And this was occurring way before Covid. In fact I mentioned Otaku culture as one of my top future investments back in 2019 on my personal blog.

Another major catalyst upcoming? The Canadian government. Bill C-13 has been introduced to decriminalize single-event sports betting in Canada. The ban on single-event wagering is estimated by the Canadian Gaming Association to cost the Canadian gaming industry CAD $14-billion annually.

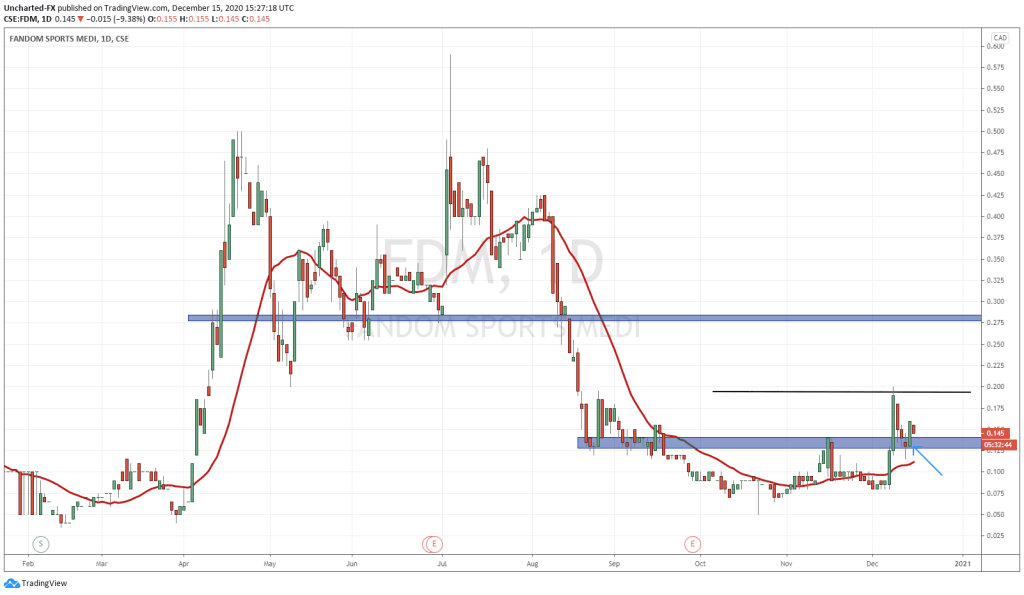

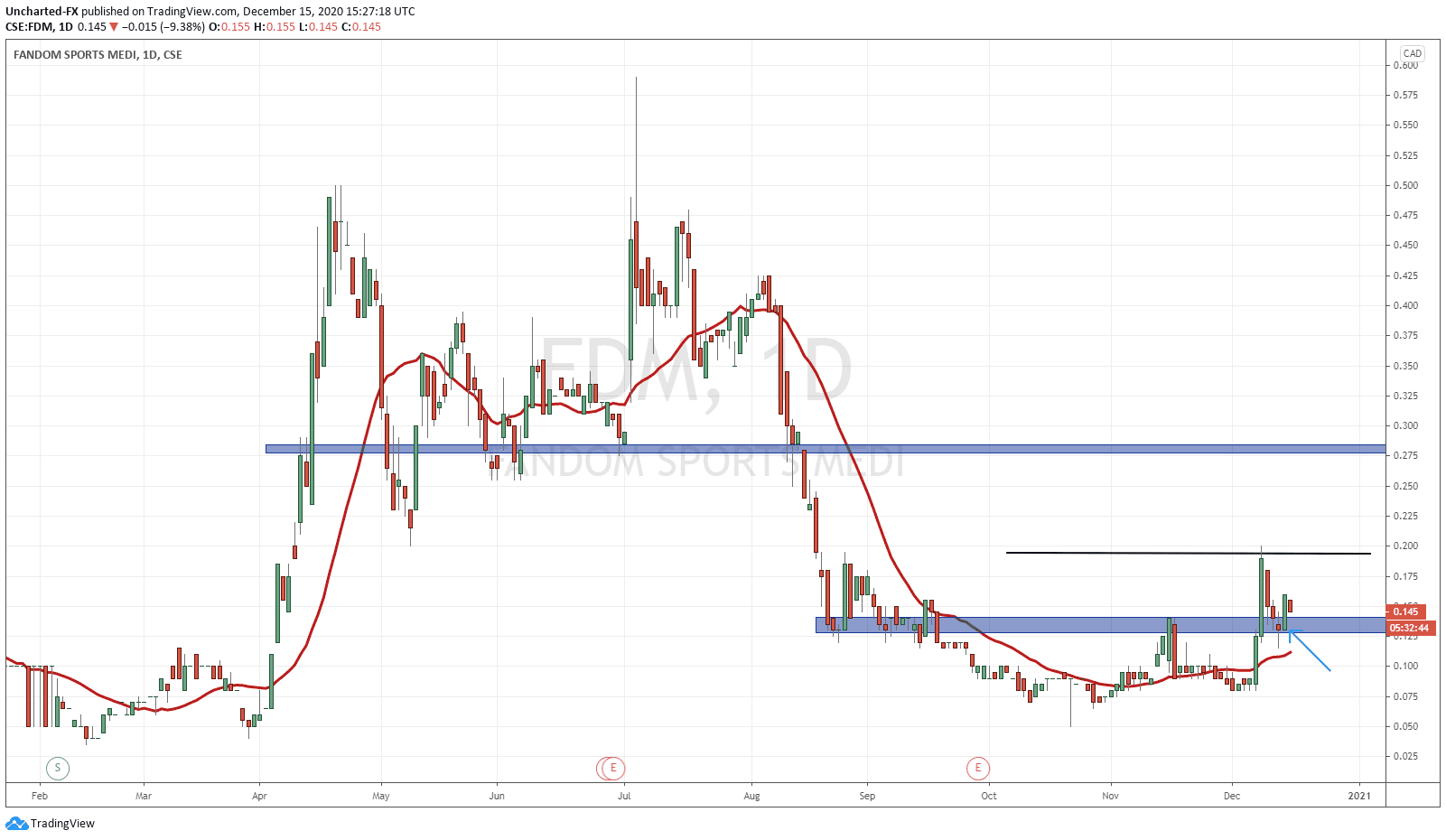

The chart of interest for today’s Market Moment is one we have been keep tabs on over on Equity Guru’s Discord Trading Room. The chart of Fandom Sports Media (FDM.CN).

From their homepage, the company is an entertainment company that has developed proprietary gaming and micro-services platform for esports.

“Pick A Fight. Talk Trash. Get Rewarded.”

Fandom Sports Media Corp., a live sports and esports entertainment company, aggregates, curates, and produces fan-focused content. The company’s principal product is FANDOM SPORTS App, a mobile application for unfiltered raw sports talk. Its application allows sports fans to unleash their primal sports passions, pick fights, and earn rewards. The company also develops FANDOM SPORTS entertainment platform, a micro-services platform for esports with Blaze blockchain technology.

Their latest news is announcing the development of application programming interfaces (API’s) for in-game data from the popular game Valorant:

The Company previously announced completed development of APIs for League of Legends, DOTA 2 and CS:GO. Receiving live data from direct integrations through the Company’s API’s, has allowed the Fandom team to train the live data for the prediction models and pattern recognition needed for the platform launch. By Utilising machine learning to identify the amount of actionable data; Fandom provides players the ability to interact in near real time with live streaming content in both the all ages prediction and regulated wagering verticals.

Fandom utilizes machine learning enabled neural networks as a superior method to otherwise person dependant limited predictions as employed by competitors. Proprietary pattern recognition using data contextualization also separates Fandom’s technology from existing hard coded monoliths and static wagers. As a result of these past successful API and direct to publisher integrations, Fandom has now identified and started the process to further develop API’s and integrate Riot Games’ emerging Esports title Valorant.

Onto the chart pattern.

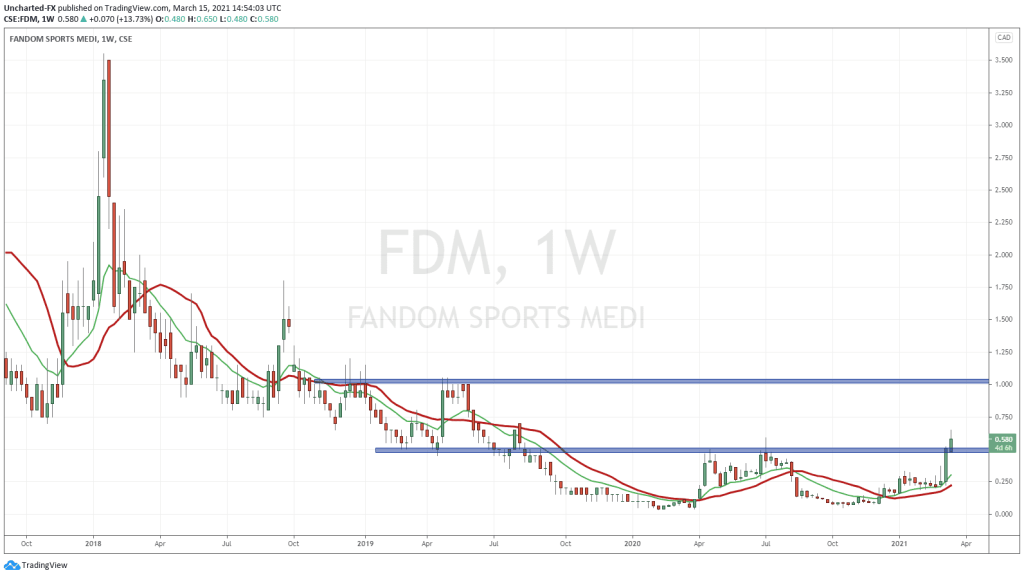

My readers already see the set up. Market structure tells us all markets move in three ways: uptrend, range, and a downtrend. These come in cycles. We have had the downtrend, and a range indicates bottoming.

A range is nice, but a pattern is even better. One can argue there has been a cup and handle pattern on Fandom. The 0.14 zone was our resistance, and a breakout above would end the downtrend and initiate a cycle of an uptrend. The breakout occurred with a strong green bodied candle.

The next three days saw price pull back to the breakout zone. Entirely normal. Price tends to pullback in order to retest the breakout (or breakdown) zone before continuing higher.

I drew a blue arrow to indicate the retest candle. Buyers did indeed step in to protect this zone. The day before even had a wick candle, indicating buyers stepping in. We know where the buyers are.

Entering at this zone gives you a good risk vs reward targeting the resistance zone of 0.28 for a trade. My stop loss would be placed below 0.115, just under the wick.

Alternatively, you can wait for price to make new recent highs with a breakout above 0.20 cents. Your risk vs reward would need to be modified, but the probability of success increases greatly.

We have seen these patterns play out very nicely on many small cap stocks to the joy of our Discord members. Market structure with reversal patterns increase our probabilities of success, and this is really what trading is: a business of probabilities.